Balancer Labs and Compound Finance. are both liquidity providing platforms where you can supply your tokens to these platforms and other users can in turn borrow from the pool where you and many other users are providing liquidity. These platforms are new and being touted as the new big thing in De-Fi world.

Lets see how to provide liquidity on Balancer first.

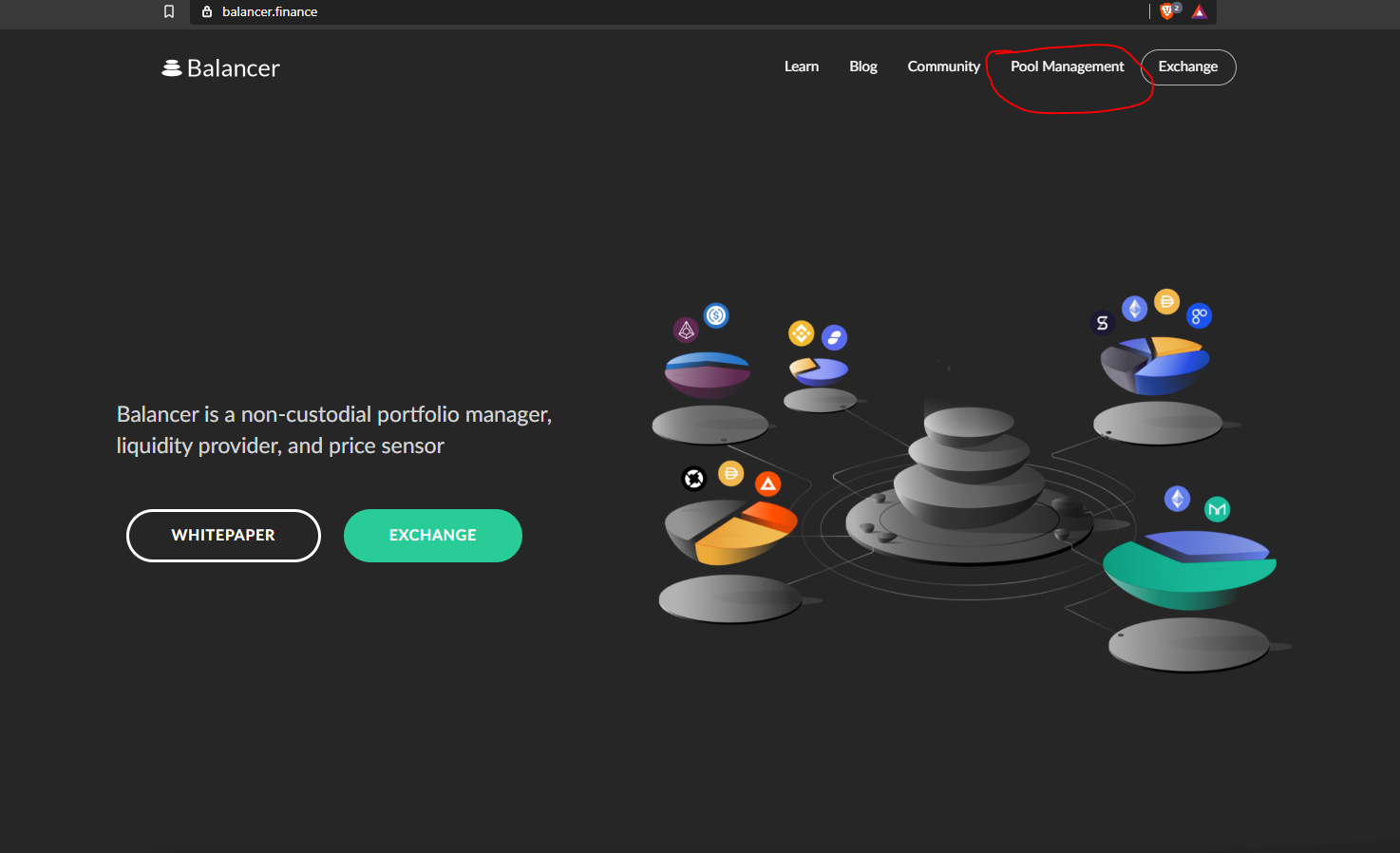

- Log into the website Balancer.finance and click on Pool Management.

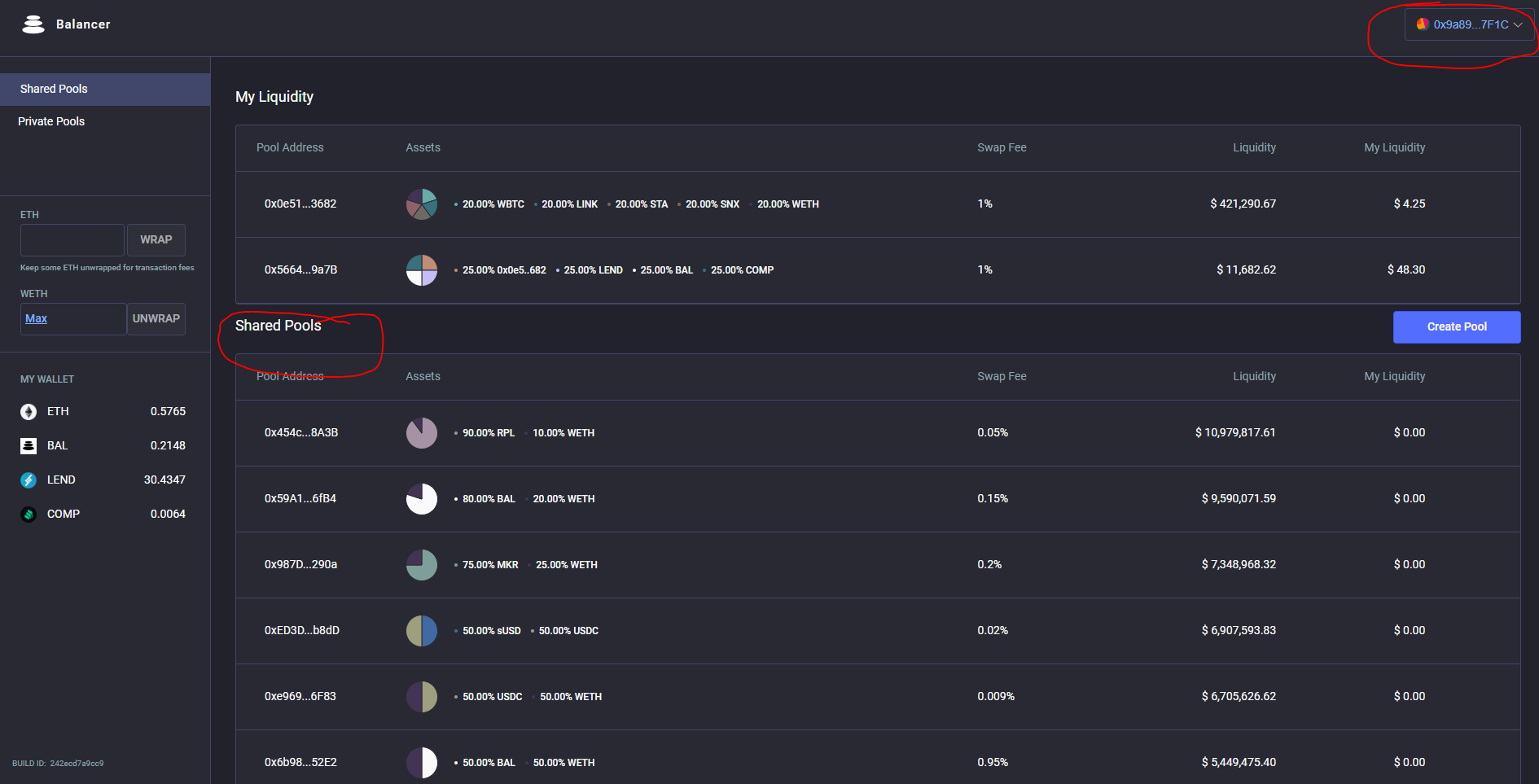

2.Under Pool Management you can see the various pools where you can provide liquidity. Before doing that you need to connect your wallet to the platform. I used Metamask extension which you can get from here.

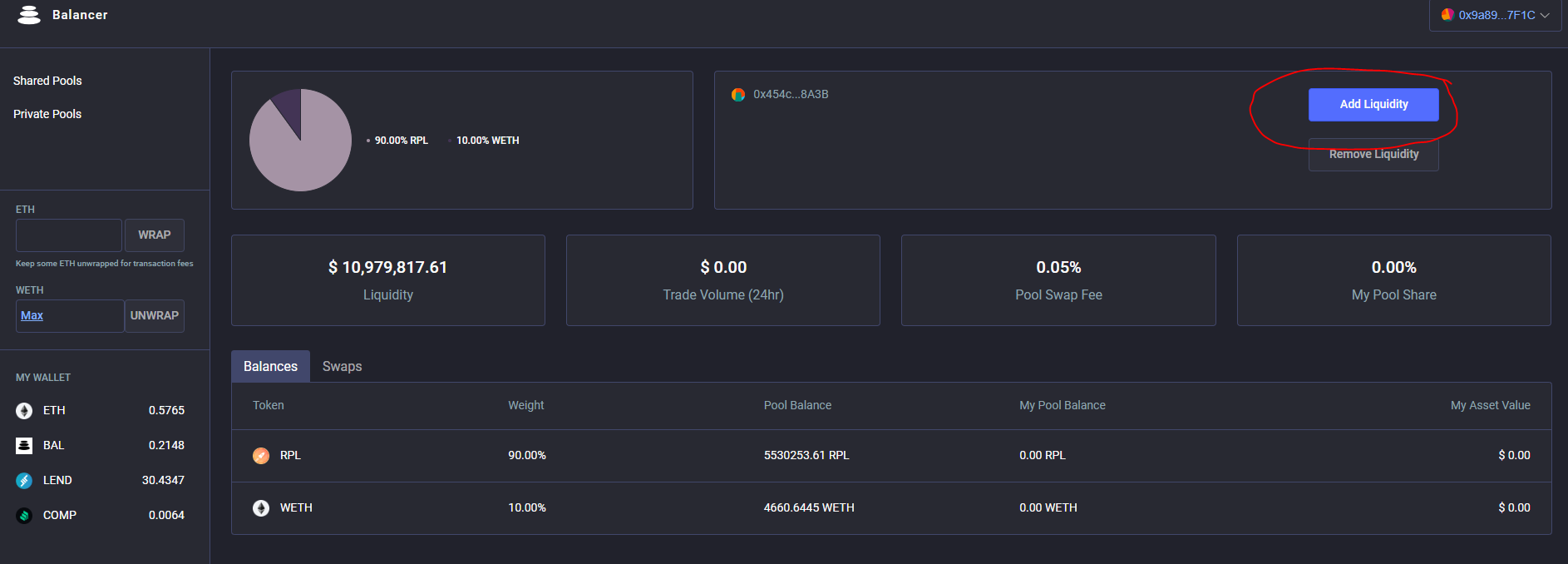

3.Lets say you choose to provide liquidity to the First shared pool shown in above image. Click on the pool and you will see the below image.

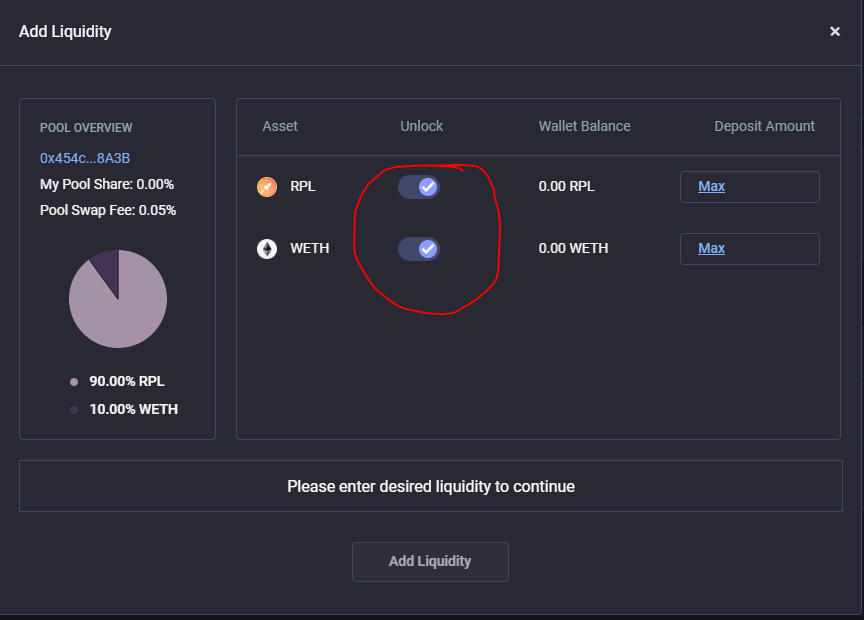

Click on Add liquidity. and then unlock the tokens to supply the tokens to the pool. Mine are already unlocked as i tried this pool earlier.

4.Before you supply liquidity to these pools you need to have the tokens you will be supplying. For above pool you need RPL and WETH. Both you can get from any of the exchanges that support swapping ERC-tokens like Kyber Network or Uniswap Exchange.

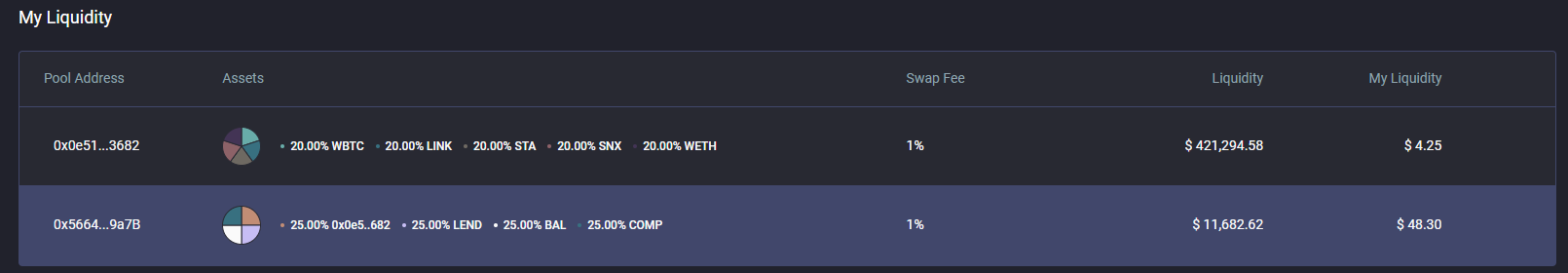

Simply swap your ETH for RPL and WETH and once swapped you can start supplying these tokens into the pool. Once you have supplied you will see changes in the pool screen. For example you can see how my screen reflects changes now that i have supplied some tokens.

Your main screen will also start showing the pool into which you have provided liquidity.

And that's it. Remember that by doing all these tasks, you will be asked by metamask wallet whether you want to confirm your actions or not and these will consume some GAS/fee.

Let's take a look at Compound now.

1.Log into the Compound.finance website. And like Balancer connect to your metamask wallet.

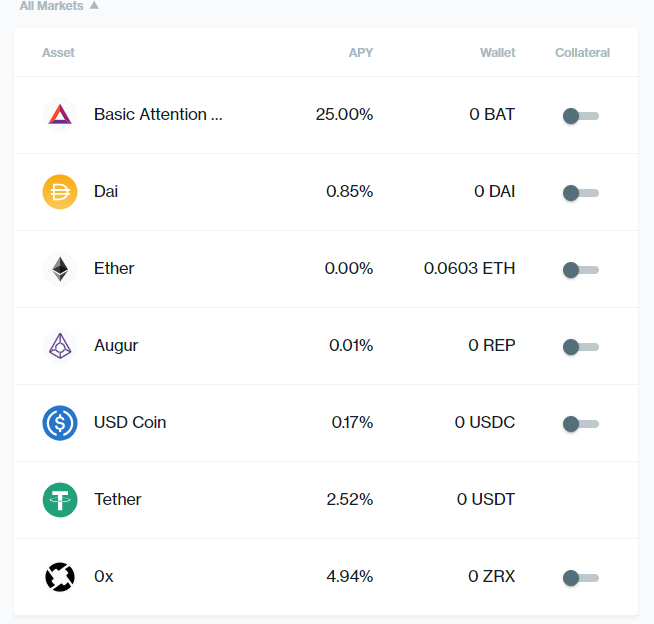

2.Choose the asset you want to supply.

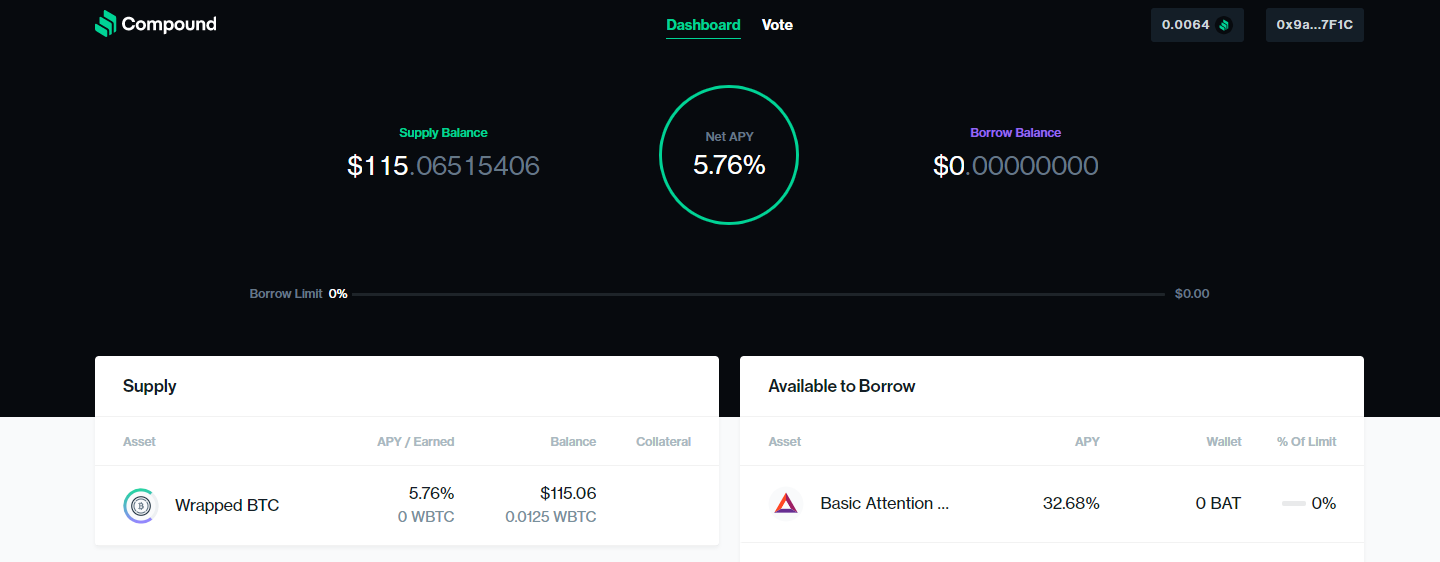

3.Once asset is supplied screen will update with relevant information.

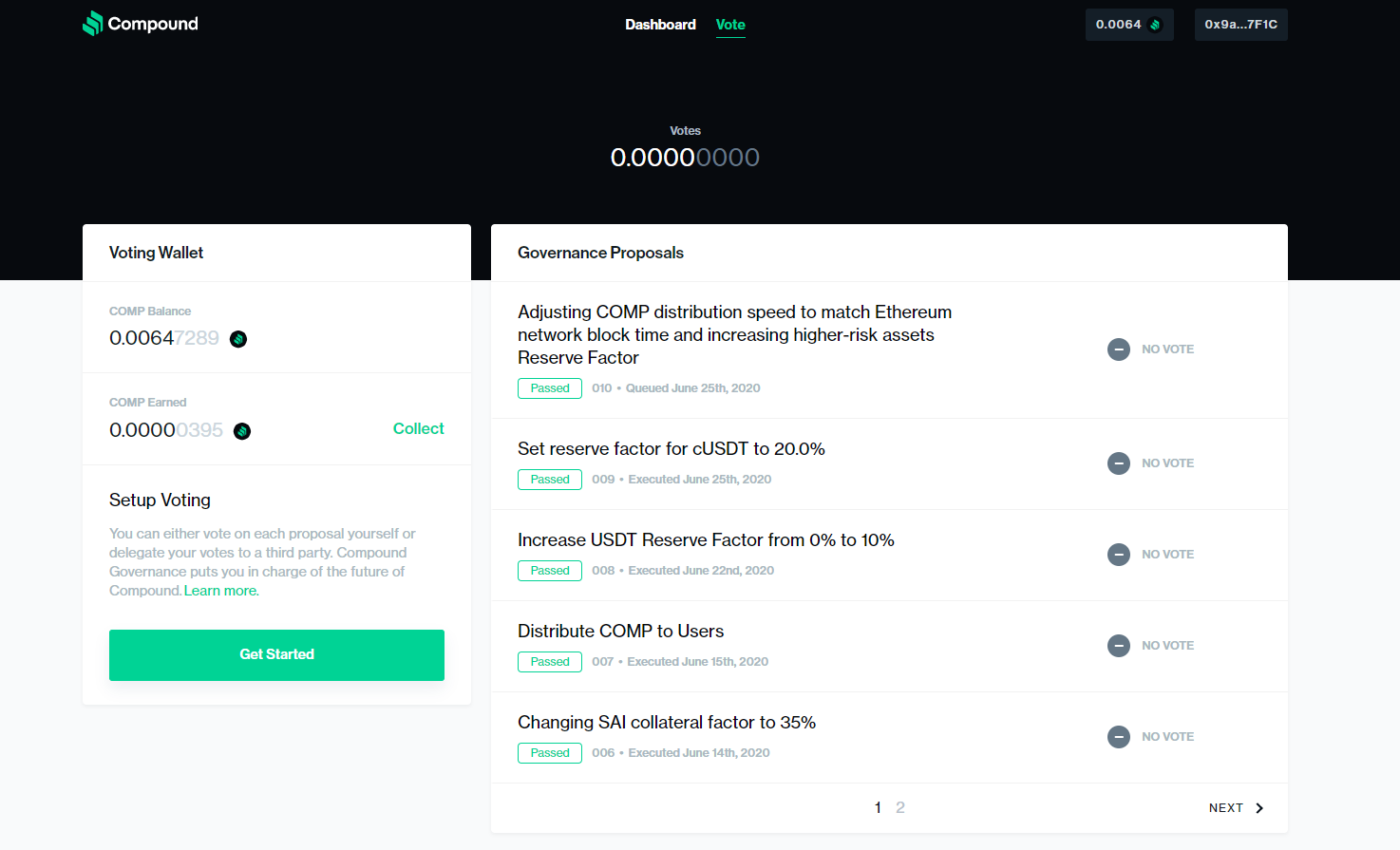

4.Check your accumulated COMP by clicking on Vote.

That's it you are now providing liquidity on both Balancer and Compound platforms.

Always remember these are still new platforms so invest after your own research and only invest what you can afford to lose.

Very good guide on how to provide liquidity on the 2 platforms!

This post has been manually curated by DeFi Campus.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.auctus.org/5-ways-of-identifying-a-liquidity-pool-dc5920aaf2fa