Ever since the craze of yield-farming has started I have been tinkering with various Defi Dapps. Since the native ecosystem of Balancer, Curve, Compound, Uniswap, Ampleforth Geyser is a little bit tricky to navigate, several Dapps are coming to the market promising to manage your De-Fi portfolio, optimize it and to provide maximum yield-farming gains.

Zapper is one such Dapp that provides you a platform to easily navigate and understand the De-Fi portals and invest in them. And if you are already invested in De-Fi you can still manage your existing portfolio with Zapper.

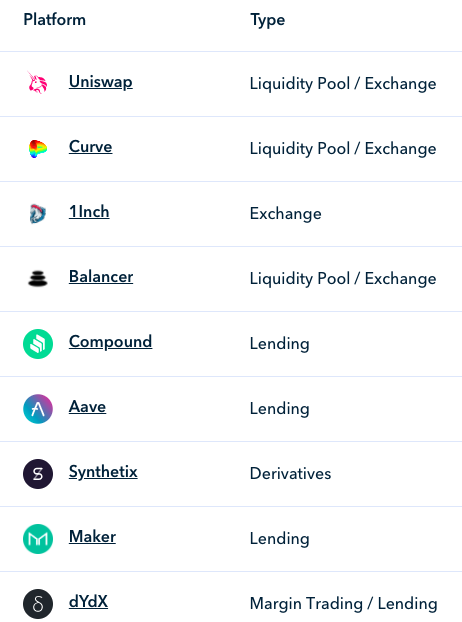

Below are some of the supported platforms.

All the major wallets like Metamask, Argent, Trust, Atomic Wallet are compatible with Zapper.

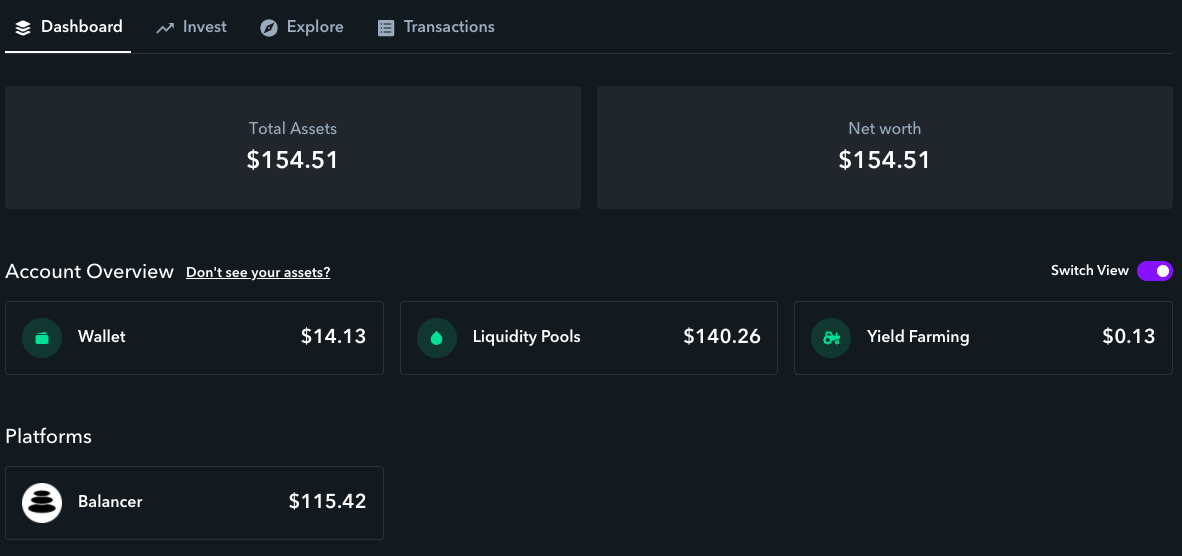

For the sake of convenience, let's say you are using Metamask Wallet. Just click connect wallet on the website and provide authority to Zapper to connect to your Wallet address. I put in around 150 USD to start. You can look at the dashboard below.

- I have 14 USD in the wallet as ETH mainly to cover GAS (which is insanely high that's why I recommend argent as they cover the gas on their own).

- I have 115 USD in the Balancer Liquidity Pool. You can click on the respective fields to know more details about them.

- I have received $0.13 from yield-farming AMPLE via Geyser/Uniswap combo

Click on Invest to explore investment options.

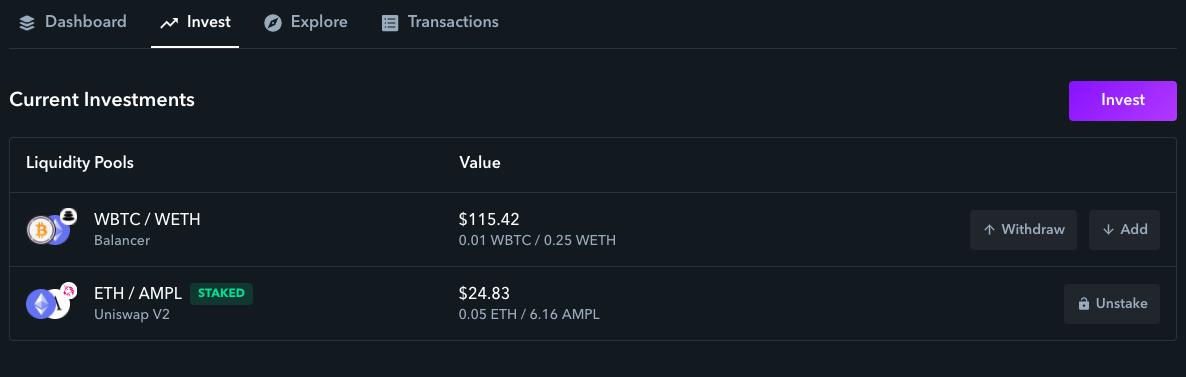

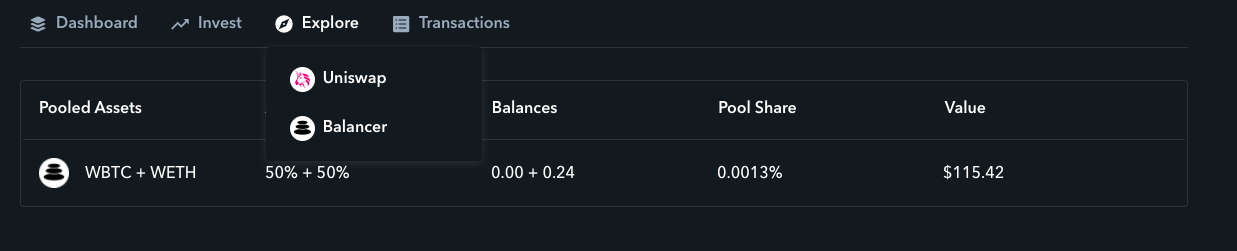

This page lists all the pools where you are a liquidity provider as well as various other pools where you can invest.

If you wish to invest in a pool you can do so via Zapper instead of going via native platforms which can be a bit tricky. You can withdraw and unstake your tokens as well via Zapper.

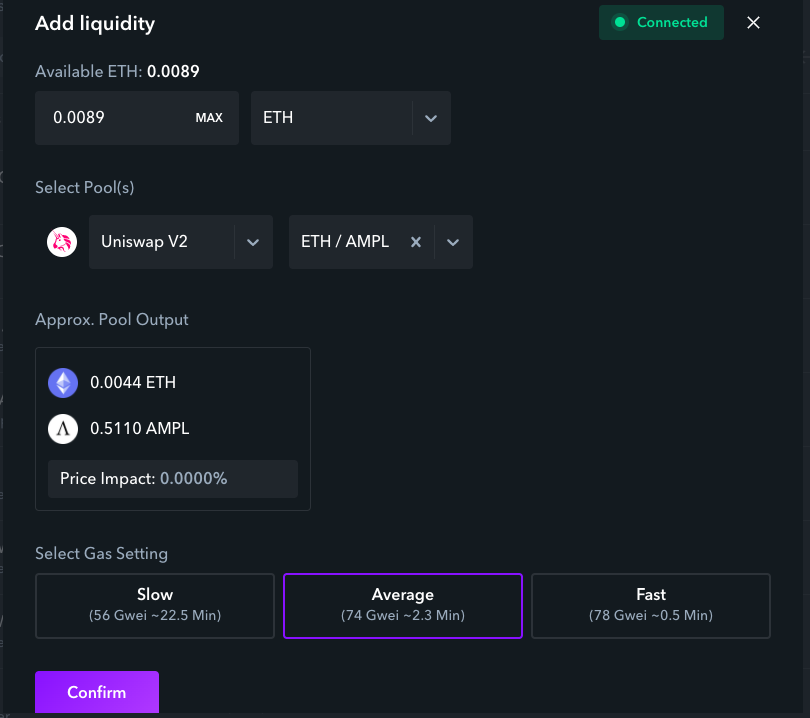

I clicked the ETH/AMPLE pool to invest. On clicking, you get the above image. Specify how much ETH you wish to provide and it divides that 50-50 into ETH/AMPLE. Note that Uniswap is the platform here. Specify your GAS and click confirm and then approve via Metamask. That's it. Your screen will reflect the same in some time. Now you are an LP in Uniswap ETH/AMPLE pool. This will provide you with a different kind of token which is denoted as UNI-V2 in your Metamask Wallet. Remember to stake these tokens into the Geyser platform to earn interest via the Ampleforth platform. Geyser is a way introduced by Ampleforth itself to reward users providing liquidity on the Uniswap platform.

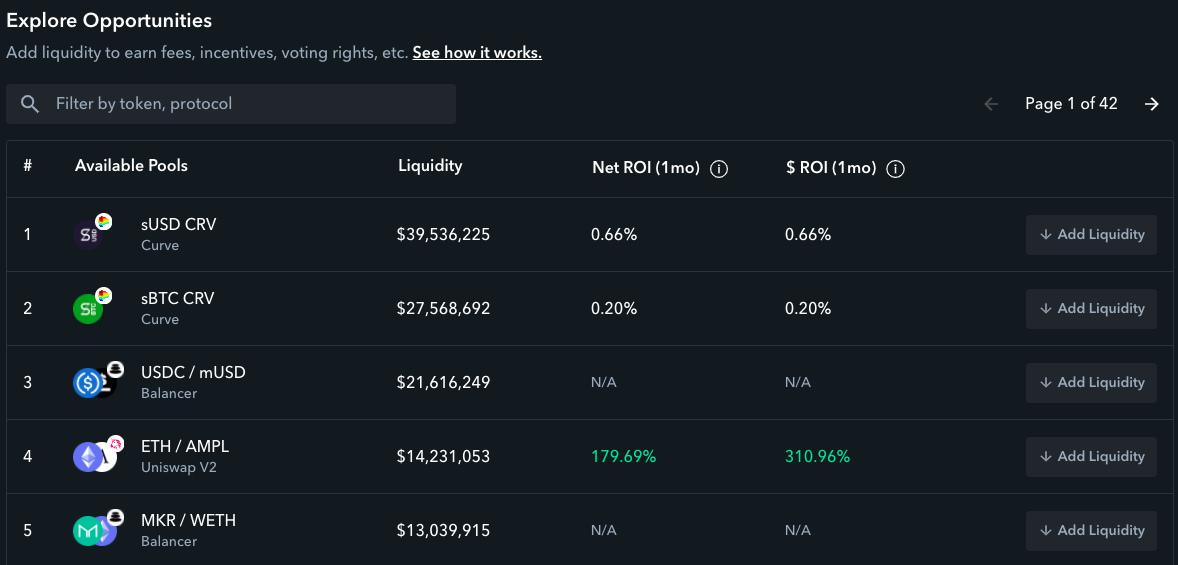

Clicking on explore lists all the various platforms where you are currently invested. Click on any to see more details about your De-Fi investments. Refer to the above image for information.

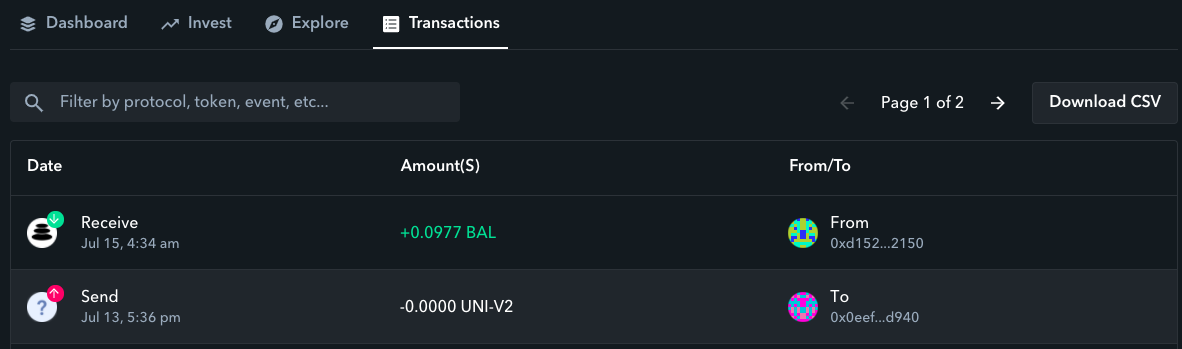

You can check all your transactions made by the address. In the above image, you can see I have received 0.00977 BAL as a reward for providing liquidity on the balancer platform.

That covers almost all the functions of Zapper. I am also trying other platforms like Argent which has its own mobile wallet to directly manage your de-fi portfolio. I am playing with Instadapp as well which is again a De-Fi portfolio manager.

Congratulations @nobean! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: