Hello Readers,

For some days I was not in a happy mood, because though my favorite coin Hive made a recent High at 0.41$, I didn't convert my Hive for HBD thinking it would surpass at least 0.5$ this time and ended up losing the trend as Hive is now trading at 0.27$. Though BTC is still roaming above 100k$, I started to think this may be the end of the pump season and soon everything would be back to its normal state. But when I stumbled upon a particular news, I again got a big hope. Yes, as you have already read the Title above, BlackRock has crossed holding a total of 1 million Ethereum coins and this may boost the pump season even further. So in this post, I will be talking a bit about this news and how financial Institutions are slowly and quietly taking over the crypto world. So if you are interested, let us take a jump without any further ado.

Today, the world of cryptocurrency just witnessed a major event, as BlackRock’s iShares Ethereum Trust (ETHA) has officially crossed the milestone of holding over 1 million Ethereum (ETH) coins. This bold move my BlackRock has given it the place of the world’s second-largest ETF holder of Ethereum, right behind the long-standing leader, Grayscale. But, being a crypto enthusiast or just a retail investor, is it such a big deal for us or just another big buy? Let us try to break it down.

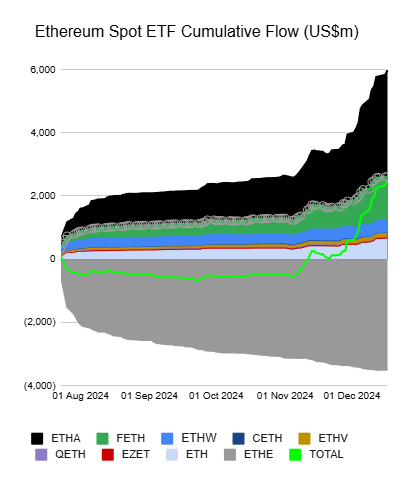

A Year of Aggressive Buying

Over the past year, BlackRock has made some bold moves not only in Bitcoin but also in the Ethereum market. While most of the other institutions kept their holdings under 100,000 ETH while taking a cautious approach, ETHA went on a buying spree, accumulating 1.025 million ETH in total at present. This aggressive purchasing strategy from BlackRock began in September in spite of the market remaining relatively stagnant, and it even ramped up further in December and crossed 1 million ETH holding before the end of the year.

Today, if we look at BlackRock’s total Ethereum holdings, they are worth over $3.9 billion, making it a strong opponent or competitor to Grayscale’s Ethereum Trust, which currently owns 1.96 million ETH. But noticeably, what is setting BlackRock apart is its rapid speed of ETH accumulation and its exponential growth and influence in the ETF space. Not to mention, The company’s current state of confidence in Ethereum as an asset seems to match the minds of investors, thus driving more interest to invest in their iShares ETF.

Why It Matters

Since its launch, Ethereum has been a major player in the crypto sector earning its place just after Bitcoin being the second most dominant asset in crypto, it is no stranger to the spotlight. As the second-largest cryptocurrency by market cap, it is a cornerstone of the decentralized finance (DeFi) ecosystem and a major key player in the world of smart contracts. Despite its utility, Ethereum’s price has struggled to break the $4,000 barrier mark this year, 2024, even with significant institutional buying. BlackRock’s milestone however is more than just a symbolic win for crypto lovers or investors. It is a signal that Ethereum is gaining traction among mainstream investors, not just crypto enthusiasts anymore. This increased demand could potentially build the way for further adoption and potentially new financial products, like more ETFs related to crypto coins or staking-focused ETFs, which I believe would add even more utility to the ecosystem.

Comparing BlackRock's Holdings

If we currently compare, BlackRock’s holdings are now more than 3X larger than those of the Ethereum Foundation, showcasing its dominance in the ETF space. It is also catching up to Robinhood, which is a big ETH holder and currently holds about 1.4 million ETH. However, unlike retail-focused platforms, BlackRock’s holdings are managed through experienced institutional custody solutions like Coinbase Prime and I think they are into this game for the really long term. Gladly, some Other funds like Fidelity etc. are also expanding their Ethereum portfolios, with Fidelity’s holdings current crypto holding valuation at around $1.63 billion. However, no other fund has matched or even near BlackRock’s steep growth rate in such a short time, making ETHA a standout star player in the market.

A Mixed Impact on Ethereum’s Price

As we can see, despite the heavy buying, Ethereum’s price still remains under $4,000, right now trading at around $3,884. While the ETF’s aggressive accumulation has drawn attention and made it to the front lines, it has not been enough to push the asset immediately into a higher price zone. Other entities with even larger Ethereum reserves continue to exert greater influence on the market. However, Ethereum’s role in DeFi remains indispensable, with over $77 billion locked in various protocols. In addition to that, Ethereum’s dominance as the main network in the crypto space for stablecoins, including the recently minted $22 billion worth of USDT clearly reflects its utility and staying power.

Last but not least, BlackRock’s iShares Ethereum Trust reaching the 1 million ETH milestone is a landmark event, and though we may not see its effect immediately, I strongly believe it will help other institutions to grow confidence in Ethereum and in Crypto. While it has not yet led to a dramatic price surge (who knows if it starts from tomorrow), the increased adoption of Ethereum-based ETFs is opening doors for normal people to invest in crypto and also giving them confidence as big players are all getting in one by one. So the future of ETH and crypto only looks brighter from here, what do you think?

Information Source

https://coinmarketcap.com/community/articles/67630687ea785179abdfcd21/

https://www.blackrock.com/us/individual/products/337614/ishares-ethereum-trust-etf#/

I hope you liked reading my post about BlackRock’s aggressive ETH accumulation. Let me know your thoughts regarding this topic in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha