Introduction

I remember very clearly in my mind the emotions from the Global Financial Crisis (GFC). Fear and panic gripped the world and everyone was in some way impacted by the meltdown of the financial system.

On a personal level the impact was quite severe, my dad's investments in his self managed super fund took big losses and a number of the A+ investment products he had large positions in went to zero.

I had a conversation with my dad at the time to try and get an understanding of how he was coping emotionally and to find out if he had a plan to move forward. The event almost broke his confidence and for a period he struggled with self-doubt in his investing. Fortunately, my dad is a very resilient man and over the next few years he recouped a lot of the financial losses he incurred and the experience definitely resulted in him becoming a better investor in the long term.

My Journey

For me, the GFC was the birth of my investment journey. I had recently sold my first house which I made a nice profit from. I was very lucky that I sold it about three months before the housing crisis started.

I moved to Australia as a single man, about to start a job for a large corporate fund manager. I had been reading financial books since I was nineteen and had a real passion for everything finance and investing. The only significant investment I had made up until that time was buying and then selling my first home.

The Stock Market

As the GFC was reaching its zenith and the bottom seemed near, I decided it was time to take the profits from my home sale and invest them into the stock market. One thing you must know about me, I always err on the conservative side when it comes to investing, so taking this leap was terrifying and very counter-intuitive for me at the time. I remembered the mantra that I had read in countless finance and investing books, "Buy when everyone is selling and sell when everyone is buying."

So that is exactly what I did, I started buying. I bought oversold blue chip companies, that offered attractive dividends and were a low risk of going to zero. I focused on telecoms, big banks, big miners and energy companies. I did try a few speculative investments too, but they were a small portion of my portfolio.

It took a bit of time for my strategy to work and I had a number of sleepless nights, but eventually things began to work. The market began to recover, the dividends started to come in and my portfolio that was a sea of red began to turn green.

I took my profits when I thought the time was right and when I needed a deposit to buy my next house. My first venture into the stock market was an enjoyable one and provided enough profit for me to focus on the next chapter of my life - finding my girl, marriage and building a family.

A Beautiful Investment

For those of you who are worried that I am going to start getting all soppy about my amazing wife and children, rest easy, I will save that topic for other posts and community groups.

The beautiful investment I am referring to is the precious metal, Silver! My introduction into silver investing came as a result of a natural progression from my GFC experience with my dad, through to making same profits from the stock market recovery and then wanting to find a safe haven as a store of value that is resistant to another such market calamity.

My investment relationship with silver started off with a few Perth Mint silver coins and from that very moment I was hooked and have never looked back ever since.

Silver investing or stacking as we like to refer to it in our community ( #silvergoldstackers ) has become an absolute passion of mine. I still apply all my same investment principles from the financial books I read. I still buy when everyone is selling and the price is low. Selling on the other hand is not something I like to do very often.

Silver Spot Price

If you are currently following the silver spot price, you could be thinking to yourself, "Wow the price has come down a lot from the highs a few months ago when silver touched US $30.00. What a great time to buy!"

Note: The price today at the time of writing this post was US $24.39, that is a drop of about US $6.00 from the recent highs.

The short answer is you are absolutely correct, it is a great time to be buying silver at the moment. That being said, if you run out tomorrow to visit your local coin shop or bullion dealer, you might get a bit of a disappointing shock.

- Firstly, they might not have much physical silver in stock. Bullion dealers and mints across the world at the moment are experiencing shortages in stock for silver coins and bars, due to the high demand.

- Secondly, you will soon realise that there is a very big price disconnect between the spot price of silver and the physical price of silver.

Silver Physical Price

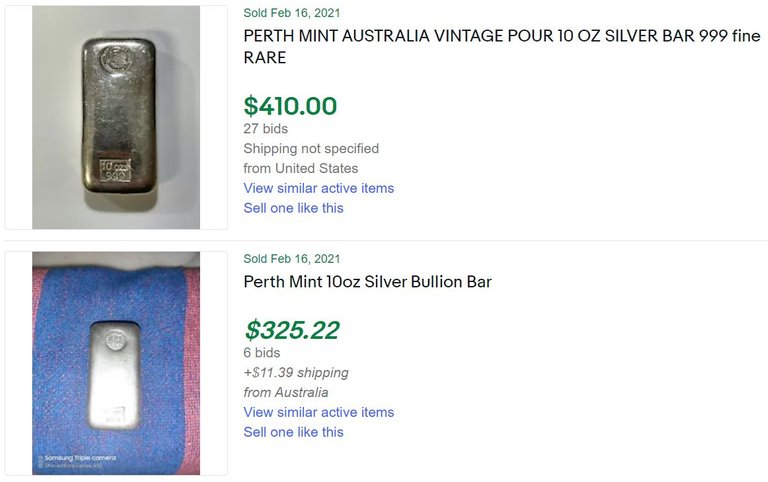

Below is an example of a 10oz Perth Mint Silver Bar. At the current Silver Spot Price you supposedly should be able to purchase this bar directly from the Perth Mint for around US $243.90.

10oz Perth Mint Silver Bar

I had a look on the Perth Mint website and four other Australian Bullion Resellers, that I source a lot of my silver from, and not one of them had any Perth Mint 10oz bars in stock for sale.

I kind of expected this to be the case, so I decided to visit the website of probably the most reputable and well known precious metals reseller in the world, APMEX, to see what their price was. Unfortunately, the story was exactly the same, currently out of stock.

I eventually resorted to going to ebay.com to see their recent sales of the 10oz Perth Mint Bar. I found two sales from mid-Feb.

- The first one sold for US $ 410.00. That works out to be US $175.10 over today's spot price.

- The second one sold for US $325.22. That works out to be US $90.32 over today's spot price.

As you can see, physical silver is an incredible store of value. Even when hedge funds and large investment banks are driving down the silver spot price with their short-selling, the underlying physical silver price is holding firm. It also further confirms for me that the silver spot price is a paper only price and has no connection to the actual metal.

Basic supply and demand economics tells you that if there is limited supply and high demand for a product then the price of that product will go up. For us physical silver investors we know from experience that the current demand for physical silver is very high and the supply is very scarce. We are experiencing high prices on the secondary market and from the bullion resellers.

We as stackers are all just waiting patiently for the market to correct itself and re-align with reality. When it does the silver spot price will move a lot higher. 🤑

10oz Perth Mint Type 'C' Vintage Silver Bar

The other amazing aspect of physical silver is that there are so many different markets to invest and trade in. The 10oz Perth Mint Type 'C' Vintage Silver Bar featured in the photo above is a perfect example that not all 10oz silver bars are priced the same. According to the Silver Spot Price, this silver bar should cost me around US $243.90. The beauty about this particular 10oz bar is that it is quite rare and sort after in the collectors market.

Again I visited ebay.com and to my surprise a vintage 10oz bar very similar to the one above sold on 20 February 2021.

As you can see this bar sold for a cool US $856.86. That works out to be US $612.96 over today's spot price.

The investment strategies for physical silver do not stop with silver bars. Once you get introduced to the world of silver coins, you enter into a whole new realm of opportunities. I will delve deeper into the silver coin world in a future post, but as a teaser I will leave you will a couple photos of some of my 1oz Australian Kookaburra silver coins.

Zoom in and take in the pure beauty of the design of these coins and the assurance that these things of beauty will always be a trusted store of value. 😎

1oz Australian Kookaburra Silver Coins

Post authored by @strenue

I remember being a much younger Nurse then working for a Community Health company making a decent living. My Retirement fund was modest at the time but I recall the abject horror of co-workers losing huge amounts of their Retirement funds. With some aggressive choices I made up for the losses over the years but the experience lead me to question other things like why wages/buying power never keep up with inflation, Government debt and how the system worked. IT all led me to Gold and Silver as the ultimate Savings hedge.

Thanks for sharing your story @strenue

Posted Using LeoFinance Beta

Thanks for sharing @kerrislravenhill, at times we do need to make some aggressive and risky decision in the short term. Hopefully we make them in a calculated way. Silver and gold is that tried and tested decision that has performed through the ages. It definitely is an investment that helps me sleep at night.

Excellent post!

I'm into it more as a store of wealth.

-We as stackers are all just waiting patiently for the market to correct itself and re-align with reality. When it does the silver spot price will move a lot higher. 🤑-

The Australian Perth Mint makes good quality coins and is commanding a higher premium as years go by. Your "investments" will pay-off.

Yes @silversaver888, I do believe my investments will work out nicely in the medium to long term. Sometimes I forget it is an investment strategy as the process is so enjoyable. 🐨 🦘

Hahaha, I am enjoying looking at it, as well as I enjoy stacking silver and gold!

Excellent post, you relate a good experience and you say something key you have to know when to use your profits. Now as for the silver coins are you always checking the market to see if you get a good deal and buy? Since it sure is like crypto the longer you hold the higher the profit.

Can somebody explain what is silver investing?

Very nice! I'm a big fan of the Perth Mint's designs on their silver coins.

You received an upvote of 56% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Congratulations @strenue! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 2250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: