A long time ago at this point, I decided to stop giving people any kind of financial advice. The truth is, most people don’t want to put in the work. They don’t want to understand how finances work to begin with. They feel completely comfortable delegating the thinking to someone else. That way, if things go south, they can avoid guilt. And that might very well be the underlying dynamic at play.

To be completely honest here—I too was, at one point, the kind of person who preferred chewed-up information. Finances are complicated. The more you learn, the more you realize how much you don’t know. But eventually, you learn just enough to know what to stay away from. And I guess… that’s where I exist these days.

It doesn’t really embarrass me anymore to admit that I fell for many scams in my life. I bought into the MLM hype in my early twenties, and when I was chasing that elusive “financial freedom” (whatever that means), I found crypto—and bought into some more ponzis for good measure.

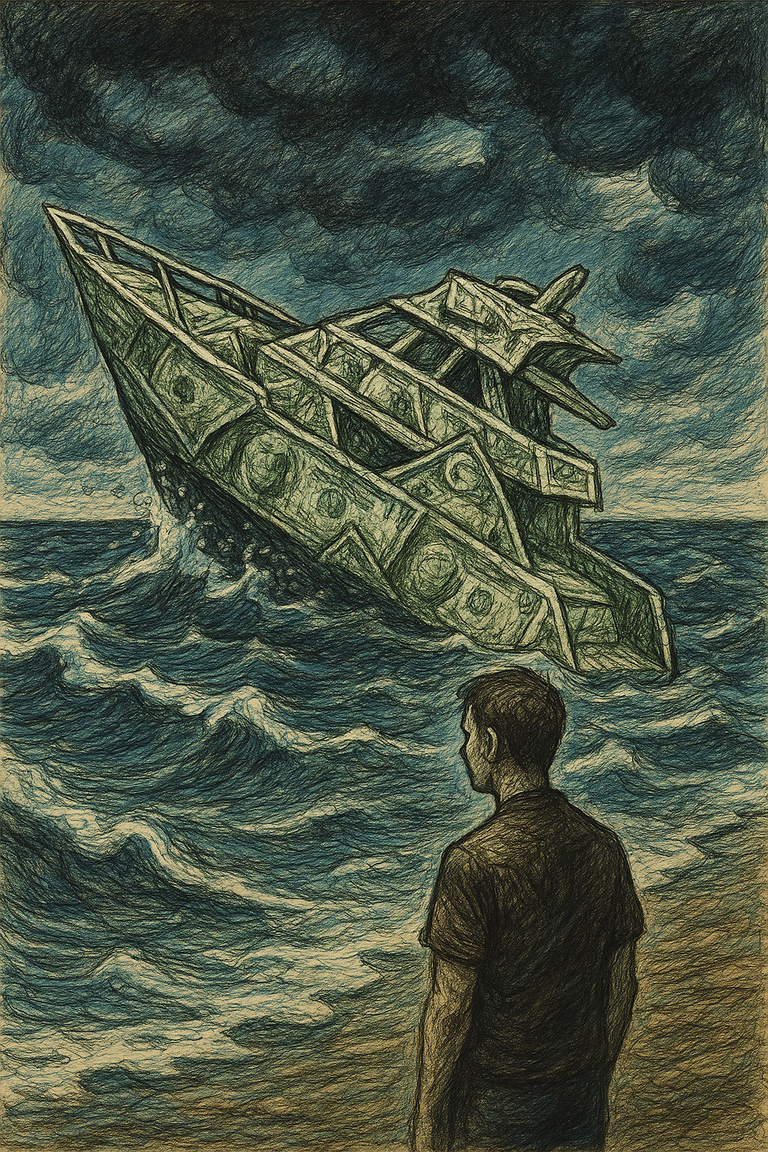

One memory that keeps circling back is my experience with the now-defunct Bitconnect. The so-called “lending platform” that, at one point, was front-page material in any cryptocurrency ranking. You’d think having just been burned by scams a few months earlier would’ve been enough to keep me away—but no. The lavish lifestyles of YouTubers at the time, their videos showing real cash-outs, eventually wore me down.

There was a channel back then—I wish I could remember the name. It wasn’t well known, and the host never showed his face. I remember a British man, a professor maybe. Unlike other Bitconnect promoters, he focused on the tech.

Tech? What tech?

He had whole videos dedicated to explaining the bot. The one responsible for all the profits we investors were seeing in our wallets. A bot no one else understood—but it was supposedly doing the magic.

Of course, we now know no such bot ever existed. We know now, quite clearly, that Bitconnect wasn’t like a ponzi. It was one. And when the pool of new “investors” dried up—mostly thanks to governments throwing a bucket of cold water on our fever dreams—the whole thing exploded.

I went through a deep depression after it happened. I had been so gullible, so stupid—I’d even taken out a loan to invest in the ponzi. All in all, I had $35,000 riding the wave of a ticking time bomb. My days consisted of watching a number go up on a screen and dreaming of better days just around the corner.

Unlike many other dum-dums, I had one amazing thing on my side—my wife. She supported me. We accepted the mistake and made a plan to dig ourselves out. That investment “lesson” cost me $35k—a year’s salary for an average worker.

The experience stained me. Scarred me. Use whatever metaphor works. And because of it, I feel strongly that intelligence doesn’t protect anyone from being seduced by a promise of better days. People will leap in desperation. And I don’t want to be a catalyst for that. I don’t want anyone to follow my actions blindly as if I’m some sort of oracle. If they don’t understand what I’m doing, they shouldn’t follow. Period.

So, why am I writing this?

Maybe I’m just talking to myself. But I also think I’m talking to an audience—one that isn’t here yet, but will surely arrive. The newbies. The noobs. Pick your label.

They’ll stumble into this blog, maybe this blockchain, with little idea of how any of it works. They might get seduced by a charismatic personality or a bullish blog post. Or worse, they might choose to stay ignorant—following someone “smarter” just because.

If they find this post—these words—I want them to know: they are wrong. And they’re likely to mess up.

If you want to win at the game, you have to understand the rules. If you want to make good financial decisions, you need to learn what money even is, the history of it, why the financial reboot that crypto offers was even necessary.

Because if you don’t get that, you’ll make the same mistakes we all made. You won’t understand the power of being your own bank, of removing the middleman. And you’ll definitely fall for the shiny promises that have no value behind them.

Who knows? Your financial lesson might cost less than mine—less than $35k—but if there’s one thing I’m sure of, it’s this:

It won’t be free.

It never is.

MenO

In various ways over time, @meno, do we all have some experience with learning some very hard lessons in life and hope others near and dear will listen to our warnings to avoid going down the same road? While I do know sometimes these warnings are heeded, more often they are not. If so, what is it about the human condition that explains this? I know personally how some of my own hard lessons could have been avoided, had I chosen to listen.

My own losses in crypto have mostly been linked to deciding to go beyond simply HODLing some and instead "put your money to work!" in various platforms under the Decentralized Finance (DeFi) umbrella. In far too many cases, it went to work all right. Out of the barn. Over the hill. Into the next county wallet ... 🥲

No question, in my mind. "Something for nothing!" and "Get rich quick!" are powerful appeals, even though they are false. The "degen" label is associated with people who are endlessly chasing after them anyway.

Thank you for sharing your experience, from a very painful lesson. I hope you hear back one of these days, from someone who learned from it and thanks you.

That degen label sure fits a lot of twitter users... hahahah

Hell of a lesson, but it will stick with you. I can't say I fell for Bitconnect. While I didn't suspect it was a ponzi, something about it didn't pass the sniff test so I decided to sit it out.

But some of those early crypto ponzis did get me. I forget his name now, but some guy ran a youtube introducing new "services" whenever he found them. Invariably he's claim "This one finally looks legit" and he's show some giant multi thousand dollar withdrawal he did. But then invariably they would rug a week or two later. He finally got so much hate that he disappeared. I didn't put a lot in, but I did stick a few hundred in some of those.

My big financial regret... that I didn't listen to me dad and open a Roth IRA when I was 18. He implored me to do so, telling me that if I did so, I could be a millionaire by the time I retired. No doubt his passion in telling me that was fueled in part by his regret at not having done so himself at that age. I ignored him, thinking "By the time I retire... fuck that... I want money now, I don't want to wait till then". And now I'm kicking myself for it.

I had one of those, had to kill it after I quit a job and was looking for the next move up.

I have managed to stay away from a lot of scams but my conservatism has also held me back a lot. I am not rich because I have often chosen not to pay attention to things because they seem scammy and they turn out not to be

you bring up a good counter point... if one does not take any risk, we don't get to gain anything. Its about taking educated risks. Does this mean you won't make mistakes? No, of course not. But if you learn the lesson, you never bite more than you can chew.

I have been interested to put money in that project not knowing the scam run beneath the screen. The rules are important, but I believe that in crypto trustworthy partnership is a key factor in the business. All the rules were written on the white paper with Steemit, but many bad things happened on that platform. It is my opinion though. Curious to read others comments on this topic.

#hive #posh

That's a good idea adding the meniski as comments!

I am reeling in sympathy from your big loss, that must have been a hard one to deal with

oh man... it took me a year to feel normal... hahaha

Something else remains to be learned. However, I won't mention it here. I will mention two things: 1) nescience is bliss, and 2) I only invest in goodwill now.

Thanks!

#hive