The @hbdstabilizer started operating in February 2021. In the first months it had quite a low budget and towards the end of 2021 it started to gain some weight. In 2022 the stabilizer was operating at full capacity with a decent amount of funds, that have been constantly growing throughout the year. The bot is operated by @smooth.

For those who are not familiar with the project, the job of the @hbdstabilizer is to keep the HBD peg around the dollar, by trading HIVE and HBD on the internal market. It is a bot that provides liquidity for HBD around the dollar. It does this with funds that are received from the Decentralized Hive Fund DHF.

Recently there was a change in the amount of HBD that the stabilizer is asking from the DHF. The previous proposal expired at the end of May 2023. That proposal was asking for 240k HBD per day. The new proposal now asks for 24k HBD per day. It is 1/10 of the previous budget.

As stated in the proposal, this should provide opportunity for other participants to make their own proposals and create more bots that do similar job, so it is more decentralized. Will be interesting how things evolve with this amount of funds that the stabilizer has. It’s been months since this change, and it seems that the HBD peg is doing just fine.

We have two scenarios/modes of the stabilizer operation.

- Buying HBD

- Selling HBD

HBD is paired on the internal market with HIVE so the trading is in the two native Hive currencies.

1.Buying HBD

When HBD is below the peg then the stabilizer is buying HBD to bring the HBD value to $1. Because, it receives HBD from the DHF, first it converts the HBD to HIVE, and then uses HIVE on the internal market to buy HBD. Buying HBD means selling HIVE.

Selling HBD

If the price of HBD is above the dollar then the stabilizer is selling HBD to bring it back to $1. The stabilizer receives HBD from the, sells it on the internal market for HIVE and sends back the HIVE to the DHF, where it is instantly converted to HBD so it can be used from the DHF.

From the description above we can conclude that the @hbdstabulizer is receiving funds in HBD only, but it is returning funds in HBD and HIVE. To be able to compare the received vs returned funds we will need to convert the HIVE sent to the DHF in HBD.

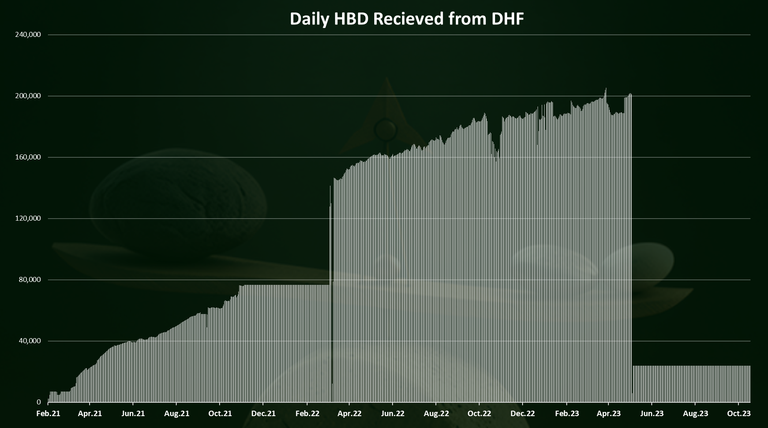

HBD Received from the DHF

As already mentioned the DHF is paying funds only in HBD. Here is the chart for the HBD transferred to the stabilizer.

We can see the low amount that it was receiving at first back in 2021. This was because the DHF didn’t have that much of funds in it yet. As the funds in the DHF grew, so did the funding for the stabilizer. At the peak in April 2023 before the expiration of the previous proposal the stabilizer had a 200k HBD daily budget.

This growth was following the growth of the HBD funds in the DHF, as the stabilizer was asking 240k funds, but the daily budget was lower than that.

Recently the funds that the stabilizer asks had been lowered to 24k per day, as we can see towards the end of the chart.

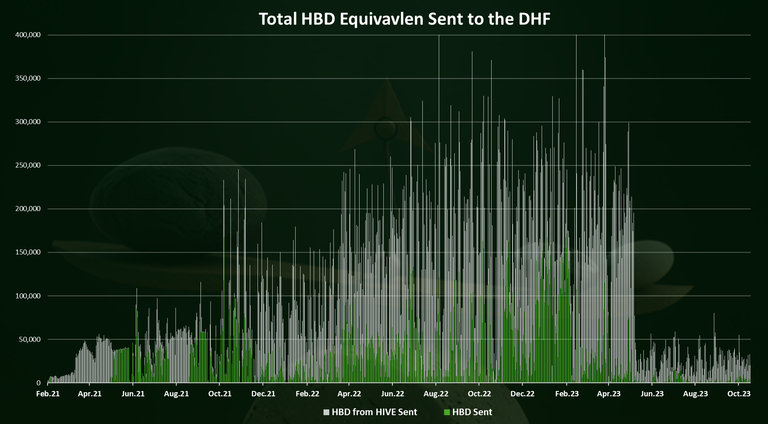

HBD Sent to the DHF

As mentioned above the stabilizer is sending funds to the DHF in form of HIVE and HBD. The HIVE is converted to HBD. Here is the chart.

Note that funds sent to the @hive.fund are in the form of HIVE and HBD. I have converted the HIVE rewards to HBD, for easy representation and comparison.

We can see that the majority of the funds that the stabilizer sends back to the DHF has been in the form of HIVE and then those are instantly converted back to HBD in the DHF. This is understandable as the stabilizer is mostly buying HBD and it needs HIVE to do that. When it doesn’t need the funds it sends them back in the form of HBD.

We can see that for most of the time it had extra funds, and it was sending them back. Just on a few occasions it was using them all.

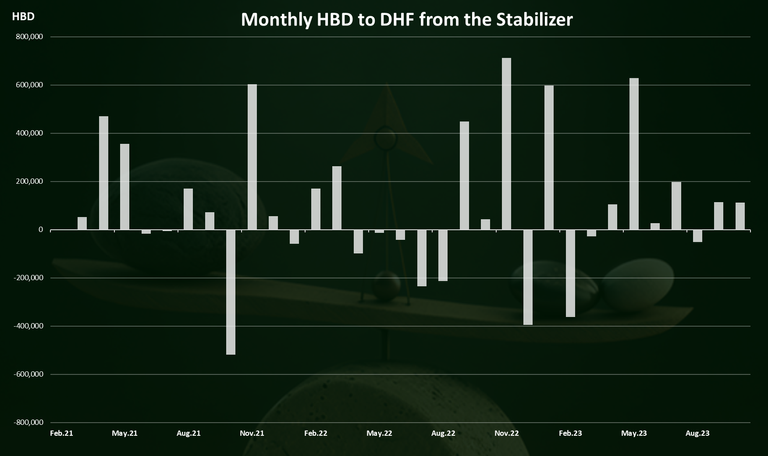

HBD Received VS Sent

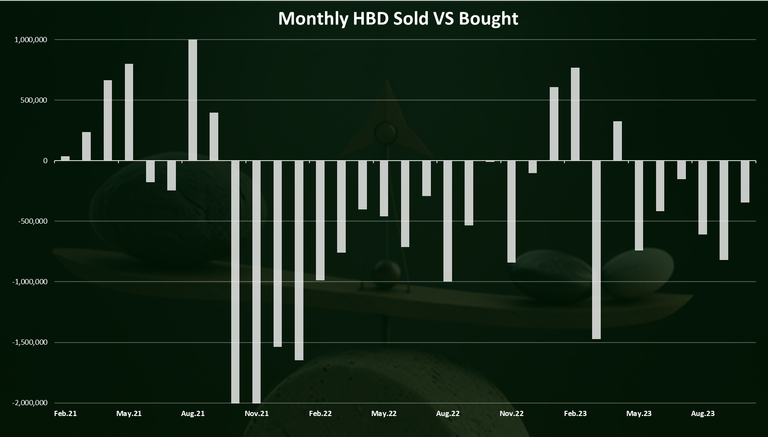

If we plot the amount of HBD received VS sent to the @hive.fund from the @hbdstabilizers on a monthly basis we get this.

A positive bar means that the stabilizer has sent more funds to the DHF then received, a net profit, while a negative bar means that the stabilizer has received more funds then sent back, or a net loss.

What’s interesting from the chart above is that when HBD loses its peg on the market, even on the downside, usually then it is when the stabilizer makes profit.

We can see that in May 2023, the stabilizer was very positive for the DHF with 600k HBD net added in the DHF. In the last few months the volatility of for the profit/loss of the stabilizer has been low and it has been in the range around 100k per month.

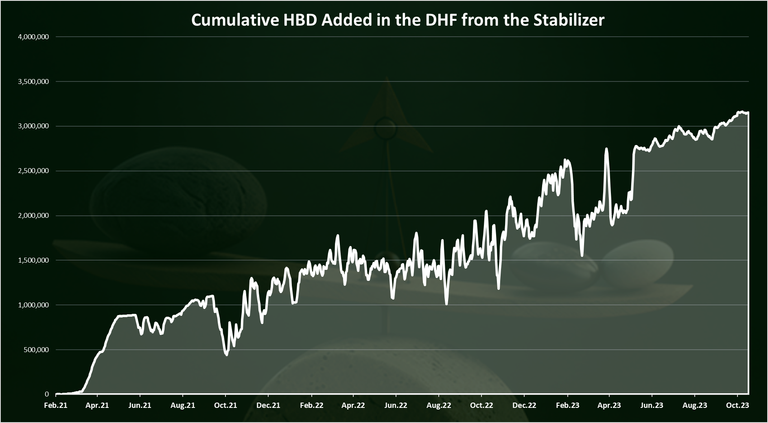

When we add the above the cumulative HBD added in the DHF from the @hbdstabilizer looks like this.

A total of 3.1M HBD profit for the DHF from the @hbdstabilizer.

We can see that there was some ups and downs in 2023, but the overall trend has been up. With the lower funds that the stabilizer has now, the movements are lower.

The hbdstabilizer profitability is a combination of the trading HBD that it is making on the internal market, and the conversions from HBD to HIVE. Also, the @hbdstabilizer comments are being upvoted daily from large stakeholders and this provides around 200k HIVE equivalent per month.

As mentioned above the @hbdstabilizer is constantly making HBD to HIVE conversions in order to have HIVE and buy HBD if needed. The thing is these conversions take 3.5 days and have a market risk in them, and sometimes they can be market positive, while other times negative. Because the stabilizer has been making a relatively big amounts in conversions, those can add up.

HBD Sold VS Bought

Let’s take a look at the market activities and how much selling and buying the stabilizers has been doing.

Positive bar means the stabilizer is selling HBD, negative bar means it is buying HBD.

As we can see from the chart the stabilizer has been mostly buying HBD in the past. In the first few months it has been selling more HBD because at the time the HIVE to HBD conversions were not enabled on the blockchain and HBD was constantly trading above $1. When the HIVE to HBD conversion was enabled, HBD returned to its peg and since then the stabilizer has been mostly in buying mode for HBD supporting the price on the downside.

In 2023 this trend has continued as well with the stabilizer mostly buying HBD, apart from the first months when there was more selling. Although the number are now lower and the volatility as well.

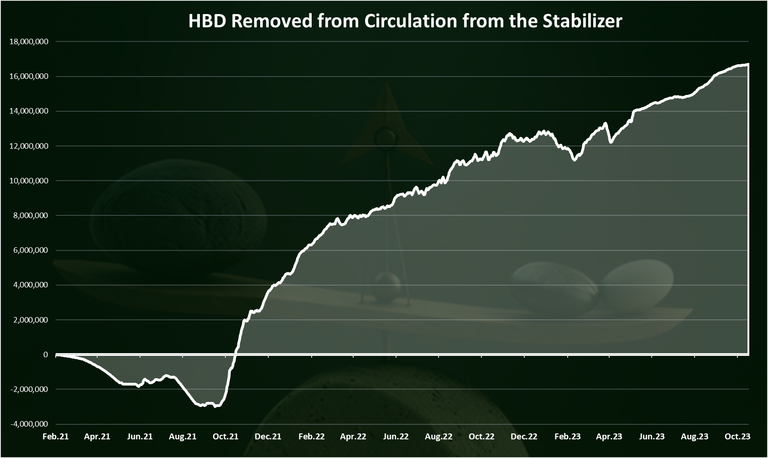

The cumulative data for the amount of HBD bought from the stabilizer looks like this.

We can see that at the start in the period February – July 2021, the stabilizer was selling more HBD. Then at the end of 2021 it started buying more HBD, because the HBD supply expanded meanwhile and there were excess amounts in a hands of speculators.

In 2023 as we can see that there was some ups and downs but the trend for buying more HBD continues.

In total the stabilizer has removed 16.7M HBD from circulation in its period of operation, out of which around 6M HBD in 2021, 8M in 2022, while in 2023 it is around 4M for now. It is the lowest since its operation.

HBD Price

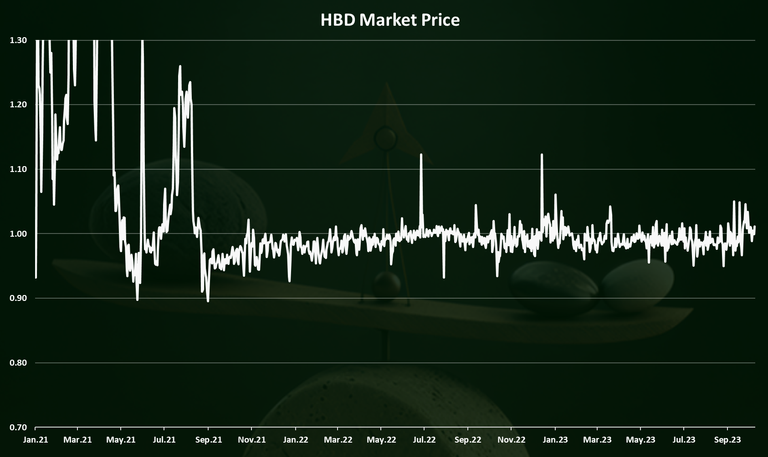

At the end the chart for the HBD price in the period.

We can see that back in 2021 the price of HBD was above the peg of one dollar. This is because the HIVE to HBD conversions were not active in the period, the bull market was on, and the speculators pushed the price of HBD above one dollar.

Since September 2021 HBD has been far more stable although not ideal. On a few occasions the price increased to more than $1.1 but only for a short period, and on few occasions, it has dropped to around 0.95. Still much better than in the last period.

Note that these are external market prices, sometimes they are based on very low trading volume and can be inaccurate, while the on chain price has been at the peg at all time, and users can convert HBD to HIVE for one dollar at any time.

Summary

The main takeaway from the above is that the @hbdstabilizer has been helping the HBD peg on the downside and has removed a total of 16.7M HBD from circulation in the last three years.

As for the DHF goes, the stabilizer has added a total of 3.1M HBD in its budget. Some of it is from curation rewards.

Since September 2021, the price of HBD has been relatively stable, with very short-lived spikes to 1.2 and drops to around 0.95.

The internal market has increased liquidity and HBD now has the most liquidity there, thanks to the stabilizer.

Since May 2023 the stabilizer has reduced its funding from 200k to 24k HBD per day leaving more room for others.

All the best

@dalz

I think 24 k a day is much more sustainable than 200k a day! That must have been ridoncilous 😂

Seems to do the job... plus there are others arbing.

This is cool

I really can't wait for HBD to get stabilized. I will be able to save in HBD instead of using USDT

Hive is the goal!

That's amazing. We have a stable coin that is actually stable... and gaining interest 20%.

Great! That's proposal is great. To get HbD stabilized is nice. Hive is really standing out. The 24k is okay.

hbd is stabilized.

HBD is gonna rock and it will top the stable coins.

The way we see its demand and supply is being controlled very well and reading your post here has given me a lot of knowledge which is very important for me in the coming time. Thanks for sharing.

Thank you for sharing this stats and getting us informed

So off topic, but not sure where else to ask:

I have $1,157 HBD in Savings, but I haven't received any interest since August. Does anyone know why I'm not receiving any interest?

You have 53.6 HBD in interest waiting to be claimed. Just make any HBD transaction (the amount doesn't matter) and the blockchain will automatically add it to your savings account.

So I have to make transactions in order to receive the interest?

EDIT: Ok, made a transaction and received the interest. Thanks!

One simple way of doing it is to withdraw 0.001 HBD from the savings account and then cancel the transaction. That way you don't have to make any actual transfer. On Peakd.com you can do this by clicking on the "claim interest" button on the wallet page. That button appears when the interest is due.