Created using https://www.canva.com/

Financial markets have experienced significant volatility, largely attributed to President Trump's strict global trade policy stance, which imposes high tariffs on America's trading partners.

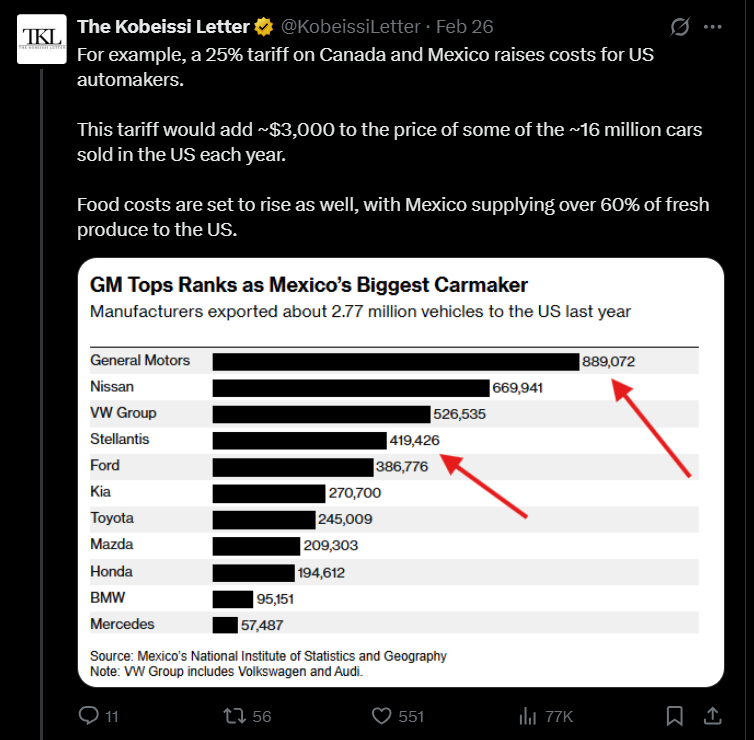

Notable tariff announcements include a 25% import tariff on goods from Canada and Mexico, a 20% import tariff on products from China, and a 25% import tariff on goods imported from the European Union (EU).

As a result of Trump's tariff news, Bitcoin (BTC) fell below the $80,000 level. This cryptocurrency had seen a surge in November and December, reaching nearly $100,000 due to "Trump Mania."

American investors are increasingly turning to Treasury bonds, as yields on US 2-year (US02Y), 5-year (US05Y), and 10-year (US10Y) bonds have declined, indicating a higher demand for these safe-haven assets.

Trading view chart - US 2 year Bond yields

[Trading view chart - US 5 year Bond yields] (https://www.tradingview.com/x/E9xAO8vH/)

[Trading view chart - US 5 year Bond yields] (https://www.tradingview.com/x/E9xAO8vH/)

Trading view chart - US 10 year Bond yields

The DXY index shows that the US dollar has recently strengthened against major world currencies.

Conversely, US indices such as the S&P 500, Dow Jones Industrial Average (DJI), and Nasdaq have all experienced declines, likely due to investors moving their money into safer instruments like bonds.

Gold prices have also dropped following the tariff announcements, although its overall trend has been upward.

Trump's Aim: To Provide the USA with a Global Economic Edge

Overall, President Donald Trump’s tariff deals are causing financial uncertainties globally, which we will soon evaluate in greater detail.

However, let's first consider the positive intentions behind Trump's tariff imposition policy, which he believes will contribute to making America great again.

One of Trump’s aims is to provide tax relief to American citizens by generating government revenue through tariffs rather than imposing taxes on the populace.

Another goal of President Trump is to establish favorable trade terms. He argues that it has become a norm for other countries to benefit from trading with the US, resulting in a trade surplus for them at the expense of the US, which suffers from an unfair trade deficit.

Trump has expressed willingness to negotiate terms with America’s trading partners to create deals that benefit the US, which may lessen his high tariff imposition plans.

For example, he wants China to invest in US sectors like electric car batteries and to purchase more American products, while also seeking to prevent the devaluation of the yuan to gain a competitive advantage.

He briefly postponed tariff imposition on Mexico for a month as part of an agreement that includes deploying 10,000 Mexican troops to guard the US-Mexico border, which aims to prevent illegal migration and drug trafficking.

Expected Negative Global Repercussions of Trump's Tariff Plans

Despite these intentions, Trump's tariff policy is expected to have several negative impacts:

Tariffs will likely increase the prices of end products. For instance, America imports copper, cars, and agricultural products from Mexico. As tariffs are imposed, it is reasonable to expect that the prices of these products will rise, leading to increased inflation and reduced purchasing power for American consumers.

Trump’s tariffs have also sparked a trade war, as other countries indicate their intent to impose retaliatory tariffs on American products. This situation could lead to a global rise in product prices and further inflation.

With higher costs for imported goods, demand is likely to decrease, which could contract global trade and negatively impact the revenue of manufacturers worldwide, including America's trading partners like China, Mexico, Canada, and India.

Manufacturing companies face new barriers that could complicate global supply chains, making it more challenging to source input materials required for production.

Overall, Trump tariffs are expected to drive up inflation as manufacturers pass on the costs of tariffs to customers. These tariffs create barriers to global trade, adversely affecting purchasing power.

While the value of the dollar may strengthen, this isn't advantageous for financial markets, as investors may prefer to hold cash in US dollars rather than invest in other financial assets, such as cryptocurrencies or stocks.

Reality Check: The US Does Not Hold Sole Commercial Dominance

It’s crucial to recognize that other countries, particularly China and European nations, are successfully competing on the global stage, demonstrating robust earnings and revenues.

Stock indices such as Germany’s DAX index, the UK’s FTSE 100 index, and China’s SSE Composite index did not react adversely to Trump’s tariff announcements.

The US certainly faces competition, especially from China, which has advanced in developing efficient AI frameworks that challenge the dominance of certain American companies like NVIDIA and OpenAI. China's technological advancements, such as the DeepSeek innovation, have eroded the financial market control once held by American tech firms.

This evolving landscape calls for careful observation as the consequences of these tariffs unfold.

Tesla also faces competition in the electric vehicle (EV) segment from companies like Volkswagen Group in Europe, General Motors (GM) in North America, Ford, NIO and Geely in China, and Toyota in Japan, all of which are manufacturing electric cars.

Regions that have companies capable of producing products across various sectors—such as artificial intelligence, EVs, agriculture, textiles, chocolates, consumer durables, mobile and computer technology, metals, oil, green energy, and defense products—will likely experience successful economic growth due to their strong business performance. These companies can supply their products wherever there is demand, both in global markets and their domestic regions.

There are also alternatives to the U.S. dollar, such as the Chinese yuan, which makes it unlikely for America to remain the sole dominant economic power, even with President Trump’s tariff policies.

Case for an Open Global Market Economy

It would be ideal to have open global trade. This would benefit consumers and companies across various regions, allowing them to manufacture and export products wherever there is demand. Quality products will be sought after at consumer-friendly prices.

However, this is just my perspective; practical realities may differ. Some countries can produce items that others need more cost-effectively due to their resources—such as labor, raw materials, and natural resources—along with favorable business conditions.

Countries should consider entering bilateral trade agreements that mutually benefit each other to enhance trade and commerce, rather than creating global trade barriers. This approach promotes a more collaborative global commerce landscape with an integrated stance!

Posted Using INLEO

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 1.00% vote for delegating HP / holding IUC tokens.

Congratulations @mintymile! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 700 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Thank you for posting in the Ecency community

Sending you Ecency points ♥️