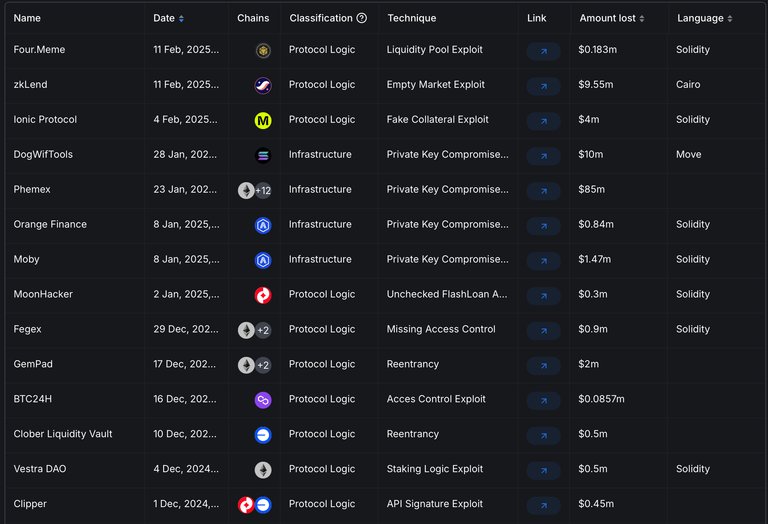

The List of Recent Hacks, Source: Defillama

The List of Recent Hacks, Source: Defillama

Looking at the recent crypto hack exploits, I can clearly see that most hacks, scams, and rug pulls come from EVM chains like Ethereum, Binance Smart Chain (BSC), Arbitrum, Optimism, and Base. The frequency and scale of these hacks predominantly originate from EVM chains—not just throughout crypto history but also over the last several months.

Based on this data, we might be tempted to conclude: "Be careful with EVM chains and avoid using them." But is this a reasonable conclusion?

I genuinely feel that the EVM ecosystem is a riskier and wilder place where many predators are constantly hunting for unsuspecting prey. BSC has been one of the most extreme examples of illegal actions and scams. Every day, new scam DEXs would emerge, luring rookie users eager to make quick money. Then, the next day, the founders would announce they were "hacked." In reality, it was likely a self-hack where they pocketed all the customers' funds. But nobody could complain because Binance didn’t care. Binance was the king, and Binance itself was often at the root of many scams. Binance even listed tokens from scam protocols and turned a blind eye. These scam protocols would then announce they would issue a new token as compensation—tokens that were essentially worthless.

On Ethereum, there have been numerous hacking incidents where protocols were exploited, and customers never recovered their funds. Yet, nobody blamed the Ethereum chain or raised concerns about its stability or security.

Do you know why?

Because centralized exchanges (CEXs) and most KOLs are on the same side—they all hold large amounts of ETH and have profited significantly from these incidents by collecting customer funds. KOLs never criticized the Ethereum chain, choosing instead to ignore users’ losses.

This also explains why ETH Maxis frequently criticize Solana or other emerging chains. It’s clear why ETH Maxis and so many KOLs are quick to highlight even minor weaknesses in rising star chains. These new competitors threaten Ethereum by potentially lowering its price, especially since Ethereum’s internal development has stagnated for a long time without introducing additional productive revenue streams or benefits for holders.

ETH Maxis and KOLs represent a significant obstacle to the evolution and development of crypto and blockchain technology.

Congratulations @harryinawolf!

You raised your level and are now a Minnow!