Just like day and night, some things in human history are bound to repeat itself. Just like dummies people walk into the same basic traps but coated in different shades of flavor. I have studied three to four scenarios that prove this fact in entertainment and business (crypto especially). But in all, some heroes were made through the night darkness. This article highlights a few of these heroes, what made them, and why Avalanche is one of such heroes.

TL; DR

- When there is a market boom from any sector, there is bound to be an influx of low-quality innovations that saturates the market ultimately leading to a market downturn.

- But there are companies, innovations, techs that survive the downturn, they are the heroes. They are proven by their product, business model, and organizational structure.

- Avalanche has proven itself many times and over to be a hero in every ramification and a platform that will stand the test of time.

- It will be the best option to turn to when the current Defi (Decentralized Finance) bubble bursts.

The current trend in the Crypto ecosystem has proven beyond reasonable doubts that we are in the evening of another history about to repeat itself. The night is upon us but Avalanche has been launched to be the hero that shines through the night and in the morning it's beauty will shine even brighter.

The 1983 Video Game Crash

Source

The year is 1983 console games are taking over the market. Consoles have replaced the huge arcade machines at game houses. Everyone can buy one copy and play at home courtesy of one major brand- Atari VCs. The huge success attracted many other producers who created “copies” and saturated the market with low-quality consoles and games. This market saturation brought about a recession for developers. A once huge market became a wasteland because some greedy developers want a “share of Atari VCS success”. A market worth $3.2 Billion in 1983 became as low as $100 Million in 1985.

If not for Nintendo Entertainment System (NES) in 1986, many childhoods then would have been boring. What was their secret? 16bits console instead of 8bits in addition to a series of evergreen games like Super Mario Bros, Duck Hunt, etc. The summary was High-Quality Games. Read the full story here.

The Dotcom Bubble Burst of the Late 1990s

Source

The late 1990s when the internet had become a thing. The investing market saw a huge influx of internet-oriented companies led by the Nasdaq index gaining from below 1000 to 5000 between 1995 to 2000. These companies were any with dot com as a primary domain. Investors began pumping huge funds into internet companies feeding themselves the hopes that the companies will be profitable in the coming years. Stars-ups also got obsessed with getting big very fast that many pull huge weights into advertising. According to Investopedia, some even threw 90% of their budget at marketing. The end came in a few months when whales panicked and began selling. Nasdaq crashed to 1,139 by 2002, a 76.81% loss. Many other companies had packed up since they couldn’t cope with the crash.

Rise under the duress of the crash was the survival of companies like Amazon and eBay. Amazon did face the draught when the bubble busted but was flexible in its plan. With a well-structured business model, product, and team it was able to keep the cash flow enough to survive the crash. Amazon today is a well-established company with a lot of products. What they did differently has been analyzed here.

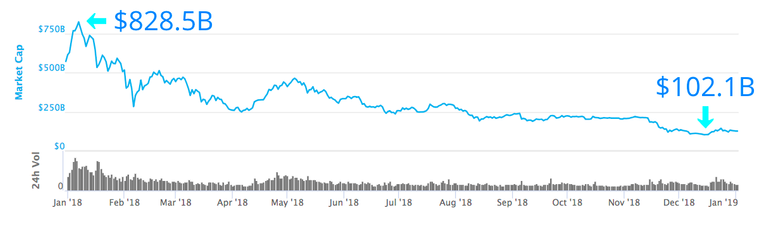

The ICO and IEO Crashes

Total Crypto Market Cap between 2018 and 2019

The fall of 2017 to early 2019 was the lifespan of the Initial Coin Offering bubble. It busted leaving a crypto market of $828.5 Billion at $102Billion around January 2019 and even far lower right now. I’ll keep it very short, almost everyone knew what went wrong was only repetition and a combination of what went wrong in the history with the 1983 Video Game crash and the Dotcom crash. There was a saturation of start-ups with only ideas, whitepaper, and websites. Many of the founders lack experience with what crypto is all about. They invested heavily in marketing such as bounties and airdrops. They lacked the patience to persevere and see their projects to success. Many were collecting money to fuel a failed centralized project to convert them to the same centralized project with a token- no particular use case. Investors were too greedy to see the facts, they also wanted quick gains and were impatient- all they wanted was tokens tradeable on crypto exchanges. Initial Exchange Offerings came along after the crash but could not amount to much as its end was the same. This year, almost all investors have lost faith in funding start-ups.

Right in the midst of these was Avalanche -a hero in the order of NES, and Amazon. Its ICO sold $42Million in just four hours. What have they done right? We’ll get there very soon.

An Impending Vicious Cycle about to Burst Again

Source

The Decentralized Financial Market is trending right now because of the freedom it is giving every crypto holder especially on Ethereum Blockchain. The keyword is about putting banks back into the hands of people. Uniswap and Bancor were the first to launch people into the heavens of Defi, then came along protocols like Compound, Aave, and many others with the added advantage of non-collateralized lending, and many more pecks. As the Defi space is growing larger and attracting attention so is the influx of many mixed multitudes coming to repeat history. According to Defipulse, the Total Locked Values in DeFi protocols are now above $10 Billion. I see the vicious cycle repeating itself. These are the signs:

- Market Saturation: There has been an influx of many DeFi platforms now which are copies of the existing ones. These protocols took very little time to build. Now it seems as if, what a developer needs is just to copy smart contract codes (add a little tweak if he is hardworking), and a website! They pride themself in having an anonymous team, to keep themselves safe and irresponsible for the codes they have written. What is worse, even existing projects with an unrelated vision are turning into DeFi protocols.

- Marketing: Many of these low-quality projects are pulling a lot of weight into marketing by distributing airdrops just like that of Uniswap.

- Experience: We hear of so many things that prove that the developers of these low-quality projects without the experience of how crypto works.

If this DeFi bubble burst, the surviving protocols must find a haven- a scalable blockchain that is proven, a hero in history.

Why Avalanche is the Hero of the History

Each of the stories above had heroes that rescued the day, some were made through the situations, some before. Avalanche platform was made originally as a platform to create and launch highly decentralized assets, blockchains, and DeFis. It has surpassed blockchains in scalability as it completes up to 4500 transactions in a second. It's able to efficiently bear the weight of the current Defi system.

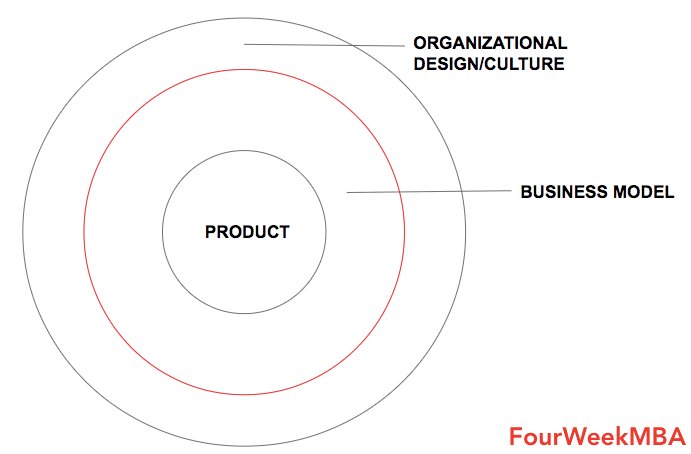

According to Gennaro, founder of FourWeekMBA, in his Hackernoon article dissecting how Amazon survived the Dotcom crash, he stated that Amazon had a solid product at its core, a business model that worked, and an organizational structure. It can be boldly said that Avalabs, which created the Avalanche platform, has this winning structure.

Source

Product

At the core is the Avalanche consensus or protocol, a new set of protocols that makes an incredibly fast transaction possible without giving up decentralization and security. It is an innovation never seen before. It is the result of years of work by researchers. The Avalanche platform has been extensively compared with existing innovations and is exceptional. It has been tested enough to be trusted. I have also made many articles towards what potential the platform has, you can read about them.

The platform has a Proof of Stake model which strengthens the security of the platform and proves its decentralization. Right now it has well over 520 validators from all continents except Antarctica. Leaders in the crypto space have great testimonies about the platform. There is no doubt Avalanche is a solid product at the core.

Need knowledge about Avalanche platforms? Check here.

Avalanche Business Model?

Avalanche is leaderless, it is a platform of validators with an equal voice. Its core value is in being independent of any centralized body. AvaLabs created Avalanche but even when AvaLabs cease to exist, Avalanche will continue to be. Its rock-solid business model is decentralization, capacity to incentivize validators and delegators, the ability to create blockchains, and assets that have never been seen before on the blockchain, etc. As long as blockchain, decentralization, and even the internet is a thing, Avalanche will continue to evolve and thrive.

AvaLabs hasn’t stopped with Avalanche mainnet, they have been active in supporting the platform so that the world may see its true beauty. Through hackathons, startup grants, and collaborations Avalabs has been in the background working things out beautifully.

Organizational Design/ Structure

Avalanche is leaderless, it is a decentralized structure- solid and proven. Bitcoin survived more than ten years as a decentralized structure, much more than this Avalanche will.

Avalabs has a team with a huge pool of experience. They have been actively involved in Blockchain technology for many years. Check the link to the official website below to get to know them.

Avalanche: A Ready Safe Haven When Defi Bubble Bursts

Source

Collin Cusce made an interesting overview of what ICOs and IEOs might evolve into- Initial Subnet Offering (ISO). From his description, it will take a lot of effort and time before a solid offering can be raised. This will serve as a filter to remove bad actors and saturators.

I foresee that when the DeFi bubble bursts, solid protocols will find new homes. Avalanche is always ready to house these protocols as established in this article.

Stay Connected

Website | Whitepapers | Twitter | Discord | GitHub | Documentation | Explorer | Telegram | Facebook | LinkedIn | Reddit | YouTube

Posted from my blog with SteemPress : https://cryptostocksreviews.org/avalanche-platform-a-hero-to-save-when-defi-bubble-bursts-the-vicious-cycle-is-here-again/news/

Many DeFi will burst the market soon or later.

This is really a sad truth. Many will not like to believe