The DeFi ecosystem has gathered a lot of attention recently due to the increase in its Total Value Locked (TVL) metric.

However, given TVL measures both the change in locked token value and the change in the value of these tokens compared to USD, we need to be more nuanced in our analysis, especially during a bull run in USD token values.

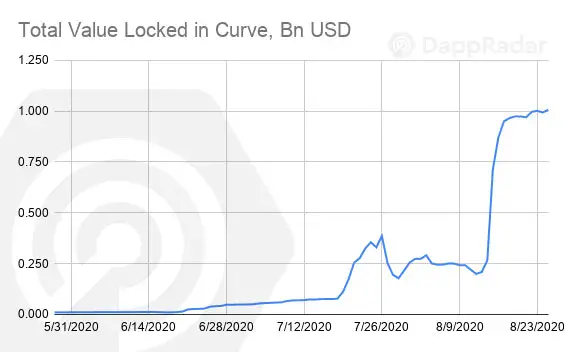

DappRadar, recently, analyzed the Curve Finance by measuring inflation-adjusted TVL to discover Curve’s real growth excluding fluctuations in token price, and compare this to other leading DeFi dapps.

Key takeaways

- While Curve’s TVL has surpassed $1 billion, its adjusted TVL has not (yet)

- Stablecoins account for 74% of total value locked in Curve

- Curve’s growth has out-performed both Aave and MakerDAO