Jarvis bi-weekly issue [13]

October 16th, 2024

⏩ TLDR

jEUR lending market on Morpho on Base

New jEUR-EURC pool on Aerodrome on Base

New JARVIS pool on Base and BNB Chain

~20 to ~30% APY real yield on USDC and WXDAI

Discussion on improving the Jarivs’ flywheels

Liquidity Pools interest split upgrade

🗞️ Quick news

jEUR lending market on Morpho

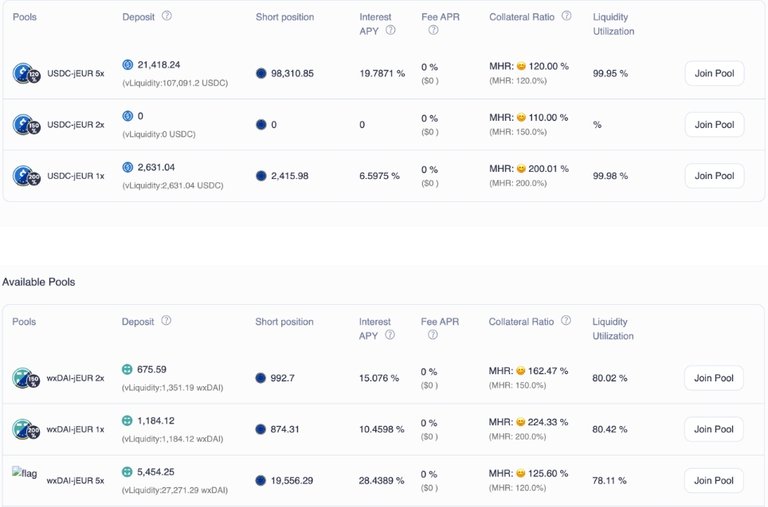

Following the shutting down of jEUR Credit Lines, we have deployed two markets on Morpho on Base, the WSTETH-jEUR and USDC-jEUR markets, allowing to borrow jEUR there. Then, from Base, users can bridge jEUR on any other chains.

More collateral will be added, especially productive assets such as yield-bearing stablecoins (USD, EUR) and RWA, but also other jFIATs, WBTC, WETH, and even stJARVIS, when this will be possible (the liquidity of JARVIS should be higher, and currently sits at $1.5M on Base, and an reliable oracle should be deployed).

Together with Gnosis Chain, Base is becoming our main chain, from where most of the features

These lending markets will also help with re-collateralizing jEUR and jCHF on Polygon, by allowing users to purchase depegged jCHF and jEUR on Polygon, and deposit them in the the money market on Base, to be borrowed (and therefore collateralized).

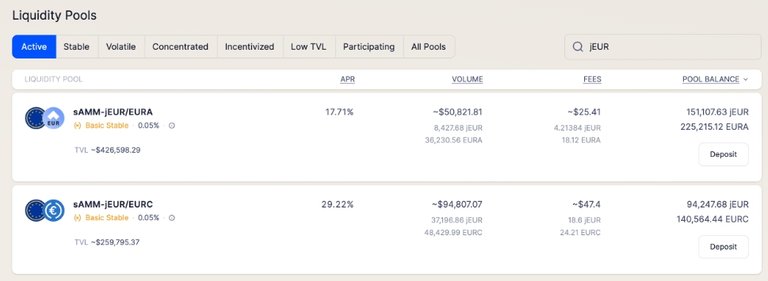

New jEUR-EURC pool on Aerodrome

A new jEUR-EURC pool is now live on Aerodrome.

New JARVIS pools pool

A new JARVIS-WSTETH pool on Aerodrome (BASE) and JARVIS-ETH pool on Thena (BSC) have been deployed with their respective gauge.

🧪 Protocol

- We keep updating the LP Vaults and the Liquidity Pools. We have now completed the updates on Avalanche, Base, Arbitrum, Gnosis and Optimism.

As a result of these updates, the yield on the Vaults have increased a lot! 28% APY on WXDAI on Gnosis, or 19% APY on USDC on Base. Remember that when you deposit WXDAI or USDC in these vaults, you are long USD and short EUR, and may lose money if EURUSD goes up.

📱 Application

While we had completed the calculation of Trading Fees APR, the update of the pools and of the vaults requires from us to update our code there. As a result, only the Interests APY is currently being displayed.

We have started working on the Morpho market integration within our app, in order to borrow jEUR on Base.

We will start working on the “Earn” page of the app, where users will be able to see all the yield opportunities for jFIATs, USDC and XDAI within the protocol, and outside of the protocols.

🗳️ Governance

Discussion

- Preliminary talk: we have started discussing two new systems to allow for a better yield for JARVIS and jFIATs, and to get rid of the non-bribers LP, as well as a system to delegate JARVIS to the DAO to generate yield.

Jarvis bi-weekly issue [13]

November 4th, 2024

⏩ TLDR

Juicy USDC yield for LPs

Small Cascade Protocol “overview”

Building a position on QUOLL

New discussion to seed Morpho markets.

New discussion to optimize the treasury.

🗞️ Quick news

Juicy USDC yield for LPs

Tweet Jarvis Network

Some updates from the Cascade Protocol

Tweet Cascade Protocol

Jarvis LTD building a position in QUOLL

Tweet Jarvis Network

🧪 Protocol

We have finished updating all the LP Vaults and Liquidity Pools.

We have started working on the staked jEUR. Staked jEUR allows to earn yield from staking our Euro stablecoin. The governance will need to discuss about the parameters of this new product.

We have completed all the modules of the Cascade Protocol, and we are now working on linking them all.

📱 Application

We have fixed several issues such as displaying the correct APR of the vaults, the correct trading fees on the swap page and the correct bridge limits.

The Morpho market integration has been completed.

🗳️ Governance

Discussion

JIP 9: Seeding Morpho Markets. New discussion about using the money printer to deposit jEUR in the Morpho Markets.

JIP 10: Optimizing treasury. New discussion on how to use our treasury for generating more yield for JARVIS and jFIATs LPs. We are discussing buying voting power on some protocols and bribing on others.

JIP 11: jEUR investment vehicle. New discussion for enabling holders of jEUR on Polygon to invest them through the DAO on other networks to generate yield.