Math!

Math is one of the most important tools that humanity has at our disposal. Whether we're talking about medicine, finance, construction, or most any part of our realm - Math is going to play an important role.

Of course, in the crypto world, this is especially true, as we are combining finance, programming, and cryptography - all three of which rely heavily on Math.

For today's post, I want to introduce you to the math behind the most undervalued crypto on the market right now: Cult DAO

Deflation vs Fixed Inflation vs Random Inflation

One of the biggest narratives in the crypto space is that crypto is here to counter hyper-inflationary fiat currencies.

But how many cryptos out there are actually deflationary, or at least have a flat supply?

Currently, the Bitcoin network prints 6.25 $BTC every 10 minutes... That's over a quarter of a million dollars, or $1.5M every hour.

That is hyper-inflation

Bitcoiners would argue that because the inflation rate is algorithmically set ahead of time, and decreases over time (cut in half every 4 years), that somehow it isn't inflation.

Obviously, it is.

Sure, it's better than the Fed being able to print any amount, whenever they want. But it's not anything new or different in function really - it's just built into the code.

$CULT doesn't share this hyper-inflationary nature. 100% of the CULT supply was minted at launch, and the supply is ever-decreasing thanks to various burn mechanisms.

How Deflationary Is It?

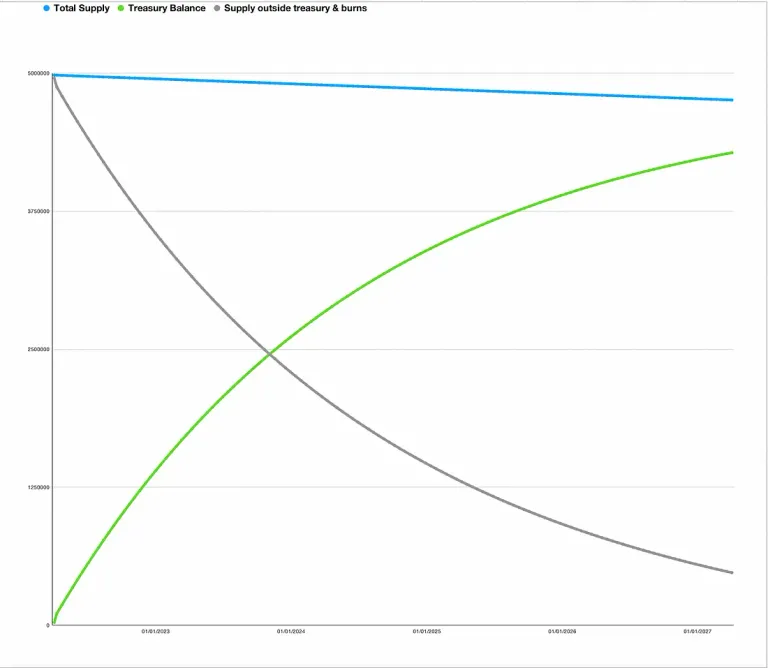

The image above is from this Medium post, which dives into the tokenomics of Cult DAO.

There's a whole bunch of different elements in CULT that add up to having the best math in the crypto world...

First up, a 0.4% tax is paid on every transaction, being sent to the treasury. When the DAO votes to fund a proposal, 15.5 $ETH worth of $CULT is paid out of the treasury, with 2.5 $ETH of that being immediately burnt.

When profits/divestments come back to the DAO, it is all used to buy $CULT on the open market, and then 50% of that $CULT is burnt, and the other 50% is sent as rewards to the stakers.

So, the circulating supply is always being slowly siphoned into the treasury, and a HUGE portion of everything that comes out of the treasury is burnt.

There's more though - the Liquidity Pool for $CULT is locked for 263 more years, and contains 15-20% of the supply... PLUS there's ever more $CULT being staked, people are locking $CULT away on Unicrypt (some for 10 years), AND there are already other tokens that have a tax to buy & burn $CULT (Like $RyderOSHI, $TRG, and $RVLT)

Modulus is Coming...

Modulus is the in-development Layer 2 zk-rollup EVM blockchain being created by Mr. O and the other CULT devs.

One of the main functions of Modulus, for the purpose of our conversation at least, is that $CULT will be the base token on the chain. Meaning that every transaction on Modulus will cost a little bit of $CULT for gas...

And that gas is all BURNT!

Head to the website to check out the documentation and the many projects already building:

https://moduluszk.io

In Summary...

$CULT is truly deflationary - 100% minted at launch, 27.777% burnt so far

The more volume on $CULT, the more it burns. The better our investments do, the more it burns. The busier Modulus is, the more $CULT it burns.

Now think about this... By staking your $CULT, you earn staking rewards (50% of the buyback from investments) - That means that you have a steady income, in a token that has an ever-decreasing supply.

I'm sure most of us know the basics of supply & demand... It's not hard to imagine what happens when the supply shrinks faster & faster, the more demand there is...

Interesting. i've looked at CULT before but not taken the plunge. i've learned more.

What interests me most is how the consensus/voting mechanism of the DAO works. There's a particular Community Governance system i am attempting to bring into being, and wonder if CultDAO might take a look at it.

Hey there!

Yeah, the voting mechanism is rather interesting.

The top 50 stakers can put up proposals, but can't vote on them.

The rest of stakers can vote on proposals, but can't post them to the chain.

The DAO can learn from & integrate all sorts of systems and tools into what we do, but the DAO itself can never be changed. The code is locked, keys renounced.

Yes, it is interesting.

"The top 50 stakers can put up proposals, but can't vote on them.

The rest of stakers can vote on proposals, but can't post them to the chain"

Can any of these parameters be changed?

eg.

The no. of top stakers ?

And/or

The criteria of vote weight for the rest of the stakers? - this one in particular.

i assume all DAO members are anonymous. Correct?

Yeah, at base it's just an ETH wallet that you vote with, or put up proposals with.

Many Guardians are known by aliases, some are doxxed.

Congratulations @cultdaoist! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: