Crypto use is increasing day by day and with the continued surge in popularity, many are starting to question whether cryptocurrency would democratize finance to any and all. Crypto promises one thing: a decentralized financial system without traditional banks, placing control directly into the hands of the people over their assets. That could herald a global financial system including everyone worldwide.

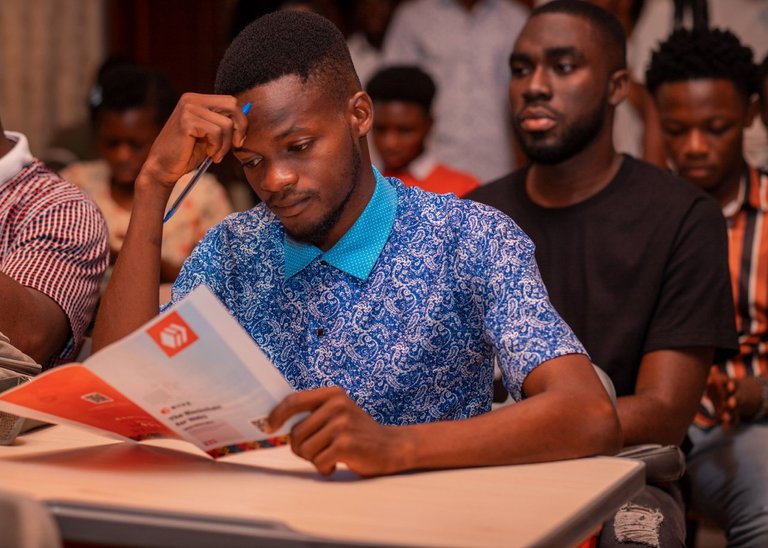

But in practice, the actual barriers cannot be taken so lightly. There is first the challenge of understanding how they work. Most cryptocurrencies are based on blockchain, which is a pretty complex technology to understand. Terms such as "mining," "tokens," and "decentralized finance" seem frightening to those starting. Many people also lack financial literacy for traditional systems, let alone the special knowledge to fathom

Without access to proper resources to learn about the risks and opportunities in crypto, one is sure to either fall prey to scams or maybe make bad investment choices. A whole range of other accessibility issues also stands out. Considering its democratic ideals, crypto requires universal internet access and electronic devices no smaller than a smartphone or computer that many people simply do not have. When economic conditions in a country create a tempting environment for cryptocurrency due to the instability of local currencies, the very same infrastructure required for crypto may be highly underdeveloped.

Market volatility is a another critical challenge, even to those who have access. The value of cryptocurrency surges and falls in huge steps, and the risk involved for those without financial cushions to absorb any losses is tremendous. While some early adopters have made an absolute fortune through it, many people have lost their savings when the markets have taken sharp, sudden downturns. This sort of instability might be catastrophic for the ordinary person, especially the economically vulnerable.

Then there is also the issue of regulation-or, rather, a lack thereof. The problem for many governments across the globe is how precisely they would go about regulating cryptocurrencies. The actual concept of decentralization promotes independence or freedom from centralized players while at the same time cutting down investors' protection. So there is just few people would be ready to take the risk of investing in an unregulated market, where you can become a victim to fraudsters and general attacks from hackers if you barely know your way around.

Despite all of these challenges, there is a growing movement to address each of the barriers to entry. Be it education on platforms, facilitating interfaces for end-users, or increasing internet access to areas that have not been reached yet-crypto might be nearer than one thinks. But the question is, will that be enough? While the crypto revolution promises greater inclusion in financial services, it really is not ready or able to serve everyone.

Of course not everyone would be interested in cyrpto but for the majority of people, mass adoption would take much more time as they there are barriers such as a lack of knowledge and technological access to the intrinsic risks of crypto market. For cryptocurrency to realize its full potential, it will take determined endeavors: first, to bridge the gaps-at least-and second, to ensure that true financial freedom can be extended to all people.

The number of crypto users increases by each passing day convincing me that cryptocurrency is indeed the future.

Cyrpto is indeed the future, but looks like there is still more that needs to be done as there are a number of people who have no clue of what it's all about

Anyone CAN ... bu who WILL?

That's true, anyone can but I also think not everyone is ready for crypto

Agreed ... that is the part that I come to terms with as an author on the subject. I can put books into people's hands to explain what is going on ... I can't make them read, understand, and be willing to use what is in the book. It is hard to see this passing so many people by, this cycle ... but, it cannot be helped.