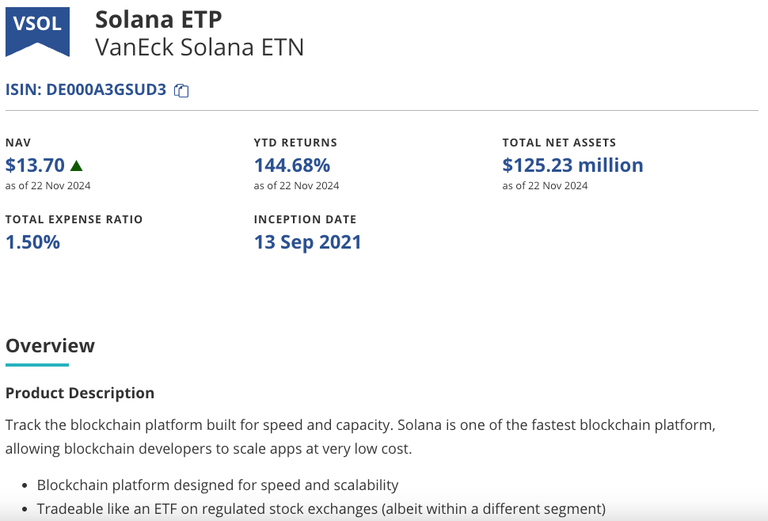

VanEck Solana ETF

VanEck Solana ETF

As the cryptocurrency market continues to evolve, a new chapter is unfolding with the potential introduction of Solana-based Exchange-Traded Funds (ETFs). This development marks a significant milestone in the journey of digital assets towards mainstream financial acceptance. Let's dive into the current landscape, the key players involved, and what this could mean for investors and the broader crypto ecosystem.

The Current State of Solana ETF Applications

Several major asset managers have thrown their hats into the ring, signaling growing confidence in Solana's potential as an investment vehicle:

- VanEck

- 21Shares

- Canary Capital

- Bitwise Invest (recently announced intention to file)

These firms have submitted S-1 registration statements to the SEC, laying the groundwork for what could be a transformative moment in crypto investment.

The SEC's Shifting Stance

In a notable turn of events, the SEC appears to be warming up to the idea of Solana ETFs. Recent reports suggest that SEC staff are actively engaging with issuers on their S-1 applications, a stark contrast to the regulatory skepticism of the past. This engagement has sparked optimism within the industry, with some sources indicating that we might see 19b-4 filings from exchanges in the near future.

The 19b-4 form is a crucial step in the ETF approval process. Filed by exchanges like the CBOE on behalf of issuers, it requests SEC permission to list the proposed ETFs. Once the SEC acknowledges receipt, a 240-day review period begins.

Factors Influencing Potential Approval

Several factors are contributing to the renewed optimism surrounding Solana ETFs:

Changing Regulatory Landscape: The anticipated pro-crypto policies of the incoming administration have injected new hope into the market.

SEC Leadership Changes: With Gary Gensler's departure from the SEC scheduled for January 20, 2025, there's speculation about a potentially more crypto-friendly successor.

Growing Institutional Interest: The success of Bitcoin and Ethereum ETFs has paved the way for consideration of other cryptocurrency products.

Potential Impact of Solana ETF Approval

If approved, Solana ETFs could have far-reaching implications:

Increased Institutional Adoption: ETFs provide a regulated and familiar investment vehicle, potentially leading to significant capital inflow into the Solana ecosystem.

Improved Liquidity and Price Discovery: The introduction of ETFs could enhance trading liquidity for SOL and contribute to more efficient price mechanisms.

Ecosystem Growth: Increased investment and attention could drive further development and innovation within the Solana network.

Market Dynamics: While some analysts predict that inflows to Solana ETFs may not match the initial rush seen with Bitcoin and Ethereum products, the market impact could still be substantial.

Challenges and Considerations

Despite the optimism, several hurdles remain:

Regulatory Scrutiny: The SEC has previously labeled SOL as a security, which could complicate the approval process.

Network Decentralization: Solana's smaller pool of validator nodes compared to Bitcoin and Ethereum may raise concerns for regulators.

Market Volatility: The crypto market's inherent volatility could influence the SEC's decision-making process.

Looking Ahead

While approval is not guaranteed, the increased engagement from the SEC and the optimism among issuers suggest a shifting landscape for cryptocurrency investment products. Industry watchers anticipate that a decision on Solana ETFs could come as early as 2025, coinciding with the potential regulatory shifts under a new administration.

For investors, this development represents an exciting opportunity to gain exposure to Solana through traditional investment channels. However, as with all investments in the crypto space, it's crucial to approach with caution and conduct thorough research.

As we await further developments, one thing is clear: the potential approval of Solana ETFs could mark a significant milestone in the integration of digital assets into the mainstream financial system, potentially opening doors for other altcoin ETFs in the future.