It's funny how as the years go by one becomes more and more aware of the need to prepare for the unexpected... To tell the truth, it seems a bit absurd that this phenomenon is like this when you get older. Rationally you should prepare for the unexpected from your youth since the time you have ahead of you on this planet is greater and, therefore, the probability of unexpected events happening is higher...

I think that the "preparationist" sense was more common in our ancestors, parents, grandparents, great-grandparents etc...

At present, our society has succumbed to the most acute consumerism and therefore, living in the moment has transformed into "immediately spending" any income that falls to us during our first years of adult life.

However, I have the impression that since the pandemic this trend has changed and there seem to be more and more savers and investors at an early age, trying to prepare for what may happen in the future.

Obviously, the inflation we have suffered in recent years has taught many what it means to have money sitting in a savings account.

I think I am lucky because I have managed to get my children, still teenagers, to learn from what has happened and develop a sense of saving and investing that will help them on their journey through the years on the planet.

In fact, in the case of my daughter who has just turned 18, this saving and almost "preparationist" sense is very pronounced. So much so that I have had to ask her to stop saving so much and also start spending to enjoy the moment... it is not that I am worried that she saves too much but I am worried that she becomes obsessed.

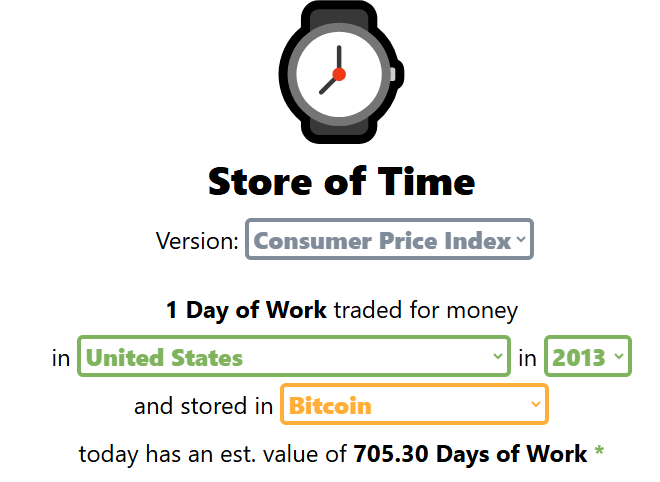

Lately, I have been giving her lessons in "light frugalism" so that she makes sense of what she does with her money... so that she knows, above all, that money is nothing more than "time in storage" and that earning money also means "investing your time" to obtain it, at least when you are young.

Before people used to save money and think at the future, then we had the spend spend spend everything now, and since after pandemic, inflation and wars people are starting to save money again

Good points, Eddie. Saving formte future but also don’t forget to live in the present. To Balance that can be a Challenge.

What you invest in matters. Not everything went up like crazy like BTC, but it does show how amazing some of those assets can be if you do invest.

Inflation is a threat to savings, so it is better to invest, frugality helps to invest more