Hi investors,

Today we're talking about Bitcoin's performance across different markets, why the S&P 500 rally is in fact a S&P 4 rally, the sad state of industry in the US and how crypto can boost any portfolio.

Let's dive in!

Bitcoin v. USD

Bitcoin seems to be consolidating following a breakout above 10k. At the time of writing, BTC is trading at $11,671 USD on spot against the US dollar.

Bitcoin v. Gold.

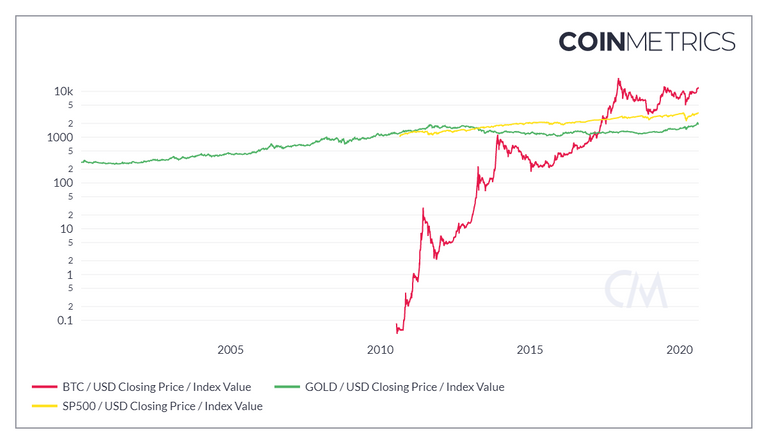

Bitcoin is also looking bullish against gold. We're down -0.63% since last week but +27% YtD and the market has been making higher lows since March's COVID crash.

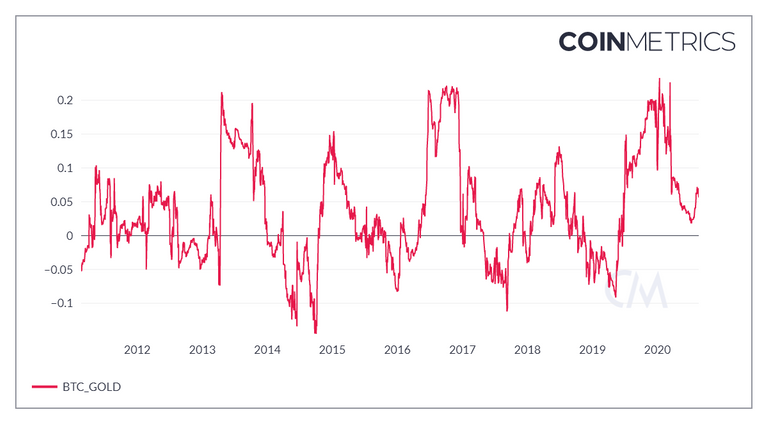

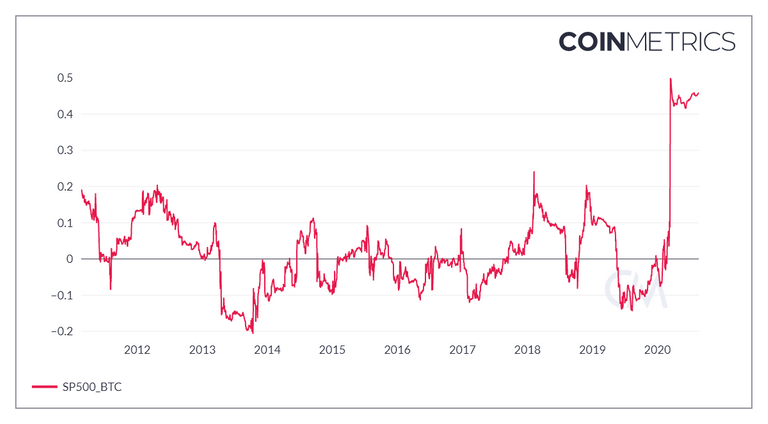

Interestingly, Bitcoin shows very minimal correlation to gold but high positive correlation with the S&P 500.

This is not surprising, a lot of capital has been flowing into assets since March as the market has been pricing the potential inflationary impact of quantitative easing policies adopted by governments around the world. The market is looking for scarcity and momentum. Equity, Bitcoin and gold have delivered on both accounts.

Bitcoin in the Macro Picture

The stock market broke all time high valuation this week.

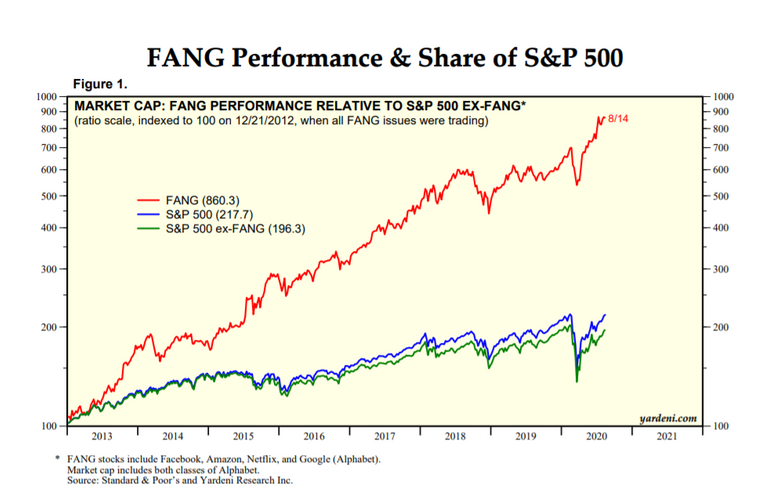

Recent research suggests that this massive increase in valuation has been mainly the consequence of ballooning FANG stocks which have dramatically outperformed over non-FANG stocks (aka S&P 496):

Non-FANG stocks themselves have underperformed the S&P500.

This mean that this near-decade equity bull run has been almost exclusively driven by a handful of tech companies.

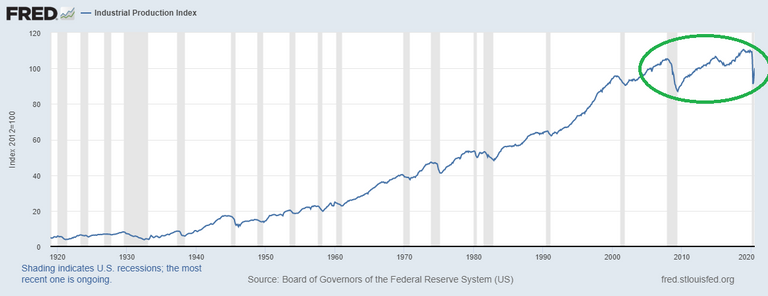

For comparison here's the US industrial index in the last 10 year. The US industry has been stagnating for over a decade as a consequence of massive globalization of their industrial supply chain.

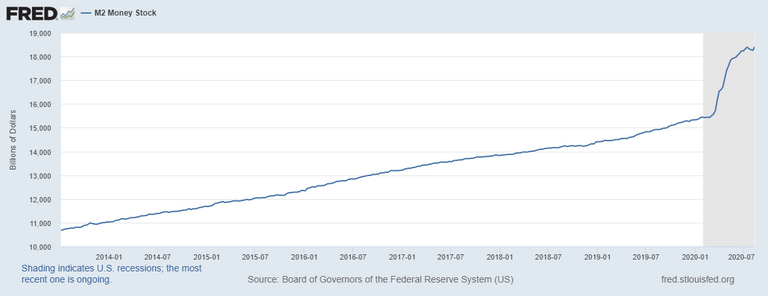

As a result, the US has had no choice but running huge trade deficits and resort to money printing to keep global commerce running and acquire industrial goods from abroad.

This strategy has strengthened the position of the US dollar worldwide but has considerably weakened the US economy as a result.

The US equity markets is now driven by literally a handful of companies whose stocks have been pumped by rounds after rounds of QE. This addiction to money printing is now codified into Modern Monetary Theory (MMT) which advocates money creation as the preferred tool for regulating the economy via the creation of infinite bank collateral.

MMT is dangerous, not necessarily because it leads to price inflation of basic commodities (it hasn't so far) but because it widens the wealth gap by inflating financial assets and weakening the moral imperative for paying taxes (why bother paying your tax when money can seemingly be conjured out of thin air?). Taxation, however, is system-critical in an MMT system because it's used to extract dollars from the economy in order to avoid price inflation as a consequence of monetary inflation.

MMT thus create nihilistic systems where economic agents distrust government-issued money, avoid paying taxes and rush into financial assets, creating bubbles and widening the wealth gap.

Sounds familiar?

The Bitcoin Opportunity.

According to PEW Research Center, the median millennial (people born from 1981 to 1996 will be turning 32 this year. Many are entering the most productive and richest (in the literal sense) years of their lives and will stay there for at least the next 20 years.

In such environment where do you invest your money?

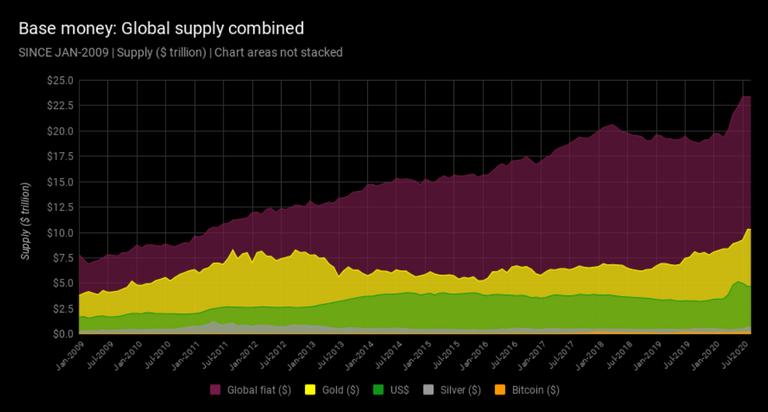

As we already discussed, fiat-denominated bank accounts are a no-go. The APY on these is (at best) hovering just over a pathetic 1% (which means that you'd automatically see your net-worth sanded down by inflation year after year). Cash is the literal opposite of a scarce store of value.

Source: https://cryptovoices.com/basemoney

The return on treasuries is not much better, topping 1.35% for the 30+ year maturity bills. T-bills also don't have any scarcity as they can be conjured by treasuries on a whim then swapped for cash to finance their issuing government.

Equity (particularly the NASDAQ) is still an attractive option and frankly, so is gold but nothing compares to Bitcoin.

Bitcoin's outperformed gold and the S&P 500 for years now and the upside is still massive.

As Raoul Pal brilliantly put in the latest issue of the Stephan Livera podcast,the bitcoin opportunity looks to millennial similar to what the stock opportunity looked like to baby boomers after WW2: juicy.

Having been brought up playing video games and surfing the internet, millenials and the generations that come after them are comfortable with the idea of de-materialized value and Bitcoin as a digital equivalent of gold.

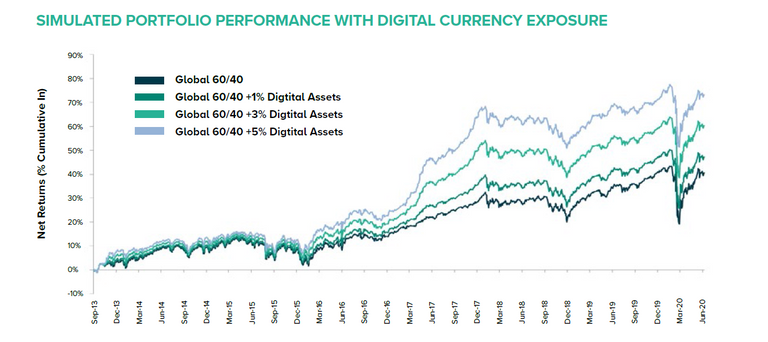

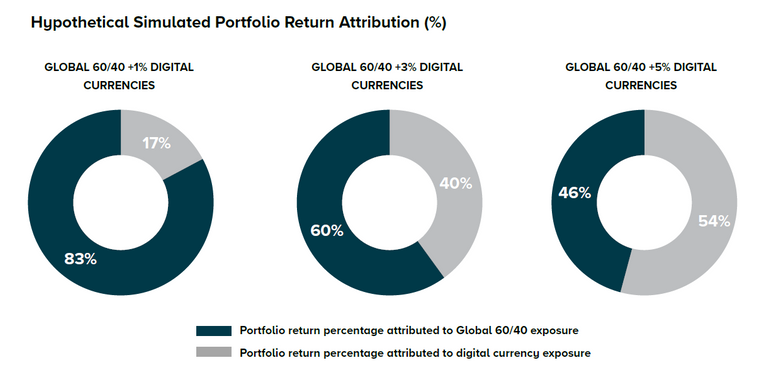

As a recent Grayscale research pointed out, even adding a relatively conservative amount of digital currency exposure (1%-5%) to a vanilla 60/40 portfolio can significantly improve its performance:

Source: https://grayscale.co/financial-advisors-toolkit/

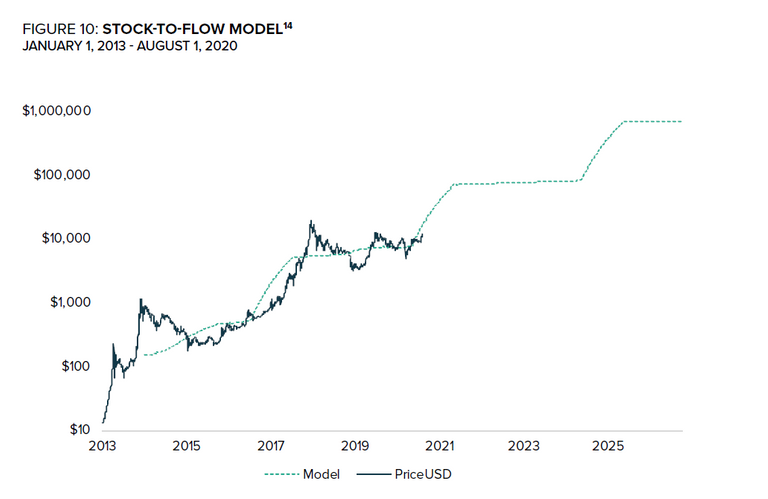

And while these charts only describe past performance, other metrics like the (controversial) S2F model point towards Bitcoin performing equally well in the future.

Source: https://grayscale.co/insights/valuing-bitcoin/

Finally, Bitcoin's relative valuation compared to other store of value assets is still tiny.

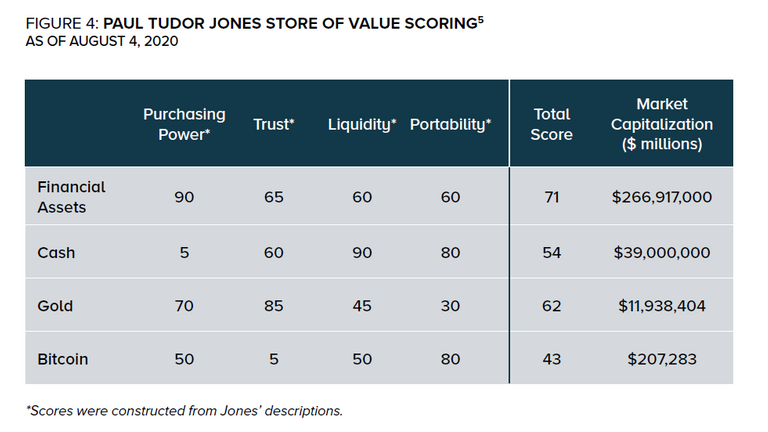

In May 2020, investor Paul Tudor Jones wrote a letter to investors that revealed his investment case for Bitcoin.

The analysis examined 4 store of values: financial assets, cash, gold, and Bitcoin. Each asset was scored based on purchasing power, trustworthiness, liquidity, and portability.

Interestingly, Bitcoin's trust score itself (as defined by Jones) could be the subject of an entire article

Source: https://grayscale.co/insights/valuing-bitcoin/

Jones suggested that while Bitcoin ranked lowest among the stores of value,

its score implied a far higher market capitalization than it currently has.

What was surprising to me was not that Bitcoin came in last, but that it

scored as high as it did. Bitcoin had an overall score nearly 60% of that of

financial assets but has a market cap that is 1/1200th of that. It scores 66%

of gold as a store of value, but has a market cap that is 1/60th of gold’s

outstanding value. Something appears wrong here and my guess is it is the

price of Bitcoin.

Jones’ analysis sheds light on the sheer size of the addressable market for Bitcoin.

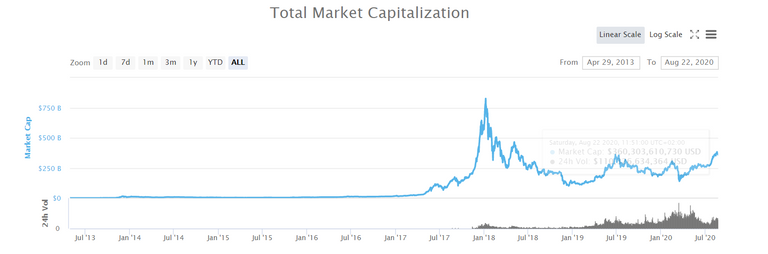

To quote Raoul Pal again, "the macro is colliding with the micro in a perfect storm for Bitcoin". For once, retail has the opportunity to front-run the largest institutional players because, at around 360B fragmented over countless markets, crypto is still way too small to allow for multi-billion allocations of capital.

Source: https://coinmarketcap.com/charts/

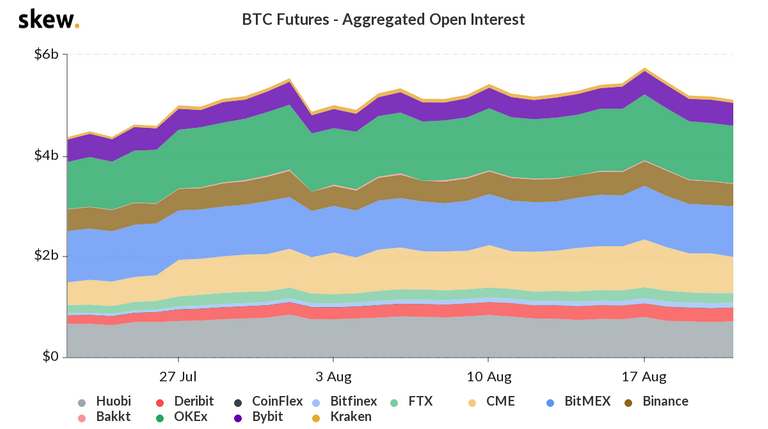

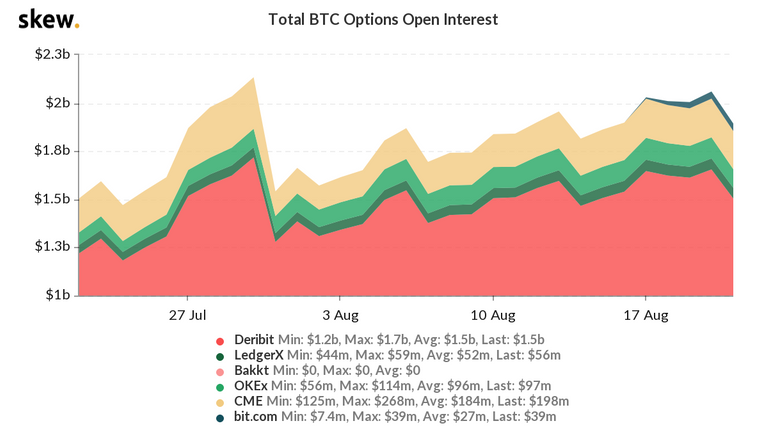

Unlike Caitlin Long, Pal doesn't see the financialization of Bitcoin (via the explosion of derivatives) being a factor in dampening the price nor the scarcity of the asset.

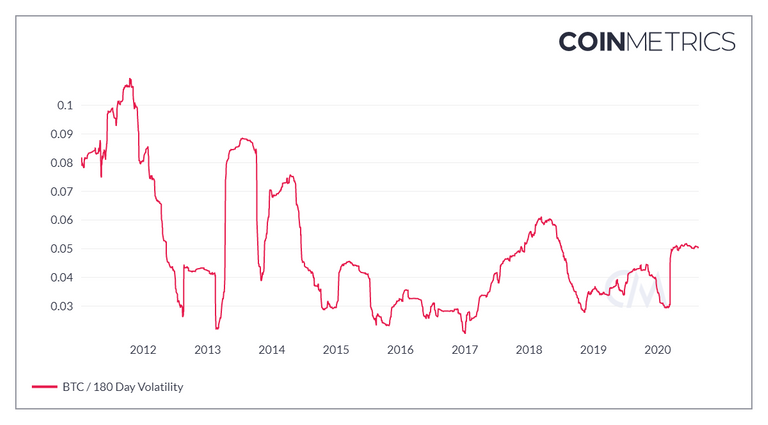

If anything, Pal sees derivatives as reducing price volatility in the long term. For now, his view has been confirmed by data. Bitcoin's volatility is around the lowest it's been in existence meanwhile derivatives instrument on top of Bitcoin are at an ATH.

Like Pal, I believe that Bitcoin has a place into every portfolio (and balance sheet!). To me, the de-materialization and decentralization of money seems inevitable. In a world that's shifting with increasing rapidity into the virtual, Bitcoin introduce a much needed element of scarcity. It is a paradigm shift in what value is and how it should be created and stored. And for once we, the people, can front-run the institutions, carve our plot of digital real-estate, and patiently wait for the revolution to happen.

Worth your time:

- When Bitcoin and Macro Collide from the Stephan Livera podcast

- What Are Austrian Economists Missing About Money And Banking? also from the Stephan Livera podcast

See you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Indeed as a millennial if I am thinking about long term savings with low economic cycle correlation (well even if it did not work in March 2020) I am either considering Bitcoin or Gold. And as I spend 10 hours a day on screens, I guess Bitcoin wins 😂.What a great read my dear @f0x-society and I can tell we listen to a lot of similar podcasts 😉.

We need to take a beer 🍻 very soon, wouldn’t you agree ?

Another thing, don’t forget to use « leofinance » as a tag. It will bring financial focused investors and will give you free tokens that you could sell later on (with the same posting habits as you do now).

Sure man, I should (not 100% sure yet) be in Paris from September 7 to September 21, we could meet for a crypto chat!

Bitcoin's got more upside than gold imo but depends on your risk appetite I guess