The Hive stablecoin, or more accurately soft pegged dollar coin, has been around for a long time. More than seven years when we include the previous version. Since the creation of the Hive chain, March 2020, it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can lose its dollar peg.

Let’s see how did HBD did in 2024.

HBD is being created and burned in multiple ways. Like many things on Hive, it has its nuances. The main mechanics for expanding and contracting the supply are the conversions, but there are also the author rewards, proposal DHF payouts, interest payouts etc.

For better visibility we will be categorizing the HBD created/burned in the following manner:

- Author rewards

- Conversions

- DHF Payouts

- @hbdstabilizer

- Interest payouts

The HBD in the DHF is treated differently than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market, so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is 2016 – 2024, with a focus on the last year.

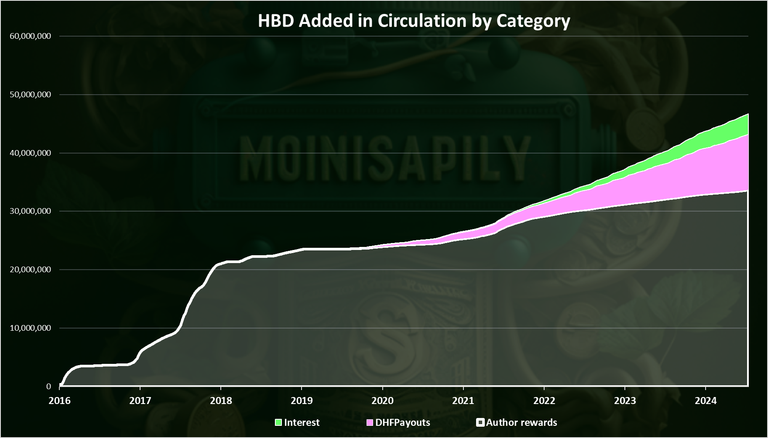

HBD Added in Circulation

HBD enters circulation via multiple ways, like author rewards, DHF payouts and interest to HBD held in savings. HBD is added in the DHF as a share of the inflation, but we will be looking at the HBD that only leaves the Decentralized Hive Fund, the DHF payouts.

Here is the chart.

The chart includes the following:

- Author rewards

- DHF Payouts

- Interest

As we can see the authors’ rewards are the number one source for HBD created, but in the last years the other ways have been growing faster.

HBD in theory can be created through conversions as well, but conversions can be both positive and negative depending on market conditions. Here we will be looking at the data for conversions under the HBD removed section.

A 33.6M HBD was created as an author rewards since the very beginning. A 9.5M as payouts from the DHF, and 3.5M HBD as interest. These are all cumulative numbers for multiple years.

We can notice that in the first years, all of the HBD creation was due to author rewards, but this has changed in the last years and now the DHF is at the first spot, followed by the author rewards and then the interest rewards.

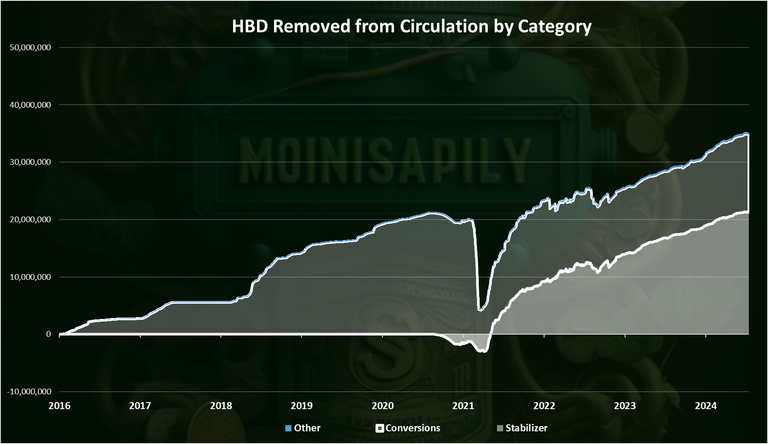

HBD Removed from Circulation

Now let’s take a look at HBD removed. Here is the chart.

We can see that up to the start of the stabilizer, the main way to destroy HBD was conversions to HIVE. Since the launch of the stabilizer, it has played a major role in the decrease in the HBD supply. In the last years it has been the main method for removing HBD from circulation.

Cumulative, the stabilizer has removed 21.3M HBD from circulation, while 13.5M were removed trough conversions.

The stabilizer is providing support for the HBD price on the internal market, buying HBD with HIVE if the HBD price is below the dollar. The stabilizer has scaled down its operations in 2024 and lowered the funds that is receiving from the DHF but in the long run it’s still playing the major role.

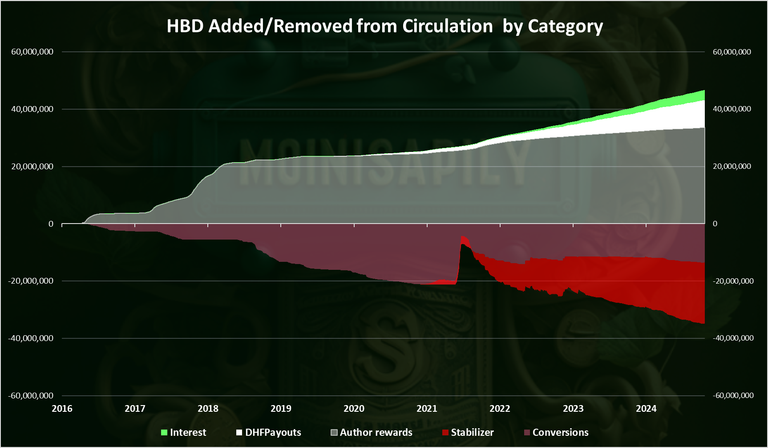

Cumulative HBD Added/Removed from Circulation

When we add the two charts above, we get this.

As mentioned already the author’s rewards are the main category in the positive, and the stabilizer is dominant in the negative.

What’s interesting is that after the introduction of the HIVE to HBD conversions, we are now seeing that the trend for the conversions has switched and now there is more HBD created from conversions than removed.

Also, while the authors’ rewards are still dominant in total, in the last years we can see the DHF is also putting more HBD in circulation, followed by the HBD interest.

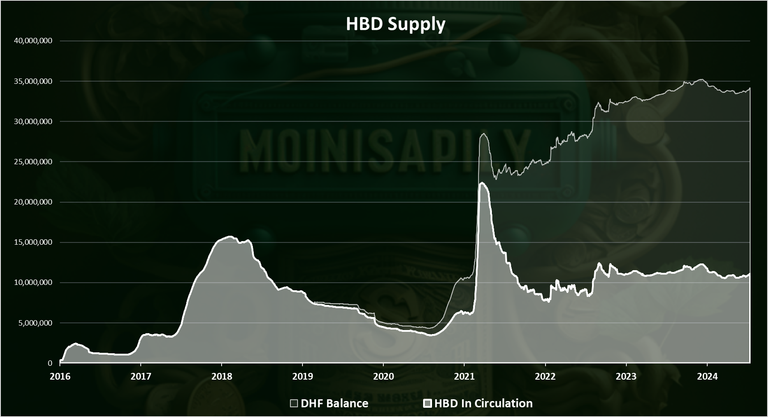

HBD Supply

Finally, the HBD supply looks like this.

The HBD in the DHF is represented with light white.

We are now at 11M HBD in circulation, while there is another 23M HBD in the DHF, accounting for a total of 34M.

We can notice that in the last two years the amount of HBD in circulation has been quite stable in the range of 10M to 12M HBD.

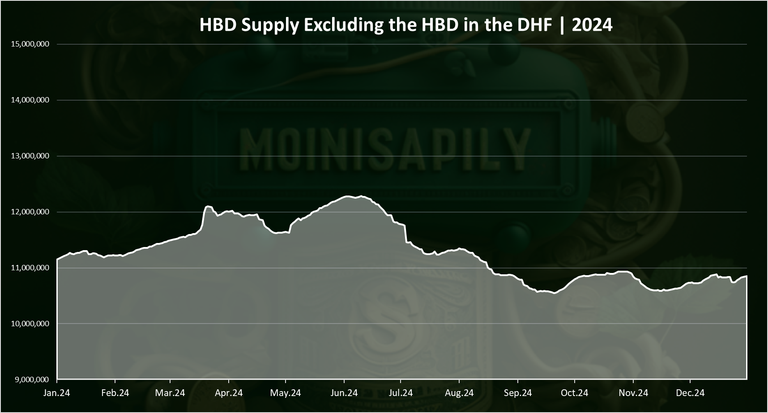

When we zoom in 2024 we get this:

The chart is zoomed so the movements are more visable.

At the beginning of 2024 the amount of HBD in circulation was at 11.2M HBD and now we are at 11M HBD. The overall supply of HBD has dropped for just 200k HBD in 2024. We can see that up to June 2024 the HBD in circulation has even increased a bit to 12.5M but then dropped during the summer when there was low HIVE prices and some made conversions to HIVE. In the last months of 2024 the supply was almost constant.

The HBD supply in the DHF has also been stable around the 23M.

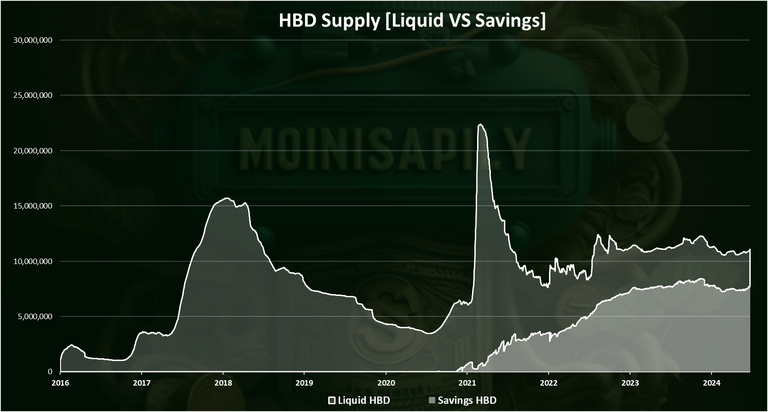

HBD Liquid VS Savings Balance

The HBD in the savings give a 15% APR at the moment. It was just recently changes after been at 20% for years. When we plot the amount of HBD in the savings against the supply we get this.

We can clearly see that since the introduction of the interest for HBD, back in 2021, there is a constant growth in the amount of HBD in savings, while the liquid HBD supply went down.

We are now at 7.7M HBD in savings from the totally 11M supply, leaving 3.3M liquid HBD.

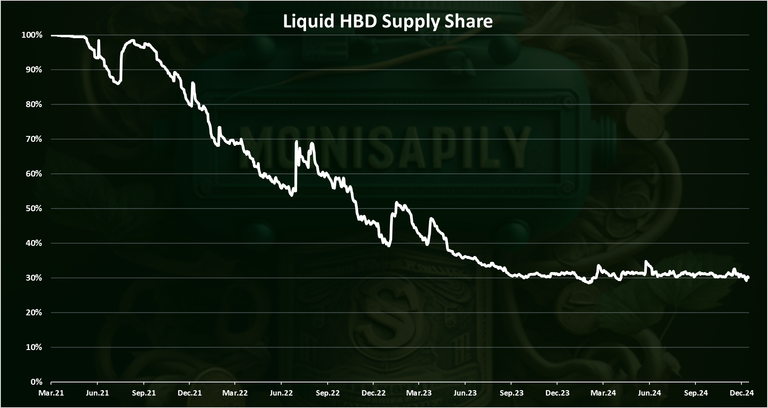

Liquid HBD Share [%]

The chart for the liquid HBD supply share in percent, excluding the HBD in DHF and in the savings looks like this.

We can see that the liquid HBD supply share keeps going down. In the last two years. It has dropped to 30% liquid HBD and 70$ staked HBD, and it is around that spot in 2024 with short fluctuations from time to time.

As the liquid HBD supply drops, the demand for new HBD should trigger conversions from HIVE to HBD, driving demand for HIVE as well.

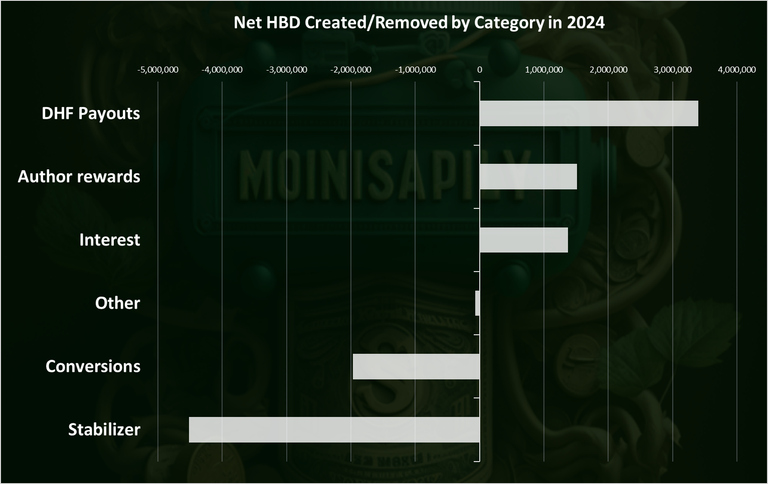

Summary for HBD Added and Removed by Category in 2024

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

The DHF payouts are the number one way for HBD entering in circulation in 2024 at 3.4M HBD.

Next are the authors rewards with 1.5M followed by the interest payouts with 1.4M.

When it comes to removing HBD from circulation the stabilizer is the one doing most of this and has removed 4.5M HBD from circulation in 2024. The thing is that to remove this amount of HBD the stabilizer had put additional HIVE in circulation increasing the HIVE supply in the process.

Conversions are next in removing HBD from circulation with 2M HBD removed in 2024. There are around 70k HBD that has been sent to null or burnt as post beneficiary.

When we sum the positive and negative numbers we get 6.2M HBD put in circulation and 6.4M HBD removed from circulation, or almost neutral supply change for 2024 of just -200k HBD. Again for this to happen the HIVE supply has apsorbed the HBD.

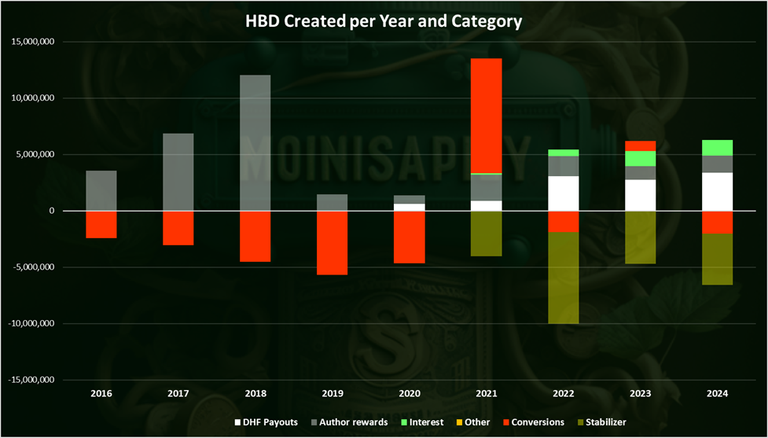

Historicly the creation/removal of HBD per caterory trought the years looks like this.

We are seing that there is now a shift in the way HBD enters circulation. In the past the majority of it was put in circulation from the authors rewards (grey), and cumulative this is still the bigesst position. But in the last years the shift is more towards proposal payouts from the DHF (white) and then HBD interest (green). It should be noted that this is just half of the author rewards, the other half is paid in HIVE.

The stabilizer(orange) has been the main way to remove HBD from circulation for third year in arow, in 2022, 2023 and 2024. Conversions (red) are negative this year, last year was positive and in 2022 are negative again. In all of the HIVE history, for the nine years, conversions have been positive only in two, massively back in 2021 and a samller amount in 2023.

All the best

@dalz

Espectacular work done here!

The system seems working like a swiss watch IMO, perhaps DHF payouts are a little uncontrolled here, in particular knowing that the output obtained from the funded projects are sometimes tiny, but HBD interest looks healthy even if we increase to 20% in my opinion.

Tnx!

I mean it's not as bad as it could be. The higher Hive price I'm going to say will help a bit with inflation of hive unless the higher print of HBD now in rewards turns into conversions for Hive but relatively it should be roughly the same unless there are some wild swings again downward making it dirt cheap to convert HBD into hive. I personally feel like we are still over spending and the APR on HBD is too high. I'd like to see us around 7% but that's just my opinion.

If history repeats we should expand the hbd supply by a lot in 2025 and finaly have hive to hbd conversions decreasing the hive supply. Will see.

Hi, @bitcoinflood,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

Over 13 million HBD removed through conversion, a huge amount of .. The most HBD has been created as author rewards. Many important information about the stable coin HBD

Which is better for the stability of HIVE, Author rewards or DHF creating HBD?

Thanks for the great data. There is not much difference between author awards and interest earnings in 2024. Is it more interest earnings or less author awards?

So, any more decrease in HBD interest rate would increase the liquidity, and what about the price of HBD?

I'm still curious, is HBD a stablecoin which means 1 HBD = 1 Usd, or at any time the market value can reach $3/1HBD?

HBD is backed by HIVE.

There are multiple mechanics to keep the price around the dollar, like conversions HIVE<->HBD, the internal market and the hbdstabilizer.

That said, outside markets where HBD is listed, especialy the Upbit exchange, can increase the demand for HBD and temporarrly increase the price, or the oposite up until arbitradge is made. You can see on Coingecko how was the price in the last four years. Also if the HIVE prices drops extremly low beyond the debt levels HBD can depeg by design.

!PIZZA

Thank you so much for giving us this detail data about exchange of HBD to Hive

$PIZZA slices delivered:

(8/10) @danzocal tipped @dalz

whoa! i didn't know exchanging HBD for HIVE had such an impact on the total supply,

great to see it growing tho. HBD rocks!! 💪😎🤙