最近Defi很紅,連我都聽多了... 據說是ICO 2.0版,但是後面還有空間嗎?我想大概誰都不知道,只知道現在風險已經高了...

我曾經試著看過幾篇文章,老實說,看完還是一片茫然,不知道這是什麼,不知道從哪裡開始來投資...

我只大概知道,就是去中心化的金融發展,用加密貨幣來抵押啦,借貸啦...至於那些幣,到底做啥的,也是很茫然... 當中大概有幾個關鍵字,例如Uniswap, Curve, AMPL, wETH...常常看,卻很是很茫然... 漲百倍,漲千倍,都沒辦法跟它有關哪...😅

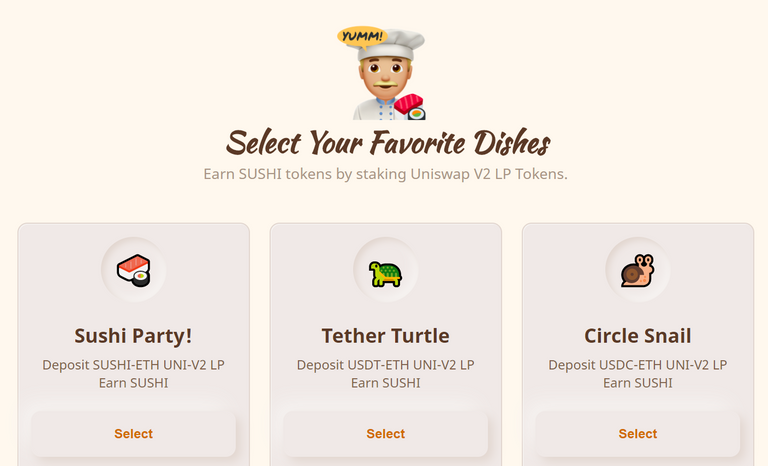

可能是看太久了,今天又看到有一家壽司交換(Sushiswap)據說要複製Uniswap然後改進其模式,然後剛剛啟動之類的...於是我就去網站瞧瞧熱鬧...

做得挺有趣的,還有大廚要我點餐...

點了半天,似乎是要質押些什麼代幣來獲取Sushi代幣... 我想說那就拿一顆ETH來試試看好了...

結果也是找不到地方可以質押ETH,可能是我搞錯了...但有地方似乎可以同時提供ETH跟SUSHI去質押?

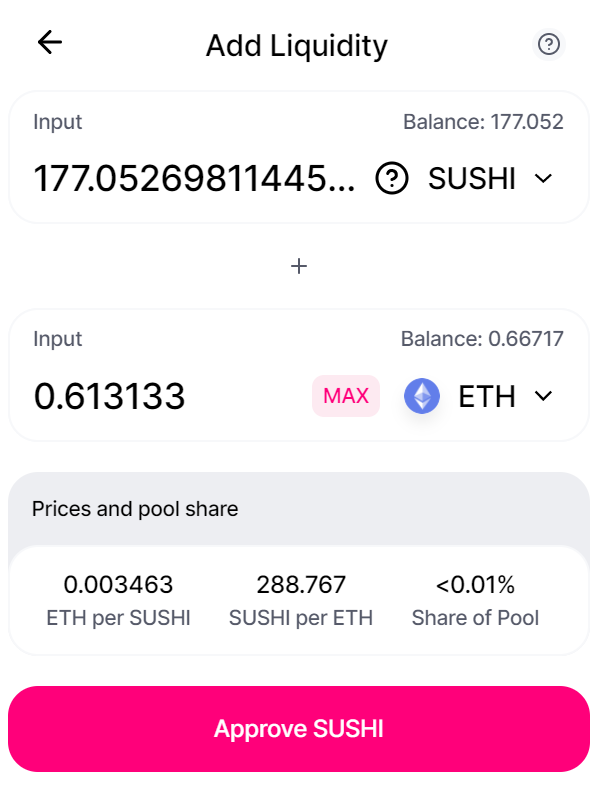

問題是,我手上根本沒有SUSHI啊?但是我就去找到一個地方似乎可以直接用ETH兌換SUSHI,似乎就是用Uniswap平台...好怪...用想取代的對手來兌換...

所以就用一半ETH換了170幾顆SUSHI...

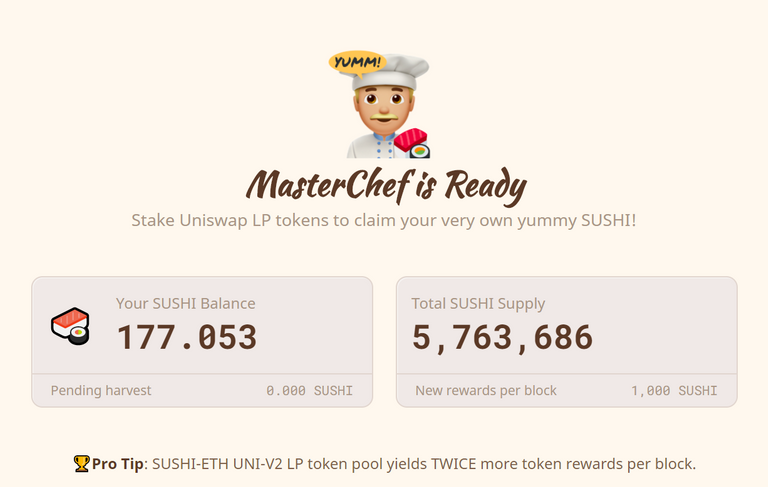

所以可以同時質押ETH跟SUSHI了...好像啦...似乎有成功... 但是沒有地方顯示成功,以太scanner上面的紀錄我也看不懂...反正帳戶裡就還是剩下0.6個ETH...也不知道我這壽司是否開張了...😂

總算首頁有顯示我的壽司餘額,至少,如果其實手續還沒完成,沒辦法開始賺SUSHI,這些幣也還在手上吧... 希望啦,哈哈哈~~~~

至一篇算是我defi的第一篇,希望能有更多朋友一起來討論,交流一下,高手來指導一下怎麼入門...總不希望繼續熱門下去,我卻都沒參與到,參與了虧一點錢,也就罷了,沒參與到,還好意思說混幣圈嗎?😊

所以 [Defi門外漢] 我會使用 #defi-newbie 來當標籤,希望能引起一些討論囉~~~~ 或是有什麼好的什麼第一次投資defi就上手這種文章,都歡迎留言指導一下囉~~~~

Hey bro, good to see you getting into DeFi too.

As for Sushi, it’s yield farming, meaning you earn Sushi when you stake other coins. But you first need to add to liquidity pool on Uniswap. I’m currently doing BAND liquidity pool here. In turn, you will receive Uni-V2 tokens after adding to the LP on Uniswap. Then you need to stake Uni-V2 tokens on Sushi website corresponding with the pair you staked on Uniswap.

As you already bought Sushi, then you need to add to the SUSHI/ETH pool on Uniswap, and then stake Uni-V2 token on Sushi.

Any questions, feel free to contact me.

The DeFi world is a bit difficult to grasp at first, but very rewarding once you get into it, but risky too.

thanks Jimmy! yeah, I almost forgot that you are a finance expert! 😍

Do you have some links to recommend so I can learn some very basic concepts and steps for entering this defi world? (your description seems very clear but I am not out of the woods yet XD)

It seems to involve both assets of same value simultaneously?

Could you explain this tx msg? "Approve SUSHI spend limit" <-- I assume this is the msg I get after I added liquidity

Thanks again!! ^_^

Yes, adding liquidity on Uniswap requires 50/50 of each asset.

I think the tx means you’ve approved Sushi, but if you don’t see the Uni-V2 token in your wallet, then you still haven’t added liquidity. After you approve the token ‘Sushi’, you need to choose how much to add to liquidity pool.

oh, shoot, no wonder! finally today I've successfully added liquidity... yeah!! (do I hence incur the risk of losing my assets (ETH and SUSHI)?) and it seems I've started to earn SUSHI tokens... but the fees for every moves... gee... cost a lot...

if you have any recommended sites or articles, I am all ears!

Thanks again! ^_^

Yeah, yield farming isn't a great option if you're playing with anything less than 5 ETH because of the crazy fees on ETH of late. But having said that, once you've staked it, the APY is pretty good at the moment, so it should be quite profitable as long as the price of Sushi doesn't crash. The Sushi/ETH is the most risky pool but also most rewarding if the price of Sushi holds up. You can check out the stats for Sushi here.

YFV is another token I'm farming, but it works a bit differently to Sushi.

Some good DeFi resources:

https://defiprime.com/ https://defipulse.com/

wow, gee... I feel like an illiterate when browsing through these sites... 😅

thanks for those resources...

5 ETH!? that's really a lot!

By the way, I think I've successfully added liquidity to SUSHI-ETH pair, but it is weird to see such result..

After some reading and my guess, I assume this is what happened: I did add liquidity and got LP tokens, but since I staked LP tokens on Sushi right away, so my position became zero again.

Do you think this sounds about right!? 😅

Yes, if you received the LP token Uni-V2, then you don’t need to worry. Your balance will be deducted. If you’ve successfully staked on Sushi, then you should see some SUSHI you can Harvest here.

Don’t worry, this yield farming thing is a bit tricky at first, but once you grasp it, it’s easy and can be fun. Yield farming is relatively new, so most of us are quite new to this. I’ve only been doing this for a few weeks too. It’s very addictive though. :)

我也是刚刚学习玩defi,我加入了很多微信群,他们都说ethereum链的交易费太贵,没有10eth的话,赚的都不够给交易费,我只好去穷人的地方也就是tron链和eos链上面玩,交易费接近0,可是因为全部的钱都集中在ethereum链,另外两条链的涨幅都小很多,有个3倍就偷笑了

什麼!? 難道我這都是白搞的了... >_<~~~~ 我目前只投入1 ETH就很捨不得了呢~~~~

Tron我是不玩滴,不相信那位老闆。EOS,也幾乎都沒碰過... 看來還是先研究以太上的Defi看看吧~~~~ 感謝分享你的經驗~~~~ 有推薦的文章也歡迎喔~~~~ 😃