Following the crisis on the FTX exchange, confidence in centralized exchanges has dropped significantly. Many centralized exchanges made statements and tried to prevent cryptocurrency outflows, stating that they were not in trouble. Despite this, more and more investors continue to transfer their assets on the exchanges to their wallets.

Meanwhile, the CEO of the Binance exchange, shared his thoughts on the blog about the recent events that have damaged the trust in the cryptocurrency markets and how a centralized exchange should be in order to avoid these situations. CZ explained what principles a reliable exchange should have…

6 principles that CZ outlined in his blog post

- Do not take risks with user funds

- Never use native tokens as collateral

- Share live proofs of assets

- Keep reserves strong

- Avoid excessive leverage

- Strengthen security protocols

CZ made a call to centralized exchanges at the end of his blog post.

We urge all other centralized exchanges to adopt these recommendations. Because we all have a responsibility to people who decide to invest their hard-earned money with us. It is our responsibility to prove to the regulators and the community that a few bad actors are not emblematic of this industry.

I agree with CZ, CEO of Binance exchange … The main purpose of exchanges is to trade, protect the assets entrusted to them … To receive a fee for them … They should avoid risky investments and leveraged trades … If they are going to make these trades, they should use their own equity … Not the savings of others …

So far, we have looked at how centralized exchanges should be … Well, let's look at the reasons for the widespread interest in decentralized exchanges ...

I would like to briefly inform you about the decentralized exchanges…

A decentralized exchange (DEX) is a peer-to-peer (P2P) service that enables direct cryptocurrency transactions between two parties. You need your own wallets to trade on these exchanges. (Metamask…)

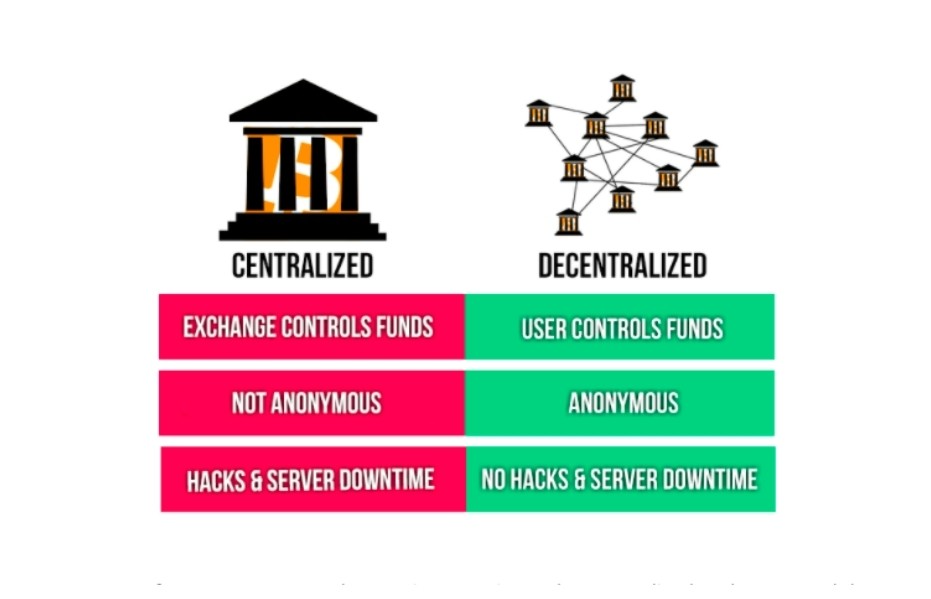

What is the difference between a centralized and decentralized exchange ... ?

Users' credentials are available on centralized exchanges and currencies are held in the accounts of the service provider company. Decentralized exchanges do the opposite.

Centralized exchanges are run by a for-profit company or individual. Such exchanges are obliged to protect user data and transaction details. The platform completely controls the activities and makes important decisions for the development of the service on its own.

In contrast, decentralized exchanges are managed automatically or semi-automatically with the support of platform participants in making key decisions. Such platforms allow direct interaction between participants. They use a distributed ledger to store and process all data. The decentralized exchange does not store funds or user personal data on its servers. It serves as a platform to find matches for the sole purpose of buying or selling.

Advantages of decentralized exchanges

- They do not store user assets

- Due to the absence of a centralized structure within the exchange, the risk of price manipulation or fraudulent trading volumes is minimal.

- The distributed architecture protects the stock market from interference by local or international authorities.

- The decentralized exchange only trades for existing cryptocurrencies.

Disadvantages of decentralized exchanges

- Since there is no Know Your Customer (KYC) system, it is not possible to cancel the transaction in case the password is forgotten or the private key is lost.

- Options like "Stop - Loss" stop loss, margin trading or credit settlement are not available in most DEXs.

- They have much smaller liquidity pools

- As transactions are made on the blockchain, there may be delays and increases in transaction fees.

- It does not have support service to deal with transactions or user accounts

My Last Words; Investors can neither give up on centralized nor decentralized exchanges … After trading on decentralized exchanges, how will you be able to convert them to fiat currencies and use them in real life … ? The important question is…? For now, the only alternative seems to be centralized exchanges… If you are not doing daily transactions, you keep your assets in your wallet, and when you need fiat money, you send them to your bank with a trusted central exchange. As you can see, centralized exchanges are essential in this time frame … It's best if you can connect your wallet in real life in the future with cryptocurrencies … But when … ? The number of companies that allow you to shop with cryptocurrencies is as many as the fingers of one hand.

Posted Using LeoFinance Beta

True, for a centralized exchange to take risks with user funds, can leads them into serious issues, if they hardly pay back the funds to the user's, when the users request for the funds.

Then for the user to go around saying negative things about exchange can ruin others trust