The decentralized Hive fund plays a major role in the Hive ecosystem. It is the backbone for the development and funding of the platform. A tool that provides a self-funding mechanism for the chain! Since the creation of the Hive chain its role has increased massively since there is no centralized entity that will keep developing. The community members are the ones making the development and the DHF is providing the funds.

The DHF has close to 23M HBD now. It holds a lot of HIVE as well but those are not available for use. Since the creation of the Hive blockchain in March 2020, the funds under management in the DHF have grown from under 1M HBD to 23M HBD at this moment.

Let’s take a look at the data.

The account that holds the DHF funds is the @hive.fund. Only 1% of the HBD holdings in this account are available for daily payouts and funding. At the moment this budget is around 220k HBD per day. Projects can create proposals for funding and if they are voted out from the community, they will start receiving funds.

There is only one way funds can exit this account and that is for proposal who have been voted from the community to get the funds.

When it comes to funding the DHF, or how funds are added to the DHF there is more than one way.

Funds added to the DHF:

- 10% share of the inflation

- Ninja mined HIVE conversions to HBD

- @hbdstabilizer

- HBD and HIVE transfers to the DHF

- DHF as posts beneficiary

The core source of funding for the DHF is the inflation.

In recent history a few more significant sources for funding were added. The most significant would be the HIVE that was transferred from Steemit Inc and co to the DHF. At the time of the fork in March 2020, there was more than 83M HIVE put in the DHF. In October 2020, this HIVE was put in a slow conversion mode with 0.05% of it being converted to HBD daily, that will continue for multiple years. This is to avoid price shocks. At the moment, we are more than half way through these conversions as there is 39M HIVE in the DHF now.

Another significant source of funds are the transfers to the DHF that are made by the @hbdstabilizer.

This account is receiving fundings for the purpose of stabilizing the HBD. It trades HBD or HIVE on the internal market to maintain the peg and then it sends the funds back to the DHF. Depending on the price of the HBD it sends back HBD or HIVE. When HIVE is sent to the DHF it is instantly converted to HBD at the feed price, making these funds available for use. The stabilizer sends and receives funds, but overall, it has been a net positive. It also acts as post beneficiary for the DHF.

Let’s check the charts.

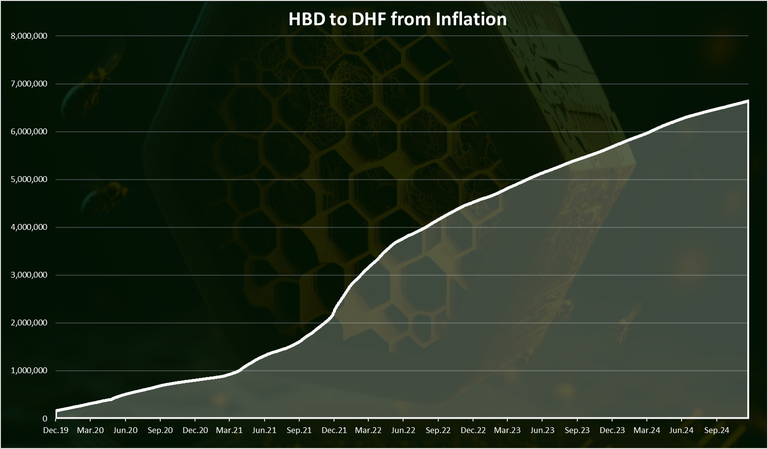

Funds from Inflation

As mentioned, 10% of the inflation goes to the DHF. Here is the chart.

The amount of HBD added in this way is correlated with the HIVE price. 10% in HBD is not the same when HIVE is 2$ or when it is 10 cents.

A total of 6.6M HBD was added in the DHF from the regular inflation. In 2024 alone there is around 0.8M HBD added in from the DHF from inflation.

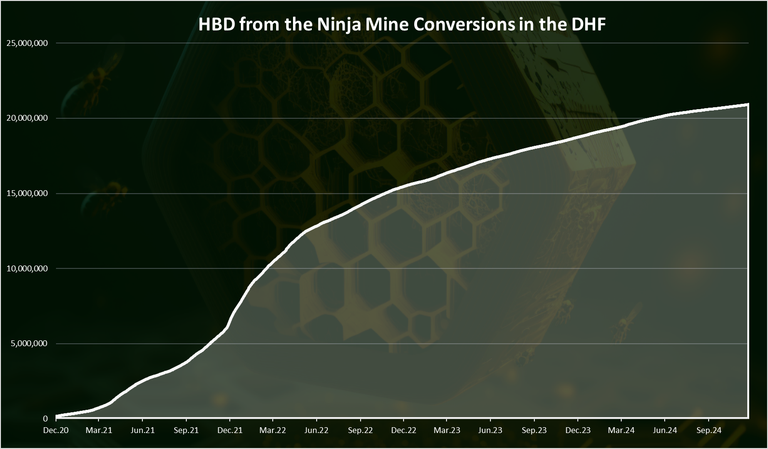

Funds from the Ninja Mined HIVE Conversions in the DHF

Here is the chart for the HBD added in this way.

This type of funding started at the end of October 2020. This is when the HF happened that enabled this. These conversions are also heavily dependent on the HIVE price.

A total of 21M HBD was added in the DHF from this source. In 2024 this number is at 2M.

This type of funds will slow down going forward as the amount of daily HIVE converted to HBD is going down. When the conversions started there was around 44k HIVE daily converted and now we are at 19k HIVE daily converted to HBD from the ninja mine. Meaning more than half from the start.

Another significant factor is the price of HIVE. Nevertheless, these funds are limited, and after a few years they will drop significantly.

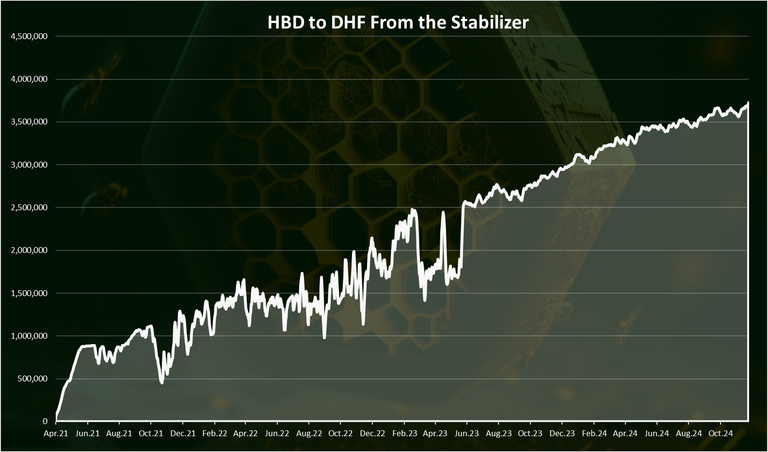

HBD Added to the DHF from the @hbdstabilizer

Here is the chart for the net HBD added in the DHF from the @hbdstabilizer.

As mentioned, the stabilizer receives HBD from the DHF, for the purpose of stabilizing the HBD peg.

If the HBD price is higher than 1$ then it will sell the HBD on the internal market. If the HBD price is lower than the peg, it will convert the HBD to HIVE and then buy HBD on the internal market.

If the price is at the peg, it will simply return the funds. It sends back funds to the DHF both, in HBD and HIVE. The HIVE that is sent back to the DHF is instantly converted to HBD in the DHF to be available for usage.

The chart above shows the net HBD added in the DHF from the stabilizer. A total of 3.7M HBD is added in this way in the DHF.

We can notice there has been some volatility in the year, with funds going up and down but in the long run they keep on growing.

When there are spikes in the HBD price, it usually marks a period when more HBD is added in the DHF, and when there are drops in the HBD price, the stabilizer is using more funds and is taking funds out of the DHF.

Note that the stabilizer also receives funds from posts payouts as beneficiary and this has been a significant amount lately since a lot of the top stakeholders allocate there votes there.

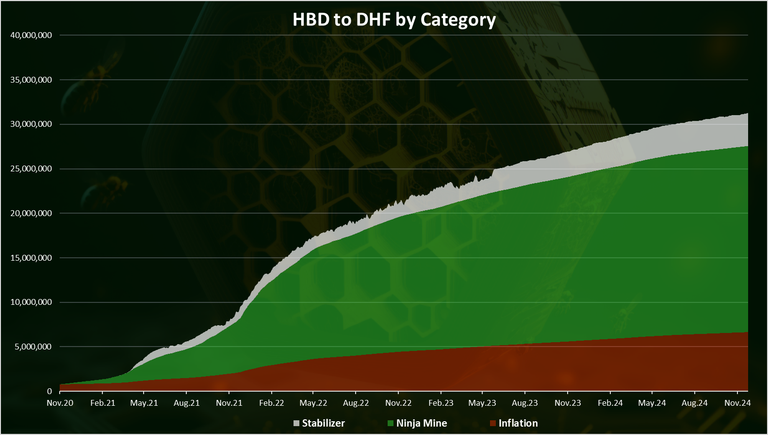

Cumulative HBD Added to the DHF

If we combine all the above, we get this.

From the chart above we can notice that the conversions from the ninja mined HIVE in the DHF are the main way for adding funds in the DHF.

A total of 21M HBD or 67% of all the funds in the DHF has been added in this way. The regular inflation is in the second spot with 6.6M (21%), and then the stabilizer with 3.7M (12%).

Payouts from the DHF

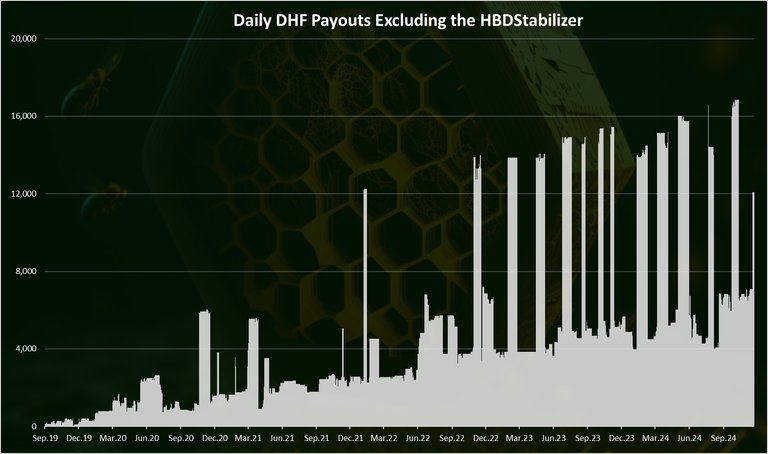

As mentioned, this is the only way HBD leaves the DHF. Here is the chart.

The chart above excludes the payouts to the @hbdstabilizer.

We can notice a few spikes in the payouts, usually when some project with heavy funding in a short period of time, like the valueplan.

On average in the last period around 8k HBD has been paid daily to DHF workers. The spikes that we can see on the chart are usually when the @valueplan account has proposal. This account manages a multiple activities under its umbrella.

On a yearly basis the total payouts look like this:

| Year | HBD |

|---|---|

| 2019 | 30,880 |

| 2020 | 616,784 |

| 2021 | 888,701 |

| 2022 | 1,775,947 |

| 2023 | 2,737,887 |

| 2024 | 3,049,709 |

Note than 2024 is not over yet.

The funding to projects has reached an ATH in 2024 with more than 3M HBD allocated. This might seem a lot, but it is still a small number when compared to some other projects that have much larger development and marketing budgets. On the other hand the market cap of HIVE has been struggling as well so not sure does this development funding is in line with the size of the chain.

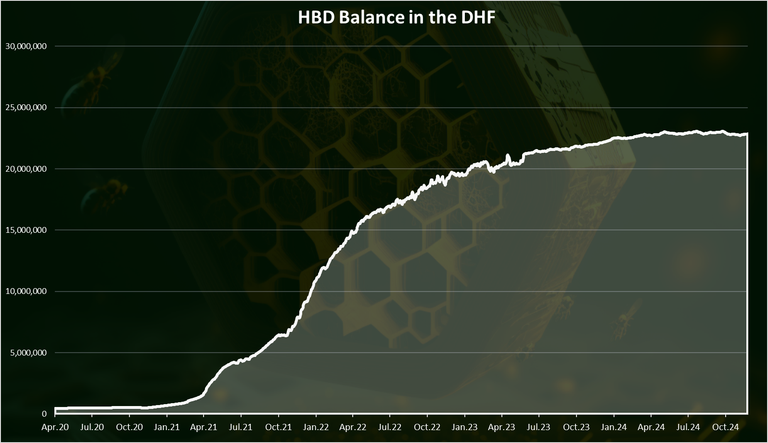

HBD Balance in the DHF

Here is the chart.

When we add the funds added and removed form the DHF we get the chart above.

Close to 23M HBD in the DHF now.

We can see the sharp growth in the funds back in 2021 and 2022. This is mostly because of the ninja mine HIVE to HBD conversions in the DHF and the high HIVE prices at the time.

In 2023 and 2024 this growth has slowed down as HIVE prices have dropped and payouts increased.

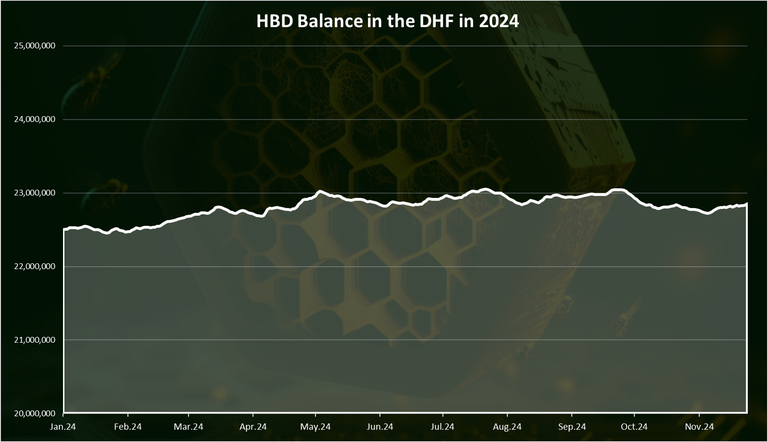

When we zoom in 2024 we get this:

Somewhat stable situation with the HBD in the DHF in 2024. Meaning the net inflow and outflow has been almost balanced. Although we can notice that at the beginning of the year there was a small increase in the funds and in the last months there is a slight decrease in the funds.

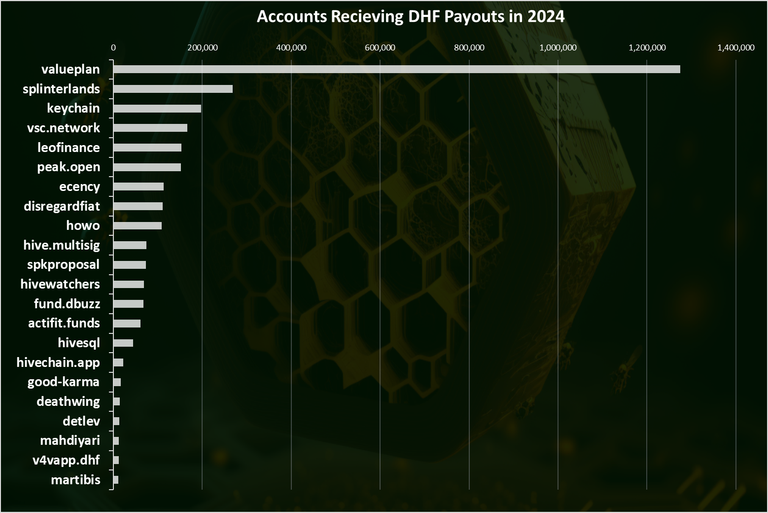

Accounts Receiving Funding from the DHF in 2024

A total of 27 accounts received funding from the DHF.

Here is the chart, excluding the stabilizer.

The @valueplan is on the top for the first half of 2024 with 1.3M HBD, followed by @splinterlands and @keychain.

Other known projects in the top as @peakd, @leofinance, @vsc.network etc.

From the beginning of the chain, back in March 2020, more than 50 accounts received some form of funding.

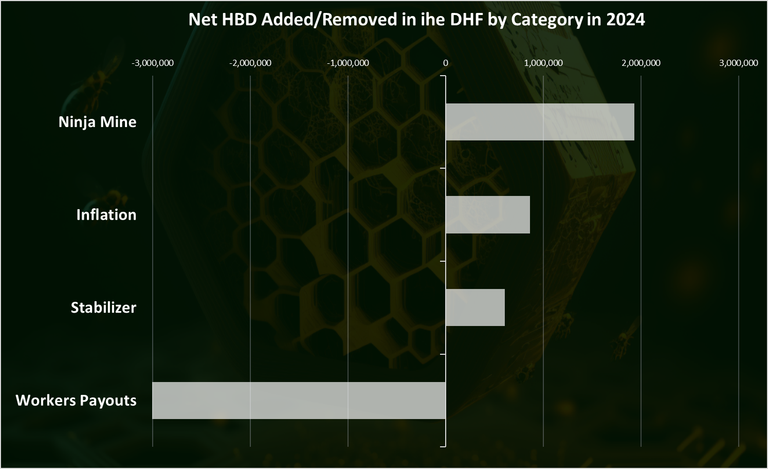

Summary for HBD Added and Removed in the DHF by Category in 2024

Here is the chart.

The Ninja mine conversions are on the top with close to 2M, the regular inflation is on the second spot with 860k, and next is the stabilizer with 600k HBD added to the DHF in 2024.

The payouts to DHF workers are at 3M and are negative on the chart. A net 350k HBD was added in the DHF in 2024.

All the best

@dalz

Defund the DHF or Defund Valueplan already. Blows my mind the amount of wastefulness and how like one account has so much voting power cough blocktrades that whatever they vote on gets passed. Totally centralized money grabbing system Hive has turned into. Anything decentralized about hive is gone.

IMO in 2024 we have defenetly overspent, the regular DHF inflation is close to 1M and we have spent more than 3M.

Which projects are justified is an never ending debate and at the end of the day we have this PoS voting mechanics and the desions was made. It obviosly isnt perfect and left a lot of small stakeholders not happy.

Its the ninja mined funds that are causing this discrepancy in the spending, and IMO it would be wise if we put some of those funds in a slow burning mode in the next HF.

Blocktrades doesn't have enough voting power to pass anything unless there are about 10 million additional concurring votes. That's not an insignificant number in my view, but if you think it's too low, add votes to return. I recently did so which improved the balance somewhat.

Not alone but in a vast amount of the things they do vote for they hold over 50% of the vote. Which would mean without that vote most of those things would fail. AKA valueplan. They effetely eat up over half of the return proposal which is kind of a stop gap for the limitation of how the DHF works. Sure I could go buy million more of Hive and cast my vote but with how over spending the DHF has become and how the few on top just gobble up hoards of new hive it's more and more impossible to even try to keep up with it. It's becoming more and more centralized with every passing day.

I just looked through the proposals and there are several passing proposals with no blocktrades vote. I didn't count but it seemed like close to half.

DHF payouts are rising rapidly. We need to cut some spending soon if we go on like this

I guess the fork from Steemit has bred positive results. I must say the DHF got a great amount of HBD from Steemit Inc during the fork. I love the way the DHF is being handled to sustain the ecosystem and prevent inflation. Thanks for the stats

Whoever has the most voting power can decide everything. Maybe this is how it should be, but after a while it becomes unfair. Wouldn't it be better if project owners published posts about their projects and those with voting power upvoted the posts? And wouldn't we have the opportunity to understand their projects more closely?

Thanks for all your work to put these reports out!

There is a huge difference in spending during the bear and spending during the bull... If we add on all that declining HIVE market cap, we should maybe revise our spendings and try to be more effective, and more transparent...

Picking this post to give it a bit more exposure as it's important to keep Hivians informed about these things!

I have picked this post on behalf of the @OurPick project! Check out our Reading Suggestions Posts!

Please consider voting for our Liotes HIVE Witness. Thank you!

!PIZZA

$PIZZA slices delivered:

@danzocal(6/10) tipped @dalz

These data shows how far hive is doing. It's going great. Thank you for the information