The Importance of the Time Axis in Trading

The Importance of the Time Axis in Trading

One aspect that novice investors often overlook in trading analysis is the "time axis" — the critical role of timing in market movements.

While it's tempting to focus solely on price patterns, indicators, and resistance/support levels, the time axis can have an equally significant impact on trade outcomes.

In fact, skilled traders recognize that successful trades are often the product of not just the right setup but also the right timing.

The Relevance of Timing in Price Movements

Markets move in cycles, with price patterns developing over specific periods. Identifying these cycles and understanding the probable duration of a pattern can greatly enhance decision-making.

For instance, even if a price movement suggests an impending rise or fall, it’s the timing of this movement that determines whether a trade succeeds or fails.

Taking positions too early can lead to prolonged holding periods or even unexpected losses if the market consolidates or reverses, while entering too late can reduce potential profits or increase risks.

Examples of Timing Misinterpretations

A common scenario where timing plays a pivotal role is during news-driven events or anticipated economic data releases.

In such cases, price may start to trend in the anticipated direction before the event, but a reversal may occur immediately after, depending on how the market interprets the news. Traders who enter based solely on the setup, without regard for timing, might find themselves on the wrong side of the trade when the anticipated reaction doesn’t materialize as expected.

The Time Axis in Technical Analysis

Technical analysis traditionally focuses on patterns like triangles, flags, or head-and-shoulders formations.

While these patterns give an idea of probable price direction, the time element embedded in them is also crucial.

For example, longer patterns (like a daily or weekly head-and-shoulders) often signify stronger movements than shorter ones (like intraday patterns).

Additionally, different patterns have different "time cycles" — they may take hours, days, or even weeks to complete. Recognizing the pattern’s expected time duration allows traders to align their trades more precisely.

Indicators Sensitive to Time Frames

Indicators like Moving Averages (MA) and the Relative Strength Index (RSI) can also be time-sensitive.

For instance, a moving average crossover on a shorter time frame (like a 15-minute chart) might indicate a minor trend change, while the same crossover on a daily chart suggests a more substantial trend shift. Timing the entry based on these time frames can affect the success of the trade.

Time Axis and Risk Management

Misjudging timing isn’t just a missed opportunity — it’s a risk factor.

When traders hold onto positions longer than intended due to mistimed entries, they expose themselves to greater volatility and potential drawdowns.

Time is not only a component of opportunity cost but also of risk.

Properly timed trades, on the other hand, allow for more efficient capital utilization and better alignment with stop-loss and take-profit levels.

Practical Application of Time in Risk Management

To practically incorporate timing into a trading strategy, traders can consider aligning their trades with established cycles or timing indicators like the Average True Range (ATR) for expected price movement periods.

Additionally, they might set a time-based stop along with a price-based one; for instance, closing a trade if it doesn’t move in the anticipated direction within a given time frame.

Case Study

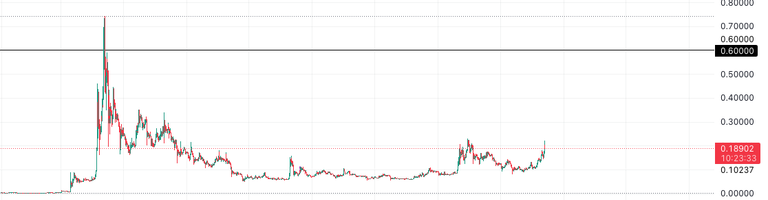

As illustrated below in the attached chart example, this DOGE trade idea centers around a targeted price of 0.6$, showing an upward trend with the warning to not rely solely on major exchange volumes.

Some analysts limit their stake to under 2% of their capital that is due to time consideration — essentially acknowledging that despite the possible setup, the trade might take longer to reach the target price.

This time-based approach allows for a conservative, lower-risk exposure while still capturing potential gains from the anticipated movement.

Final Thoughts

In summary, understanding and leveraging the time axis can refine trade entries and exits, improve risk management, and enhance overall trading strategies.

y recognizing that timing isn't just secondary to price but a vital part of every trade, investors can better position themselves for sustainable success.

Integrating time analysis with other trading strategies helps to create a holistic view of the market, reducing the likelihood of mistimed trades and enhancing profitability.

Key Takeaways:

- Timing is a critical but often overlooked aspect of trading that can impact the success of trade setups.

- The duration of price patterns and indicator signals on various time frames can affect the strength and reliability of a trade.

- Misjudging timing can lead to increased risk exposure, while a well-timed trade can optimize capital usage and profitability.

By keeping the time axis in mind, traders can cultivate more patience and discipline, aligning their strategies with not just the where but also the when of market opportunities.