Except for the few months between late 2023 and March-April 2024, when we had a bit of optimism and excitement in the market—right after Bitcoin spot ETFs went live in the US—the whole crypto space has pretty much been a constant fear-mongering arena. And I get why. Most of us are all-in on alts, and so far, we haven’t had a proper altcoin season.

So, is the bull market over? Well, according to Peter Schiff—one of Bitcoin’s biggest critics, alongside Nouriel Roubini and others:

— Peter Schiff"Turn out the lights, the #Bitcoin 100K party is over. As is typically the case, I'm sure most of you stayed too long. Also, despite Bitcoin entering a bear market today, there was no panic or capitulation. That means the Bitcoin bear market is not over, but just getting started."

How often has Schiff been right about Bitcoin? Not that often, I’d say. Part of me believes he’s genuinely clueless, given how long he’s been pushing this anti-Bitcoin narrative. But another part of me thinks he’s just farming engagement and trying to sell his gold products.

Personally, I don’t believe the bull market is over. But if that turns out to be the case, then this would be the first bull market to end in fear and pessimism. I’ve seen no euphoria anywhere this cycle—so far...

Past performance is a useful indicator of future outcomes, though it’s not an irrefutable argument. However, if we study past performance and compare the current bull market to 2017, we’d see that the real uptrend actually began in March 2017.

Especially in the case of altcoins—ETH and XRP both did more than 30X from March to June 2017, while Bitcoin only managed to double in price during that same period. Will history repeat itself? I have no fucking clue. I can only hope it does because that would finally give us a shot at making some real money with our cheap alts.

While some meme coins are dead in the ground, plenty of cryptos—despite not delivering anything—at least have a roadmap, yet they aren’t doing shit. Their charts are lifeless, just like many were in early 2017. If history does repeat itself, the best part of this cycle is waiting for us in late 2025.

How low will BTC go before finding a bottom? No clue. If I had to guess, I’d say mid-$70Ks—a bit above the March 2024 highs. What I have noticed, though, is that some altcoins have only suffered minor losses compared to BTC.

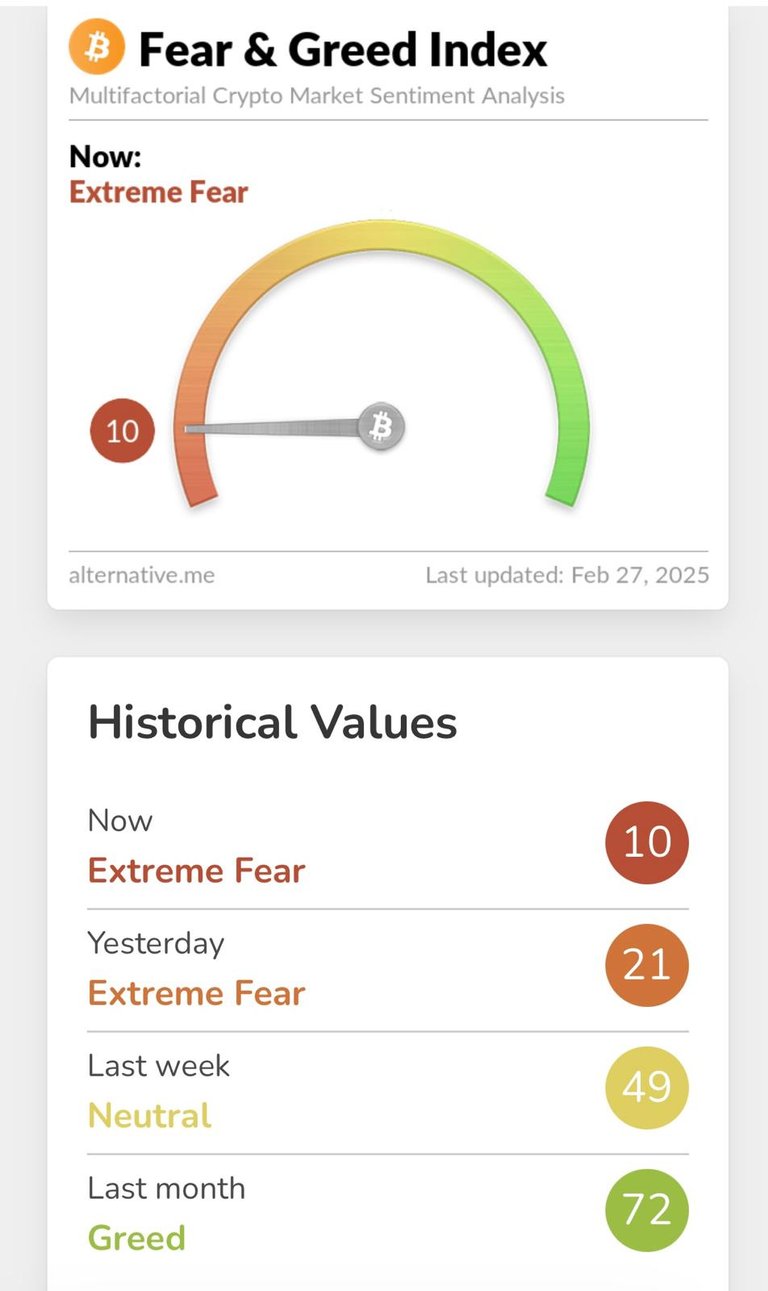

Bitcoin dominance is bleeding out but still holding above 60%. The market is deep in extreme fear, according to the Fear and Greed Index—and that screams opportunity...

Just my two cents.

Thanks for your attention,

Adrian

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks.

My favorite part is when people ask "is the cycle over!?!"

Like... no... it would be like asking if 2+2=5.

It's a four-year cycle.

Everyone knows this.

The cycle is either broken... or not broken. It can't be "over".

And there is zero evidence to suggest the cycle is broken.

So then why is everyone asking?

Almost ironic that the current psychology of the market is in the ultimate sweet spot.

Almost.

The masses always lean towards the "this time is different" narrative at the wrong times...

nah, the Bull Market is not over yet. Even Bitcoin has not touched/is still halfway to its "selling range"

In 2017, BTC exceeded its "selling range"

Whereas in 2021, BTC only touched a little bit of its "selling range" and then it went down (which could signify that the movement that year was noticeably lacking)

Where can one check the selling range?