These are two easy yet fundamental questions that you may ask and depending on who you ask, you may get different answers! First lets check out the definitions of these two terms, how to calculate them and why it is important.

Market Cap = Price (X times) Circulating Supply

Wherever you go, coinmarketcap, coingecko or Bitpanda, this is the standard defintion to calculate the market cap. Here you can see their example for Bitcoin.

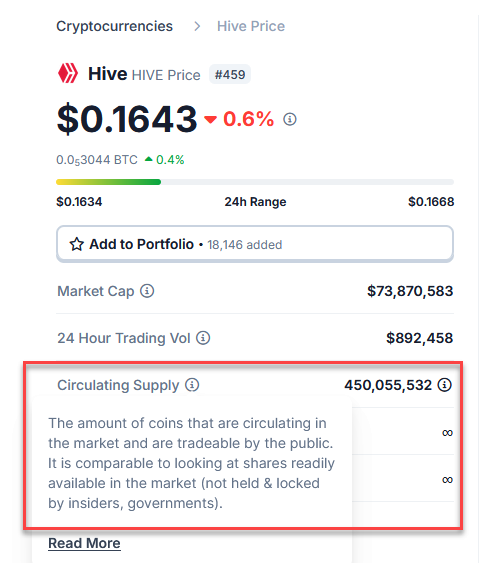

A key thing to note here is Circulating Supply. In particular this is highlighted by both coingecko and coinmarketcap as such:

Circulating supply excludes locked up shares such as those held by a DAO and not publicly tradable. This is important and a good reason why we follow unlock calendars for cryptos as we know this will clearly dilute the overall market cap if it unlocks.

So what is Hive's market cap? It should be straightforward to calculate now we know all the variables and the caclulation is very easy.

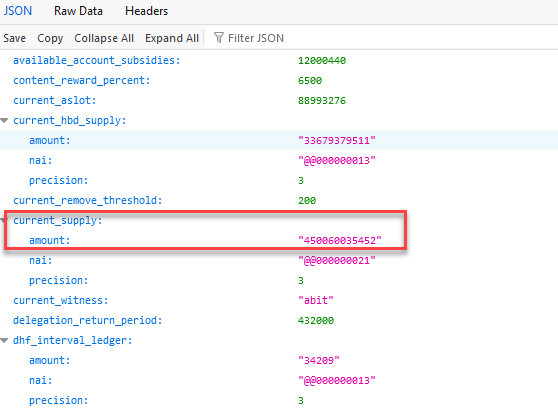

We can take the Hive circulating supply from the Hive Explorer API here that shows

450,060,035 Hive current supply.

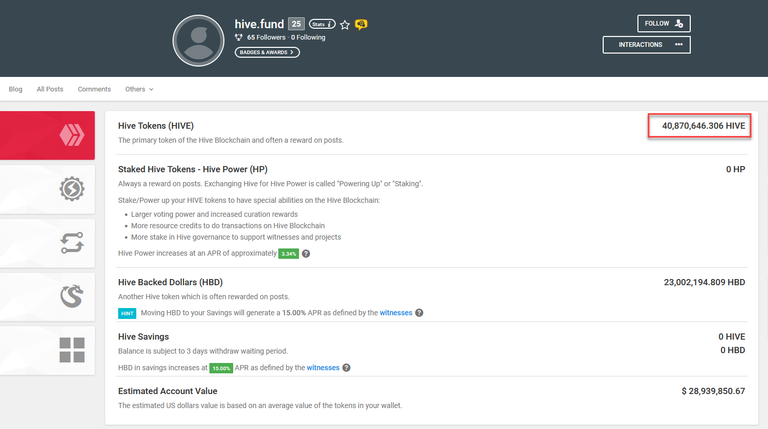

We then need to take the locked up DAO Hive that is not freely circulating, but actually being converted into HBD slowly. You can find this number by checking the DAO account @hive.fund and you will see:

40,870,646 Hive

If we then remove the fixed DAO supply from the Hive Total Supply, we would be left with: 450,060,035 - 40,870,646 = 409,189,389 Hive

We are then almost complete with the equation and must just take the latest Hive price from the internal market/coingecko or Binance. For me they were almost harmonised on $0,1644.

Market Cap = Price (X times) Circulating Supply

$67,270,735 = $0,1644 x 409,189,389 Hive

Therefore the marketcap of Hive is just over $67m. You may be wondering then, how could coinmarketcap, coingecko and HBDstats.com all have different numbers?

I think it is mostly that coinmarketcap and coingecko do not understand the DAO/HBD debt dynamic and do not spend much time to figure this out, although coingecko tries to give the most accurate picture but is not aware of the fixed DAO Hive amount.

With regards to HBDStats, although it says Hive Market Cap, its calculation includes not only the circulating supply, but like coingecko, the fixed DAO part (450M) and then a conversion of the HBD held outside of the DAO converted to Hive as though it is equity. Yes the $10.7M HBD DEBT is included and labeled equity which massively inflates this number. $107m - $67m is a $40m inflation of the Hive Market Cap!!!

Why is this important? Well lets move onto the debt limit and find out.

HBD Debt Limit

So we already know the market cap calculated above, now lets look at the debt which is HBD in the Hive world. We can get the total HBD supply from the API above where it shows 33,679,379 HBD, which if we say that it is at peg, also = $33.67m.

We can then see that 33,679,379 / 67,270,735 = 50,07%.

Yes, including the Hive DAO HBD, the current debt limit is just over 50%!!! But should we include the DAO HBD in the debt limit? As the DAO is paying out around $250k per month to projects vs. around $100k HBD interest to HBD outside of the DAO, it would make sense to include it in any debt limit, as it is now debt being serviced!!!

If we did fictively remove the DAO HBD debt and look at the impact of HBD outside of the DAO, how does the debt limit look now?

We can take the total HBD from the Hiveexplorer API above and and minus the amount of HBD held in the DAO wallet shown above 23,002,194 HBD. Therefore we get 33,679.379 - 23,002,194 = 10,677,185 HBD/$

The debt limit would then be excluding the DAO:

10,677,185 / 67,270,735 = 15,87%

Conclusions

With the recent crash in Hive price from $0,3x to $0,16x area, it has massively lowered the market cap which in turn has increased the debt limit to more than 50%. We can see that the DAO is the majority of the debt at over 34% and that it is the biggest monthly outlay.

How Does Hive Blockchain calculate the Market Cap and Debt Limit?

If you check hbdstats.com, you can see the RESULTS of how it is calculated on chain or read this technical post, to see the details of the way the market cap and debt limits are calculated on chain, this is to say, the blockchain has other assumptions that it uses instead of the generally accepted way that aggregators like coinmarketcap or coingecko would accept.

Although the term marketcap is used, it is referring to something called the Hive "Virtual Supply", which is a fictive calculation including all circulating Hive and non circulating Hive from the DAO = 450M, plus the total of the HBD Debt held outside of the DAO converted to Hive. So $10.7m of HBD is converted to Hive and added to this figure to bump up the number giving around $107m "Market Cap" although it is not market cap of course.

The debt limit used for the soft and hard limits are then used against this "Virtual Supply" number... so $10.7m / $107.9m = ~9.9%. Which of course is way below my real calculation of the debt limit.

So to summarise, the blockchain only considers the debt outside of the DAO, plus it adds on the debt to the market cap which is really odd because why would you add the debt to the equity part of the ratio you are trying to find the limit for?

Consequences

What does this all mean you might ask?

The Hive total debt is already at over 50%, so the value of HBD is higher than HIVE itself!! The Hive equity supporting the HBD debt is becoming smaller and smaller and the debt burden more onerous.

It means the debt limit is being massively understated on-chain and it is not a FIXED debt limit of 30%, but a dynamic debt limit that fluctuates with the size of the HBD held outside of the DAO!

If the HBD stays around the same proportion as now, the hair cut will kick in at a real debt limit (excluding DAO) of around 45-50%! Of course, the DAO debt will be so high to dwarf everything.

Most likely, the soft and hard limits are not going to kick in on time to save Hive, we could face a Terra Luna moment.

Thanks for reading.

Credits:

Title image created with Hive logo. Screenshots from HBDStats.com, coingecko and coinmarketcap.

Let's connect : mypathtofire

Thanks for taking the time to find these numbers and create a "second view" about the same things... I suppose that the reason behind HIVE being "not attractive" as much as it deserves is a lack of clarity...

I was surprised by my results as the calculations are pretty basic and i wouldn't think to question them. I guess never trust, always verify.

Why not more people are talking about this? This is really not good reading haha, it is quite scary when we are so invested in HIVE.

The numbers are not good reading. Certainly the risk has increased substantially on Hive.

Wow very interesting breakdown of complicated market and Hive data, it would not surprise me if there are manipulations on some of these digital market places causing further complications and corruption of values.

Have the best day

Made in Canva

!ALIVE @mypathtofire

This post has been curated by the Alive And Thriving Team, we curate good content in the We Are Alive Tribe that is on topic for #aliveandthriving, and it's included in our daily curation report on @aliveandthriving, plus @youarealive is following our Curation Trail.

Hi Ben, yes, it is not easy to get harmonised data!

Maybe next week at HiveFest some wise Hive heads will meet and figure out how Hive can avoid the evil fate of Terra Luna?

The limits need to be lowered and DHF spending reduced until Hive's price picks up at least, but maybe they have some better ideas, be interesting to find out.

Did they talk about this? This is really scary now... not good to make people panic.

This fundamental analysis is soo good. I've never looked at it like this while all this information is available to everyone. Although I don't know anything about this Terra Luna moment but it sounds like a nightmare. :/ Will search for it.

Sending Love and Ecency Curation Vote!

Thanks! Yeah this is just some standard crypto number crunching that maybe useful with the current situation. Have a great rest of the weekend!

A great new week to you too!

Interesting read, but a little depressing. Nothing surprises me these days when it comes to cryptos. I guess time will tell. Thanks for sharing!

Yeah, it is the wild west out there. Hopefully we get the long awaited alt season and then everything will be fine!

💪

Delegations welcome! You've been curated by @amazingdrinks!

@tipu curate

Upvoted 👌 (Mana: 0/48) Liquid rewards.

Thanks for your support

I don't know if anyone is actually looking at the DHF and and that spending with value plan and everything. Even if some projects shouldn't be refunded, at least a 50% cut will be wise..

Compared to the size of the DAO in HBD, the amounts being unlocked are huge. So if around $3m a year spent = 13% of the DAO funds yearly!!

No real shocks here, the DHF spending versus benefits are out of control and have been since I joined Hive at least.

Yeah, when compared to the current market cap, it looks huge. It is no wonder the price has tanked.

Yes that it has Steve.

wow so this is why you powered down o.o but you only post it now D:.

Seems kind of scary now . something needs to be done asap or its gonna pop and not in a good way

I just post about it now as the stats published were not correct. Things could spiral out of control faster than I even realised.

so what's the worst case that can happen. you mention terra luna meaning hbd depeg? and hive go spiraling down and people panic and mass sell. I don't think it will be as fast though since it takes weeks to power down x.x

That price just keeps teasing me and not quite hitting the point I need it to for my buys to actually process. It's quite annoying! I just plan on waiting it out though.

I hope you manage to get some bargains Bozz, but a nice rebound from here would be nicer for me! Lol

Very clearly written compared to some hallucinations. We have a problem right around the corner, but I don't know if anyone is aware...

Yes, the debt is now becoming a mountain and the soft peg would kick in around 0,10$. Hopefully we get some posting price action though and Hive goes up from here.

What about Hive on accounts, which are lost (Key lost/User dead...)?

That also should not be in Circulating Supply, but not easy to know the amount.

I think they should be included as they are part of the circulating supply. Howevery probably it would be interesting to see how many inactive accounts with Hive there are...

They are not tradeable of they are lost. It's like they are sent to null

Well, this is the same as if you would count Satoshis wallet in the total supply in Bitcoin? Officially you still do. But then people make a separate calculation for inaktiv Wallets to show supply is lower.

I commented the other posting:

https://peakd.com/hive-121566/@thehockeyfan-at/steckt-hive-in-problemen#@blkchn/re-condeas-sjy14x

Now here in english:

I'm still pretty new here, but I quickly became interested in the topic, but haven't found a satisfactory answer yet.

One is the ratio of debt to property/real value. HBD is supposed to represent a certain value. Are real dollars really being held somewhere or is it just a fictitious value where HBD and Hive are somehow pushed back and forth.

The other thing is/would be to show the income and expenses. Is there a surplus, i.e. more is received than spent, or does expenditure exceed income? If the positive surplus, i.e. more income than expenses, is large enough to pay off the debt/interest and the debt can also be paid off, the debt would not be a problem. If this is not the case, there is a risk of insolvency or bankruptcy at some point.

But if the surplus is only borne by users through new investments (someone buys Hive for euros or dollars or ...), then it's more like a pyramid scheme.

@dalz is providing a lot of statistics. Maybe he could create an overwiew of income and expenses. I think this would be very interesting but maybe not so easy to create.

Hey, The answer to your question is in my post. The backing of HBD is by the holders of Hive eg. The Hive Market Cap. That is why the Hive Market Cap is so important and not to be distorted... Basically unlike other stable coins where they have USD treasuries as backing (USDT), HBD has just Hive!! So the equity of Hive HP holders is being drained to maintain the HBD peg, pay HBD interest 15% AND pay the Hive DHF funds!!!

The HBD debt is now LARGER than the HIVE equity! $67m market cap MINUS $35m HBD debt = $32m equity... Therefore in my opinion, the HBD stable coin and interest and DHF payments are unsustainable and Hive is going to crash.

Congratulations @mypathtofire! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 58000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Hello mypathtofire!

It's nice to let you know that your article won 🥉 place.

fantagira Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by

You and your curator receive 0.0035 Lu (Lucoin) investment token and a 2.94% share of the reward from Daily Report 416. Additionally, you can also receive a unique LUBROWN token for taking 3rd place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine (Lucoin) and get paid. With 50 Lu in your wallet, you also become the curator of the @hive-lu which follows your upvote. exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART