Hello Hivers and HODLers,

This was a news in my Daily Morning Article, I am really looking at it as it is a BIG indicator for the overall economy's health.

People not paying their mortgages show that they are having financial issues and therefore

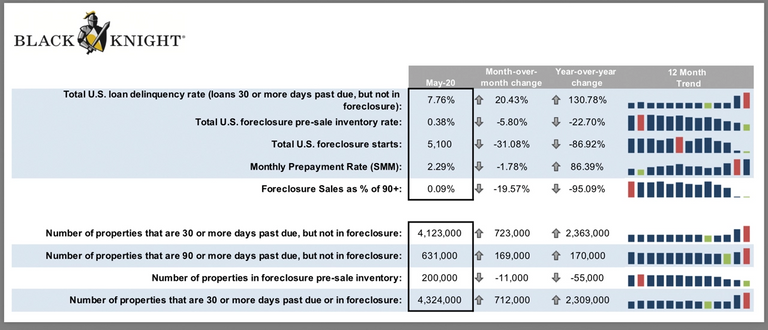

“Another 723,000 homeowners became past due on their mortgages in May, pushing the national delinquency rate to its highest level in 8.5 years,” says Black Knight data

This is still manageable and we need to see June's numbers which are the "real ones" in my opinion. They will show if people are getting hired-back and more optimistic about their future.

I have ALWAYS linked CryptoMarkets to Financial Markets and they seem to go hand by hand lately.

Therefore, Credit defaults, Frauds (such as Wirecard), COVID19 Trends and Consumer Confidence are indicators that I am looking at.

Another metric to look at is: existing-home sales

The National Association of Realtors explained on Monday that “existing-home sales occurred at a seasonally adjusted annual pace of 3.91 million,” which is the lowest in over a decade. Sales that stem from pre-owned houses dipped by 9.7% in May.

Therefore, I remain in my Wait & See Mood and will take a decision by week-end whether to go long again, neutral or even short.

Stay safe and Take care.

Sources:

- https://news.bitcoin.com/us-real-estate-market-crisis-4-3-million-mortgage-delinquencies-commercial-properties-sink-in-value/

- https://www.blackknightinc.com/

➡️ Publish0x

➡️ UpTrennd

➡️ Minds

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

Proud member of:

Helps us by delegating to @hodlcommunity

Make a good APR Curation by following our HIVE trail here

I agree on this one:

JUNE numbers are really important, if you could share it with us it will be appreciated! 😉

I will try to if I see them around 😉

It is the perception of minds. If majority thinks that our currency is going down, the only way to survive is to invest in digital currency like Bitcoin, it can go up. Too many factors are involved that make it hard to predict or analyse the market.

!tip

Indeed for emerging economies or less "stable currencies" but you would see outflows from US based customers or Europeans / Japanese as they would need to prepare for a recession.

So there is some positive for BTC and some negative. Hard to know which way will be leading BTC price

I am doubtful too. I so want to trade and then the market is volatile + affected economies. I am in a observations mode. I see the charts and try to predict, see the positive position then close the chart. I think sometimes the best trade is not to trade.

Thanks for such a deep insight!

This is important news, I like to follow your blog

🎁 Hi @vlemon! You have received 0.1 HIVE tip from @dolphin-assemble!

Sending tips with @tipU - how to guide.