Sögur, SGR, value is built on its ability to remain stabilized even during an uncertain market condition. The fatal mistake of the current fiat system is that it is hedged on the state of an uncertain economy. An economy determined by people with selfish ambitions who know only to rake into their purses. Sögur as identified in the previous article solves various challenges in the money system via its foundational structure. One of which is its monetary model. This article takes a brief depth dive into details of the Sögur monetary model. The full measure can be found here.

Sögur monetary model is founded on solid pillars, three of which are, Reserve ratio, Genesis tokens, and the shrinking economy.

Sögur Reserve Ratio

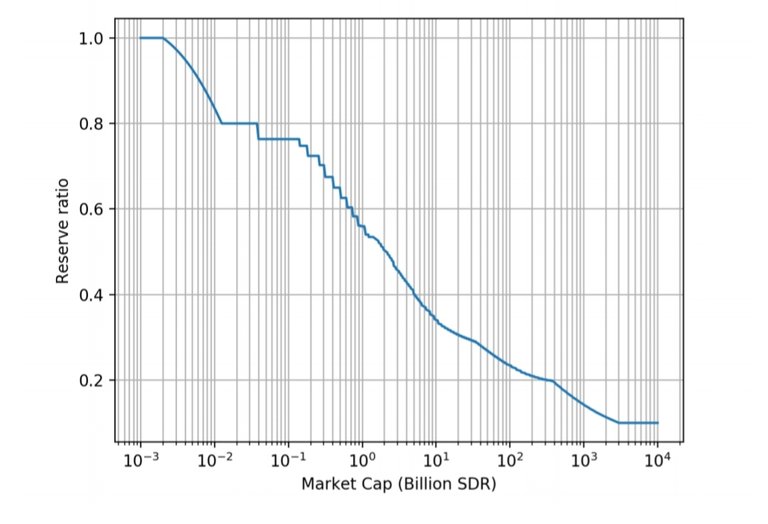

Sögur fuel, SGR, is minted by a smart contract on the Ethereum blockchain. The smart contract also stabilizes the price. As stated in the previous blog post, SGR is backed by fractional reserves stored in different banks and on the blockchain as cryptos. The percentage of SGR backed by reserves reduces according to the number of tokens minted. The reserve ratio reduces as SGR demand increases and more tokens get minted. As more tokens get minted, the SGR price offered by the smart contract to buyers increases.

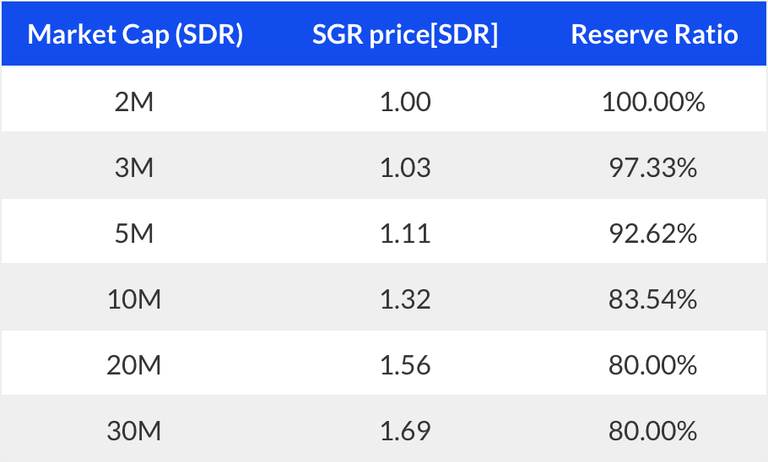

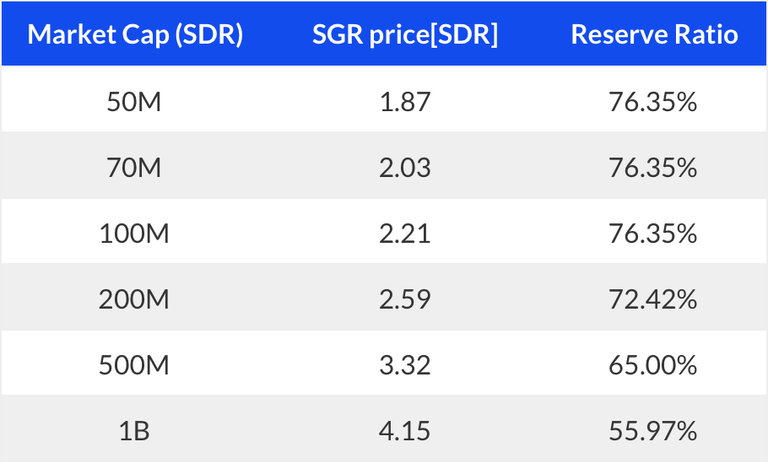

Sögur's reserve ratio is the portion of the total SGR tokens in circulation that can be bought back at the current price. Take a look at the tables below:

When the number of SGR minted reaches 20Million the reserve ratio reaches 80% and the price to buy SGR from the smart contract will be 1.56$. This means that only a 16Million tokens can be bought by the reserves at $1.56. (SGR is currently tradable on secondary exchanges). Do not forget that as the demand for SGR increases, the price buyers buy the token from the smart contract increases.

Just like a child's growth, they don't need a walker when they can walk. When a man is old enough, they need support to walk.

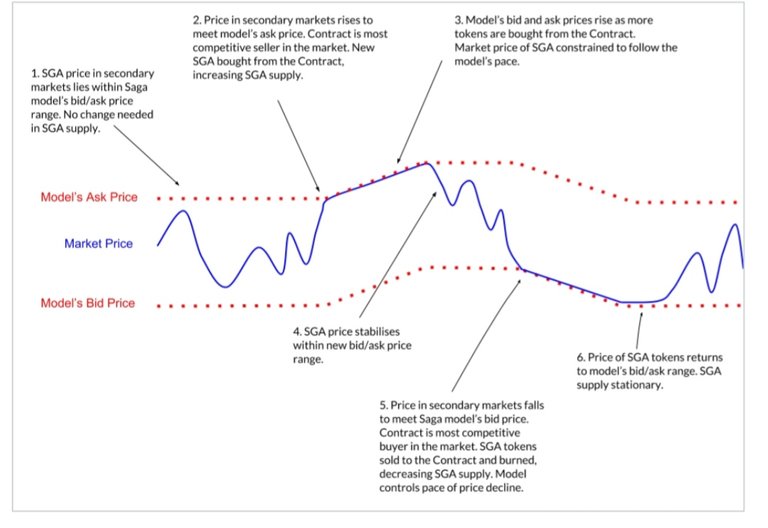

The implication is that when the prices on exchanges become higher than that which is offered by smart contracts. Users will be willing to use the smart contract to buy more thus increasing the number of SGRs in circulation. Consequently, the price will normalize and be within the buy and sell price of the smart contract. Check the image below.

Sögur Genesis Tokens

Sögur is supported by early adopters who were given SGN tokens for their purchase. To compensate for their willingness to invest in a dream at its zygote, Sögur has a plan. There is an SGN-SGR swap available when SGR crosses milestones (or becomes successful). Since the smart contract will not mint tokens out of thin air unless an amount is paid, there are Genesis Minting Points (GMP). These points are points where milestones have been achieved. For example, when the SGR market cap reaches a certain defined point, it reaches GMP where seven SGR tokens are minted for each SGN token issued. SGN tokens are burnt after they have been swapped.

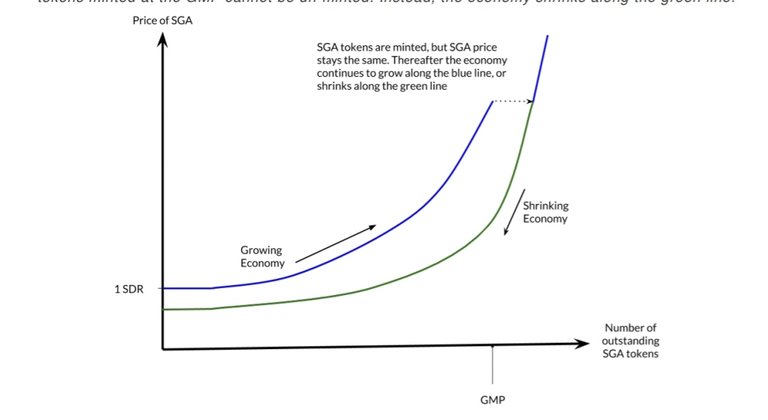

Shrinking Economy

Sögur developers have thought things through when they began designing the framework. They thought about how the price will be stabilized even when users sell more SGR tokens to the smart contract to be burnt. The prices at which the smart contract buys back from users will continue to diminish steadily as it increases when tokens are being minted. In the case of buybacks, there will be deviations from the prices each token is sold from the smart contracts. This is because of the Genesis Minting Points. There are no funds collected to mint SGR tokens swapped for SGN.

Factors that might cause Price Deviations from the model

There are factors to be considered:

- Service charges and revenues: Transaction fees covered by smart contracts. Revenues from conversion

- Interests from reserves in Banks

- Market price fluctuations for Revenues held in Cryptos

These are some of the factors that affect the prices of SGR sales and buyback prices from smart contracts. These factors can cause deviations from the model.

All images are a property of Sögur

Get Informed and In Touch with Sögur

Website | Twitter | Telegram | YouTube | Facebook | LinkedIn | GitHub | Medium

Posted from my blog with Exxp : https://cryptostocksreviews.org/sogurs-monetary-model-the-internal-combustion-engine-of-a-stabilized-cryptocurrency/news/