Hi investors,

Today on the menu:

- Bitcoin Market Update

- Guggenheim Macro Opportunities Fund gets into Bitcoin

- Thoughts on the FATF Travel Rule and its impact on the crypto economy

DISCLAIMER: This content is not financial advice and only represents my own personal views

Bitcoin Pulls Back, Outlook Remains Bullish.

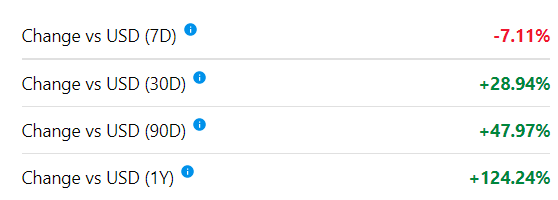

BTC is trading at $17,380 USD at the time of writing, we're down -7.11% since last week and up +124.24% Ytd.

With 2020 almost in the rear-view mirror, my forecast for 2021 remains bullish. As discussed in last week's edition, I expect the price to break out of this cup and handle pattern sometime EoY 2020 or early Q1 2021.

My rationale?

Strong fundamentals.

Let me take you through the metrics that I think best reflect Bitcoin's strength going into 2021.

Ratio Bitcoin Market Cap (BMC) / Realized Cap (RC).

This ratio is currently clocking at around 2.3. Also note that RC has been within the 100 to 125B range during most of 2020.

To me this indicates that your average BTC holder is somewhere around 230% in profit as of now. For reference, this metric was at around 5 when BTC reached an ATH $ price back in December 2017.

This is a useful metric to understand where we stand in the current cycle.

My definition of a Bitcoin cycle aligns with that of a halving cycle, the last of which happened back in May 2020. I like to use the S2F model to keep track of Bitcoin cycles.

This all means two things:

- we're still early in the cycle

- serious profit taking hasn't started yet because just about anyone who's patiently held BTC through 2020 or prior to that is waiting for higher price to lock in some profit.

On to the second metric.

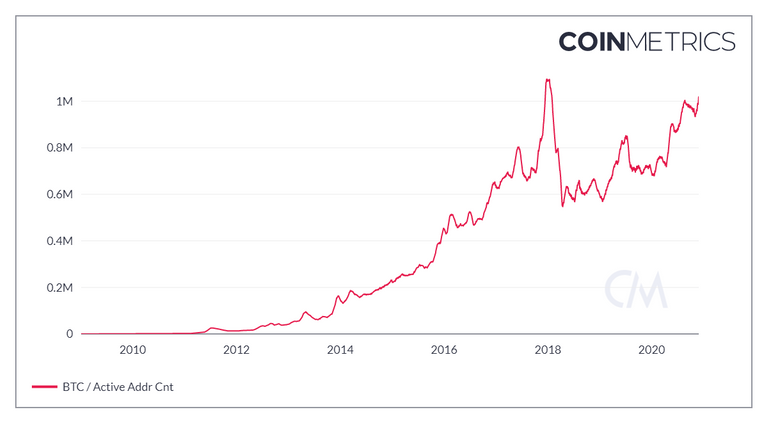

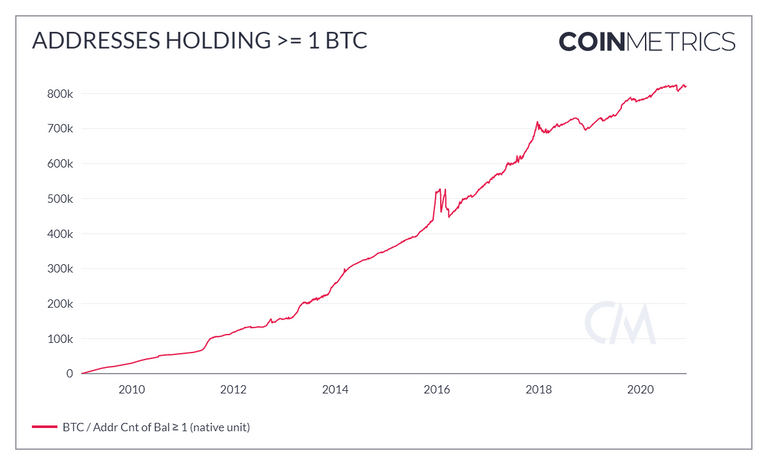

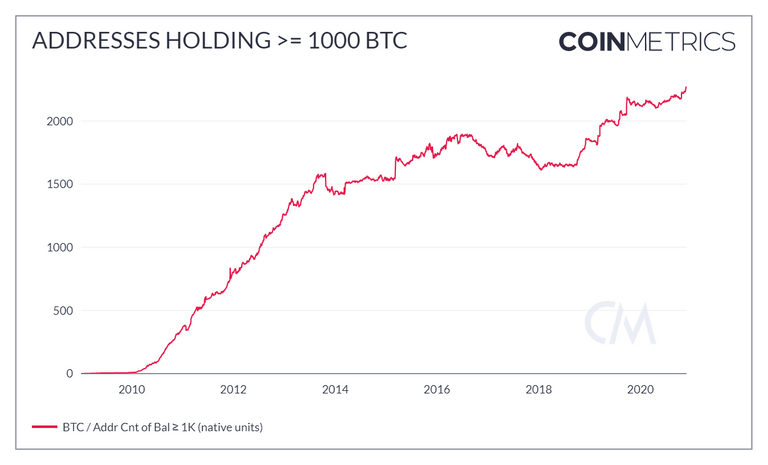

Bitcoin Dispersion.

I call "Bitcoin dispersion" a set of metrics which tracks the growth of Bitcoin addresses and the number of coins within each address.

Since Bitcoin is a monetary good and a store of value, ideally we want to see an ever increasing number of active addresses containing an increasing number of BTC.

Does the data confirm that?

Clearly the answer is yes.

The number of all addresses containing at least 1 and at least 1,000 BTC is at all time high *and *the total number of active addresses is also creeping up to ATH levels.

This shows that BTC is indeed used as a saving technology (aka Digital Gold) and not as a payment network a la VISA or PayPal.

Here's Michael Saylor's (CEO of MicroStrategy) eloquent take on Bitcoin as a store of value:

A bank in cyberspace... that's a good metaphor.

Institutional Adoption.

Back in 2018, institutions were crypto's Loch Ness Monster.

Much talked about, never seen.

This has changed.

As Grayscale Michael Sonnenshein brazenly put it during his latest appearance on the Bankless podcast:

"Not only institutions have been coming, they are here and their number keeps growing!"

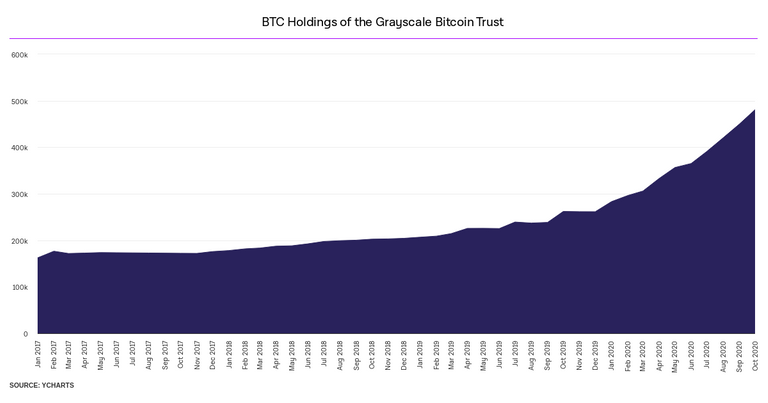

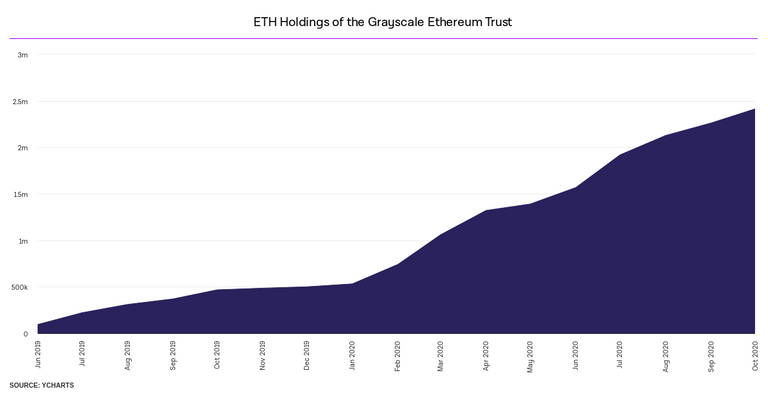

Indeed Grayscale has experienced dramatic growth in 2020.

GBTC and ETHEE have exploded in popularity and provided convenient rails for institutional investors of all sizes to gain custodial exposure to crypto underlying.

Grayscale Ether (ETH) Trust fund in particular has been on quite the run lately.

Grayscale estimates that 80% of the demand for $GBTC emanates from institutional investors, latest of which the Guggenheim Macro Opportunities Fund which announced on Friday it could invest up to 10% of its net asset into Grayscale's Bitcoin Trust Fund.

You can read the SEC filing here:

"The Guggenheim Macro Opportunities Fund may seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (“GBTC”), a privately offered investment vehicle that invests in bitcoin."

This is a smashing success for Grayscale and a welcome addition to the list of institutional investors (Paul Tudor Jones, Stan Druckenmiller) that have already announced they've put money into Bitcoin.

Even famous Bitcoin skeptic Ray Dalio is now having doubts:

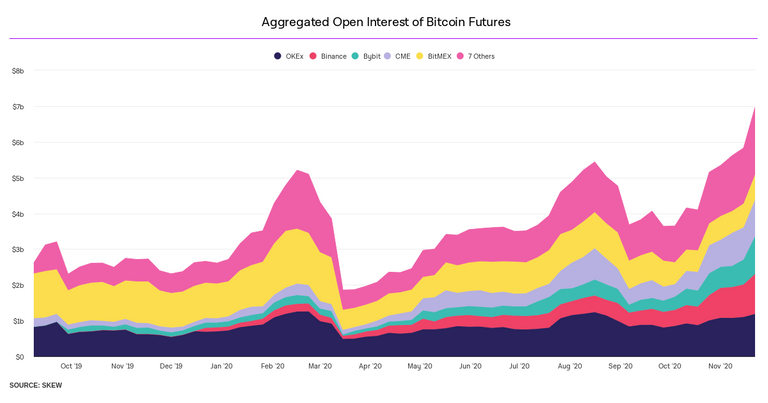

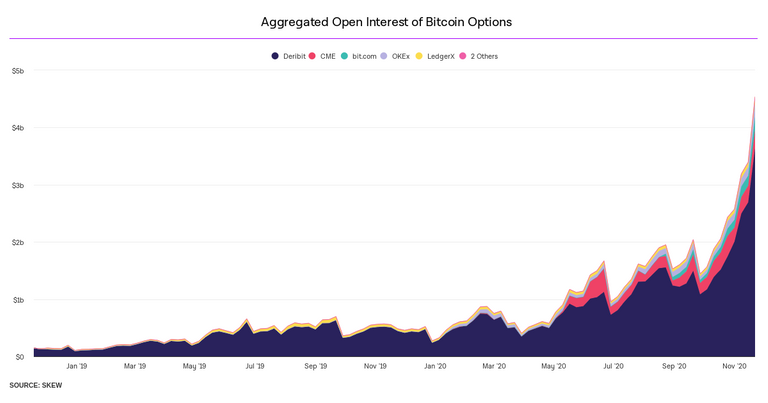

Beside Grayscale, institutional investors have also sought exposure to crypto via derivatives products offered on regulated exchanges like the CME (I believe this was the route chosen by Paul Tudor Jones' hedge fund).

For an in-depth description of what institutions are and what their risk appetite for crypto looks like, I highly recommend reading this article from former Coinbase employee Nick Prince.

It's clear that data vindicates the narrative of institutions finally having arrived in the space. This also reinforces the notion that we're still early in the cycle as retail is still mostly on the sideline.

As for the last metric.

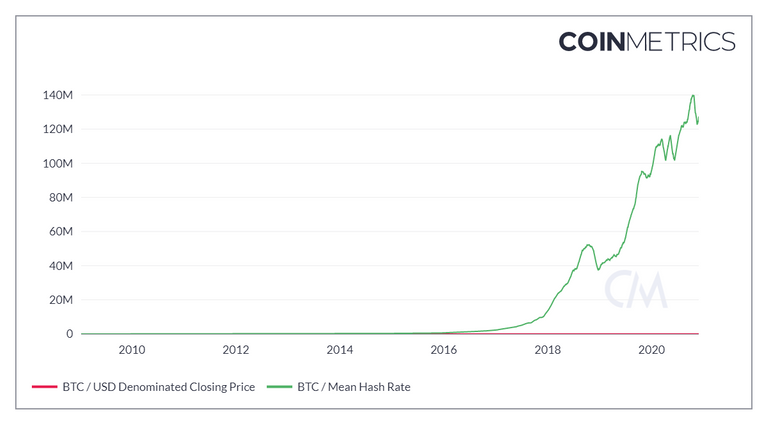

Hashing Power from Bitcoin Mining.

I find this metric useful to track the overall security of the network and to gauge miner sentiment.

Basically, high hashing power reflects overall miner bullishness and willingness to fronting the cost of acquiring mining equipment (ASIC rigs) in exchange for future cash flow derived from block rewards.

The issue with the hash rate metric though is that it's somewhat lagging because hashing power is not completely elastic.

By that I mean that miners can't just turn their machines on or off on a whim to adjust to the fluctuations of supply and demand. As such, hashing power doesn't always reliably track miner's sentiment but I still find it a useful metric to gauge the security of the network.

In any case, the big takeaway here is that hash rate is close to all time high. This means that your Bitcoin is safe from 51% attacks.

On a quick side note I should add that though total Hash Rate looks great, hash rate distribution is an ongoing issue since over 60% of hash rate comes from Chinese miners.

To be clear I do not subscribe to this "China controls Bitcoin" narrative which I find dangerous and slightly alarmist in a very cold war sort of way. Nevertheless, I think the network would be better off and more secure if mining was better distributed around the world.

Speaking of going around the world.

Let's touch on the ever important topic of crypto regulations.

FATF Travel Rule

On the regulatory side we're seeing an interesting ecosystem develop to meet the newest AML recommendation from FATF.

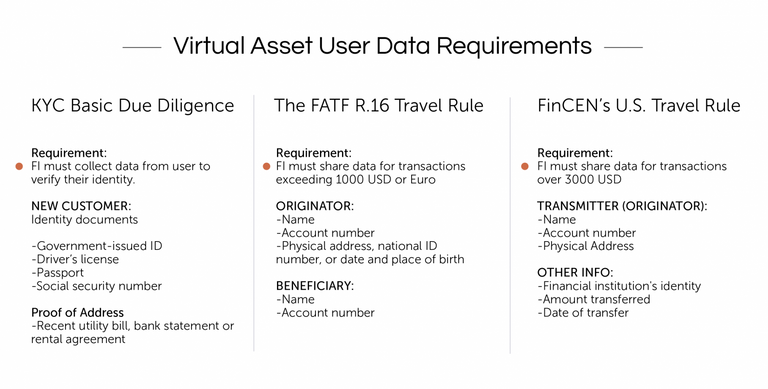

Colloquially known as the "travel rule" this recommendation proposes to add more compliance layers to existing AML practices such as KYC.

The ravel rule already exists in traditional finance (see: Bank Secrecy Act) but it's now aiming at suppressing money laundering risks created by virtual assets service providers (VASPs). VASPs include crypto exchanges, crypto start-ups DeFi projects, etc.

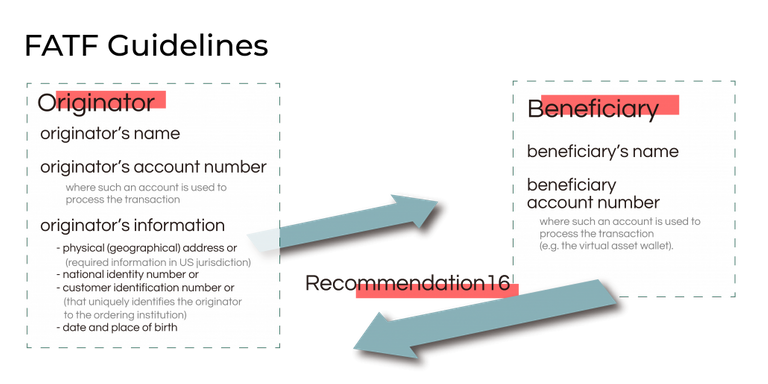

From a very high level, the Travel Rule requires all 200 FATF member-states to ensure that VASPs under their jurisdiction start collecting and exchanging beneficiary and originator information with VASP counterparties during any transaction over $1,000 USD.

Mind you, the travel rule doesn't replace KYC procedures, it supplements them.

Is this really necessary, you ask?

Well, it's been shown that the current KYC regime applied to VASPs is not good at preventing money laundering.

In a 2019 report, blockchain analytics Cyphertrace showed that it was possible to move 0.25 BTC around the world (hoping from one exchange to the next) without ever needing to undergo KYC.

The travel rule aims to change the status quo by making it harder for the bad guys to use VASPs to launder crime money and integrate it back into the legitimate economy.

Like any AML process, the goal of the travel rule is to allow VASPs to have a more complete understanding of their clients' business so to better detect and report suspicious activity that could constitute money laundering.

The hope is that stronger AML policies at the VASP level will avoid a situation in which crypto-friendly states become a hot bed for crypto money laundering and end up on the FATF's naughty lists.

However, crypo being crypto, implementing the travel rule poses a unique set of challenges:

- How do you know if the beneficiary is a wallet hosted by a VASP or a privately hosted (cold) wallet?

- Does the travel rule applies to transaction originating from private wallets?

- If the beneficiary is a VASP, how do you correlate the payload data with the blockchain transaction so that the data is exchanged before the on-chain transaction takes place?

- What about transacting to a VASP located in a country with a lower level of travel rule compliance (this is known as the "sunrise" problem)?

- What about complex crypto transactions which are structured to go through multiple VASPs intermediaries?

- How do you make sure that the payload data complies with local privacy laws such as the GDPR?

- As a regulator, how do you force crypto companies under your jurisdiction to implement the travel rule without nipping innovation in the bud and passing down crippling compliance costs to VASPs?

A number of companies and projects have risen to the challenges addressing these issues by building tools and standards to help VASPs comply with the travel rule.

If you're curious to learn more, you can check out the following:

Until a true standard emerges though, these solutions will need to be interoperable with each others so that the payload data is understandable by all VASPs all around the world.

This is just the start though.

I believe that the travel rule is going to have massive long term repercussions for the crypto industry, particularly in the DeFi space.

It's important to understand that the Travel rule is an obligation that weight on member-states that are part of FATF and not directly on companies/projects.

This means that compliance will have to be exerted in a top down fashion through the regulators in each and every country part of the FATF.

Some countries will crack hard on crypto projects. As a result we might see many such projects play regulatory arbitrage at first. Eventually though I think that the whole industry will end up being regulated. Non-compliant projects and companies will either disappear or cast aside as bad actors.

It will be interesting to see how DeFi in particular will fare under the regulatory pressure. Having to deal with AML compliance will surely test the principles of many so-called decentralized communities.

What do you do as the core team when your token holders vote to not comply with the travel rule? As a solo staker or validator, are you required to implement KYC/Travel Rule and monitor transactions?

Interesting times ahead.

See you next weekend for more market insights.

Until then,

🦊