Greetings friends!

(AI Generated Image)

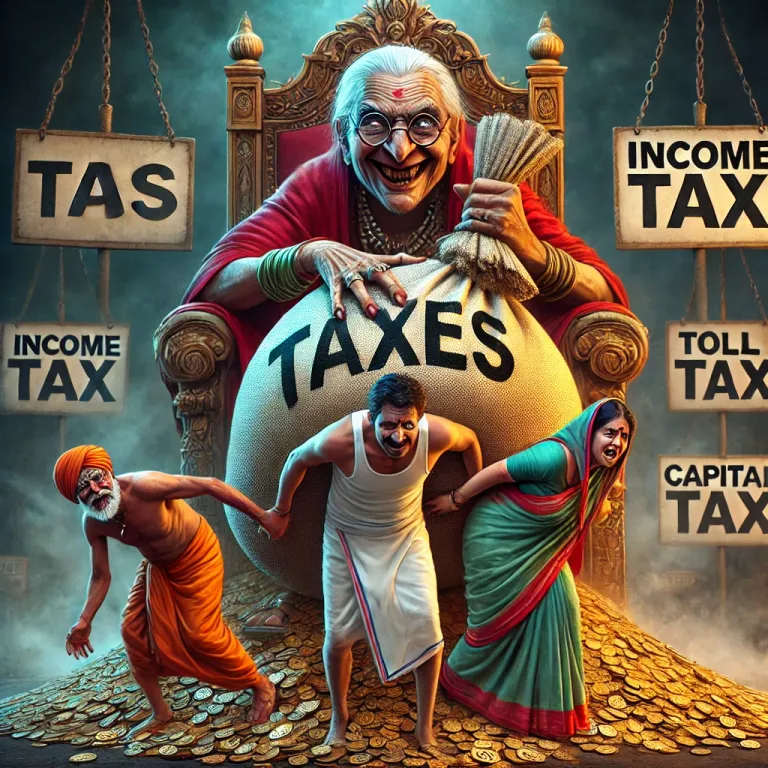

Taxes and death are often described as the two inevitable certainties of life. In order to survive, humans must pay taxes to governments in various forms from their birth till death. While the concept of taxation isn’t new, its scope has expanded significantly in the modern era. Historically, during the ages of kings, taxes were limited to essentials like crops, livestock, and business activities. Consider yourself, what would have a king done by getting excess crops from the farmers? He even could not have sold that much crops as buyers were few. However, with the advent of the welfare state, the taxation system has become far more complex and widespread.

In modern nations like India, individuals face a plethora of taxes. For example in India people have to pay following taxes. This list is only a tip of the iceberg. There are lots of other taxes too.

Income Tax: Levied on earnings.

Goods and Services Tax (GST): Applied to purchases of commodities and using services.

Property Tax: Imposed on property ownership.

Stamp and Registration Taxes: Required for property transactions, other transactions and making negotiable instruments, deed etc.

Municipal Taxes: For local amenities like owning a house, property, using sewage, water etc.

Toll Taxes: Charged for road usage.

Even savings in a bank account are taxed on the interest earned. Investments have to pay taxes on gaining profit from property or stocks in the capital gains tax on profits. This creates a never-ending loop of taxation. Consider purchasing land for a house, one has to pay stamp and registration taxes. Building the house incurs taxes on materials and labor. Once the house is built, there’s house tax, municipal tax, tax on electricity, and water tax. Repairs are also subject to tax as taxes are applicable on items and labor used for repairs. If the house is sold, the buyer pays stamp and registration taxes, while the seller pays capital gains tax on any profit. So, on one property the government can get tax for infinite period.

The burden doesn’t stop with property. Buying a car involves GST, road tax, vehicle registration tax, and tax on insurance, which together can account for nearly 50% of the car’s cost. Add to that recurring taxes on fuel, repairs, and tolls which often costing as much or more than the fuel itself. This layered system of taxation, compounded by surcharges, feels like a relentless financial drain. After paying so much taxes, if someone is able to save money in a bank or invest on stocks etc., he has to pay tax on interest earned and capital appreciation.

The Middle-Class' Burden

Education, healthcare, roads, and water are not free despite heavy taxation. The middle class bears the brunt of this system. Rich industrialists get various subsidies, tax exemptions and waivers from government, and also exploit loopholes to evade taxes. On the other hand the poor are largely exempted from direct taxes. So, the middle class is squeezed from all sides. Governments provide subsidies and freebies to the poor and offer tax breaks to the wealthy. However, the middle class is left with no support. Even essentials like health insurance are taxed at 18%.

These wrong policies are shrinking the middle class in India. The gap between rich and poor continues to widen, with the rich growing richer and the poor becoming poorer. The government’s use of taxpayers’ money (including extravagant spending on political campaigns and subsidies for the poor) only exacerbating the issue. This systemic neglect is pushing thousands of wealthy individuals to emigrate annually, seeking fairer systems abroad.

The Golden Goose at Risk

The middle class is often referred to as the “golden egg-laying duck” of the economy. Their financial contributions fuel growth, consumption, and innovation. Despite their importance, the relentless burden of taxes without adequate returns in terms of amenities or support has threatened their stability. If this trend continues, the eventual collapse of the middle class could lead to severe economic consequences.

Governments must recognize that sustainable economic growth depends on a thriving middle class. Policies should aim to reduce the tax burden on middle class, close loopholes exploited by the wealthy, and provide tangible benefits to those who shoulder the majority of the tax load. Only by addressing these systemic issues the middle class can be saved and the economy may flourish.

Thanks!

My income is so low that I am not coming under the preview of tax on my income. However, I can realize the catastrophic impact of the taxation system on common people.

Thank you for posting in the Ecency community

Sending you Ecency points ♥️