This post should be to educate someone about bitcoin who has no idea about it or even doubts it.

To understand bitoin, we first need to look at the history of money.

History of money in 5 steps:

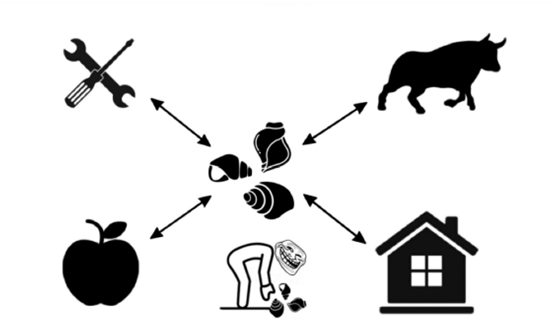

1: raw materials were exchanged

-> problem = intermediate value was needed

2: shells or bones as an intermediate value

-> problem = too many of them and easy to find (worthless)

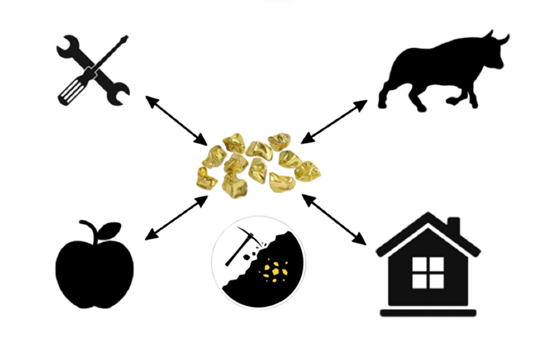

3: metals like gold or silver as an intermediate value

-> problem = impractical to transport

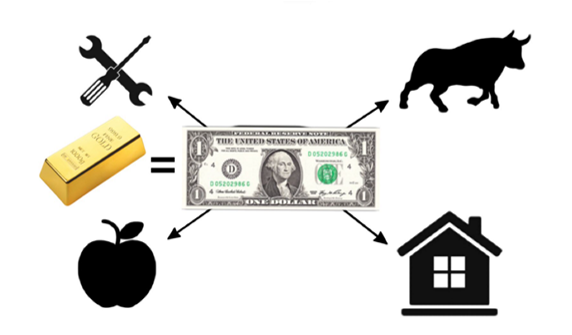

4: fiat money with stored gold as equivalent (gold standart)

-> problem = not enough gold for all the money that was printed

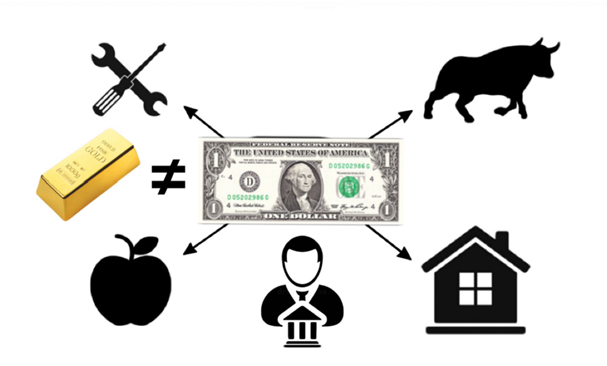

5: gold standard was abolished

-> reason = the government had to print an enormous amount of money to finance wars

-> problem = paper money no longer has any equivalent value and works only with the trust of the user.

And not much has changed since this step of abolishing the gold standard. Fiat money is unlimited and inflationary.

There are surprisingly few people who decide how much money is printed. The population does not notice much of this process.

You don't notice much of inflation either. Prices are quietly and secretly getting more and more expensive.

Fiat money is no longer a store of value since it is constantly losing purchasing power.

So we have a problem and we need a solution.

And that's where Bitcoin comes in.

Bitcoin is just like gold limited and thus disinlationary.

It is decentralized, which means that the user does not have to trust any central party.

-> I explained more about decentralization in one of my recent posts about Bitcoin mining.

Bitcoin has censorship resistance. Thus, no one can be excluded. That can be good, but it's also something the government doesn't like, because it's hard to sanction someone.

Most exchanges already offer only verified accounts. This means you usually have to identify yourself.

A disadvantage of bitcoin is that it is complicated for old people or people in poor countries to buy bitcoin.

The revolution of crypto currencies brings similar problems or inconveniences as back then with the revolution of the Internet.

There was a problem that arose over time as more and more transactions were carried out on the Bitcoin network. The fees and duration of transactions skyrocketed.

Bitcoin was not scalable enough and this is why the lightning network was brought to life.

You can think of it as another layer on the blockchain only for transactions, where the fees and waiting times are extremely reduced.

There are only 21.000.000 bitcoins, which makes bitcoin much less inflationary then fiat cash.

In a nutshell, Bitcoin is an insurance policy against the current weaknesses of today's monetary system. Many also refer to it as digital gold.

At the moment, bitcoin is still quite volatile because there is quite a lot of dumb money and speculation in the market.

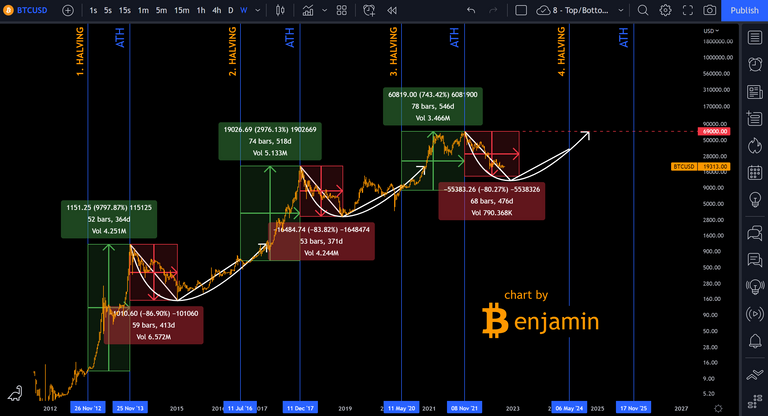

If you look at the Bitcoin in the superordinate, you can still see that it moves in a regular cycle.

Some people talk about a super cycle. This means that Bitcoin will no longer move correlating to the traditional markets.

As long as there is still speculation, there will also be bear markets and bull markets like in the traditional markets.

Many talk about gold as a store of value, but gold also has a certain volatility.

In the picture below:

Gold lost over 20% this year of its value.

Volatility, bear markets and bull markets will always be a part of any free market.

My last posts are very complementary to this one and

I recommend you to look at them as well:

-> https://ecency.com/@benjammann

Bitcoin – did we see the bottom?

https://ecency.com/bitcoin/@benjammann/bitcoin-did-we-see-the

Bitcoin - misthoughts

https://ecency.com/bitcoin/@benjammann/bitcoin-misthoughts

Bitcoin – is the bear market over?

https://ecency.com/hive-138698/@benjammann/is-the-bear-market-over

There is so much inaccurate about this article.

You never even mentioned ledger based money which was in place starting in the 1500s.

This is not true. In fractional reserve banking, the money supply is expanded when commercial banks lend. So they have to make loans, which are not unlimited, before the money supply expands.

Of course, when we have loans paid off or default, money is contracted.

Central bank reserves (liabilities) are not legal tender.

Posted Using LeoFinance Beta

Hey Taskmaster :)

Thank you for your feedback.

It may well be that I have forgotten a few steps in the history of money.

For me, it was just important that the readers understand a little bit how we came to the current situation.

I've never heard of a ledger-based money before.

I will inform myself about this and maybe I'll include it in this post.

Probably I expressed myself a bit badly with the term unlimited, when I talked about Fiat money.

What I'm actually saying is that our current money doesn't have maximum supply and we can't predict how much will be pumped into the economy in the future.

I am always open to other opinions and also willing to learn.

I wish you a nice day.

Thank you for your time. :)

Congratulations @benjammann! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 200 upvotes.

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Link to the previous post 1

Link to the previous post 2

Reposting previous posts or parts of them without significant additional original content/changes is considered fraud and exploitation of the "Hive Reward Pool".

Publishing such content may result in the account being Blacklisted.

Please refrain from copying and pasting previous posts going forward.

If you believe this comment is in error, please contact us in #appeals in Discord.