In 2017, JPMorgan CEO Jamie Dimon called Bitcoin a 'fraud' and threatened to fire all employees who were trading it. Yesterday JPMorgan added two bitcoin exchanges – Coinbase and Gemini as their corporate banking customers. They would help these two exchanges to manage the cash in the US. It is good news for the crypto industry. Let’s come back to the title topic of the post. The third bitcoin halving happened on 11th May, 2020. I got calls from some of my friends. They wanted to understand the halving thing! No, one bitcoin didn’t become ½ bitcoin. Bitcoin block mining reward got reduced from 12.5 BTC to 6.25 BTC. This was the third bitcoin halving in the history and it took place at the block height of 630,000. The first halving happened on 29th November, 2012 and the second halving took place on 10th July, 2016. Generally halving schedule is 4 years. In every halving event, bitcoin’s inflation or supply rate gets reduced. After the latest halving, bitcoin’s inflation drops from the previous rate of 3.6% to 1.7%. Okay cool! 1.7% is quite low. Bitcoin’s inflation rate is almost comparable to gold’s inflation now. But what happens to the miners?

Here is the case study – Miners start dumping Bitcoin

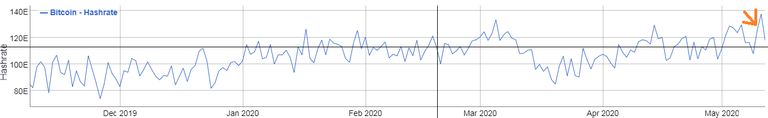

Bitcoin mining consumes high electricity. Many organizations and individuals are involved in mining. After Bitcoin halving, the price didn’t increase so much and their mining reward got halved. So, obviously their profitability gets reduced post halving. In such a scenario, the miners may start dumping their bitcoin rather than hodling. If you look at the below chart, you can see that the hash rate has dropped a bit although this drop isn’t unexpected.

Bitcoin hash rate of last 6 months from bitinfocharts

Dropping hash rate means that there are fewer miners now. Some have left mining and some have reduced mining rate. It may be a temporary incident as big mining organizations work with a long term strategy. But if all these miners start to sell bitcoin at a massive rate due to low profitability, the price of bitcoin will come under pressure and it’ll fall. A short-term miner capitulation may occur and it happened previously also. ‘Bitcoin death spiral’ is a theoretical incident when the hash rate becomes zero.

Imagine a situation:

• Almost 99% miners leave mining job due to low profitability

• They start heavy dumping

• Bitcoin price falls heavily

• Hash rate becomes almost zero– ‘Death Spiral’

• Next what?

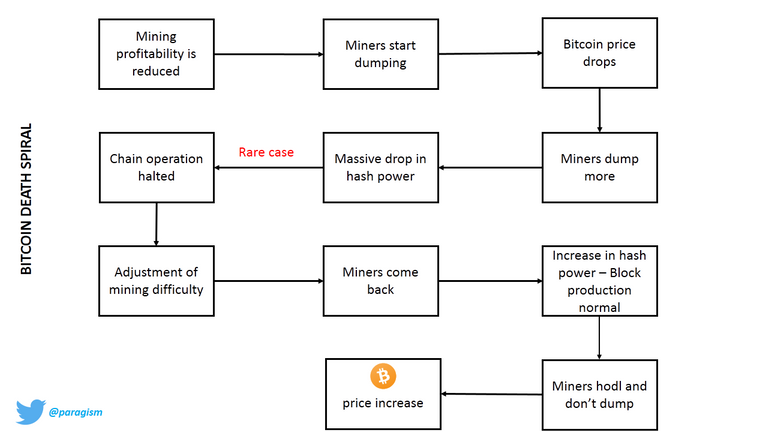

Bitcoin’s mining difficulty has been designed to adjust every 2016 blocks (approximately every two weeks). This adjustment happens as per the network’s hash rate and it keeps on changing. When hash rate comes down, the mining difficulty gets reduced too and it helps to solve new blocks easily. The miners come back again to mine blocks as it becomes easy for them to mine new blocks. The mining profitability increases although the inflation doesn’t change. More miners start mining blocks and the network hash rate increases. As mining becomes profitable due to less difficulty of mining, dumping doesn’t happen and bitcoin price increases due to simple demand-supply economics.

A diagrammatic representation of the situation made by me

The European Union introduced negative interest rates in 2014. Trump wants to bring negative interest rates to the US now. That means you need to pay banks to store your money. To be more precise, it is taxation on people’s savings. US dollar is heading towards a massive value erosion and banking system is becoming a joke. Satoshi Nakamoto wanted to fix this with his programmed money. He didn’t create Bitcoin as a digital useless asset. He envisioned bitcoin as ‘a peer-to-peer electronic cash system’. While creating a transparent & censorship-resistant monetary system, he took care of the economics of bitcoin too. Bitcoin’s price recovery mechanism is also inscribed into bitcoin! Sound money!

Note: The images (if not cited) are created by the author using free vectors.

If they stop mining then the number of bitcoins out there don't get inflated as fast and the price stabilizes or goes up.

You are right

#posh

Congratulations @paragism! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Thank you for explaining that. If I keep read posts like yours , maybe I will start understanding crypto.

Many thanks. Crypto writing needs to suit the mango man's understanding for mass adoption. Glad to learn that you found it interesting.

Very interesting article even if it is quite scary when one think about it.

If miners begin to dump and we start this death spiral, is there any mechanism that could prevent us from going to 0$?

Thanks in advance for your answer.

Sincerely,

@vlemon

The mechanism is only mining difficulty adjustment. The rest is economics. It is an imaginary situation but on paper it may occur. The bitcoin network is designed to handle such situation by the law of economics with help of technology.

So if more miners quit, difficulty will lower and then they will need less power to mine every bitcoin making it at some point profitable ?

Did I get this right ?

Yes..right

Yes.. "lesser power"because less time will be needed to solve a block due to complexity reduction. Less time=less electric power.

Wow so it means there will be a 0.1% chance of mining bitcoin with my CPU lol, that will be interesting, but will never happen.

Worse case that can ever be is mining gets less profitable till it gets profitable again, satoshi is a smart ass...

Your explanation was super cool, now I know this.... Maybe you can explain Java to me as well because Im just not getting it😣😔

***@paragism also consider that if miners were to sell off fast their transactions as well as the buys would create a lot of blocks to alive and thus boosting the underlying workout for other miners and thus although the workload escalates the miners themselves aren't breaking a sweat and one may be quick to say, "Yeah @skillz but power consumption would rise and offset their profit!". Nope not really, I won't bore you with the analytics but most miners machines are working 24/7 OCed and revving and regardless of the workload power consumption is pretty stable, in fact miners rely on it to do so...so if miners bailed, those left would pick up their workload and rewards, transactions may take longer but somewhere a miner that was willing to "hodl" out is getting paid. 😎 **

The whole argument is based on the death spiral of bitcoin. It is an imaginary situation when hash power becomes zero due to low profitability of the miners.

There are a lot of other factors which influence price.

Understood...however that's a very improbable possiblity. I was simply making a point that halving isn't going to negatively affect bitcoin's value long term and as such, to proclaim Bitcoin to be in a "death spiral" is imaginary indeed 😋.

Death spiral in POW is a theoretical established concept. I am not saying whether halving will lead to price drop or not. The cited incidence is obviously imaginary.

👍 ... Sorry I didn't mean to sound argumentative, I enjoy all your blogs and love all here in the HIVE community. I really hope to see HIVE prosper as well as BTC, not just because I'm vested in both but the members on the STEEM and now HIVE block chain are really great ppl and we all strive to build each other up and that's hard to find these days. Thanks man for great blogs and positive replies. 😇 #HIVEON

Great write up @paragism. At first, I was worried for the price to fall. Halving affects a lot to miners. But then when I read this post, gives a me a better understanding. Amazing!

Many thanks. Price still may fall as it is function of many things. I just explained an imaginary scenario.

Good to know that.

Many thanks :)

If they do that, the miners with the least efficient machines will be forced to stop their operations and the rest of the miners will kick off a new bull run, after taking those guys out of the game.

Due to one of these reasons:

1. Post is not published with Esteem apps.

2. Post is already curated by Esteem team.

3. Post is not curated by our curators within 24 hours.

4. Post might be too old post, try more recent content.

5. Author already received vote in last few hours, try again later.

ESTM Boosting refund to @paragism! Install Android: https://android.esteem.app, iOS: https://ios.esteem.app mobile app or desktop app for Windows, Mac, Linux: https://desktop.esteem.appLearn more: https://esteem.app Join our discord: https://discord.me/esteem

I certainly hope your scenario never happens. There is too much going on with crypto right now. Blockchains are gain momentum in areas where they were never seen before. I want it to continue.

Tnx for noticing an old post. It is hypothetical situation only and it may not happen ever.

I certainly hope your scenario never happens. There is too much going on with crypto right now. Blockchains are gain momentum in areas where they were never seen before. I want it to continue.