Hello Readers,

As we all know, the United States elects its president every 4 years and this creates a ripple effect on the financial markets on a global level as we have seen in the past. Not only the share markets but the crypto market, which is also known for its volatile ups and downs, responds strongly to elections. For investors regardless of their capacity, they see this as an opportunity and also a reason to stay cautious during this time period. As a matter of fact, Donald Trump has just won the US elections and will become the president soon and I think this will create a huge wave in finance, especially in the crypto market and hopefully in a positive way, as Trump is known for his positive approach towards crypto. So, in this post, let us take a dive and look at how elections can impact the crypto market, and what lessons are needed to know for those who are curious about this digital asset space. So if you are interested, let’s take a jump without any further ado.

Why Do Elections Impact Crypto?

As seen in the past, most of the time elections only bring uncertainty. Suppose you notice any major political event closely, like the election of President or Prime Minister of any country. In that case, there is always a lot of guessing about future policies, regulatory changes and economic plans among common people. All these speculations and predictions can often lead to volatility in the financial markets and large swings. Cryptocurrencies, like Bitcoin and most of the Alt-coins, also respond to these changes because, in today’s world, people have started to see these digital currencies as alternative assets. During these uncertain and stressful times, many people lean on crypto while treating it as a kind of financial “backup plan” if things get rough. People tend to want stability and when they worry about the future of traditional markets, some of them turn to crypto as they feel it is a safer place to invest, especially during times like these. This sudden demand can increase crypto prices temporarily, as everyone rushes in all of a sudden and starts to buy without thinking much.

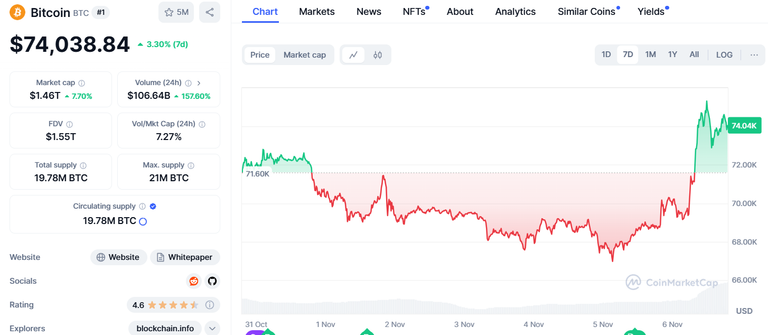

What’s Happening with Bitcoin and Altcoins?

When it comes to elections, Bitcoin being the most shouted and powerful coin in this crypto world often becomes the show's main star. As I have seen just recently, Bitcoin has already hit $75,000, which is exciting news for all investors around the globe! As it creates a FOMO effect, people around the world who didn’t even own any Bitcoin or invested a single dime in crypto suddenly feel thrilled by this impressive jump. With Bitcoin on the rise, most of the other cryptocurrencies or Altcoins also get a boost, but not all of them follow the same path (Like our hive sadly). Now Sometimes as seen in the past, while Bitcoin starts surging during these types of big events, Altcoins may still lag behind, which often frustrates crypto investors who hold these assets.

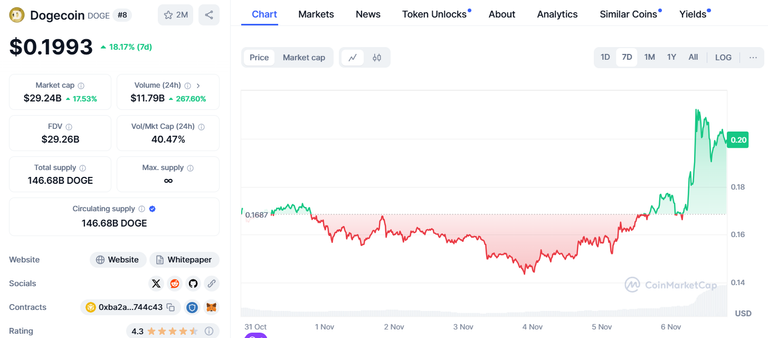

The Rise of Dogecoin ($DOGE)

Dogecoin, a crypto inspired by a meme and limelight by Elon Musk, has also seen some action around election time. Many crypto investors focus on this coin and notice even small changes in Dogecoin’s price, especially during this election season. As we can see from the chart above, Dogecoin has experienced a whooping 17.56% growth in its price within the last 7 days and has been gaining ground and pushing previous resistance levels. I think Elon Musk is the reason for what is happening with Dogecoin right now, as he shared his positive views about this coin openly in the past and is also a huge supporter of Trump who just won the election. Now this is a promising sign, and I think that Dogecoin may experience even more interest and investment in the future. But keep in mind that while the election period can sometimes bring positive energy to the crypto space, giving a boost to Bitcoin and Altcoins that have not seen any big price movement in a while, nothing is guaranteed in the Crypto world and it is a very volatile space so we have to be cautious while investing.

Reading the Signs

For me, I think one particular tool to use in the crypto market during this high time is the Relative Strength Index (RSI). The RSI is a technical analytics tool that helps investors see if a particular crypto asset like Dogecoin or Hive etc. is being overbought or oversold. During this US election, Dogecoin’s RSI showed strong and steady growth, which means there is demand but it is not at dangerously high levels. So, while there is visible positive momentum, it has not yet created a big bubble of people piling in all at once. Now in technical analysis, When Bitcoin and other cryptos show stable growth in their RSI, investors tend to feel more confident. This often leads to even more growth over time as more people buy in, hoping to ride and benefit from the wave.

Patience Pays Off

For people who are new to crypto, watching these election-driven sharp price movements might be both exciting and stressful. In this wild wild crypto world, timing is everything and patience can make a huge difference in your return. We have seen a lot of times that a single coin’s price varies greatly in just a day’s time. I know waiting feels boring, but sometimes holding on to your crypto can lead to bigger rewards than you even imagined.

Green Light - Red Light

In the crypto space, a green candle on a price chart means that the price is moving upwards, while a red candle shows that the price is moving downwards. Today, green candles have captured the whole market and are giving crypto people a reason to be happy. But experienced investors know things can go south in minutes, so they may always keep an eye on red candles that might pop up, when the election excitement cools down. So, if you are thinking of investing, you may choose to wait for a better entry point when prices dip in the future.

Smart Tips for Investing

- Stay Calm - The crypto market can be wild as we have seen in the past, but I believe patience is the key. Cryptocurrency is very well-known for its volatile ups and downs, and election season is just one of those times when volatility might be higher than usual.

- Check the RSI - Use technical analysis tools like the RSI, moving average or others to inspect whether a cryptocurrency is in a good position or being overbought or sold. This can help you decide whether to buy, sell, or hold.

- Keep yourself updated with News - Political announcements, Bans or Tax and policy plans can change markets within the blink of an eye. Staying updated with news will surely help you make smarter choices with your crypto.

- Have a Long-Term Plan - Elections are a short-term event, but I think crypto’s growth is likely to continue to move upward over the long run. So it would be good to focus on your long-term goals, rather than reacting to every market shift and going wild.

I hope you liked reading my post on the US election and its impact on crypto and now let me know your thoughts regarding this topic in the comment section below. That’s all for today and I will be seeing you all in my next post.

Posted Using InLeo Alpha

Congratulations @mango-juice! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 56000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: