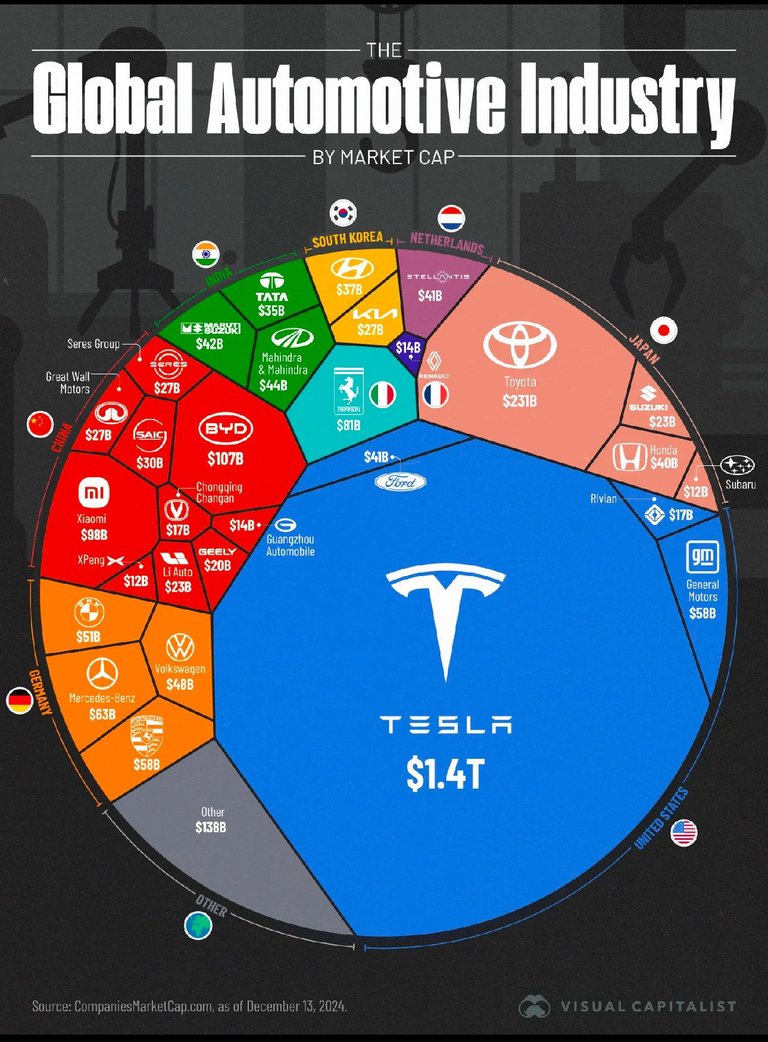

Market capitalization is predicated on projected future earnings.

As a result, investors think Tesla will surpass Toyota and Volkswagen in future auto sales.

The current share price is multiplied by the number of outstanding shares to determine the market capitalization. For instance, a business with 50 million shares and a $100 stock price would have a $5 billion market capitalization.

The following 20 automakers' combined market capitalization is less than Tesla's. However, Toyota alone sells around 9 million more vehicles than Tesla.

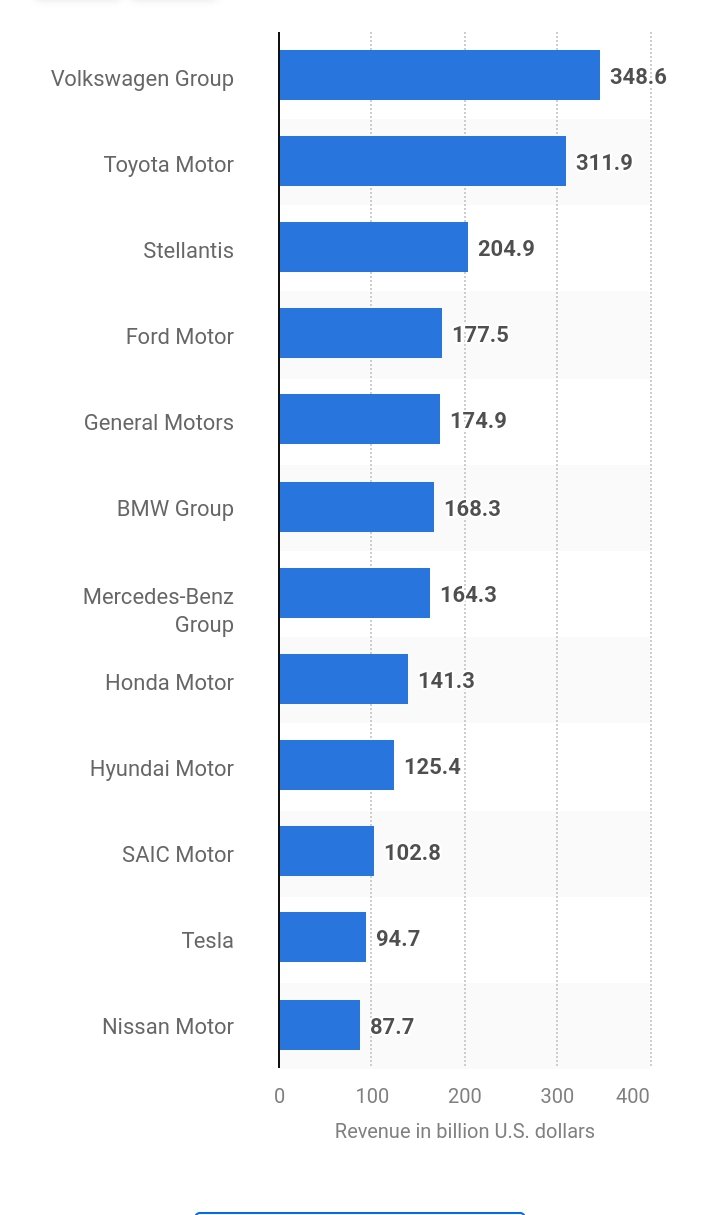

Why would a company with higher revenue have a higher stock price than a company with lower revenue?

Stock prices are highly influenced by many market factors not just revenue, therefore investors value a company's ability to turn revenue into high-margin profit also growth potentials, innovation and sometimes AI-driven technology since that's the next big thing, might contribute

Therefore if a company has the above-listed qualities the stock prices of such a company might Be higher because of future expectations than a company with high revenue but less future expectation

Congratulations @levidesmond69! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP