Hey All,

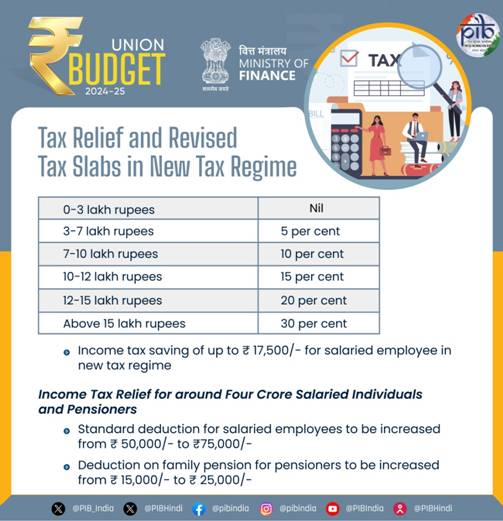

ITs the budget presentation time here in India and recently the Union Budget 2024-25 was presented in the Parliament by our esteemed Finance Minister Nirmala Sitharaman ji that introduces key reforms in tax policies, infrastructure, healthcare, and agriculture. It was the first general budget of the 18th Lok Sabha. For the salaried people the budget is more tied to any tax relief or not and this time the budget did have some revisions to the Tax Slabs in New Tax Regime. The Budget 2025 has increased standard deduction of salaried employees from ₹ 50,000/- to ₹ 75,000/- only for those opting for new tax regime. Also the rate structure here is revised to give a salaried employee benefits up to ₹ 17,500/- in income tax. Have a look at the following image taken from pib.gov.in that well summarizes the breakdown Tax Slabs and the Tax associated to it.

Apart from this on the Tax Slab structure change here what I found interesting to know and hence sharing.

No income tax on average monthly income of up to Rs.100K [1 Lakh] and this is to boost middle-class household savings and consumption.

For salaried class there is a NIL Income Tax up to Rs.12.75 Lakh per annum in the New Tax Regime. Subject to the necessary saving being made under different income tax sections like 80C and others

The Union Budget has recognized 4 engines of development which are

1. Agriculture

2. MSME [Micro, Small, and Medium Enterprises]

3. Investment AND

4. Export

There is this "Prime Minister Dhan-Dhaanya Krishi Yojana" to benefit more than 1.7 crore farmers. As this scheme is going to cover above 100 low agricultural productivity districts

"Mission for Aatmanirbharta in Pulses" the major focus being on major pulses like Tur, Urad and Masoor dal is going to be launced. So expect low prices for these common pulses.

The other interesting thing about the budget 2025 are as follows::

TDS on rent

Annual limit raised from Rs 2.4 lakh to Rs 6 lakh

Tax deduction for senior citizens

Limit doubled to Rs 1 lakh

Benefits for start-ups will continue for five years from inception

FDI [Foreign Direct Investment] in insurance sector the Limit raised to 100%

Allocation of Rs 15,000 crore for the completion of one lakh housing units

**Kisan Credit Card **- Loan limit increased from Rs 3 lakh to Rs 5 lakh

Daycare cancer centres - To be set up in all district hospitals; 200 centres planned by fiscal 2026

This get interesting with Regional airports - Over 100 new regional airports planned over the next decade.

Plan for UDAN 2.0 [Ude Desh Ka Aam Nagrik] will connect 120 new airports, with a focus on Northeast and Bihar

Water Management - Jal Jeevan Mission is to be further extended until 2028

There much more to it and for the detailed information you can refer to the post from Jagranjosh here. I guess this should be it for todays post around the INDIA Budget 2025 and highlighting the part that is more associated to the Tax Relief and Revised Tax SLABS. As I end this post I think that The Union Budgets 2025-26 or of any other year is an important plan that helps the country grow financially and take care of people's needs. The focus should always be on improving businesses, creating jobs, and supporting social programs to make life better for everyone. cheers

INDIA Budget 2025 - Key Takeaways & Highlights around Tax Relief and Revised Tax SLABS...

#unionbudget #unionbudget2025 #india #budget #budget2025 #ministryoffinance #taxslab #incometax #taxrelief #indiabudget2025

Best Regards

Image Courtesy:: pib.gov.in

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've have an interest in BlockChain & Cryptos and have been investing in many emerging projects..

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 10.00% vote for delegating HP / holding IUC tokens.

Indian were talking about the 12L, but the various indirect taxes are yet to come into picture next week...government may take back something through various way. It will be interesting to see how they deal with LTCG and STCG

Good night and good luck to us together. Interesting article.❤️❤️❤️