The Economic Report. May 28, 2020

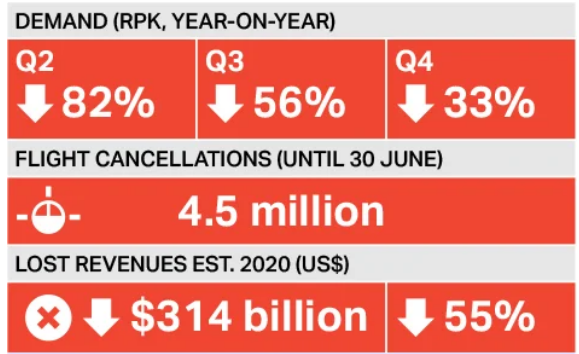

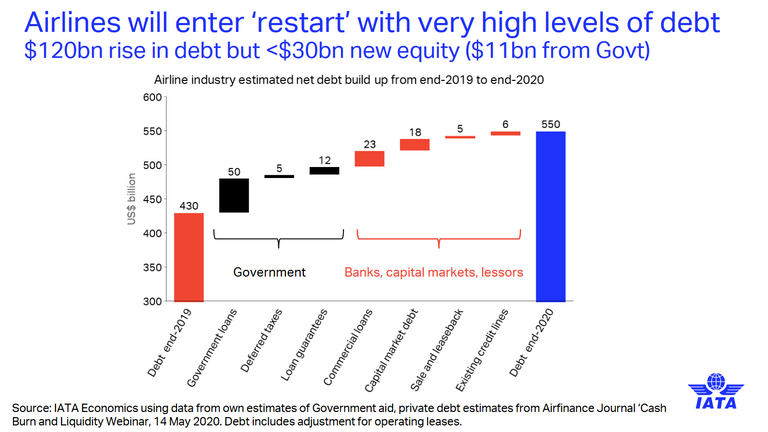

The International Air Transport Association or I.A.T.A. consists of 290 airlines, representing 117 countries or 82% of total available seat air traffic. Their most recent report on May 26, 2020 is projecting a whooping $550,000,000,000 in debt by year end 2020. That's an increase of $120Bn. or 27.91% from year end 2019 and that's after the $123Bn. aid (cough, cough😷 bailout) from governments.

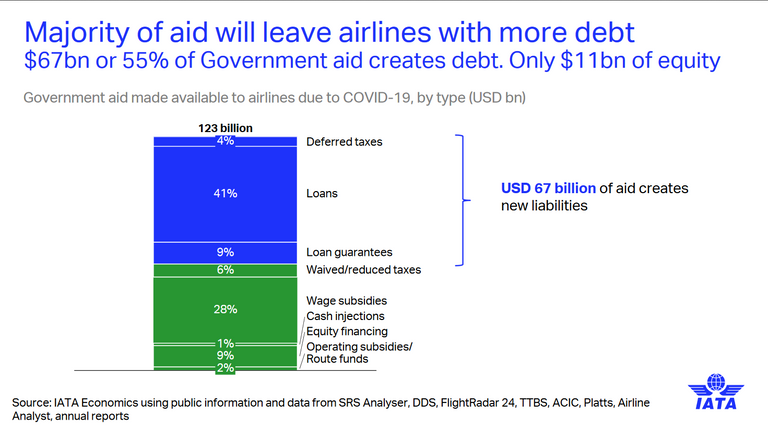

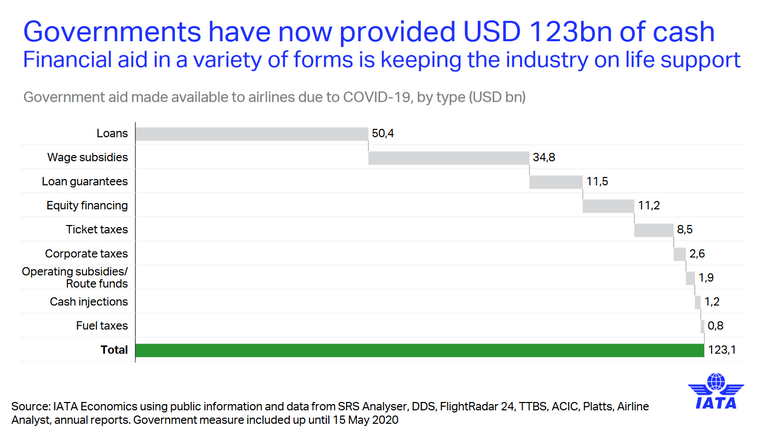

Of the $123Bn. aid 55% or $67bn. will have to be payed back in the form of loans, loan guarantees, and deferred taxes, meaning more debt on their balance sheets with only $11bn. equating to new equity from governments.

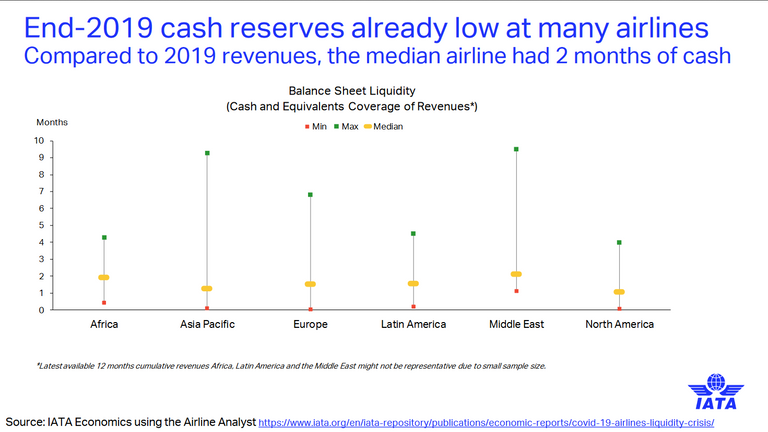

At the end of 2019 cash reserves were already low with the the median airline only having 2 months or less of cash reserves with North America's best airlines only having a max of 4 months in reserves and the worst having nearly nothing in reserves. While the Middle-East performed the best overall, their worst airlines having over a month of reserves (which was North America's median) and the best airlines having 10 months in cash reserves.

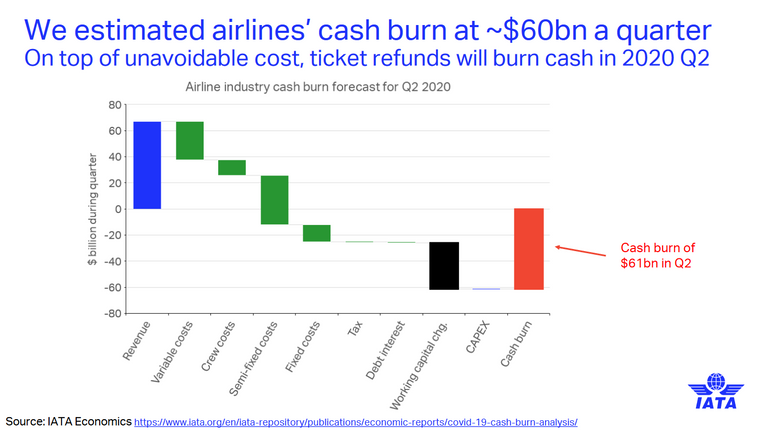

With airlines burning cash faster than jet fuel, Roughly $60bn. a quarter currently, That $123bn. aid with more than half needing to be paid back, looks like it wont be enough as airline companies like Lufthansa's CEO Carsten Spohr told employees on April 24th that the company was losing cash at the rate of 1 million euros PER HOUR and that passenger numbers had fallen to 1% of previous levels. The German government came out on Monday May 25th approving a 9bn. euro ($9.8bn. dollar) bailout for airline company Lufthansa. This would leave the German government with a 20% stake in the company and two seats on the board of directors.The government's stake is below the level needed to block major decisions, but it has the option to raise it to a blocking stake of 25% plus one share in case of needing to takeover of the company. Under the package, the government would sell its stake at market price by the end of 2023, on condition that key parts of the aid have been repaid and the government can sell the shares for more than what they paid for them.

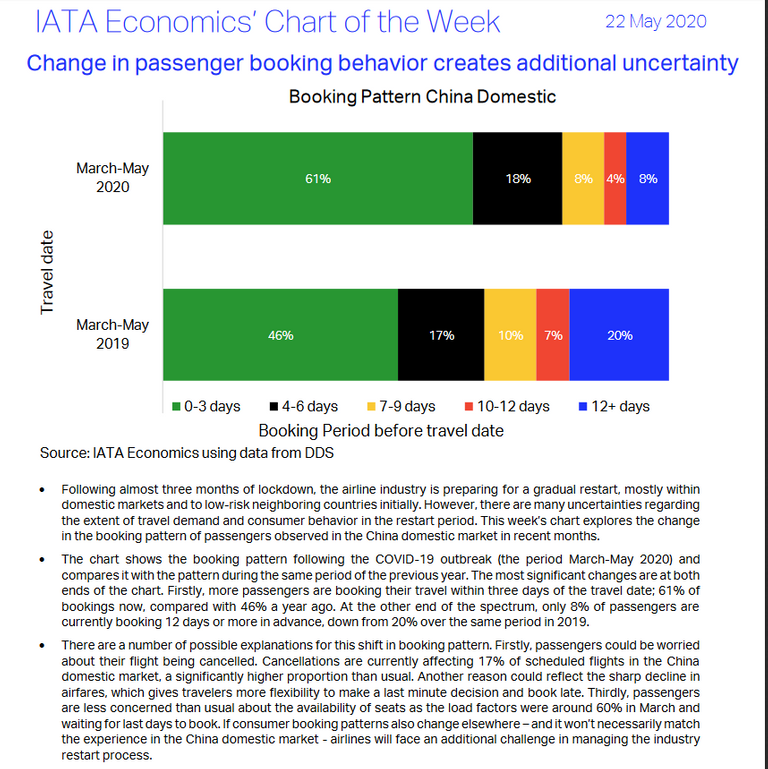

With so much uncertainty going forward in china, flight booking behavior has change dramatically. Last year we seen fight bookings well in advance with 20% of bookings being purchased more than 12 days out. Now that's been cut more than half to 8% this year. While this time last year only 63% of bookings were within 6 days of departure, this year it's 79% within 6 days of departure.

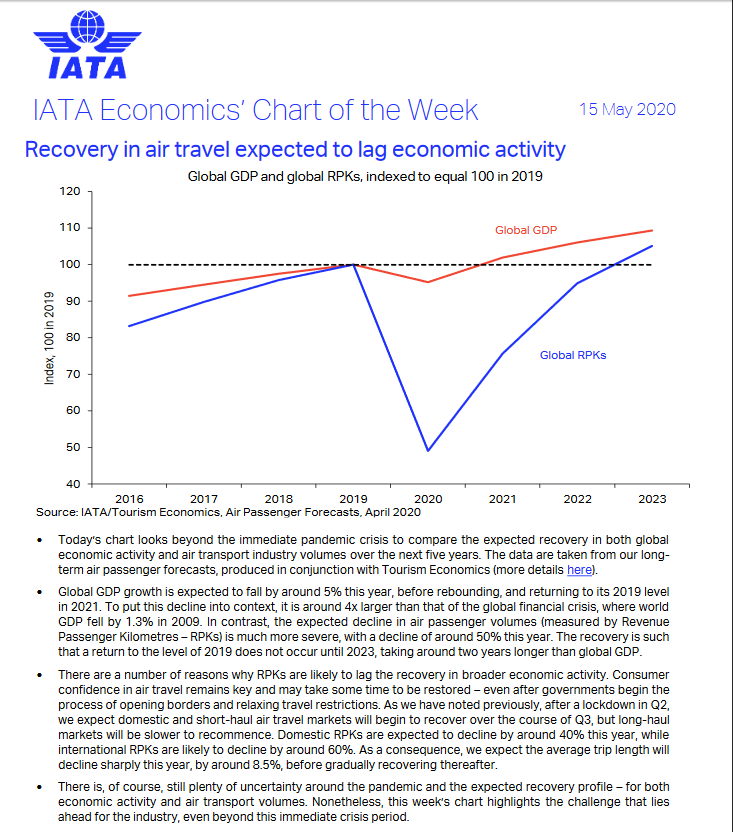

Overall the IATA expects the airline industry wont recover back to the 2019 levels for another 5 years and that's if world GDP recovers back to the 2019 levels and surpasses it within a year and a half from June 2019, but with the FED predicting we should end 2020 with a negative GDP in America i find this hard to believe, but if you were looking for that V-shaped recovery.. here it is..

all sources can be found at https://www.iata.org/economics

If you like my content show some love by giving me a upvote and a follow, as we'll have many more reports on a daily and weekly basis keeping you up-to-date on pertinent information!👍

Written and edited by: The Economic Report, @economic-report

Congratulations @economic-report! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!