SOLANA, one of his stars in the Bull Rally we had last year, had a companion accompanying him. This is TERRA LUNA. The development of the Terra Luna ecosystem does not slow down.

High transaction fees on the Ethereum blockchain, recent blockchain bottlenecks in Solana have turned their eyes to the Terra Luna ecosystem. Terra Luna is an ecosystem created for low transaction fees and DeFi platforms.

The most important of Terra Luna DeFi platforms is Anchor Protocol. In particular, its listing on the Binance stock market and its support within the scope of Binance Launchpool have turned the eyes to Anchor Protocol.

So what makes Anchor Protocol special… ?

Anchor Protocol (ANC); Terra Luna is the lending and borrowing protocol on the blockchain. ANC is the protocol's native utility and management token that allows users to leverage, lend, borrow and earn interest on their digital assets in an over-collateralized model. It is also used as a tool to suggest how the community pool will be spent, change parameters (e.g. LTV rates for liquid stake derivatives) and vote to add new collateral to the supply side.

Anchor Protocol (ANC); Solana plans to expand its native token to other PoS tier-1s such as SOL. The protocol provides a return for depositors by staking borrowers' LUNA collateral. ANC is Anchor's inflationary protocol token, offering its holders a percentage of the protocol earnings as well as management rights.

Anchor Protocol(ANC); It is a project consisting of 3 components. Using ANC token incentives/management, money markets and diversified stake returns. These components help create a completely decentralized fixed income vehicle.

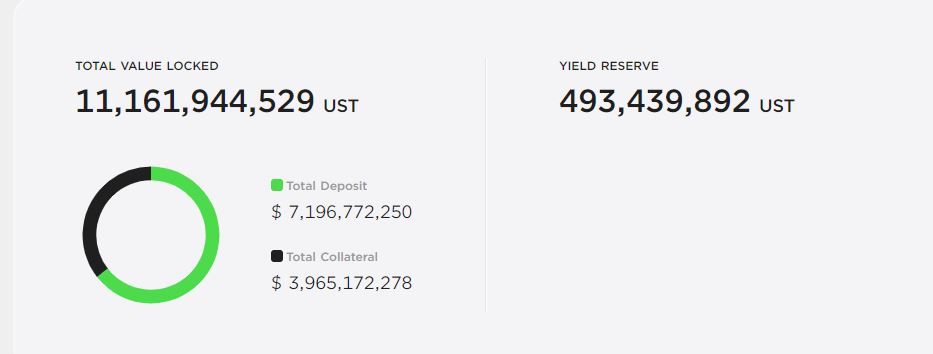

Anchor Protocol(ANC) accepts Terra deposits, allows instant withdrawals and pays depositors a low volatility interest rate. Anchor deposits liquid stake PoS assets from major blockchains to borrowers who put bAssets (bonded assets) as collateral to generate returns. Anchor balances the deposit interest rate by transmitting a variable portion of the asset return to the depositor. It guarantees depositors' principal by cashing in debtors' securities through liquidation agreements and third-party arbitrageurs.

Anchor Protocol(ANC); promises to provide depositors with;

High, stable deposit returns backed by the rewards of asset collateral

Instant withdrawal via pooled credit of stablecoin deposits

Principal protection through liquidation of loans at risk of insufficient collateralization

Wallets that you can connect to the Anchor Protocol system;

Terra Station Wallet (My choice for ease of use)

Wallet Connect

XDEFI Wallet

Leap Wallet

With the wallets above, you can quickly make transactions in Anchor Protocol...

Total supply; 1,000,000,000

Current circulating supply; 256,000,000

Anchor Protocol (ANC) token; You can get it from Binance, Gate.io, KuCoin, Mexc, OKX centralized exchanges, TerraSwap decentralized exchanges…

With Binance launchpool and listing support, it achieved a 155% increase. $2.75 at the time of writing the article was trading.

What is the Risk of Anchor Protocol … ?

Like all DeFi platforms, the Anchor protocol has a huge risk that users should be aware of, and that risk is credit liquidation. This can happen when the value of the collateral falls below the value of the loan. This is common to all DeFi platforms, so it is recommended to borrow at 45% or less at LTV, while liquidation happens at 60%.

Various measures have been taken to reduce losses and one of them is the feature added to Anchor desktop which allows users to turn on LTV notifications. You can set a threshold in LTV and you will be notified once it passes. This allows users to manage risk more efficiently in Anchor. On desktop browsers, WalletConnect is available via View an address with Chrome extension and Ledger. Importantly, Anchor is now also available on mobile via the WalletConnect integration, where any user with a mobile phone can connect to Terra Station.

My last words; Anchor protocol (ANC) is an innovative savings product that offers unprecedented APY on stablecoins, primarily UST. The structure of Anchor ensures that returns are stable and reliable. It is built on the Terra blockchain, which means better scalability and cheaper fees. In the long run, Anchor will be sustainable and further drive DeFi adoption.

Posted Using LeoFinance Beta

TERRA seems to me to be a fairly efficient blockchain. I was not familiar with Anchor Protocol, even though I had already seen it. UST staking on Anchor Protocol seems interesting to me.