This is an interesting tweet by Vitalik Buterin. I have compiled it and immutably backing it in Hive Blockchain. The best part of this tweet for me is: "After all, public goods and community are incredibly important even to the crypto space itself."

On 2008 vs 2020, and what it means for crypto(currency).

I've said this already at some of the recent newfangled e-conferences, but want to reshare here too.

Thread:

Bitcoin was born out of a crisis that was fundamentally financial in nature. Either the banks misbehaved, or the government over/under/misregulated the financial sector, or they bailed out too many banks, or they printed too many dollars.

And bitcoin itself is primarily a financial tool. Ethereum is explicitly less financial in nature, but even there it remains a fact that a large fraction of applications that a blockchain legitimately makes better involve handling coins/tokens/money of some form.

2020 is first and foremost not a financial crisis. It's a virus crisis, it's a crisis of epistemology (how we learn what's true and what's false in the face of competing groups misleading us), it's a crisis of overbearing policing in many places, and much more.

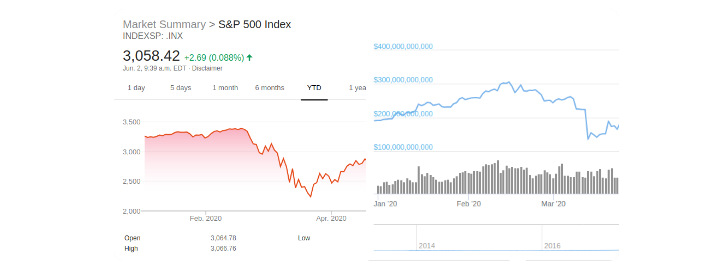

Yes, the money printer did go brrrrr. But that's a relatively small portion of what is going on, and even there inflation is still going down not up.

https://www.ft.com/content/481645ba-63a7-11ea-b3f3-fe4680ea68b5 …

And cryptocurrencies ended up being very much correlated to wider economic trends. Doesn't mean they don't protect from other things (eg. political barriers/interference), but it does mean that narratives need to adjust.

Conclusion: finance is relatively less important this decade than it was in the last decade, and the crypto space needs to adjust to this reality. Even within finance, some change of emphasis is in order.

Luckily, there's many categories of ethereum applications (and other chains) that go beyond finance. Decentralized censorship-resistant publishing and communication, decentralized communities / governance / DAOs, DAOs for content curation, etc etc. All important work.

Within the space of financial apps, I would say the success of stablecoins has shown that what people want is NOT to get away from the USD right this minute, but to move into the crypto environment where they have more options of what to do with their money.

Freedom of exit.

Financial censorship (especially the insidious second-order variety where intermediaries get quietly pushed to extrajudicially block use cases that are perfectly legal) continues to be a problem for many marginalized groups and crypto can help.

Though I do think that a broad shift from crypto just being finance to crypto also being decentralized governance and organization and community is needed, and is happening.

After all, public goods and community are incredibly important even to the crypto space itself.

I will come out and say this directly: this mentality below is exactly what we should be expanding beyond right now. REFORMING MONEY IS NOT SUFFICIENT.

2016-20 is a period of ideological realignment. Many old ideologies and coalitions are dying, and many new ones being born. The hills and valleys on the battlefields are shifting.

The crypto space needs to be watching carefully and adjust to new realities.

You can follow @VitalikButerin on Twitter.

References:

Hive Frontends:

Hive Block Explorer

Hive Projects Directory

Congratulations @sacrosanct! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!