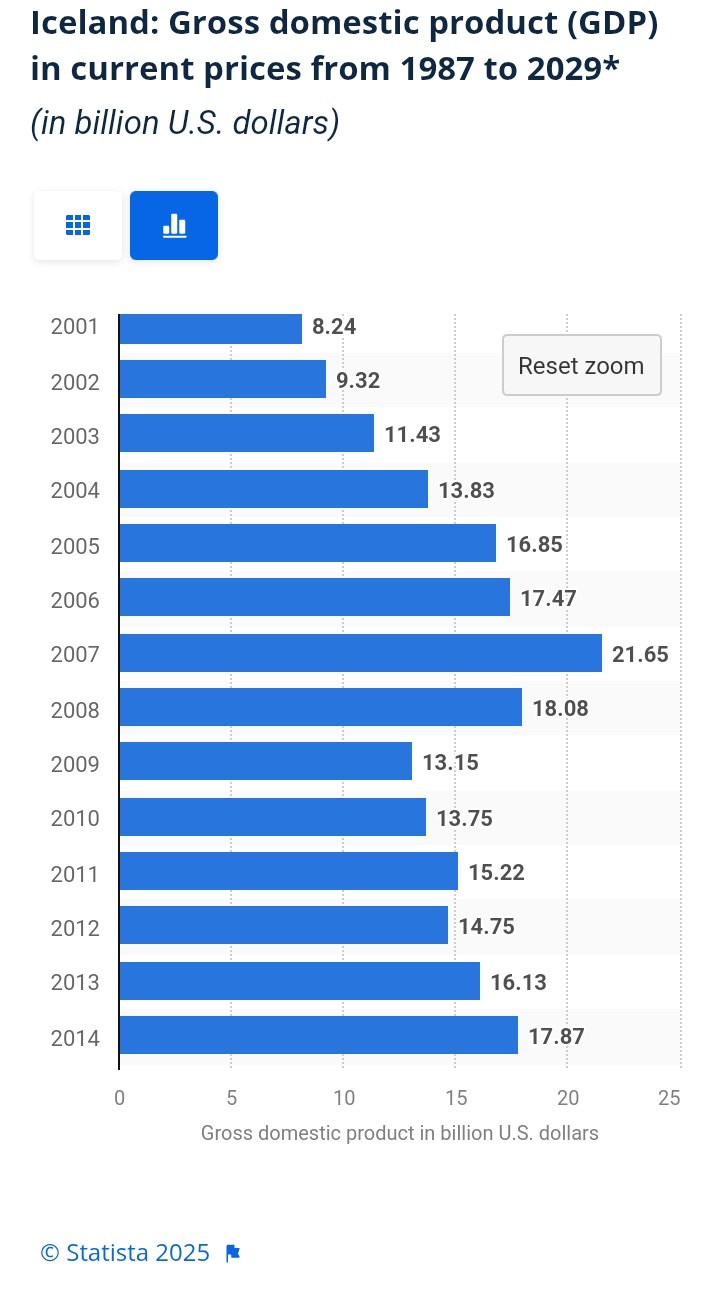

In 2008 a combination of some major economic problems caused a great recession popularly known as the 2008 global economic crisis. Many countries were hit, and even to this day, most countries haven't recovered fully or are still recovering.

Iceland was one of the countries that was hit very hard to the point that it lost almost double of its economic outputs

The money market was one of the major concerns because the crisis affected most financial institutions, and for countries like Iceland that depend more on their financial institution and a major player in the financial world, there was a big problem. Because of low industrial output and a volatile currency, Iceland went all in, in the financial market.

In the process of building their financial sector, they acquired an external debt of about $53 billion which for most nations is little money but for Iceland, it was a completely different case because this was a very small country with very little population and once you compare the debt per capital it's devastating to the point that it's Central Bank which is supposed to be lender of last resort has to back out and can't save commercial Banks from destruction.

Iceland was fast becoming a failed state, but by 2016, it was almost as if nothing happened.

In 2023, Iceland's Debt to GDP dropped by half. That's the unique nature of Iceland, with a GDP of about $31 billion. Iceland simply does things in a modest way which matches their little country. Their employment rate is about 85.3% as of 2023. They export mainly fish and fish products, aluminium, agricultural products, medicinal and medical products, and ferrosilicon to countries like the Netherlands, the UK, Spain, Germany, the United States, France and Canada.

They import refined petroleum, aluminium oxide, carbon/graphite electronics, cars and packaged medicines from countries like Norway, Netherlands, Germany, Denmark, United States, China, United Kingdom, and Sweden.