liquidity pools serve as a key point in the project.

I've been actively contributing and investing into the liquidity pools. I jumped into the POB and SWAP.BTC pools and also BEE pool, in addition to SWAP.HIVE and SWAP.HBD. This has created great demand for CENT tokens to continue contributing liquidity. So much so that I have been purchasing from the market (or swapping) to keep up with demand.

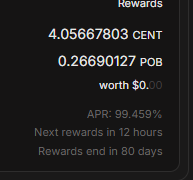

Regarding the APR of liquidity pools... I would rather call them psuedo-apr, since the daily rewards usually discontinue before the end of 365 days. For example, my contribution to the CENT:POB pool is said to return 99% APR, but rewards (may) end in 80 days, bringing the real APR closer to 20%.

Being carefully managed pools, it's likely the rewards will renew and continue all year, but I don't make that assumption. Rewards could also change after the 80 days.

I contribute to 15 pools, reportedly earning 52% APR, but when calculating the REAL APR, it's about 20%.

Thank you for sharing your thoughts. The 'APR' stated in the pool represents the annual average return. It doesn't matter if it is distributed weekly. Or an eighty-day distribution still represents the annual average return. In Cent's liquidity pools, reward distribution has been ongoing since the first stage. We usually match the APR of the previous distribution period with the APR of the next distribution period.

This has been a very attractive attribute of the cent liquidity pools, I've had several other pools remove rewards unexpectedly, or not renew rewards at the end of the distribution period.