Like everything else in life, becoming a student cost money. Today, education is just as important as it was hundreds of years ago. During earlier times, it might not have been so expensive, but these days it has become one of the most expensive debts you can take on.

Life is hard and we literally don’t have the money to save up for education, because of other expenses. In most cases, a student loan may seem like the best option. It is often your last choice but when you don’t have a choice

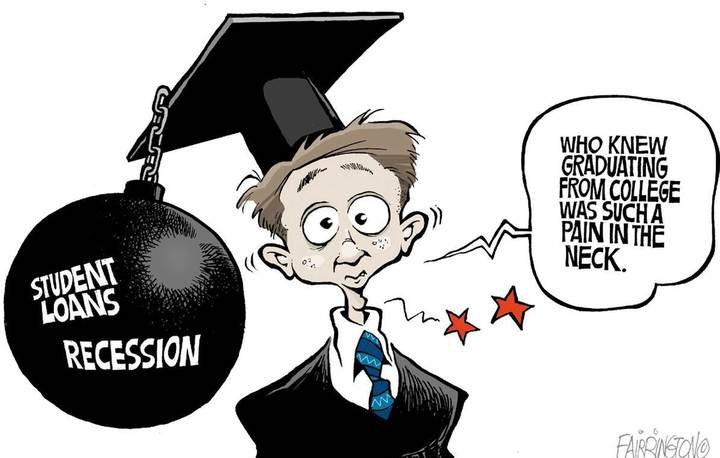

Student loans can give you the freedom to survive and pay for your studies, but the aftereffects can be devastating. Just like any other loan, student loans need to be paid back after you complete your studies and that can take a lot of your salary once you start working.

To prevent that, you may want to reduce your payback rate by refinancing all your debt at a lower interest rate. It might still take you longer to pay back everything but at least you will have more money available on a monthly basis.

You can also cut back on your living expenses and pay more so that you pay off the loan sooner. This way you can cut back on a lot of interest which will count towards your credit score.

Why are student loans so expensive?

Everyone wants to improve themselves. Banks charge enormous interest rates and you sit with the problems. Most people dream of college or university and if you don’t have the money, your big dreams can be shattered.

If you take out a student loan for (x) amount you might even have to pay back up to 2.5 x (x)! Horrifying isn’t it?

How can you prevent paying back a student loan?

The only way that you can prevent paying back a student loan is to actually NOT take out a loan. Easier said than done right? If you have a dream to go and study, nothing in the world chases you to do it at a specific time. In the end, it doesn’t matter where and when you get your degree does it? If you take out a loan, finish your studies and the next step would obviously be to find a job. What if you can’t find a job? Your debt is not going to disappear overnight.

Life has changed in so many ways during the last decade that more and more students are working and studying at the same time. They save up and use every cent they earn to pay for their studies. Luckily, most colleges and universities have specific packages where you can pay off your fees on a monthly basis. When they finish their studies, they literally have nothing to pay back.

A lot of bursaries are also available, and if you search hard enough you might qualify for a bursary. Bursaries give you a little financial freedom and you might even get a job with the company that gave you the bursary, but even that is not a given. If you are not lucky enough to qualify for any bursary, you might want to find a job and study part-time.

We also have the issue of dropouts. University or college might not be what you thought it was. If you took out a loan and you drop out, you will still be responsible for that amount you're borrowed. If you didn’t take out a loan, but you paid for it yourself, you are going to lose all your hard-earned money, but at least you won’t have to pay anyone back.

If you believe that you cannot do studying and working at the same time, you might take the option of saving up money before you enroll for a course. Many students have this belief that you have to study a degree to become someone in life, but if you have a fair idea of what you want to do, then you can enroll for a short course in your direction to see if that is really what you want to do. Rather be safe than sorry. You might find that you really don’t like it and then you didn’t waste any money, but you will have an extra qualification on your CV.

The best solution is to borrow less money. The less you borrow, the less you will have to pay back. If possible and you are a full-time student, find a job and pay back whatever you can while you are still studying.

Even though a student loan can make it a lot easier for you to study and you don’t have any other choice, here are some pointers to look at:

- Sign a debit order and do not count that amount as part of your expenses.

- If you can pay a little extra on the amount so that you can pay off the loan faster.

- Cut down on personal expenses and pay off what you can as fast as you can.

- See if you cannot take out a personal loan with a lower interest rate so that you can pay off the student loan in full.

In the end, do not let finances take over your life. Where there is a will there is a way! Education is the key to everything and if you have to go through a few years of difficulty it is nothing compared to what you get after you finish your degree.

A student that would spent 7 years asking questions on Hive rather than fees in a University will end with a nice stake of Hive Power that would allow him to start a business on Hive.

You always have the best ideas @chrisaiki!

Thank you !

You need a degree most times, except rarely in tech. I remember sitting with a newly printed degree reading the government jobs that had entry-level jobs with 5 years experience.

Seriously?

Upped and Reposted

!tip

Anyone going into debt thinking that it will make them more employable (or intelligent) is yet another case of social Darwinism in action.

to paraphrase Mr Carlin' 'Any employer that took a degree as a sign of intelligence, is not an employer I'd want to work for'.

(medicine, law, or the sciences not included)

Agree with your sentiments, sadly today too many corporate companies expect that degree, even after years of working in your profession, piece of paper over here takes you a little further.

On the other hand we have many with degrees sitting on pavements looking for menial labour never being given an opportunity in corporate world.

Degree still does not mean you are able to problem solve, it really is walking a thin line between knowledge and experience....

Going into debt right at the start is exceptionally hard to go in full time and pay back.

Working and studying takes a lot of dedication getting up in the early hours of the morning to study, do a days work then come home to study a little before going to bed was one way of doing it. Some institutions offer Saturday education services which is another way to study.

No matter which one is selected they all take their toll, one really must know what you wish to achieve before going into any institution and signing on the dotted line.

@tipu curate

Upvoted 👌 (Mana: 0/5)

Congratulations @giantbear! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Ain’t that the truth I was lucky to still be able to pay my studies cash and get into the working world on zero! Tertiary education as exploitative by nature they don’t even give you real job skills these days just a piece of paper!

People need to wake up and see that’s not the only path to success and stop overpaying for a dream that so far is not working out for the majority

Very good advice for students. Thank you for writing.

Check out @dswigle blog here and follow if you like the content :)

Sending tips with @tipU - how to guide.

🎁 Hi @giantbear! You have received 0.1 HIVE tip from @dswigle!