De-Fi is the buzzword of the past few weeks. Everyone is hearing about it. Many are excited about it. Few are investing in it. Rarely anyone understands it. To make it a little easier for my readers, here are a few resources that will help you navigate this new, rapidly evolving world of Decentralized Finance where you control your finances and not the financial institutions.

These resources don't serve as an introduction to De-Fi but will assist you in your quest to invest or maximize your Yield-Farm or optimize De-Fi for you.

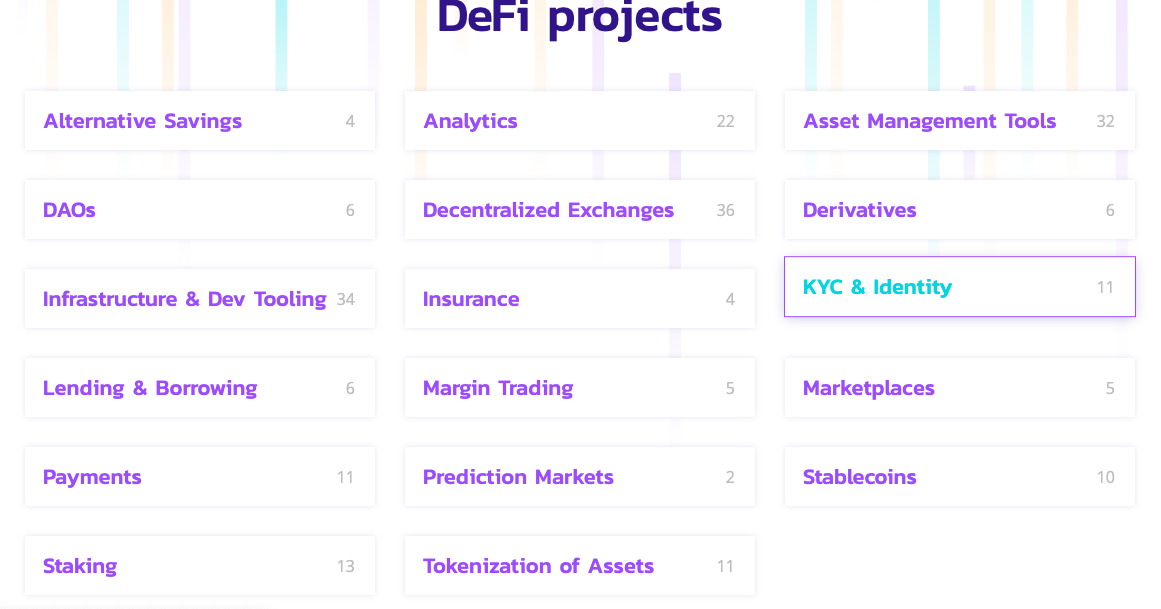

1.Defiprime.com

Defiprime acts as a repository of all De-Fi related projects. Any project in the De-FI community can be found here. It describes itself as-

DeFiprime.com is a media outlet and analytical services provider for the Defi community. Its mandate is to inform, educate, and connect the community as the definitive source of news dedicated to decentralized finance space.

Defiprime.com lists various categories and these categories list various projects. If you want to find which wallet provides access to most de-fi services, various decentralized exchanges, de-fi portfolio tools, lending & borrowing platform, all can be found on defiprime.com.

Not only the website lists the various projects but also give a brief overview of them so as to help you identify and serve your requirement. Some entries also have an AMA with the founder of the project thus helping you understand the use case of the respective projects.

If you are following De-Fi you need to bookmark the website since this is a rapidly evolving field many more listings will be listed on defiprime.com.

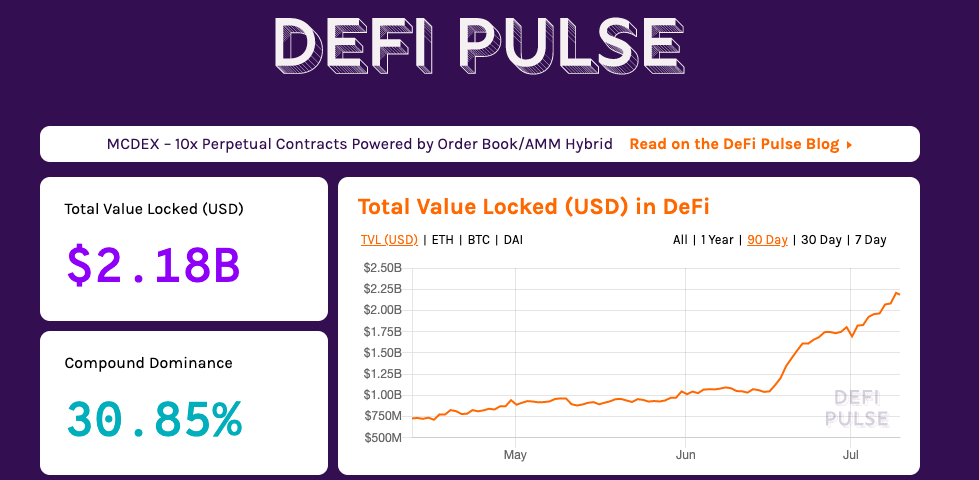

2.) Defipulse.com

Defipulse.com presents you with various statistics and analytics like the total value of money in de-fi and many more. Along with this they also act as an aggregator for various de-fi projects like defiprime.com. I suggest following both the website and not substituting one for another. Defipulse describes itself as-

DeFi Pulse is a site where you can find the latest analytics and rankings of Defi protocols. Our rankings track the total value locked into the smart contracts of popular Defi applications and protocols. Additionally, we curate The Defi List, a collection of the best resources in Defi.

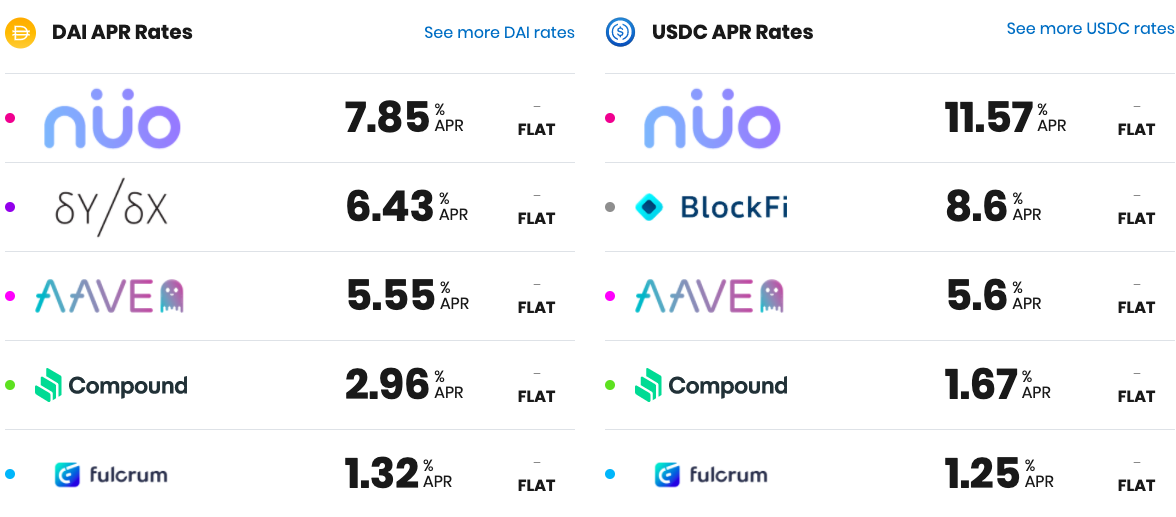

3.) Defirate.com

As the name suggests this website aggregates all the de-fi platforms and arranges them according to the interest rates you receive on lending or borrowing assets on them.

This is my favorite among the ones listed here since it provides every bit of info that one needs. You can go and check the overview of each and every platform listed on defirate.com along with a basic guide on how to provide liquidity or lend and borrow assets along with the interest rates on each asset.

You can go and check various menus like Learn, which provides a guide on how to provide liquidity and maximize your governance tokens (yield farming).

This is my opinion that defirate.com is one of the most comprehensive De-Fi resources on the market as of now.

4.) Predictions.exchange

This one is very underrated. They describe themselves as-

http://Predictions.Exchange is an explorer for open financial markets & liquidity mining tools provider.

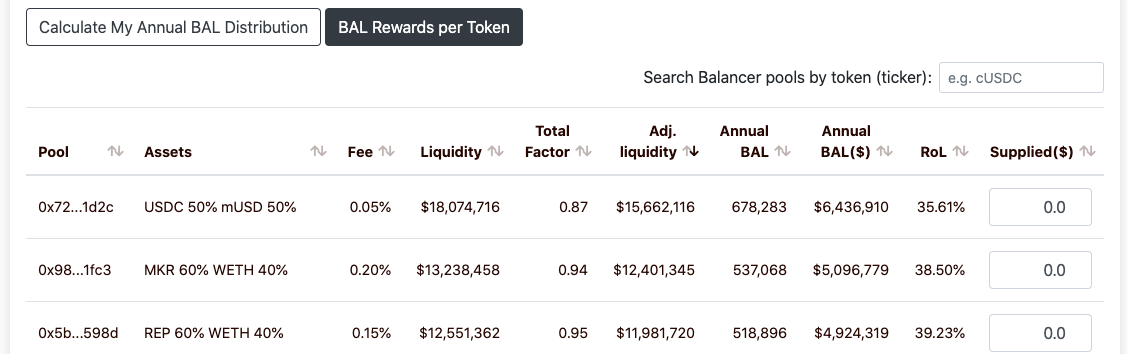

It is an explorer which aggregates all the predictions from prediction platforms. Currently from Omen.eth.link with support for Augur V2 when it launches. But this is not why I recommend this website. The most important use case of this website for me is that it calculates the interests you can earn from various de-fi platforms. It is known that all the de-fi platforms have their own ecosystem which is quite hard to navigate. There are several terms and options that one needs to understand. This also includes how much governance token you will earn by providing liquidity. To solve this issue predictions.exchange has a built-in section where you can calculate how much BAL or COMP you will earn by providing a fixed amount of asset. It will also let you know which pool will earn you the maximum returns.

Just enter the amount you will be supplying and you will know the amount of BAL or COMP earned. Currently, Compound and Balancer are supported with future updates for Curve planned as well.

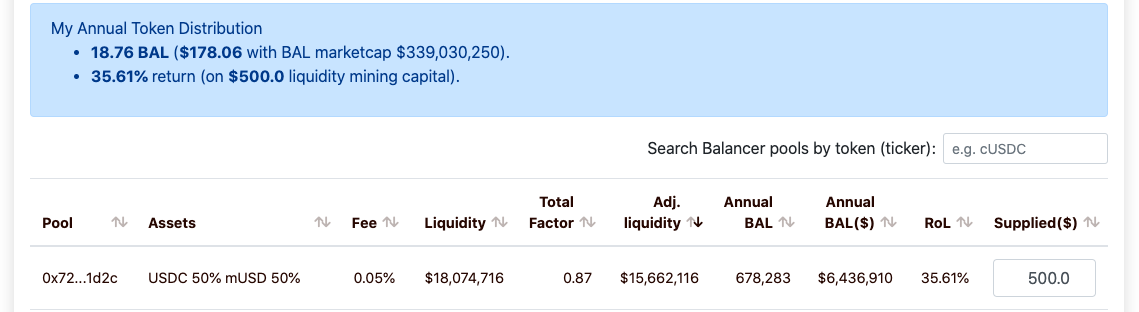

If I supply 500 USD to the USDC/mUSD pool below are the returns on the Balancer platform.

A whopping 19 BAL (178 USD) that equates to 35% returns on 500 USD.

These are the resources that I use constantly to keep up with the De-Fi world. Hope they help you as well.

Source-Defiprime

Source-Defirate

Source-Defipulse

Source-Predictions

The website Defiprime is useful to discover DeFi solutions.

Congratulations @nobean! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: