One of the central ideas espoused by the WEF is the importance of public-private-partnerships (P3), where various stakeholders throughout society come together to solve the most pressing issues of our time. The WEF and Davos attendees are enthusiastic supporters of the model often touting P3 projects as "win-win" solutions.

In effect, public-private partnerships are contracts between a government and a private company where the company assumes responsibility to operate a sector or service previously controlled solely by the government. In this arrangement, the company finances, builds and manages the project and is typically compensated through a fixed payment plan with the government or through fees paid by users and in some instances both.

A 2013 whitepaper on public-private partnerships put forth by the WEF titled:

“Strategic Infrastructure: Steps to Prepare and Accelerate Public-Private Partnerships”

reads as a "how to" guide for governments looking to incorporate P3 into national policy on infrastructure. In fact, the whitepaper specifically identifies the "target audience".

This report is designed primarily for senior government leaders and for the officials responsible for planning and delivering infrastructure projects.

Amongst an exhaustive list of corporate management best practices are recommendations on how to facilitate project pipelines and ways to institutionalize P3 projects into government policy. The WEF paper stresses the importance of creating "P3 units" and experienced "advisers" with knowledge of both the private and public sectors with "access" to "key decision makers" to guide the project from start to finish. It also recommends "governments would do well to formulate a steady project pipeline" in the interest of attracting foreign investment.

Advocates for P3 are steadfast in the belief that P3 is the ideal vehicle for cutting through red-tape and delivering more efficient outcomes while also benefiting a wider scope of stakeholders.

In reality, P3 projects are in essence a repackaging of privatization of the public-sector and the fascist-like fusion of industry and state power masquerading behind feel-good progressive language. Despite the rhetoric, P3 are a far cry from being the vehicles of efficiency and innovation sold to a credulous public and can quickly devolve into a breeding ground of conflict of interest and corruption, as we shall see.

Fink's Bank and Think Tanks

In January 2016, fresh off an election majority victory in 2015 that brought the Liberals back to power, Trudeau and a delegation of Cabinet Ministers set off for Davos to attend the World Economic Forum.

Among the contingency was then Finance Minister William Morneau, Minister of Foreign Affairs Chrystia Freeland, Minister of Innovation, Science and Industry Navdeep Bains and Minister of the Environment Catherine McKenna. The aim of the Canadian delegation was straight forward, promote Canada as a cutting edge business friendly nation and drum up capital from large institutional investors. Their main target was BlackRock CEO Larry Fink.

It was a coming out party of sorts for the Canadian government, "there has never been a better time to look to Canada" declared Trudeau in his keynote speech at Davos. In the same speech addressing the Davos faithful, the Canadian PM jokingly stated that fellow Canadian Dominic Barton had probably worked for many in the audience at some point in his career. At the time, Barton was the Managing Director of McKinsey consulting agency well known for advising major corporations and governments alike.

The 2016 conferenced marked the beginning of a courtship that would go on for several years between the government of Canada and the money management behemoth BlackRock in an effort to draw capital from the world's largest investors. It would also lead to the creation of the Canada Infrastructure Bank (CIB) and at the same time spark concerns over conflict of interest involving industry executives and Canadian government officials.

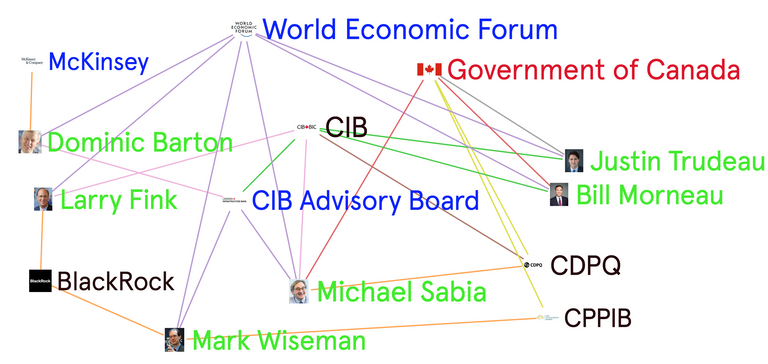

Key players in the creation of the CIB also happen to be members of the World Economic Forum.

Larry Fink - BlackRock CEO

Justin Trudeau - Prime Minister

William Morneau - Finance Minister

Dominic Barton - Managing Director McKinsey Group

Mark Wiseman - CEO of Canadian Pension Plan Investment Board / BlackRock Exec

Michael Sabia - CEO of La Caisse de dépôt et placement du Québec (CDPQ)

BlackRock

Since the 2008 financial crisis, BlackRock has emerged as one of the pillars of Wall Street. Launching in 1988, BlackRock has transformed into the world's largest private equity firms. According to 2021 filings, BlackRock has over $10 trillion under management and simultaneously is a top shareholder in some of the largest and most successful publicly traded companies listed on the stock market.

BlackRock's top share holdings include:

Apple, Microsoft, Amazon, Google, Tesla, Facebook, Johnson & Johnson, Berkshire Hathaway, JPMorgan Chase, Pfizer, Bank of America, Visa, and MasterCard.

With its ever increasing trillions under management, easily dwarfing the GDP of every country in the world aside from China and the US, BlackRock's CEO and founder Larry Fink has become the toast of Wall Street.

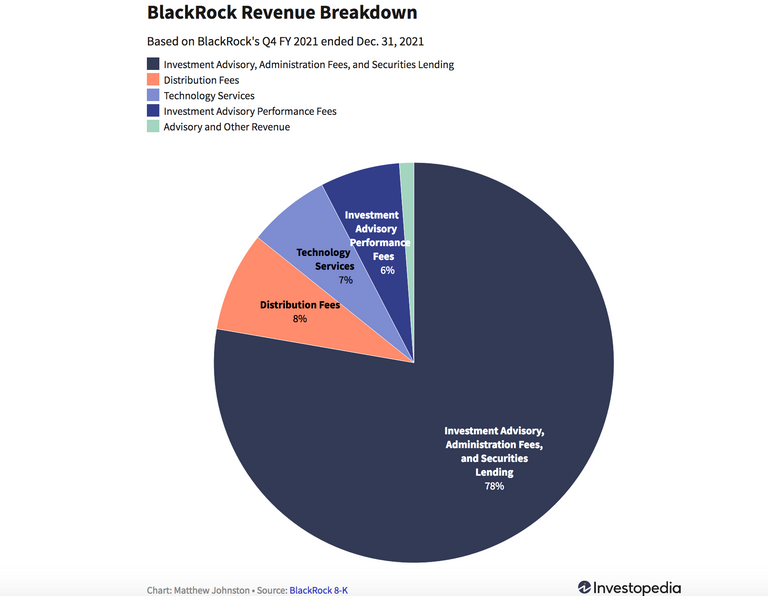

- Blackrock earns almost 80% of its $19.37B revenue (2021) from advisory and administration fees.

Wall Street's "Mr. Fix It"

During the 2008 financial crisis, Larry Fink and BlackRock were instrumental in averting a complete economic collapse as the story goes.

In 2008, the Federal Reserve Bank of New York brought on BlackRock mainly to assist in the management and sale of toxic assets held by Bear Stearns and AIG. At a time where many of Wall Street largest firm's stock prices were plunging BlackRock's stock began to soar.

There's some irony that the US Federal Reserve turned to Fink for help in 2008 as Fink had a hand in devising the toxic assets that triggered the crisis.

There is no shortage of drama these days in the credit markets, which happen to be Fink's specialty. Back in the 1980s, at First Boston, he helped pioneer mortgage securities, the kind of investments that are causing so much of the trouble now.

More than a decade later, BlackRock would be tapped once more to manage the Covid-19 relief program joining forces with the US Treasury and the Federal Reserve to oversee the allocation of $1.5 trillion CARES Act.

It has been documented that BlackRock's involvement in allocating billions of dollars in relief through the CARES Act in America represented a clear conflict of interest. Many companies that received relief funding were companies in which BlackRock was a top investor. Furthermore, it illustrated the ongoing entanglement of the US government and the private sector and the entrenchment of the firm in the financial system. To make matters worse, BlackRock is not subject to regulatory scrutiny or any sort of oversight and therefore unaccountable to the public.

Corporate America Reaps Egregious Sums | The CARES At

When not managing trillions of dollars in relief packages for governments, BlackRocK is a vocal proponent of privatization. CEO Larry Fink has long argued for the need for privatizing national infrastructure.

“Substantial expertise must be dedicated to bring projects to market in a format appropriate for institutional investment,” Mr Fink says. “These projects must deliver competitive returns and that will often require efficiencies that can only be achieved through private ownership.”

That BlackRock's CEO views echo the WEF's position that only the private sector is capable of delivering new infrastructure projects through P3s, should come as no surprise.

Fink is a regular fixture at the World Economic Forum as well as the Aspen Ideas Festival which is the closest US equivalent to Davos on the ultra-rich conference circuit. Fink has garnered quite a bit of media attention in recent years advocating for WEF-styled "stakeholder capitalism" and the importance of Environmental, Social Governance (ESG).

Larry Fink famously penned a letter to investors of BlackRock in 2019 where he advocated for the need for investors to consider ESG and Net Zero Climate Change targets. The "Fink Letter" set in a motion a wave of positive press that Wall Street was changing its tune. Yet, despite the adulation in the press BlackRock remains a significant investor in Big Oil and in large scale gas pipelines such as Saudi Arabia's Aramco project.

Coincidentally, ESG is yet another agenda item aggressively pushed forth by the WEF over the years. The Davos crowd sees ESG as another important tool in reshaping society publishing yet another Whitepaper on the subject.

Strong environmental, social and governance (ESG) performance has the power to unlock significant positive impact for investors, companies and wider society.

World Economic Forum

Once again, according to the WEF all of society benefits, but perhaps more importantly it benefits actors in the private sector while pandering to the public with progressive language and idealism.

The Creation of the Infrastructure Bank

Part of the Liberal Party's platform during the 2015 elections was the promise to provide middle class jobs for Canadians, to invest in "innovation" for the future and to modernize Canada's ailing infrastructure. The creation of an infrastructure development bank was included in the platform.

At the January 2016 Davos conference, McKinsey Director Dominic Barton organized a face-to-face private breakfast between Canadian PM Justin Trudeau and several of his cabinet ministers with Larry Fink and BlackRock executives. This initial meeting was fruitful as it spurred a series of additional meetings between the parties throughout 2016.

A few short weeks after the wrap up of the Davos conference, Larry Fink and Justin Trudeau met once again on March 16th, 2016, in New York city.

Almost immediately after Trudeau's meeting with Fink in New York, Canadian Finance Minister Bill Morneau announced the formation of the government's Advisory Council on Economic Growth (Advisory Council). The Advisory Council would study Canadian economic potential and make recommendations to the Finance Ministry. Morneau made the announcement on March 18th, 2016.

The Advisory Council would be chaired by none other than McKinsey & Company's Dominic Barton, the man that organized the initial meeting between BlackRock and Trudeau at Davos earlier that year.

Other players named to the Advisory Board were executives representing two of Canada's largest investment funds, Mark Wiseman then CEO of the CPPIB and Michael Sabia the CEO of Canada's second largest investment fund at La Caisse (CDQP).

The establishment of the "Advisory Board" and appointment of Barton as chair bears a striking resemblance to the "P3 Units" prescribed by the 2013 WEF paper.

Under Barton's guidance, the Advisory Board would make a series of reports, thin on details, suggesting ways to stimulate investment in Canada. The top recommendation made by the board being the creation of a new infrastructure bank that would help facilitate large scale infrastructure projects and attract funding from global institutional investors. The report also recommended a roadmap to attract more foreign capital. The infrastructure bank would employ P3 as a cornerstone in every project as shown on the CIB official website.

Executive Summary of ACEG First Report October 2016

Unleashing Productivity Through Infrastructure

The report highlights the types of infrastructure projects that the government should focus on with an emphasis on projects of $100 million or more to attract institutional capital.

Examples include toll highways and bridges, high-speed rail, port and airport expansions, smart city infrastructure, national broadband infrastructure, power transmission and natural resource infrastructure.

In May of that year, Mark Wiseman stepped down as CPPIB CEO after 4 years as top executive as well as 10 years with the fund, to join BlackRock on Wall Street as Senior Managing Director and Global Head of Active Equities. At CPPIB, Wiseman was instrumental in shifting the investment strategy of the fund from one of stocks and bonds to one of "active investing", particularly in global markets. At the time of Wiseman's departure the CPPIB had $280 million in assets under management.

Wiseman would join his wife at the firm, Marcia Moffat a former Royal Bank of Canada executive, who was named head of BlackRock's Canadian division the previous year. Despite joining BlackRock, Wiseman did not recuse himself from his seat on Barton's Advisory Council.

On November 14th 2016, BlackRock hosted a summit at Toronto's upscale Shangri-La Hotel closed to the press and the public. In attendance along with BlackRock executives, Trudeau and members of his cabinet were representatives from some of the world's most powerful international investors. The group was scheduled to discuss infrastructure "opportunities", but the full details of the meeting remain unknown. Among major investors in attendance were: Saudi Arabia's Olayan Group, Singapore's Temasek holdings, Norway's Norges Bank and McKinsey & Company.

It wasn't until the following year that some information surrounding the summit began to materialize. According to access to information documents obtained by Globe & Mail journalist Bill Curry, it was revealed that BlackRock and Canada's federal Privy Council Office had created "working groups" ahead of the summit and coordinated closely in preparing the federal government's own presentation for the private seminar.

In the lead-up to the summit, BlackRock reportedly participated in biweekly conference calls with Infrastructure Canada and the Privy Council Office to create a presentation Infrastructure Minister Amarjeet Sohi was to deliver to the investors.

This is where conflict of interest concerns comes into sharper focus. BlackRock, a potential investor in Canadian P3 infrastructure projects was writing the policy for the government of Canada from which they would directly benefit.

It was also later revealed that Trudeau had hired an "unidentified" banker to help advise the government on the CIB. The unnamed individual had previously been employed by Merril Lynch and Bank of America.

Merril Lynch and Bank of America have close ties to BlackRock. In 2006, BlackRock merged with Merril Lynch Investment Management. In addition, Bank of America purchased Merril Lynch in 2008 during the financial crisis. BlackRock is the 3rd largest shareholder of Bank of America behind Vanguard and Berkshire Hathaway (in which BlackRock is also a large shareholder) with a 6% stake.

Just days after BlackRock's summit in Toronto wrapped up, Finance Minister Bill Morneau released the 2016 Fall Economic Update report. He announced the Liberal government's plan to create and seed fund the Canada Infrastructure Bank, closely following the recommendations of the Advisory Council developed by McKinsey and BlackRock executives.

Fall Economic Update November 2016

As a 2021 investigative report describes:

Morneau outsourced policy-making about the bank from his department to this advisory-council - and through Barton to McKinsey Consulting, which has largely been responsible for the content of the council's flimsy reports.

In February of 2017, Trudeau announced the appointment of Jim Leech as special Advisor to the CIB. Before retirement in 2014, he was the CEO of the Ontario Teacher's Pension Fund. Leech is a long-time friend of Mark Wiseman, the two often take ski trips together. The pair also previously worked with each other at the CPPIB.

In the spring of 2017, Morneau tabled the annual Federal Budget for 2017. No new details on the CIB were presented. However, on April 11 2017, the Finance Minister presented Bill C-44 (the Budget Implementation Act).

Here, the establishment of the Infrastructure Bank Act was included among 300 pages of a variety of unrelated items in an Omnibus Bill. One section describes the 'accelerated implementation' of the CIB which was largely indistinguishable from the Advisory Council recommendations made the previous year. The Finance Ministry announced that the CIB would receive $35 billion dollars in initial funding and projected that the bank would be up and running by the end of 2017.

Canadian Budget Implementation Plan 2017

By the end of 2017, the board of directors of the CIB was revealed. The board consists entirely of actors from the business community without a single representative from unions, environmental organizations or an elected political official. Named to the board was Janice Fukakusa, a former Royal Bank of Canada executive who was previously the supervisor of Mark Wiseman's wife Marcia Moffat at the bank. Having a board populated with representatives from the private sector all but assures a profit first program at the bank.

If that wasn't enough, another of Wiseman's associates was named President and CEO of the CIB in May 2018, Pierre Lavallée. Lavallée had previously worked with Wiseman and another BlackRock executive, André Bourbonnais.

Lavallée's tenure at the bank didn't last long as in April 2020 the federal government announced a significant shakeup of the bank's leadership under mounting public pressure and skepticism. With the CEO making his departure, chair of the board Fukakusa also stepped down from her position. In place of the outgoing chair, it was announced that Michael Sabia, one of the Advisory Board's original members, was tasked to lead the CIB as it searched for a replacement for Lavallée.

In an almost absurd continuation of conflicting interests, Sabia's former institution La Caisse (CDPQ) is involved in the first CIB funded venture with the establishment of a light rail transit system in Québec known as REM. The CIB has earmarked up to $1.3 billion to buoy the project and an additional $300 million in loans. The first item on the agenda is the construction of a REM route connecting downtown Montréal and Trudeau airport. At the time, CEO of the CIB Mr. Lavallée stated that the REM project would "set an example" of how future infrastructure projects would be implemented. La Caisse will own and operate the REM project on a for-profit basis.

The revolving door-between high-finance and government continued when in December 2020, Sabia returned to government as Trudeau appointed Sabia as the new Deputy Finance Minister under Chrystia Freeland further blurring the lines between public service, the bank and private financial interests.

For years, the Liberal government has maintained that the CIB would operate independently and "at arm's length" from the government. Yet, considering the close relationship between the the government and corporate investors and how the CIB was created, it's hard to take these claims seriously.

At every step of the way, since the inception of the CIB, it has been steered by insiders with direct connections to BlackRock and financial institutions that stand to benefit the most from future projects.

The Risk Reward Equation

For the private sector, interest in funding CIB/P3 large-scale projects is straightforward. Investors who provide funding for projects upfront are guaranteed a 7%-10% return on investment by the government. On top high rates of return, P3 infrastructure projects have a life span of 20 to 30 years assuring longterm fixed income streams. These types of surefire returns are not easy to come by in current markets which make them attractive to institutional investors.

P3 contracts allow private operators to assume responsibility for providing services that the public sector previously supplied. The government then pays the contracted companies to cover their financing, operations, and maintenance, assuming the risk while they retain the profits.

The Canada Infrastructure Bank is designed to operate in exactly the same way. It's believed that since the private sector puts forth the initial capital and therefore exposing their firms to increased "risk" they should be well compensated for taking on this burden.

Advocates of P3 claim that their financial knowledge and expertise in project management inherently makes the private sector a better choice over their counterparts in the public sphere. Therefore, due to superior cost savings, management and the assumption of capital "risk" from the private sector, there will be more money in the government treasury to return to other critical public services.

Before his swift departure, former CIB CEO Mr. Lavallée echoed these sentiments.

The CIB's investments advance projects in a way to ensure there is risk transfer to the private sector. By injecting capital from the private sector into infrastructure projects that provide public benefits, governments are able to allocate scarce government capital to other public sector investment priorities.

Government official and business executives never pass up an opportunity to heap praise on the wonderful benefits of P3 for the greater public. Yet, these arguments fall flat when under further scrutiny.

Far from being the efficient cost effective approach to infrastructure funding, there exists plenty of evidence demonstrating that P3 projects end up doubling the price tag compared with traditional low cost loans and bonds over the long run.

The CIB's true purpose is to cater to special interest and secure inflows of capital to private investors. According to Western University's Ivey Business School,

One of the primary functions of the bank is to provide "loan guarantees" to private investors, essentially protecting their return on investment and making the taxpayer entirely liable in situations where forecasts prove inaccurate, projects fail, or costs otherwise accrue above and beyond what was expected.

Toby Sanger executive director of Canadians Tax Fairness explains that P3s typically rely on what is known in the industry as Special Purpose Vehicles (SPV) corporate structures that are limited liability. By definition, a SPV is a "subsidiary created by a parent company to isolate financial risk. SPVs may be used to undertake a risky venture while reducing any negative financial impact upon the parent company and its investors."

These complicated structures essentially act as shielding for institutional investors. "If the thing goes belly-up they (private investors) only have 15% equity at risk and the rest - the bonds - stay with the SPV." Therefore, private financiers are only 15% exposed and the proclaimed transfer of risk is simply a mirage. Ultimately, the risk remains with public entity and the taxpayer.

Likewise, funds that are supposedly "freed" up by P3 cost savings to be reallocated to other public services is another misleading corporate fantasy. In fact, the opposite is a more likely outcome.

A 2017 study conducted by the Canadian Centre for Policy Alternatives found that CIB funded projects may actually double the cost for infrastructure and overall could reduce the amount of funding available for future projects.

This study finds that private financing of the proposed Canada Infrastructure Bank could double the cost of infrastructure projects—adding $150 billion or more in additional financing costs on the $140 billion of anticipated investments. It would amount to about $4,000 per Canadian, and about $5 billion more per year (assuming an average 30-year asset life). The higher costs would ultimately mean that less public funding would be available for public services or for additional public infrastructure investments in future years.

Therefore, the "risk transfer" is indeed substantial but in the opposite direction. The private sector passes off significant risk onto the public all the while reaping the benefits of decades long guaranteed profits.

In order to guarantee the high rates of return to institutional investors, additional costs must be accrued over time in the form of fees, tolls and taxes. And since ongoing payments are contractually guaranteed, payouts take priority over other public services and create situations where governments are forced to divert funds from public services to cover the costs of P3 payments.

In the end, it's the taxpayers that windup paying more over the long haul. First the taxpayers subsidize the CIB with a $35 billion dollar slush fund and ongoing government payments to its P3 partners. Second, over the life span of a project the citizens pay increasing user fees and tolls for public services.

Privatization Nation

source

It's not surprising that the list of CIB critics grows longer by the day. Many view the CIB as nothing more than attempts to privatize and profit off of Canadian public services. Others see the inherent conflict of interest in the establishment of the bank.

It's hard to argue with CIB detractors such as NDP member of parliament Alexander Boulerice who put it bluntly

If this isn't a major conflict of interest. I don't know what else you could call it."

Conservative MP Dianne Watts sees the CIB in much the same light. She sees the CIB as nothing more than handing control of the bank to private entities and giving out billions in subsidies to "powerful corporate interests."

Critics also point out that since private investors naturally wish to earn the highest returns, the selection of CIB/P3 infrastructure projects will of course be the projects that will generate the greatest profitability rather than projects that the public urgently needs.

Perhaps the most glaring critique of the CIB project is the reality that there are viable alternatives for funding large infrastructure projects which are also far more cost-effective.

Researchers for the University of Ottawa's Institute of Fiscal Studies and Democracy argue that the Canadian government already has the ability to fund infrastructure projects at much lower rates. As they point out,

yields on 30-year Government of Canada bonds currently sitting at 2.2%, Ottawa can borrow at much lower rates than what is available in the private sector.

Globe & Mail - archived version

Despite the existence of low-cost conventional funding mechanisms at the government's disposal, government officials seem hellbent on pursuing CIB/P3 and attempting to create P3 pipelines as recommended by WEF and McKinsey.

As mentioned, the Québec REM system is the first project to garner support from the CIB's $35 billion fund but there's a concerted effort by CIB backers to create a string of quick successes to justify a P3 pipeline and accelerate P3 institutionalization. Other areas of interest for the CIB include waste water management, agriculture and energy projects, to name just a few.

However, some projects sponsored by the CIB have not resulted in PR victories. The Ontario town of Mapleton was slated to be a CIB success story with a P3 wastewater treatment project. The CIB committed $20 million dollars to the project and the bank was set to subsidize the borrowing costs for the winning corporate bid on the 20-year plan.

The bank is offering to lend the private sector money at a lower rate than corporations could get on their own. Details of the loan terms are blacked-out in public documents about the deal.

Sometime in 2020, the The town of Mapleton made the decision to axe the P3 project instead going with a more conventional public option. This was an embarrassment for the CIB, unable to reach an agreement on a relatively small P3 project.

The Mapleton case sheds light on one of the most damaging aspects of P3, accountability and transparency. The fact that details of the agreement

were redacted in public documents are a red flag for municipalities considering 'partnerships' with the private sector.

Corporations are not accountable to voters and the public at large. Government officials are elected by the populace and, at least theoretically, can be held to account by Canadian citizens. Backroom deals, secretive contracts, lack of transparency and accountability are all serious risks that come with P3 projects.

The Public Will Own Nothing and Be Happy

Although Trudeau's government maintains that the CIB is designed to be independent, the truth of the matter is there are just too many conflicts of interest in plain sight.

It all stems back to the dubious design of the bank itself. The CIB being co-authored by BlackRock executives and Liberal ministers, the so-called "independent" board of directors of the CIB being composed entirely of corporate actors, the advisory board steered from start-to-finish by industry insiders Barton, Wiseman and Sabia, and the overall aggressive drive for P3 projects thoroughly demonstrate a high-level of collusion surrounding the CIB.

Furthermore, the fact that Trudeau, Morneau, Fink, Wiseman, Barton and Sabia are all members of the World Economic Forum adds another dimension to the situation. The creation of the CIB originates from a meeting of major players at Davos, illustrating the nature of the backroom deals that are concocted away from prying eyes.

As many know by now Klaus Schwab openly bragged about 'penetrating the cabinet' of Trudeau's government. Here we have a clear example of how agendas are cultivated at Davos, working frameworks are disseminated from WEF whitepapers and are later integrated into the platforms and policies of national political parties.

In addition to the "Strategic Infrastructure" paper, the WEF has produced dozens of whitepapers promoting P3 integration into national policy. From health, to education, to water security, to energy, to fiscal sustainability. It is clear that the WEF is aggressively engaged in crafting global public policy.

P3 projects are nothing more than trojan horses for the privatization of the public sphere. They are established to provide the private sector with access to public pension funds and government treasuries. Think tanks such as McKinsey play a critical role in the advancement of P3s. They charge a hefty sum to advise governments and corporations alike on the necessity of public-private-partnerships and ultimately help to redesign public services for the benefit of their partners in private capital.

Attempts to institutionalize P3 pipelines are well underway in Canada and Canadians should expect to see increased privatization of the public sector. The 'new normal' will be one where unaccountable private entities will decide the majority of future public infrastructure developments irregardless of the benefit to the public just as long as institutional investors receive their guaranteed ROIs.

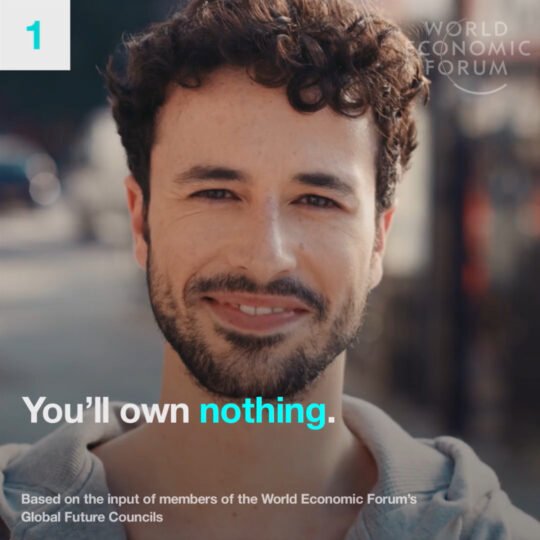

As the WEF mantra goes "You'll own nothing and be happy." It appears that the slogan applies equally to the public space as well. Infrastructure will no longer belong to the people of Canada but will be in the hands of powerful private consortiums and transnational corporations. Private infrastructure, for the benefit of the people.

Edit* Grammar

More Canada and the WEF

Upcoming posts in this series will dive deeper into partnerships between the government of Canada and institutions tied to the WEF, Canadian Banks and the WEF, the WEF'a promotion of MDM, digital ID and CBDCs and the impact on national policy and decision making.

Related Articles

Canada and the World Economic Forum - A Deep Dive Intro

Canada and the WEF (Part I) Captured Government, Controlled Opposition?

Canada and the WEF (Part II) Chrystia Freeland the 'Billionaire Whisperer'

Corporate America Reaps Egregious Sums | The Cares Act

Sources

2017 Macleans

https://www.macleans.ca/politics/blackrock-liberal-canada-infrastructure/

2017 Canadian Dimensions

https://canadiandimension.com/articles/view/the-canada-infrastructure-bank-and-the-perversities-of-predatory-capital

2017 CBC

https://www.cbc.ca/news/politics/morneau-messaging-infrastructure-bank-1.4349094

2017 CBC

https://www.cbc.ca/news/politics/leech-canada-infrastructure-bank-1.3975977

2017 Globe & Mail

https://www.theglobeandmail.com/news/politics/ottawas-dealings-to-secure-infrastructure-funds-raise-questions/article34904963/

https://archive.ph/szZBR

2017 Globe & Mail

https://archive.ph/gp4Tw

2017 Financial Times

https://www.ft.com/content/d99b322c-1b9b-11e7-a266-12672483791a

2018 Campaign for Accountability

https://campaignforaccountability.org/work/new-evidence-shows-blackrocks-role-in-canada-infrastructure-bank-may-have-also-included-advising-on-key-personnel/

2019 Press Progress

https://pressprogress.ca/why-the-liberal-governments-infrastructure-bank-is-helping-big-banks-and-dumping-user-fees-on-citizens/

2020 Macleans

https://www.macleans.ca/politics/ottawa/farewell-then-canada-infrastructure-bank/

2020 Toronto Star

https://www.thestar.com/opinion/contributors/2020/07/02/how-ottawa-is-driving-up-the-cost-of-infrastructure-by-listening-to-wall-street.html?rf

2021 Jacobin

https://jacobinmag.com/2021/04/canada-infrastructure-bank-cib-justin-trudeau

2013 WEF Whitepaper

https://www.weforum.org/reports/strategic-infrastructure-steps-prepare-and-accelerate-public-private-partnerships

2015 World Public Services International Research

world-psi.org

they are all so ugly

outside & inside

@tipu curate

Politics is Hollywood for ugly people

Hollywood is also for ugly people xD

holy woodstick - harry potter

Upvoted 👌 (Mana: 36/46) Liquid rewards.

The globalist parasite class are systematically destroying Canada and the rest world for their own self serving authoritarian dystopia they are forging ahead at full speed to create.

It's hard to see so many people suffering in a country of so many natural resources. Homelessness and poverty are on the rise and it's directly caused by Trudeau and the WEF agenda. Stop supporting any politician that is a WEF member or supporter. Learn what their plans are and do what you can to stop it.

I have to agree with you that Canada is on a downward slide concerning rights and freedoms. The fake "wokeness" coming out of the PMO is just cringe. It ties in well with the sort of rhetoric coming out of the WEF though.

We need to stop letting these people rule over us and dictate the direction of society, we need to create our own solutions. It's a long road though and I fear most people are just focused on keeping their heads above water trying not to drown in debt and rising costs of the basics.

Canada is like WEF's private property.

lol, yeah it's looking like that atm

Some really incredible graphs from that period forward, makes you wonder...Ah yes, another user @littleboy recently sent me a link to: https://wtfhappenedin1971.com/

Interesting, thanks. Assuming that this wasn't all caused by the popularity of flared trousers somehow, maybe Nixon's move to decouple the US Dollar from Gold has a relevance: https://history.state.gov/milestones/1969-1976/nixon-shock

There could be a correlation to bell bottoms, haha, I hadn't thought of that. Maybe someone should do a deep dive on that. But yeah, the decoupling from the gold standard certainly has had lasting effects on the economy. It's depressing to see wages have remained flat since the 70s, while the wealthy have seen their net worth increase dramatically.

71 😒

It seems Canada is deep in the mess. Maybe we all are if we don't do anything about it. Great post!

some great research. hopefully we wont need banks in the future. they wont be missed.

Posted Using LeoFinance Beta

Agreed, hopefully what's being built in the crypto space can help free us from the traditional banking system. It's likely that they will eventually become obsolete but then who knows what will fill the vacuum. Seems as though more and more CEXs are merging with banks, so that's not really the fulfilling the promise of BTC/crypto/decentralization.

true, i guess they will try and save themselves as the CEX will be an on/off ramp to fiat. at some point we just wont need fiat or on/off ramps though

The Arrogance is just astonishing. @.@

So many reasons to limit the usage of FIAT.

Yeah, this is done out in the open just nobody really calls it out. The arrogance that the "elite" will solve all our problems for us, while making a profit of course, is just foolish.

I think we call em out, but they don’t care. Our political system is not agile enough.

The game of politics is the game of uncertainty. Most times, it must be given to the ugly people. Thank you @v4vapid

Congratulations @v4vapid! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Great post lots of information. I am not an economic person but tried to understand what is going on in the world. why do they do this?

This people have a very ugly mindset, I just pray they find God.

Greetings dear friends. I feel that this morning comes loaded with very good positive energies, that's why I dared to write to you to ask for your support for the live education initiative that we do through Discord.

Since early I was reviewing the criteria used by the healing projects and that's how I ran into you.

I immediately identified with the premise of creating quality content and promoting the increase of users on the platform to expand horizons with their creations of literature, art, crafts, lifestyle, and more.

Thus attracting investors and making a marketing strategy for Hive in search engines with their publications.

That is why I would like to invite you to expand your horizons by supporting the Spanish-speaking community by joining as sponsors with your votes to the educational process and encouragement of creative freedom that we do in our live healing programs and community initiatives.

As a thank you, we would advertise your project as a sponsor of the initiative, trying to encourage participants to join the trail or make delegations to increase the community power of the curatorial account.

The programs are made in the Discord servers on Fridays and Sundays in the Hispapro server, on Saturdays in the Celf Magazine server, and Mondays in the Ecency server.

The main idea is that participating users feel encouraged to improve the quality of their writings while sharing their experiences and receiving support in votes.

Together we can do great things by empowering users while enjoying an enjoyable time among content creators, having fun reciting their poetry or literature, talking about their inspirations for creating art or simply telling us what their lifestyle is like, the universe is the limit.

I am at your service to answer any additional questions by Discord susurrodmisterio#0954

Hi @v4vapid,

I was actice in #DeepDives during 2020 and 2021, it was one of my favorite communities and I still appreciate it.

May I kindly ask and request if you are interested in voting on our proposal?

It's to #OpenSource -> https://d.buzz

Thank you.

nice

They are too ugly to look

Not a big deal, I try to support independent journalism whenever I can and I remember you on Steem years ago reporting from the ground. Things have changed, not just here, but the whole social media landscape seems to be getting more and more polarized where people freak out when they see/read opposing viewpoints. Seems as though you have a lot of haters atm, don't let the downvotes get to you man.