A long time ago, in a land far, far away, this crypto kiddie first read about a magical new asset class referred to as cryptocurrencies.

In this fairy tale, utopian land, Bitcoin was King. The story arising out of the historic global financial crisis of 2008 about the noble Satoshi Nakamoto's vision for creating it was compelling.

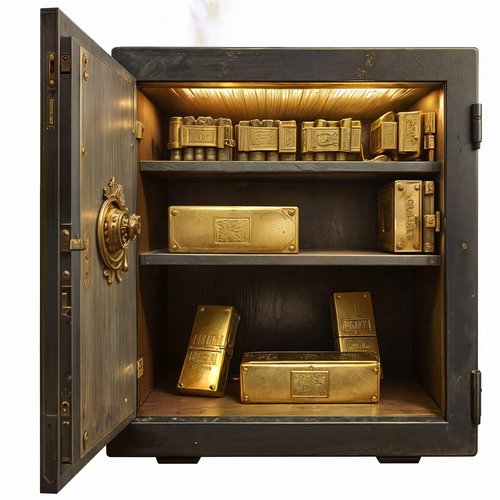

Virtual gold? Wow!! What was not to like?

How is that working out?

Safe Haven

Pun intended! Like most pitches enticing us to consider most anything, to succeed the pitch must tie in to some idea or concept already at work on us.

A growing lack of confidence in the global financial system was the perfect environment for the creation of such a brilliantly conceived idea as Bitcoin. Blockchain technology combined with algorithms which would mimic the increasing scarcity of gold, in the real world?

How can we get some?

The mystical appeal of gold is ancient. While passionate arguments can be made on both sides of the "hard money" debate, the lure of gold being a safe haven is not new. And that lure is universally known and understood.

That some new virtual simulation of it now made it possible to cross international boundaries with all of your earthly wealth securely held in your pocket? This was a disruptive, transformational concept that one might argue is still in its early stages of changing finance forever.

Central to the early day safe haven argument was that crypto was a revolutionary asset class which would rise and fall completely independent of any other asset class.

Right? Again, with enthusiasm, how is that working out?

Or Not?

Any safe haven advocate today would have a very challenging time making a case that Bitcoin, or any other crypto for that matter, has a market trajectory completely independent of the real world. When the stock market crashes, Bitcoin soars, right?

No.

For a significant period of time, many clung to this mythical characteristic of Bitcoin being a safe haven. A very significant argument was how real gold prices were not behaving in its historically characteristic way. Money was moving into Bitcoin and other cryptos instead.

In the first quarter of 2025, real gold is setting new all time highs. As this is written, Bitcoin has dropped temporarily below $75,000, which is down almost 30% from its ATH.

Is real gold reasserting its historic claim to being the true safe haven?

Smart Money to the Rescue!

Anyone who has been around this asset class for the long years I have will be familiar with all the press reports about the "Smart Money" crowd constantly dismissing the credibility of this new asset class. Or worse than that, in many cases.

"When what to my wondering eyes did appear?"

When did this begin to change? When Michael Saylor arrived on the scene, as a champion for investing a portion of institutional balance sheets into Bitcoin? About the time Larry Fink, head of BlackRock, filed for a Bitcoin ETF with the SEC? When the head of SEC, Gary Gensler, had successfully driven back all previous attempts? What were the projections, at that time, of whether Gensler would succeed in stopping BlackRock?

Surely all of this had nothing to do with BlackRock and other major financial firms finalizing all the behind the curtain details of how they were NOW ready to profit from Bitcoin and other cryptos themselves, right?

One would have to be remarkably skeptical and cynical to hold a view anywhere near this, right? 🙄🤷♂️

Ending a long time ago were the days of frequent hard forks of Bitcoin. With the notable exception of Litecoin, most would agree they were all flashes in the pan. And long since forgotten.

Is there a hardfork in Bitcoin's future? If so, what will the enticing argument be for why what we know now as Bitcoin should be abandoned, in favor of the "next generation?" Bitcoin V2 anyone?

I do not claim to know. If that day comes, though, I for one will not view that favorably. Due to who and what I believe will almost certainly be behind it.

What is your personal storyline with Bitcoin? When did you hear about it and what were your first impressions, to overcome any objections you might have had back then?

Source: Creator aiperfectportraits on Pixabay

Does it still seem as secure as you originally envisioned, when deciding to invest in it? Or does it seem a little more uncomfortably vulnerable than you would like to admit?

My own answer to these questions is I am less confident about Bitcoin's long-term security than at any previous time. Long gone are the days when the basic argument was it was a new asset class which would be an independent, safe haven from the corruption and volatility of other asset classes in the real world.

In other words, what Satoshi Nakamoto stated as the objective for creating Bitcoin has not aged as well as I would have hoped, in the beginning.

How about you? What is your view on what Bitcoin is today and likely to become, in the future?

Best wishes, until we meet again,

QT

👋❤️👋

Source: Creator GDJ on Pixabay

🤝 Partnership Pledge! 🤝

• 10% of Post Payout to Comments• 1 HSBI to the Best Comment

🤝 Pledge Honored! 🤝

• 1 HSBI to the Best Comment• Awarded to @shortsegments

I enjoyed reading your perspective.

I will add to this post to my bitcoin article collection. link

#bitsocial

That is encouraging to hear, @shortsegments. Thank you kindly, for stopping by and letting me know! 🤝

Your welcome.

Your welcome.

Congratulations @quark.top! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 40 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I am confident that the volatility is part of the cycle and the storage of value of BTC will surpass all expectation in the future.

The part concerning the security is a moving discussion as tech reveals some weakness and strength against brilliant hack that only existed after BTC gained so much attention from the people worldwide.

I stack more each time the prices drop.

Regards

Maybe, @rogerlabanane:

That is certainly what many say. The tight control of the trading range over the last little while is concerning. In effect, demonstrating to some that the price of BTC is being manipulated.

You are right.

This phase hopefully will pass as soon as possible

Regards

@quark.top, I paid out 0.204 HIVE and 0.045 HBD to reward 1 comments in this discussion thread.