In a recent conversation I had with fellow Hivean and Lion Joel Valenzuela, it was brought to my attention that it could be useful to have some easy to understand information about how the Hive currencies work and the mechanics of the reward system used to distribute these tokens to validators, stakeholders, content creators and curators.

We dug up some very useful articles from yesteryear and updated much of the information to create some cheat sheets that will hopefully be of useful to anyone who wants to get a better understanding of Hive.

I'm not by any means an expert, so it's possible that there are mistakes here. If you think this might be the case, please let me know in the comments below, and I'll gladly update the information in this post.

There are three assets on the Hive Blockchain:

HIVE

- Liquid, tradable on exchanges. At the time of writing, Hive is available for trade on the following exchanges:

- Can be transferred from an exchange into your wallet (use your account name as the address)

- Alternatively, it can be exchanged to $HBD in Hive’s internal market

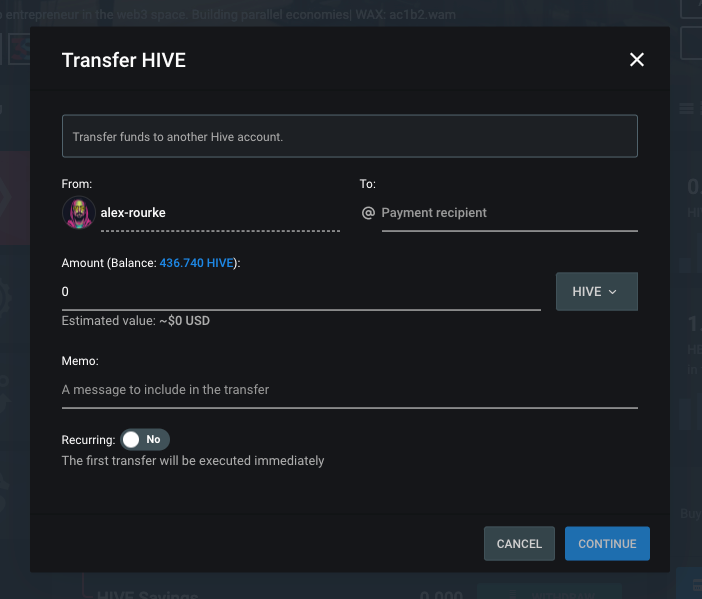

- Can be transferred to another Hive account using the transfer function in the wallet section of any Hive front end, mobile app or wallet extension such as Hive Keychain.

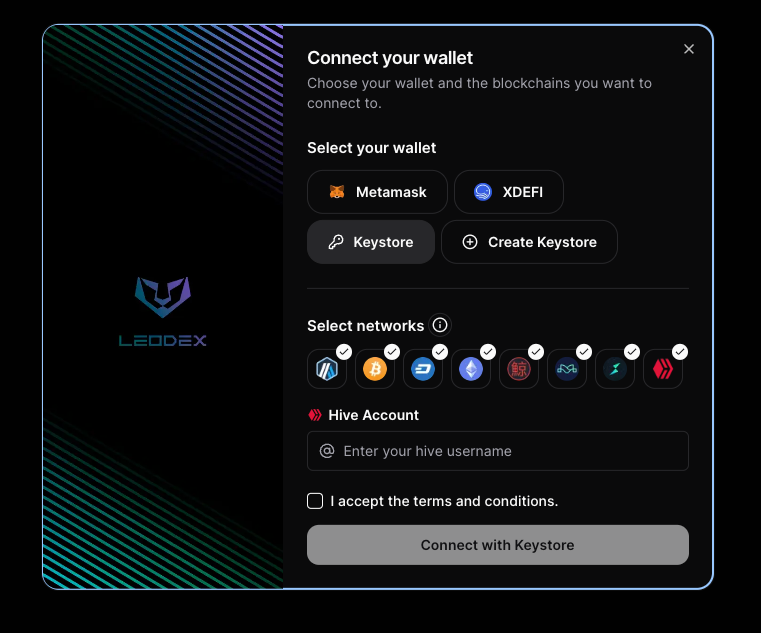

- Can be exchanged for assets on other chains such as Arbitrum, Bitcoin, Dash, Ethereum, Kuji, Mayachain and Thorchain using LEODEX decentralized exchange.

- Can be converted to SWAP.HIVE through services like beeswap and HIVE ENGINE. SWAP.HIVE is a wrapped version of HIVE on HIVE ENGINE, Hive’s smart contract layer with an independent P2P/Witness system operating 35 nodes in a network. The first smart contract being introduced is the ability to quickly and easily create custom tokens with no coding required. SWAP.HIVE can be exchanged with other layer 2 tokens such as LEO, BRO, BEE and other popular L2 tokens used by tribes, games and other dapps. Another use for HIVE ENGINE tokens are the creation of liquidity pools, which can be accessed through Tribaldex and Beeswap.

- Hive inflation is one of its key monetary features. It was set with a decreasing inflation model that started at 8% per year in March 2020 (when the blockchain forked from Steem) and decreases at a rate 0.01% per 250,000 blocks until it reaches 0.95%. Block production on Hive happens every 3 seconds.

Hive's distribution mechanism

The Hive blockchain distributes newly minted tokens through something that was at some point known as Proof of Brain (PoB) mechanism, designed to reward content creators, curators, and other stakeholders for their contributions to the ecosystem. Here’s a breakdown of how Hive distributes its inflationary rewards.

Let's first look at some key factors

Inflation Rate:

The Hive blockchain uses a declining inflation model:

Starting from ~8% annually in March 2020 (after the Hive fork from Steem). Decreasing by 0.01% per every 250,000 blocks or approximately 0.5% annually until it reaches a fixed 0.95% annual inflation rate in the long term.

Block Time:

Hive has a block time of 3 seconds. This means approximately 20 blocks are created per minute, 1,200 blocks per hour, and 28,800 blocks per day.

Inflation Allocation:

Newly minted tokens are into different groups: content rewards, witnesses, and the Decentralized Hive Fund (DHF). We'll look at the exact percentages in just a moment.

At the time of writing, the current HIVE supply is 459,970,969.512 tokens (source: hiveblockexplorer.com) with an estimated inflation rate of 6% in 2024. As mentioned above, Hive has a 3 second block time, so the blockchain produces about 20 blocks per minute or about 10,512,000 blocks per year:

20blocks/min×60min/hr×24hrs/day×365days/year = 10,512,000

If we take the current supply x the expected inflation rate we can calculate how many HIVE tokens are created per year (approximately):

459,970,969×0.06 = 27,598,258 HIVE per year (approx.)

27,598,258 Hive per year / 10,512,000 blocks per year ≈2.62HIVE per block.

These are distributed in the following manner:

65% to Reward Pool (Content Creators & Curators):

2.62 × 0.65 = 1.70 HIVE per block10% to Witnesses:

2.62 × 0.10 = 0.26 HIVE per block15% to Staking Incentives (if applicable):

2.62×0.15 = 0.39 HIVE per block.10% to the Decentralized Hive Fund (DHF):

2.62×0.10 = 0.26HIVE per block.

These Hive rewards are not paid out in liquid tokens. They're paid out in a combination of

- Hive Power (HP)and

- Liquid HBD (Hive Backed Dollars)

We'll explain these in detail now.

HIVE POWER (HP)

- Not liquid, implies long term commitment to the Hive network

- Of newly created Hive, 10% goes to Hive Power holders. Holding Hive Power is akin to holding shares of a company. The Hive network distributes a portion of newly minted tokens to HP holders proportionally to the size of their holdings. At the time of writing, the approximate APR% you’ll receive for holding Hive Power is 2.95%

- Can be acquired by powering up liquid HIVE in your wallet

- Can be acquired if another account powers up their liquid HIVE to your account as a form of reward or payment.

- Can be delegated, which means account A can temporarily or indefinitely assign a portion or the totality of its voting power to account B without the funds leaving account A's wallet. This can be useful for governance as well as curation. In fact, many curation guilds accept HP delegation from users in exchange for a portion of the curation rewards. Some curation guilds include OCD and Curangel.

- It takes 13 weeks to be converted to HIVE through a process called powering down. Once the power down process has been initiated, you will receive 1/13th of your powered down amount every 7 days. This slow power down was implemented as a security feature. If a malicious actor were to steal your keys and initiate a power down in an attempt to steal your funds, you would have time to restore your account and change your keys before any funds are withdrawn.

HIVE Backed Dollars ($HBD)

- Liquid, tradable on Hive’s internal market.

- Designed to have stable value of about $1.

- One of the mechanisms that helps achieve this is the DHF (Hive's DAO)-funded @hbdstabilizer bot that uses HIVE to purchase HBD when it is possible to do so for less than 1 USD and sellss Hive for HBDs when the price is above $1.00. Whatever sales/ buys/ conversions are made, the HIVE/ HBDs are always returned to the @hive.fund account, the Hive DAO account

- Pays holders 15% annual interest when placed in savings. $HBD in savings (staked) are held in your account, under your custody. All you need to do look for a dropdown menu in your favorite Hive front end and click on “stake HBD” or “transfer to savings”. To withdraw $HBD from savings you can simply click on unstake. This process includes a 3-day waiting period.

- Can be converted to HIVE right in the wallet. Each $HBD is converted to $1 worth of HIVE. Conversion takes 3.5 days and the price is median price over that period.

- Like HIVE, $HBD can be transferred to another Hive account using the transfer function in the wallet section of any Hive front end, mobile app or wallet extension such as Hive Keychain.

Hive Rewards cheat sheet

This Cheat Sheet summarizes various aspects of Hive rewards for authors and curators. It is designed to be short and informative; for detailed explanation check out links at the end of this post.

Hopefully you’ll find it a useful reference. If something is missing or can be improved, please let me know!

On Hive, valuable content is rewarded by the community. Whether it’s a long-form blog posts, a comment or one of various short-form interfaces such as INLEO Threads, Ecency Waves or PeakD Snaps. The exact amount of the reward depends on a couple of factors:

- The total Hive Power of curators (people who have voted for the post or comment)

- The weight each curator has given to their vote during the voting period or reward window, which lasts for 7 days from the moment the author publishes de post. Positive vote weight can be adjusted via a slider to have anywhere from 1% to 100% vote weight.

Similarly, negative votes can be adjusted to carry anywhere from -1% to -100% vote weight.

Voting power or “voting mana” decreases as curators vote, and recharges gradually while they don’t. If you start with 100% voting mana, if you vote with 100% voting weight, then it will deplete by 2%, so the new voting mana will be 98%. So when voting next at 98% with full weight then it will again deplete by 2% of the voting mana. So the new voting mana will be (98-(98*0.02))= 96.04%. And so on.....

| Number of votes with full vote weight | Voting mana |

|---|---|

| 0 | 100 |

| 1 | 98 |

| 2 | 96.040 |

| 3 | 94.119 |

| 4 | 92.237 |

| 5 | 90.392 |

| 6 | 88.584 |

| 7 | 86.813 |

| 8 | 85.076 |

| 9 | 83.375 |

| 10 | 81.707 |

You get the idea.

If you'd like to see how much your vote value is at any given time and how long it will take to recharge, you can check it on hivestats.io

As well as block explorers such as https://hivexplorer.com/

When the reward window is finished, the post will no longer eligible for votes and the amount earned will be distributed as follows:

- 50% goes to the author and is paid out in Hive Power and $HBD in equal proportions.

- 50% goes to curators. This part is paid 100% in Hive Power. How exactly it is divided between the curators depends on how much voting power each curator has at the time of voting.

Note that no payment may be less than 0.001 Hive Power or Hive Backed Dollars ($HBD)

Further Reading:

- If you’re unsure about what Hive Power or Hive Backed Dollars ($HBD) are, check this https://peakd.com/steem-help/@peterz/steem-currency-cheat-sheet

- Hive whitepaper discusses author rewards in the Subjective Contributions section, but beware: things have changed since its publication

- For a historical breakdown of how the Reward Calculus was originally designed, see this 6-piece series by @theoretical:

Credits: The original information in this article was written by @peterz on August 5th 2016 prior to the Hard fork from Steem blockchain. Much of the information has been updated to reflect the current aspects of Hive, its mechanics and the tools the Hive ecosystem interacts with.

Posted Using InLeo Alpha

Super valuable information, thanks for breaking it down!

This is a great idea, and I am sure the Dash Community Members will appreciate the effort to educate them. I think the three E's are important, Education, Engagement and Earnings. Your post is a good education tool for incoming Dash members!

We're all friends now. Hopefully many more Dash+Hive partnerships come after InLeo.

I agree. This was @thedessertlinux 's idea and I think it's genius. Dash users will definitely appreciate some guidance in the HIVE ecosystem and every little bit of useful information helps.

.

My mistake. I've made the correction.

Thank you for pointing that out.

Very good and detailed summary, Alex. 👍🏻

Thank you very much! If you think anything is missing or would like to add links to other articles, please let me know.

That's a great summary! I often get newcomers ask me stuff about the rewards system. This is a great primer to refer them to

I'll gladly update it if you think anything is missing.

Hey alex, is it possible that you can add Indodax link to exchange that lists Hive?

https://indodax.com/market/HIVEIDR

Hey Mac! yes, absolutely! added to the list of exchanges. Thank you for pointing that out. Have you reached out to @crimsonclad to see if INDODAX can be added to Coingecko?

It's already on Coingecko but because their volume it's not on top 10 they are also recently hacked and has low trust score. Although they've been operating since 2014 and the first exchange in the country

https://www.coingecko.com/en/coins/hive

Thanks for making posts like this. I think the Koreans are doing the most on upbit, one wouldn't know that Hive is in so many exchanges including the recent added Indian exchange.

@tipu curate

Upvoted 👌 (Mana: 33/53) Liquid rewards.

Yes, today it's 40%, sometimes it's ~80% and it needs to be much less concentrated. I think it's still worth getting on more top tier CEXs for exposure at this early stage. Later on, we can rely solely on tools like LEODEX and other decentralized exchanges.

Yes, I agree it needs to be less concentrated especially because of the instability that high concentration can cause. Yeah, I think internally, LEODEX and co can be beneficial, but on the larger front and externally, we just need the buzz of big CEXes

Thank you for this

I actually like the idea of the HBD

But is it possible to make HBD totally stable?

After the implementation of the HBD Stabilizer, $HBD has actually been incredibly stable with variations of 1/100th of a cent. Don't be fooled by what some aggregators display as they are missing liquidity in the internal market as well as DEXs.

Also, @godfish has suggested we, as individual users, can use Hive's internal market to make some gains with arbitrage and help keep the $HBD price stable in the process. win-win. I am not an expert trader, so I don't feel qualifies to make a tutorial about this, but I'll gladly contribute my video production skills to collaborate with someone who can break down these concepts and would like to share this knowledge with the community.

Excellent for onboarding peeps. Very well structured. Thank you, Alex!

A lot of articles were written in the prefork days and needed updating. Learned some new things in the process. Please feel free to share it id someone evee needs help.

Very well done, Alex! 💪🏼

I don't know if it's on purpose that you have left delegating HP out of it, but I think it's a good idea as I'm sure it's described in one of the links (haven't been through them all)

All in all, fantastic article!

!BBH !DUO !hiqvote

Thank you for pointing out the part about delegating HP, I've added a small section with a brief description of what it means to delegate HP.

You're welcome 😊

It's a fairly essential part of Hive, but at the same time, it may not be relevant info for all (though it is relevant for many people, especially as their account grows)

!BBH

@caspermoeller89 likes your content! so I just sent 1 BBH(2/20)@alex-rourke! to your account on behalf of @caspermoeller89.

(html comment removed: )

)

You just got DUO from @caspermoeller89.

They have 1/1 DUO calls left.

Learn all about DUO here.

This is one of the best explanations I have seen for any blockchain Token system. You have done an excellent job educating both users and potential investors.

I'm glad you found it helpful. I also think we need as much information as possible for users to learn concepts and how to use the tools available in this ecosystem.

Hive is Godsent this is a lot of explanation on how it works great details

I hope it helps you on your Hive journey.

Yes it surely will

Thanks, this is very educational. I didn't know how much a full vote lowers my mana so this was very helpful. Also, thanks for providing a list of exchanges. I mostly used Binance, but having more options is always better.

Hopefully more liquidity is moved to DEXs and more DEXs have HIVE liquidity pools. But yeah, Major exchanges could be quite beneficial at this stage.

This sums it up .!! Thanks for this article .

Thanks friend. More coming.

You've broken down a lot of details friend, thanks. Learned new things in the process.

Glad you found it helpful, don't forget to build up your stake and participate in this ecosystem.

i will, thanks for the encouragements. Still a long way to go anyway

You missing a thing on the reward curation, the earlier you vote, the more you earn in curation. The first 24h are the most rewarding expecially the first hours

I think I can add a bit of info on this aspect and update this comment. Thank you for pointing that out.

You welcome, it's a tricky thing not really explained... It's the cause of fights between whales as one used to vote splinterlands content and then upvote it with steemmonsters account to maximize curation in the first 24h,then other whale equilized it... Long story

I forget if it was on Steem or Hive, but wasn't this somewhat randomized so that bots who automatically voted an author's post might earn less than someone who voted on it a few hours later? 🤔

nope, not randomized, at least on hive, first 24h hours are that ones which gives more curation rewards (first 0-3h the best overall)

Right. Just found a post explaining that the 5-minute "reverse auction" went away a few years ago.

Great breakdown! We'll be sharing this and linking to it when we onboard users to InLeo.

Amazing! I'll be sure to make some walkthroughs for Dash lions when the integration is finished.

Excellent!

Things are difficult and will be understood after understanding. You have made a very knowledgeable post

#hive #posh

The information is very useful sir.

All the procedures sir are what I applied in terms of my Hive and HBD.😊

I'm glad you applied the procedures.

Thank you. Yes.. I think it's the easiest process, sir.😊

@caspermoeller89 likes your content! so I just sent 1 BBH(1/20)@alex-rourke! to your account on behalf of @caspermoeller89.

(html comment removed: )

)

Congratulations @alex-rourke! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 6750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP@caspermoeller89, the HiQ Smart Bot has recognized your request (1/3) and will start the voting trail.

In addition, @alex-rourke gets !PIMP from @hiq.redaktion.

Discord. And don't forget to vote HiQs fucking Witness! 😻For further questions, check out https://hiq-hive.com or join our

The rewards earned on this comment will go directly to the people( @alohaed ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.