The world revolutionizes everyday. New technologies and features are discovered and with time, we get to find out more grey areas which has limited the efficiency of our financial systems in various aspects. The presence of too many financial intermediaries in the system has posed a big threat to user's security.

A survey done by CIO Dive

showed that the rate at which cyber criminals target financial services is 300 times more than that of other existing sectors. Also, an unverified statement made by analysts from PWC shows that not less than 45% of financial service intermediaries which include the likes of money transfers and stock exchanges are attacked by cyber criminals every year.

As a result of this, many companies are starting to embrace the development of blockchain-based products and platforms due to its vast dynamism and outstanding features to bring about the solutions needed in a wide range of industrial sectors including the financial sectors. They believe the shift to the development of financial services on the blockchain technology would make it quite easier for financial services to become more easily accessible to people on a larger scale.

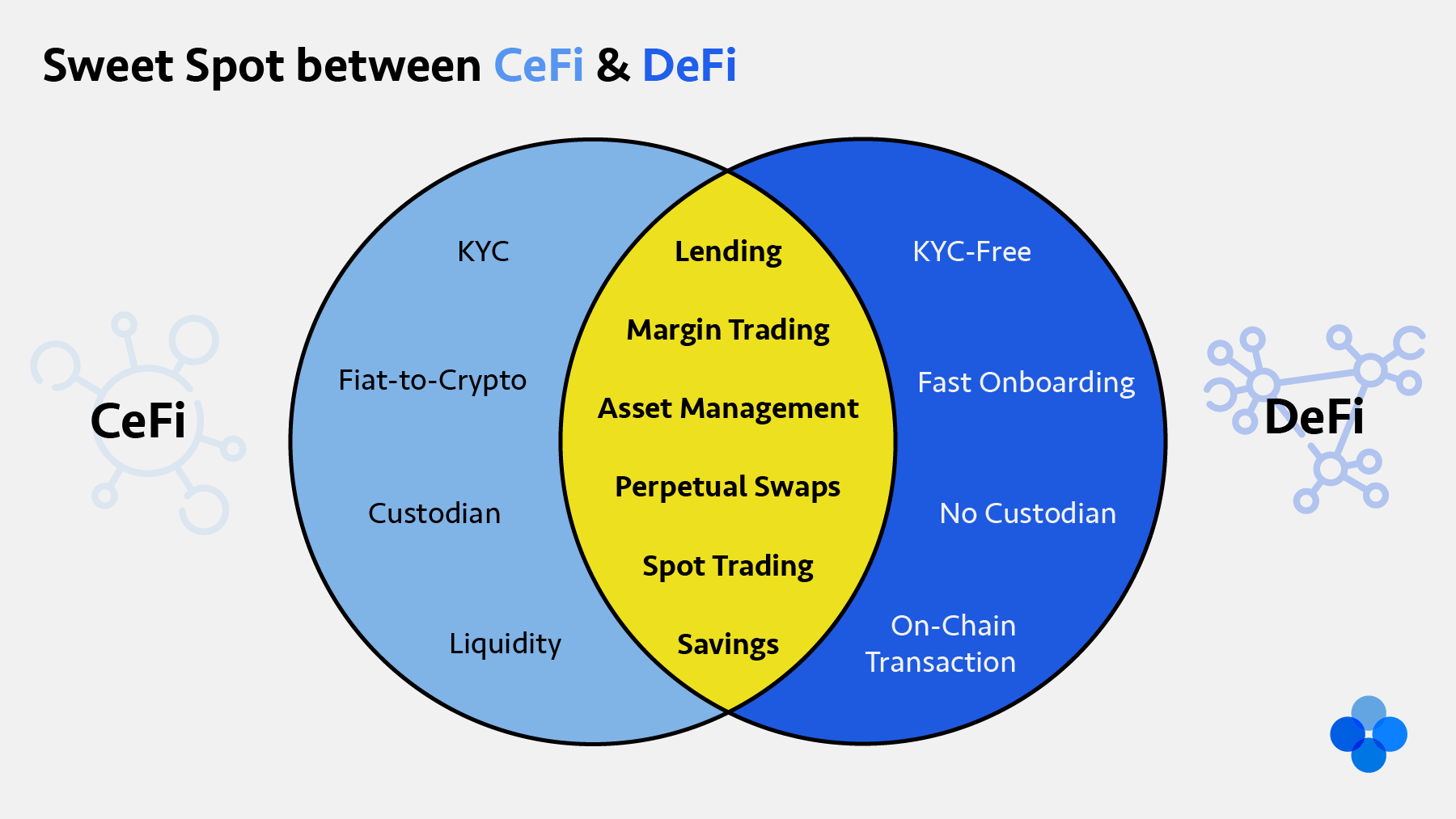

By now, the advantages of blockchain-based finance over traditional finance is well known. But within the blockchain and crypto space, there has been a large difference of opinion between centralized finance (CeFi) and decentralized finance (DeFi). No doubt, both centralized finance (CeFi) and decentralized finance (DeFi) share the same goal of making it possible for cryptocurrency to be used in financial services, but the difference between them is in how they achieve the goal.

What is Centralized Finance (CeFi) & Decentralized Finance (DeFi)?

CeFi is a blockchain-based financial system where by users need to trust people or institutions to rightly manage their funds and carry out services that is being offered by the business. Examples of CeFi include Binance, Coinbase, Nexo, Lednand BlockFi.

DeFi is a blockchain-based financial system where by users depend solely on trusting that the technology will function efficiently as it is built to carry out services that is being offered by the business. Examples of DeFi include Kyber, Compound, Augur, bZx, and OKExDeFi.

The Features and Benefits of CeFi

The main advantage of using centralized finance services is its higher flexibility features. What am saying in essence is that users don't have to worry about the safety of their keys as far as the CeFi platform they use is a trusted one. Also, they don't have to worry about management of their crypto wallets and as such, they can find it very easy to adopt cryptocurrency. With CeFi services, users can exchange their cryptocurrencies with higher liquidity and be able to contact customer service for help.

CeFi services demands that users give out their personal information in line with the KYC (Know Your Customer) and AML (Anti Money Laundering) regulations. Thereby, putting users at the risk of losing their personal data to a third party if the security system of the platform is breached. Unique features like cross-chain services and conversation of fiats to cryptocurrency and vice versa is a feature handled mostly by CeFi platforms.

The Features and Benefits of DeFi

With the use of DeFi services, users take complete custody of their crypto assets and do not need to give up their personal information or data to a third party since no KYC (Know Your Customer) is required. Therefore, the risk of their crypto assets being stolen or personal data being used without their consent is reduced by a larger extent. Another important thing DeFi does is to allow people manage their funds without depending on anybody or an authority.

DeFi platform enables transparency of all information giving everyome the ability to join a network and view all information taking place on that network since all oparations runs on top of a public blockchain. Blockchain explorers can be used in verifying transactions on DeFi platforms.

Conclusion

Irrespective of the one each and everyone of us prefer between CeFi and DeFi, I am strongly of the opinion that the net positive for everyone is the fact that they both have a big role to play in adding value to our finance systems and will most likely bring an end to banking.

Congratulations @olasamuel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

As the leading online platform for raising funds for personal needs, the online platform GoFundMe has helped many people solve their financial problems. They allow almost anyone to create a fundraising campaign, and as evidenced by the information here https://gofundme.pissedconsumer.com/review.html rarely have problems with it. To date, millions of people have used this platform, and they report in reviews that GoFundMe has been helpful to them.

Thanks so much