Canva

Hey folks.

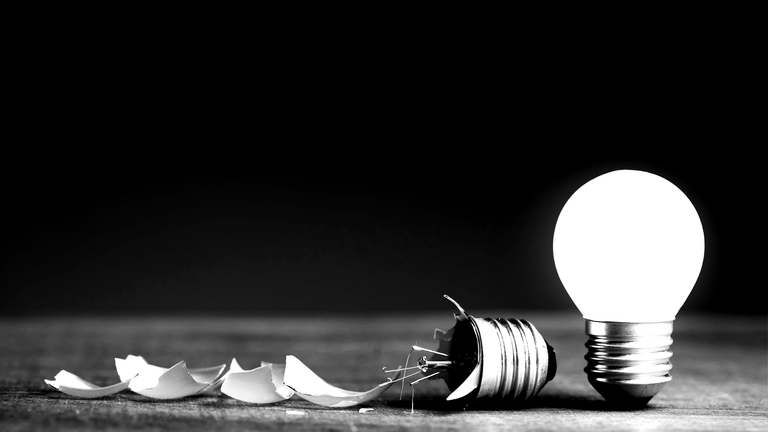

History is full of stories related to finance that can help teach us valuable lessons. Learning from these finance fails can be helpful in making better decisions today.

The Tulip Mania of 1637

The Tulip Mania in Netherlands is one of the popular financial disastrous. Tulip bulbs in the 1600s became very popular and their prices soared to high levels. People started buying and selling the Tulip bulbs for big sums of money in a hope to get rich.

But this bubble burst in 1637 and the prices of Tulip collapsed. Many people lost their money.

Lesson:

Keep in mind that markets can be irrational and proceed with caution when making investments that appear too good to be true.

The South Sea Bubble of 1720

The South Sea Company in the early 18th century promised investors big returns from trade with South America. As more people bought shares of the company, that was driven by the rumors of great wealth, the prices of the company's stocks skyrocketed.

However, it turned out that the company's future did not look as bright as it had claimed. When the bubble burst, Britain had a financial crisis.

Lesson: Always do extensive study before making an investment, and stay away from rumors and hype.

The Great Depression of 1929

In 1929, the stock market collapse in the United States led to the great depression. Prices of stock fell drastically and many people lost their savings. Businesses bankrupted and unemployed soared.

The economic catastrophe underlined the dangers of over speculation and poor financial regulation.

Lesson:

In order to curb excessive risk-taking, financial systems must be properly regulated. It's also important to never invest more than you can afford to lose.

The Eron Scandal of 2001

Eron was once a successful energy company but it was found that it had been hiding under big debt and inflated profits.

The price of the company's stock collapsed leading it to bankruptcy when the truth revealed. Investors and employees suffered significant financial losses due to the scandal.

Lesson:

In financial reporting, honesty and transparency are crucial. Businesses that avoid having honest and transparent financial communication should always be viewed with suspicion.

These historical finance fails is a reminder that financial markets are not always stable or predictable.

We can gain a better understanding of the significance of caution, diligence, and openness in handling our personal finances by examining these past mistakes. We can avoid making the same mistakes repeatedly by using the lessons we can learn from history.

Follow @haveyoursay

x.com/itshaveyoursay

Posted Using InLeo Alpha