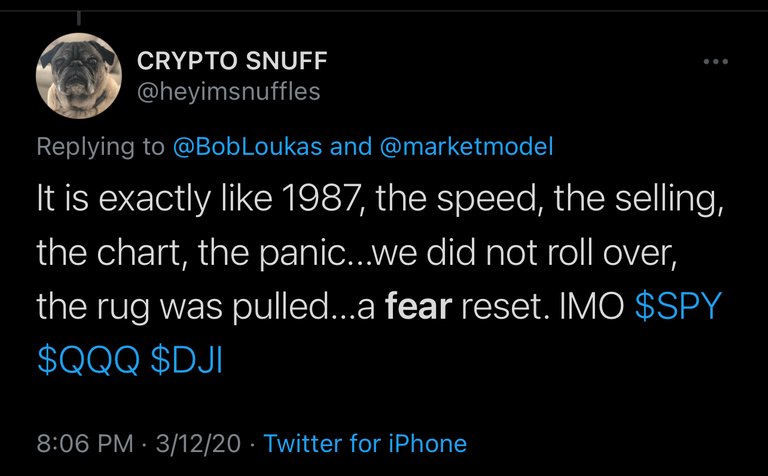

March 12th, 2020. The fear, the velocity of the down move, the big boys were stuck, the rug was pulled. A complete meltdown in a straight line over the course of a few weeks.

Until that time 2008 was stuck in everyone’s head for over a decade. Everyone that called for a crash always talked about the GFC. Then came the black swan. COVID-19.

A complete a total overhaul and fear, and a global reset within weeks. And it played out. I have been a market participant for only 9 years. I do not even remember the dotcom bubble or the financial crisis really. I was waiting for an opportunity like this. I was out in Feb. i didn’t get caught in the down move, saved my capital. But the mistake was made. I didn’t trust my gut. Boy for this fun to watch.

My gut called it, my mind was scared. I did return 140% last year but that was a grind from the bottom as I was stock picking tech and SPACS. I was in at the lows of $PENN, $NIO, etc. and sold for 3x....it went to 20+ each of them. These were once in a lifetime prices in some of these big cap stocks that got crushed. Just another lesson in market mechanics. No one ever knows what is going to happen, but I had the play mapped out, and didn’t pull the trigger.

I am much wiser now for this happening to be honest, this is the greatest game in the world and I finally deal like I have a taste of both sides for the next time. Risk happens slow and then all at once. When it is all at once, load the boat baby.

Until then, if my thesis were to play out fully, we are looking at a massive blowoff too for years to come after this. And this may continue as the new cycle is only a year old and we could see an 87-00s type move going forward. Stay on your toes!