Hello Readers,

If you are connected with the crypto world and tend to invest in different projects, then you must have accessed and invested in many dApss. Now, imagine you have discovered an Ethereum-based service or decentralized app (dApp) that could use an extra layer of security to make it even more impenetrable, well, the EigenLayer protocol has been designed to do exactly that. By allowing people to re-stake their Ethereum (ETH) coins to a system of secure multiple protocols and services within the Ethereum ecosystem, EigenLayer took a giant step toward strengthening the security of blockchain projects and thus gained popularity in the past. But while it sounds really impressive, this unique approach to security and efficiency has also raised some controversies. So in this post, Let us dive into EigenLayer to know what it is, what it does, its benefits, and the recent concerns surrounding it. So if you are interested, let’s take a jump right in without any further ado.

What Is EigenLayer?

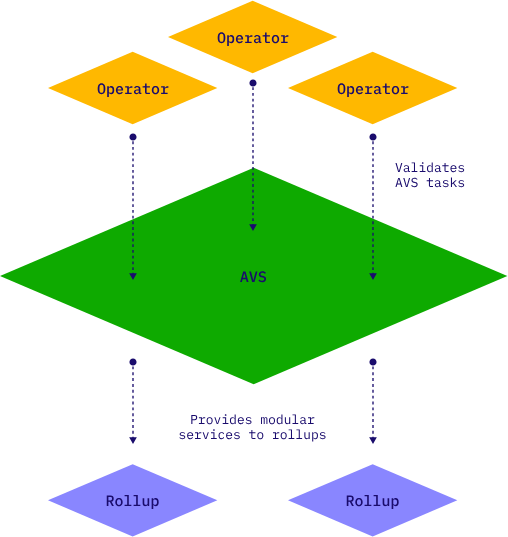

EigenLayer is a protocol that has been built on the Ethereum chain. It was founded by Sreeram Kannan, a former professor and expert in Information Theory, who saw an opportunity to make Ethereum’s security model even more flexible and efficient through this protocol idea. The concept is simple - users who stake ETH to help secure Ethereum’s network can "restake" that same ETH on EigenLayer. This means their ETH serves as extra security for other dApps or protocols that need it, without requiring the new or additional amount of ETH.

EigenLayer introduces an amazing concept called Restaking which is a digital innovation that lets validators on Ethereum support multiple projects using the same amount of ETH stake. This mew system reduces costs by obviously maximizing the utility of staked ETH, creating a more efficient and secure ecosystem.

Why Is EigenLayer So Important?

The main advantage of EigenLayer is that it allows Ethereum’s security system to stretch even further. With the EigenLayer, validators or the people who keep Ethereum safe by staking their ETH can now use their ETH to secure not just the Ethereum network but also other projects within the ecosystem. This leads to -

Improved Security By having ETH secure multiple protocols, the entire ETH ecosystem benefits from increased safety by simply lowering the risk of attacks on smaller, newer projects which are the main issues these days.

Better Efficiency Validators no longer need to stake additional funds to support multiple projects. They can use the same ETH to do both, allowing for better resource management across the board.

Developers For blockchain developers, building projects on Ethereum, with the integration of the EigenLayer mechanism, they can easily access security without raising as much funding for ETH staking requirements. So hopefully this will encourage more innovation.

The Recent Controversy

While EigenLayer holds great potential, it has faced significant challenges in recent times, which created a negative sentiment. The controversy spread like wildfire when two respected Ethereum researchers, Justin Drake and Dankrad Feist, stepped down from their advisory roles with EigenLayer just recently while raising questions about conflict of interest and governance. One of the researchers, Drake’s involvement sparked intense discussion within the Ethereum community after it was revealed that he allegedly received a giant amount of compensation in EigenLayer’s EIGEN tokens. Critics and many investors argued and raised this issue that this might affect his neutrality, given EigenLayer’s position as a significant DeFi player on Ethereum. Drake also admitted that he might have misjudged the situation, calling it a - "bad decision." He has since implemented a personal policy to avoid any further conflicts and also announced officially that he will no longer take advisory roles, angel investments or any positions on security boards.

The other researcher Feist, on the other hand, has stated that his main commitment was to the core development of the Ethereum network. So, by stepping away from EigenLayer, Feist hopes to dedicate all his energy to strengthening Ethereum’s core, even though he believes EigenLayer complements Ethereum well.

The Ethereum's Response

The Ethereum Foundation, recognizing the need for clearer policies on these types of complex conflicts of interest, has announced plans to formalize these rules. In the past, they had relied on community values and individual judgment. However, this recent and concerning situation has proven that more concrete and efficient policies are necessary.

Aya Miyaguchi, the executive director of the Ethereum Foundation, has acknowledged the need for change after this incident. They also promised that they are working on a formal conflict of interest policy to address these issues. This formal approach will aim to keep Ethereum’s community and development environment transparent and trustworthy in the future and to avoid these types of conflicts.

Why Governance and Transparency Matters

EigenLayer’s situation has highlighted a key challenge in the world of blockchain - balancing innovation with transparency. Blockchain projects are decentralized by nature and aim to avoid any type of central authority. But in the practical world, even decentralized communities need clear rules and boundaries to ensure trust and to be able to run smoothly. In this case, the departure of prominent top advisors from EigenLayer signals a renewed focus on maintaining transparency first approach. As Ethereum and its gigantic ecosystem continue to grow, maintaining the integrity of this blockchain for its contributors, users and leaders becomes more and more crucial.

This controversy around EigenLayer serves as a reminder of how important it is for those in influential positions to act transparently and with community trust in mind. But fear not, in crypto, we are in the world of decentralization and anything that doesn't support or wants to bypass will get canceled one day.

I hope you liked reading my post about Eigenlayer and will be very happy if it has added any value. Are you an ETHEREUM user and also engage with different dApps? Let me know in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha

Even investing in crypto it self is a risky business but how can you succeed without risk, crypto has made some folks richer amd some even poorer, for me i do not know if crypto is a blessing or curse