The recent loss of $1 million by a crypto user due to a wallet issue has reignited discussions around the challenges of self-custody in cryptocurrency.

This incident, shared widely on social media, has exposed the pitfalls of self-managed private keys, even for experienced investors.

The core of the problem lies in the user experience (UX) and security trade-offs inherent in current self-custody solutions.

The Problem with Self-Custody: Billions Lost Annually

The idea of "holding your own keys" has been a pillar of the crypto ethos, with the slogan “not your keys, not your crypto” encouraging people to avoid centralized exchanges. However, data from the industry shows a more complex picture: billions of dollars are lost annually due to self-custody mistakes, including forgotten passwords, lost devices, and unrecorded seed phrases. This cumulative loss surpasses even the high-profile collapse of FTX, showing that self-custody, while empowering, is fraught with risks.

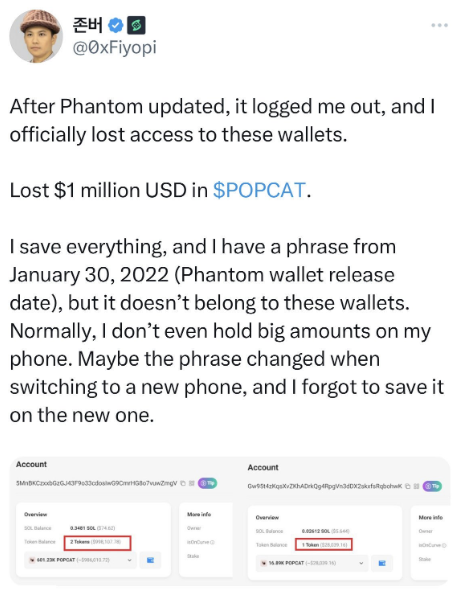

A Case in Point: Lost Funds Due to Wallet Update

In the recent case, the user reportedly lost access to their funds after an update by the Phantom wallet logged them out. Despite having a recovery phrase from the wallet’s initial setup, the phrase no longer matched the updated account. This highlights how even diligent users can lose access due to unforeseen technical or user errors. It raises the question: Is self-custody, as it currently stands, fit for the average user?

The Call for Change: Improving Self-Custody UX

Some voices in the crypto community are calling for a redesign of self-custody solutions. The current model, while secure in theory, assumes users have the technical knowledge to manage private keys without error. In practice, most people find it challenging to securely store and remember complex recovery phrases.

Key Concepts to Explore: Account Abstraction and Multi-Signature

Emerging technologies, such as account abstraction and multi-signature wallets, offer potential solutions. Account abstraction could allow users to recover funds with alternative methods, such as trusted contacts or biometric access. Multi-signature wallets enable multiple layers of security by requiring multiple keys to approve transactions, which reduces the risk of total loss from a single mistake.

Protocols Leading the Way

Projects like Squads Protocol and wallets like Backpack are pioneering these areas. They aim to offer the best of both worlds: full user autonomy combined with practical fail-safes. These protocols could enable social recovery options or grant partial control to friends or family, blending self-sovereignty with ease of use.

Striking a Balance: Autonomy vs. Usability

There is no denying that self-custody aligns with the principles of decentralization and user control. However, these ideals should not come at the cost of usability. Crypto needs solutions that allow users to hold their assets without the perpetual risk of total loss due to human error. As one commentator stated, “The best argument against self-custody is a conversation with the average human.” People are used to “forgot password” options, and crypto needs to adopt similar safety nets if it is to achieve mass adoption.

Moving Towards “Unbreakable Products”

To create a sustainable and secure future for crypto, the industry must build self-custody solutions that are as secure as they are user-friendly. The next generation of wallets and custody solutions should prioritize user experience, intuitive design, and robust recovery options.

The Future of Self-Custody

The incident serves as a wake-up call for the crypto community. While self-custody has undeniable benefits, it is clear that the current system is flawed. The way forward involves embracing technological advancements like account abstraction, studying pioneering protocols, and building solutions that offer the same reliability users expect from traditional finance. Only then can self-custody become a viable, safe option for the majority.

Such a tough experience