Hey All,

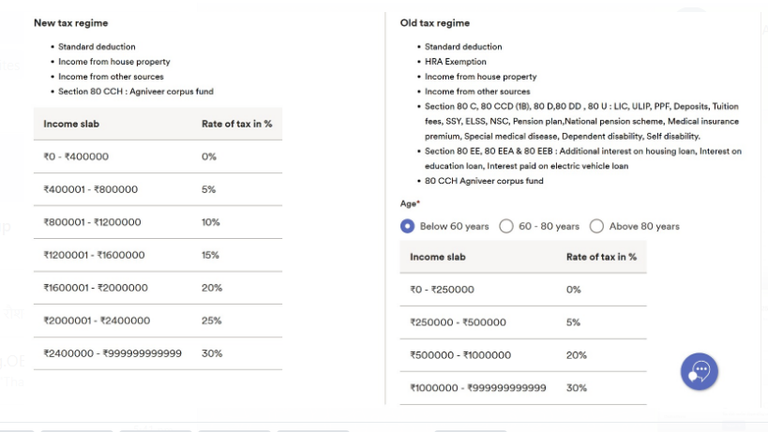

If you are a salaried person here in INDIA then I am sure you all would be getting mails from the finance team to provide your estimated tax savings for the financial Year 2025-26 including which tax regime you would be opting for Old Tax Regime Vs New Tax Regime. The immediate questions that comes to the mind is which option to choose and is going to be better in terms of tax savings. The above image at a high level speaks about the differences on the Old Tax Regime Vs New Tax Regime including the various income and tax slab rates. There are various post on the internet that talks about the difference between both the tax regimes. I browsed though them and formed this table in the markdown language which I thought would be helpful to many folks here on the HIVE Blockchain. So here we go...

Tax Deduction Comparison: Old Regime vs New Regime

| Deduction | Old Regime | New Regime |

|---|---|---|

| House Rent Allowance | Exemption up to a certain limit. Calculate now | NOT AVAILABLE |

| Relocation Allowance | AVAILABLE | NOT AVAILABLE |

| Leave Travel Allowance | Actual travel ticket expenses exempt for two trips in 4 years under 10(5). Read more | NOT AVAILABLE |

| Transport allowances (specially-abled person) | AVAILABLE | AVAILABLE |

| Conveyance allowance (employment-related) | AVAILABLE | AVAILABLE |

| Compensation for travel on tour or transfer | AVAILABLE | AVAILABLE |

| Daily allowance (for absence from regular duty) | AVAILABLE | AVAILABLE |

| Perquisites for official purposes | AVAILABLE | AVAILABLE |

| Mobile Reimbursement | Exempt if: used predominantly for office purposes & proofs submitted | NOT AVAILABLE |

| Food Expenses | Rs.50 per meal (max 2 meals a day), Annual=Rs.26,400 | NOT AVAILABLE |

| Children's Education & Hostel Allowance | Rs.4,800 per child (max 2 children) | NOT AVAILABLE |

| Exemption on Voluntary Retirement 10(10C), Gratuity u/s 10(10), Leave encashment u/s 10(10AA) | AVAILABLE | AVAILABLE |

| Professional Tax Deduction u/s 16 | AVAILABLE | NOT AVAILABLE |

| Standard Deduction | Rs.50,000 | Rs.75,000 |

| Interest on Home Loan (Let-out property) u/s 24 | AVAILABLE | AVAILABLE |

| Interest on Home Loan (Self-occupied property) u/s 24 | Allowed up to Rs.2,00,000 | NOT AVAILABLE |

| Gifts up to Rs.50,000 | AVAILABLE | AVAILABLE |

| Family Pension u/s 57(iia) | 1/3rd of pension amount max Rs.15,000 (FY 2025-26) | 1/3rd of pension amount max Rs.25,000 (FY 2025-26) |

| Deduction for Additional Employee Cost u/s 80JJA | AVAILABLE | AVAILABLE |

| Section 80CCH(2) Agniveer Corpus Fund | Entire contribution by applicant & Govt. | Entire contribution by applicant & Govt. |

| Employer's Contribution to NPS u/s 80CCD(2) | Actual contribution max 10% of salary | Actual contribution max 14% of salary |

| Section 80C Investments | Rs.1,50,000 | NOT AVAILABLE |

| Section 80CCD Additional Exemption (NPS) | Rs.50,000 | NOT AVAILABLE |

| Section 80D (Health Insurance Premium) | Self & family: Rs.25,000 (Rs.50,000 if 60+), Parents: Rs.25,000 (Rs.50,000 if 60+) | NOT AVAILABLE |

| 80TTA (Savings Account Interest) | Rs.10,000 | NOT AVAILABLE |

| 80TTB (Interest on Deposits for Senior Citizens) | Rs.50,000 | NOT AVAILABLE |

| 80G Donations | AVAILABLE | NOT AVAILABLE |

| Life Insurance Policy Maturity Amount | Tax-exempt if sum assured ≤ certain % based on issuance date & conditions | Same as Old Regime |

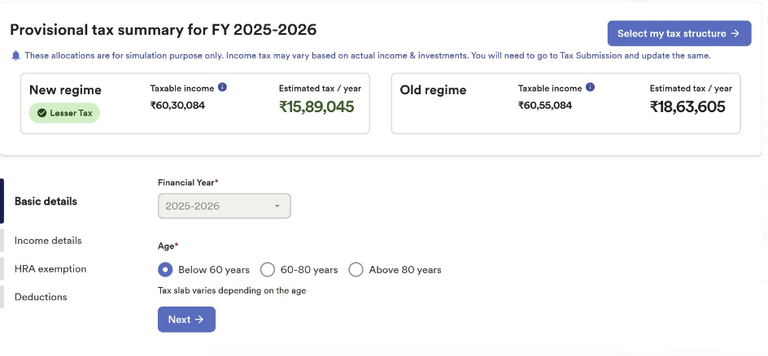

Based on this table one can decide which tax regime is better for them. Please note that incase you do not select the tax regime then by default the new regime will be selected and the old tax regime will continue to exist. I am guessing in coming years the old tax regime may even get eliminated. I also happened to ask one of my friend about which tax regime to select and here what he shared with me. I am sure he would be using some tool from his office which he didn't tell me about but shared this image to give me an idea.

It looks like from the above image its evident that a higher income salaried person where their income is greater than Rs.50 lakhs or more its better to go for new tax regime that's what I could make it from it and after having read many post and seeing the above table "Tax Deduction Comparison: Old Regime vs New Regime" also is suggesting the same. Well this should be it for todays post on - "INDIA - Income Tax Slabs for FY 2025-26 - Old Tax Regime Vs New Tax Regime Which is BETTER..." Let me know what are your views on the same... Happy Investing & Tax Saving... Cheers

Have your say on FY 2025-26 - Old Tax Regime Vs New Tax Regime...

Did you know which tax regime is better for you? Do you know any tools that will be helpful in selecting the tax regime? Let me know your views in the comment section below... cheers

#incometax #oldtaxregime #newtaxregime #india #oldVsNewTaxregime

Best Regards

The rewards earned on this comment will go directly to the people( @uwelang ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 10.00% vote for delegating HP / holding IUC tokens.

Congratulations @gungunkrishu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 320000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: