Hi investors,

In today's market round up we're reviewing this week's price action in Bitcoin and Ethereum. We're breaking down why publicly-traded company Microstrategy chose to put a large number of Bitcoin on its balance sheet and we touch on the ETH "supply gate".

Let's dive in!

Bitcoin.

At the time of writing, BTC is trading at $11,913 USD on spot against the US dollar. We're up +1.17% since last week and a cool +65.02% YtD. BTC is also up 28% against gold YtD.

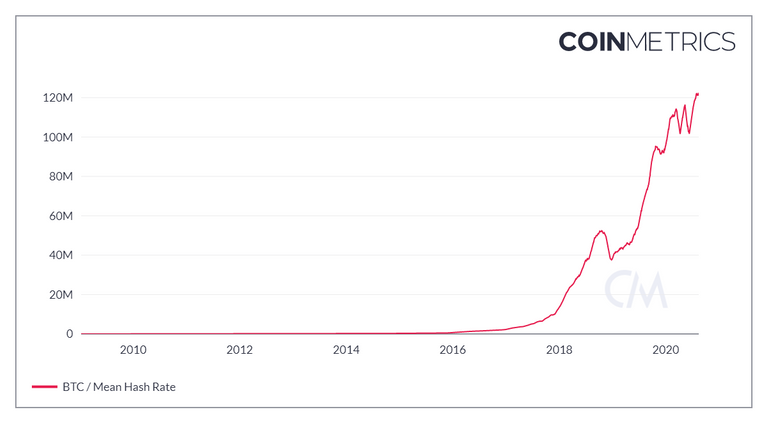

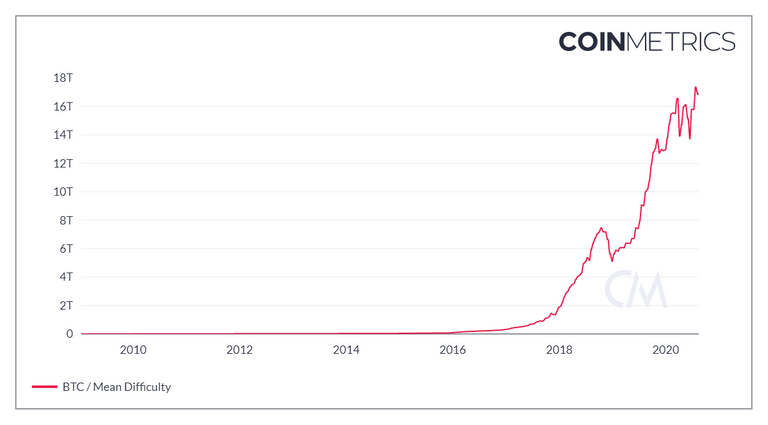

The Bitcoin network is looking stronger than ever.

Hashrate (and thus difficulty) are at ATH, with H/rate clocking at an enormous 155 EH/s (155 quintillion hashes per second). High hash-rate reflects miner bullishness in the future price of Bitcoin because they're willing to put more capital to work now (in the form of ASICs miners and long term energy contracts) to obtain Bitcoin in the future.

Bitcoin block-space (tx fees) market is also making higher lows though we're nowhere near all time high (21M USD in December 2017).

In another staggering news this week, Microstrategy, a publicly-traded US firm specialized in business analytics, just disclosed it has acquired over $250M USD in Bitcoin in a move to diversify their balance sheet.

This bold strategy was first announced in July 28 during a Q2 earnings call:

[...] today, we are announcing a capital allocation strategy under which we plan to return up to $250 million to our shareholders over the next 12 months. In addition, we will seek to invest up to another $250 million over the next 12 months in one or more alternative investments or assets which may include stocks, bonds, commodities such as gold, digital assets such as Bitcoin, or other asset types.

Yet it was unclear how much of these $250 USD would actually fly into BTC. Then in August 11, the company disclosed in a press release that it had purchased an eye-popping 21,454 bitcoins at an aggregate purchase price of $250 million, inclusive of fees and expenses.

The press release is a must read as it quotes Mircostrategy CEO Michael J. Saylor laying out a downright investment thesis for Bitcoin in terms reminiscent of Paul Tudor Jones' now famous Bitcoin letter.

This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.

The news caused the company stock ($MSTR) to jump 15%.

The ramifications of this decision for both for the company and for Bitcoin are fascinating. As Nic Carter noted on the latest episode of the on the Brink Podcast:

The company's fate is now way more exposed to Bitcoin than to the success of its own product line. If Bitcoin goes high enough, the stock becomes a de facto Bitcoin close-end fund as the Bitcoin held on the balance sheet eclipses everything else. But maybe that's the plan...

If anything, this is an enormous risk for the company and its shareholders. Not only it exposes their treasury to the volatility of BTC but also to custody risks. However, it's a bet that could pay handsomely, especially if we're in the early innings of a new 3/4-year bull Bitcoin cycle. Only time will tell if the reward was ultimately worth the risk.

For now, $MTSR has become something of a way for equity investors to have exposure to Bitcoin and this might be the first domino to fall as BTC makes its way as a legitimate asset in corporate treasury management.

This is a story to keep an eye on for sure.

Let's now look at Ethereum.

Ethereum.

Ethereum's native asset Ether (ETH) is on a tear. ETH is trading on spot at $431 USD at the time of writing. We're up +9.55% since last week and +232.63% YtD. ETH has also gained +8.61% against BTC since last week.

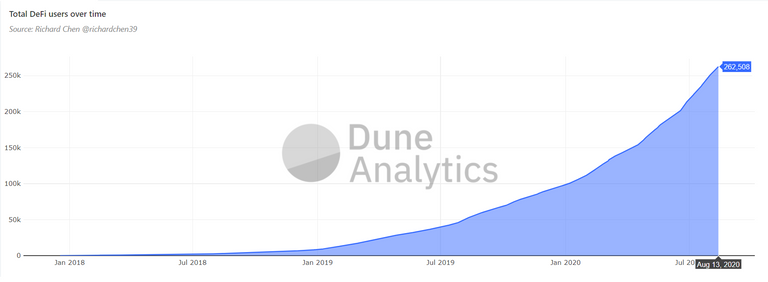

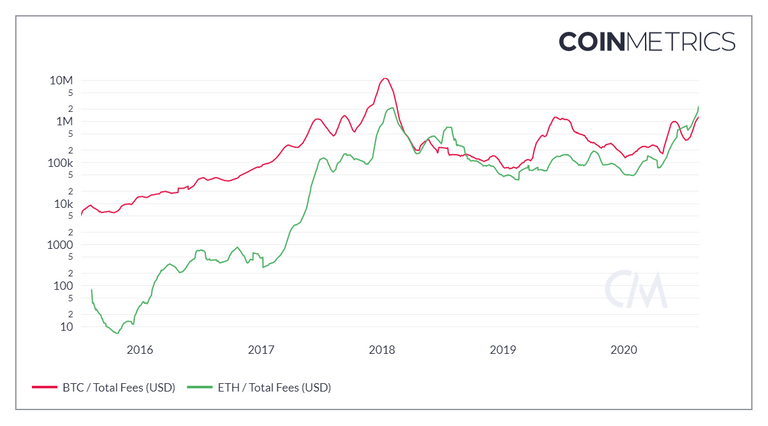

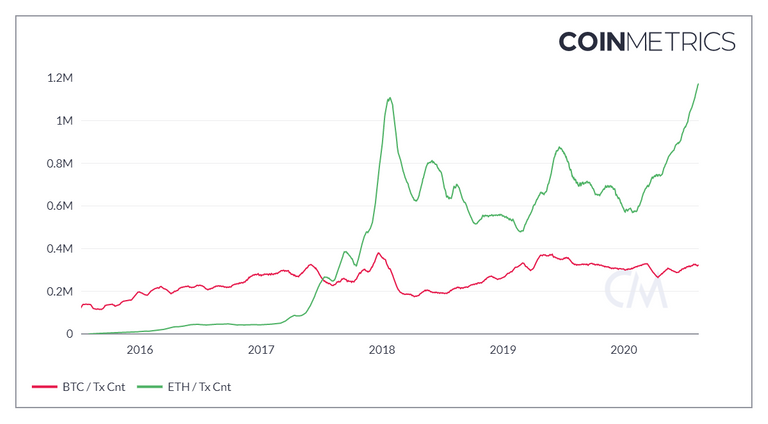

Driven by intense DeFi usage, Ethereum's growth has pushed the network ahead of Bitcoin in a number of key metrics like total tx fees (USD) and tx count.

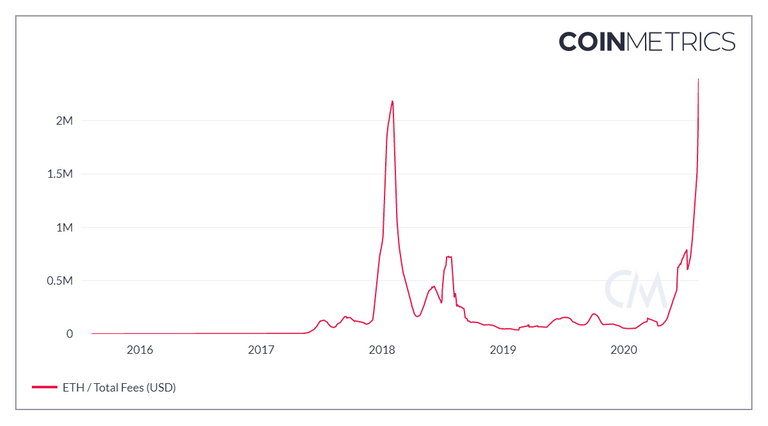

This enormous increase in activity has of course resulted in an explosion in gas price and tx fees paid to miners who are making record profits.

Source: Etherscan

While the Ethereum's making main chain is quite expensive to use as of now, it's useful to keep in mind that extremely-cheap L2 alternatives like Loopring or zkSync already exist.

By all measure, Ethereum's expensive gas is a "good" problem to have and the community is working hard to make scaling possible on higher layers while the deployment of ETH 2.0 is on the way.

Finally, a market round-up of Ethereum wouldn't be complete without a few words about the ETH "supply gate".

I strongly believe that ETH nodes should definitely offer an easy way for operators to verify supply, particularly if ETH has any ambition to become money. From this angle, I believe that the attention this issue has attracted was deserved and a check_supply command needs to be added to Ethereum clients like is the case in Bitcoin.

However as far as I can tell the problem is solved. Code to audit supply has been released and the supply-gate horse has been beaten to death yet the debate is still raging on Twitter and poisoning the relations between the two communities thanks to very vocal Bitcoiners trying to milk every single drop out of what turned out to be a tempest in a teacup.

Even esteemed Bitcoiner and technologist Andreas Antanopoulos chimed in on social media, calling the debate "silly" and "not a particularly valid criticism [of Ethereum]"

I would encourage you to listen to the following podcasts and make up your mind on whether this issue deserves so much acrimony.

- Andreas Antanopoulos' appearance on Laura Shin's Unchained Podcast (Andreas is a blockchain technologist who's written technical books on both Bitcoin and Ethereum)

- Pierre Rochard's take on the supply issue (Pierre Rochard is a "Bitcoin Maximalist")

- Vitalik's opinion on the ETH supply-gate (Vitalik is the creator of Ethereum)

- Lucas Nuzzi from CoinMetrics on how ETH's supply is calculated.

See you next weekend for more market insights.

Until then,

🦊

Whats your take on a possible pull back on BTC in the near future? I think we can still see BTC in less than 10K again. I don't think it has completely escape 10k zone yet though the current bullish momentum has been awesome so far.

Hey there, thanks for stopping by :)

Pull back is possible of course but I agree with you that the macro trend will be bullish for now.

I believe the best play here is to dollar-cost average a risk adequate portion of your cash income into BTC for the next 3-ish years until we near the next halving.

I wrote a longer post about my portfolio strategy if you're interested:

https://peakd.com/hive-126009/@f0x-society/weekly-insights-portfolio-strategy-for-the-next-bull-run

Where do you think this is going?

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz: