Understanding the Current Crypto Market and Exploring Passive Income Opportunities

The cryptocurrency market, as we know, has been experiencing significant fluctuations in recent times. From periods of stagnation to sudden price spikes, we have seen trends shift rapidly, sometimes changing within hours or over the course of a few days. This kind of volatility is a defining characteristic of the crypto space. However, for investors, it also presents an opportunity to make well-timed decisions. Knowing when to step back from the market is just as important as knowing when to enter, especially when sentiment and market movement can flip so quickly.

Key Factors Impacting the Market

Several factors can influence the market's mood and volatility:

The New Year and Holiday Seasons (e.g., Christmas): These periods often bring lower trading volumes and can lead to unpredictable market behavior.

U.S. Presidential Elections: Political events, especially in the U.S., have historically impacted investor sentiment, often causing uncertainty.

MiCA Regulations: The introduction of the European Union's MiCA (Markets in Crypto-Assets) regulations could bring greater clarity and influence market dynamics.

USDT Stability: Tether (USDT) plays a significant role in the market’s liquidity. Any potential concerns or changes surrounding its peg to the U.S. dollar could have a widespread impact on the market.

The Rise of Memecoins and "Shitcoins"

In addition to these factors, we are seeing a new wave of projects emerge seemingly overnight. Memecoins, in particular, are gaining traction and making headlines due to their widespread hype. Yet, these coins often follow a typical pattern: significant pumps driven by social media and community buzz, followed by rapid dumps once the initial excitement fades. Unfortunately, most retail investors get caught in these cycles, with only a few benefiting from the pump-and-dump schemes.

Despite the overwhelming hype surrounding these projects, it’s essential to remember that the majority of these coins do not offer sustainable value. So, if you are considering entering these markets, tread cautiously.

Exploring Risk-Free Investment Opportunities

While the volatility of the crypto market presents challenges, there are still opportunities for risk-averse investors. One option is to explore passive income strategies, which many crypto exchanges now offer through various "Earn" products. These passive income models can provide stable returns without exposure to the extreme risk of daily market fluctuations.

Launchpools and Staking: A Risk-Free Approach

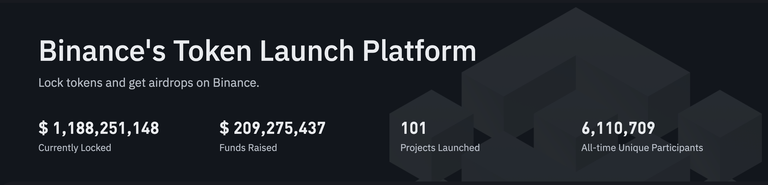

One such passive income strategy involves staking assets in Launchpools or similar programs like PoolX, LaunchX, or Launchpads (though some Launchpads may no longer be available in certain regions due to regulatory changes). These products allow users to lock their assets for a limited time in exchange for new tokens, which can later be traded or converted once the project is listed on an exchange.

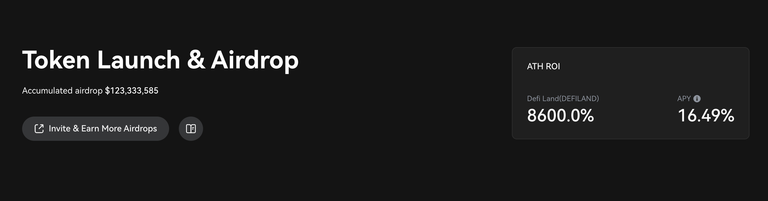

The key benefit of these platforms is that the amount staked remains untouchable throughout the earning period. The tokens you receive as rewards are separate from your initial stake. This is a crucial point: you are not purchasing or trading your staked tokens. This makes the investment risk-free, as you are not exposing your principal amount to market fluctuations.

Expanding the Staking Strategy

The great thing about these platforms is that some tokens are added to Launchpools across multiple exchanges. If you're willing to move your funds around between different platforms, you can extend your staking period and potentially maximize your rewards. In many cases, the more platforms you participate in, the longer your funds can remain staked, compounding your earnings.

By participating in these programs, you stay active in the crypto space while minimizing risk. Moreover, if you have the time and patience to do in-depth research, you might even decide to hold onto some of these earned tokens rather than selling them immediately after listing. Many tokens have seen significant gains post-launch, and by holding, you could multiply your earnings in the long run.

Types of Tokens for Staking

A variety of tokens can be used for staking on these platforms. Some common examples include:

Exchange-native tokens (e.g., Binance Coin (BNB), KuCoin Shares, Bitget Coin (BGB), ByBit Coin (MNT) etc)

Stablecoins (e.g., USDT, USDC)

Major cryptocurrencies (e.g., Bitcoin, Ethereum)

Presale tokens (tokens purchased before a project's public launch)

The Value of Consistency

Staying active in the crypto space doesn't always mean engaging in high-risk trading or speculating on volatile assets. By utilizing passive income opportunities such as staking and Launchpools, you can build a consistent strategy without the constant need to monitor price movements. This approach allows for gradual accumulation of assets while minimizing the risks associated with more speculative investments.

While the longevity of these opportunities is uncertain, they provide a valuable way to stay engaged in the crypto space without taking unnecessary risks. If you're not ready to dive into high-risk trades, or if you're looking to balance your portfolio with less volatility, these Earn products could serve as a gateway into the world of crypto investing.

Final Thoughts

In conclusion, the crypto market is a dynamic space full of ups and downs. Whether you’re interested in taking part in high-risk, high-reward ventures like meme coins or prefer the safer route of passive income opportunities, it’s essential to understand the risks and rewards of each strategy. Earn products like Launchpools and staking platforms offer a solid, risk-free alternative for those looking to remain active in the crypto space while minimizing exposure to extreme volatility.

If you’re looking to explore crypto investments without taking on too much risk, now might be the perfect time to start experimenting with these products. The crypto world is evolving quickly, and those who can adapt to the changing environment might find unique opportunities for profit.

Posted Using InLeo Alpha